Providing Cars to Employees – Tips & Traps

.

The provision of company cars to employees is a regular practice across the Australian business landscape. Generally, there are two reasons to provide a car to an employee:

- It’s a requirement of the job that employees travel regularly for work purposes, so providing a car will allow employees to effectively perform their duties.

- employers want to give themselves an advantage over their competitors being ‘employers of choice’, attracting the best and brightest, by converting non-deductible private vehicles to tax deductible company cars for their employees.

Granting employees’ access to company cars is treated by the ATO as a ‘non-cash benefit’, more commonly referred to as a fringe benefit.

Fringe benefits provided to employees and/or their associates are subject to Fringe Benefits Tax (FBT), which is currently set at a flat 47% of a benefit’s ‘taxable’.

With the tax rate for fringe benefits set at 47%, the obvious question is why would small business owners grant an employee access to a company car?

Considering that the great majority of Australian taxpayers are currently paying marginal tax rates of between 34.5% & 39% (current for the 2020 financial year and including the Medicare levy) it seems counter-intuitive to allow this. After all, this does translate to an additional 8% to 12.5% tax liability that could be avoided if the employee was simply given a pay rise.

The answer to this question lies in how the ‘taxable value’ of the fringe benefit (i.e. the car) is calculated. The taxable value of a car fringe benefit is meant to reflect an employee’s ‘private use’ of the vehicle, as only the private use of the car is subject to FBT. Additionally, the FBT law allows ‘employee contributions’ to reduce the taxable value of the car fringe benefit.

If the taxable value of a car can be reduced to nil, then no FBT will be payable. As such, employers are inadvertently provided an avenue to provide employees with extra value without incurring additional expenses.

How does the ATO calculate the taxable value of a car fringe benefit?

The Logbook Method

The logbook method, officially called the operating cost method – involves a logbook detailing how much the car is used for work purposes and how much it is used for private purposes is a requirement.

The logbook must be maintained for a period of 12 consecutive weeks and detail the purpose of each trip undertaken in the vehicle, how many kilometres were travelled with each trip, and whether the trip was work related or private. After detailing the purpose of every trip for 12 weeks, the logbook is then valid for the next 5 years.

The vehicle’s private use is then calculated by dividing the total number of kilometres travelled for private purposes by all kilometres travelled during the 12 weeks recorded in the logbook. By then multiplying the cars private use percentage against the car’s actual running costs (fuel, registration, insurance, etc.) as well as notional expenses (depreciation and interest) for the year, the taxable value can be determined.

It’s important to note that if the car being used by the employee is subject to ‘lease’ financing, notional depreciation and interest are ignored unless the purchase price of the car was more than $57,581 (excluding GST). For leased vehicles, the lease premiums paid are added to the actual costs incurred to determine the taxable value instead.

The logbook method provides for a lower taxable value when employees use their cars regularly for work purposes, as increasing the proportion of work related kilometres consequently reduces the private use.

Example - The Logbook Method

Assume a car’s running costs for the year totalled $6,000 and notional costs amounted to another $6,000. This would give rise to a taxable value of $12,000 if the car was never used for work purposes. However, if the logbook declares that the work use is 100%, the car would have a nil taxable value and therefore be exempt from FBT.

Employee contributions will further reduce a car’s taxable value. How this works will be discussed later in this article.

A common trap. It must be mentioned at this point that an employee’s travel between home and the workplace generally does not constitute a work-related trip and would be disclosed in the logbook as private, unless ‘itinerant’ travel is a requirement of the employee’s position.

A warning. Backdating logbooks is a very bad idea, as most commercial logbooks available for purchase by business owners are secretly dated. This makes it easy for the ATO to identify if a logbook has been manufactured after the fact.

Statutory Formula Method

For those with low or nil work-related use of their cars, the statutory fraction method, or ‘stat method’, is another approach allowed by the ATO to determine the taxable value of a car provided to an employee. The stat method is generally the approach adopted by employers looking to achieve “employer of choice’ status when providing cars to staff members, as the calculation can result in a lower taxable value than if a logbook were to be completed.

Changes were implemented following the 2010 federal budget, determining that under the stat method the private use is determined as a flat 20% of a car’s ‘base value’. In a nutshell, the base value is the car’s purchase price, less stamp duty and any registration costs incurred as part of the purchase. The number of days ‘available for private use’ is also taken into consideration, so if a car was not owned for the full year the taxable value is reduced accordingly.

Example - Statutory Formula Method

A car with a $30,000 purchase price would have a deemed private use value of $6,000 under the stat method ($30,000 x 20% = $6,000) if it was available to the employee for the whole FBT year.

There are other incidences that reduce the number of days available for private use (and thereby the taxable value), but these will not be discussed in this article.

As with the logbook method above, employee contributions will also reduce the taxable value of the car under the stat method.

Employee contributions

Employee contributions are after-tax costs paid by an employee in maintaining a car during the FBT year and are considered when calculating the taxable value of a car for FBT purposes and can reduce the taxable value to nil.

There are two ways for an employee to make employee contributions being after tax payments made from the employee directly back to the employer, and the employee paying the running and maintenance costs for the car directly from their after-tax income.

How these employee contributions are considered in determining a car’s taxable value are illustrated below.

How Employees Benefit

Employees can capitalise on these FBT concessions by packaging the cost of a car in with their negotiated salary package effectively turning a non-deductible private car into a tax-deductible business vehicle, gaining access to tax concessions in the process.

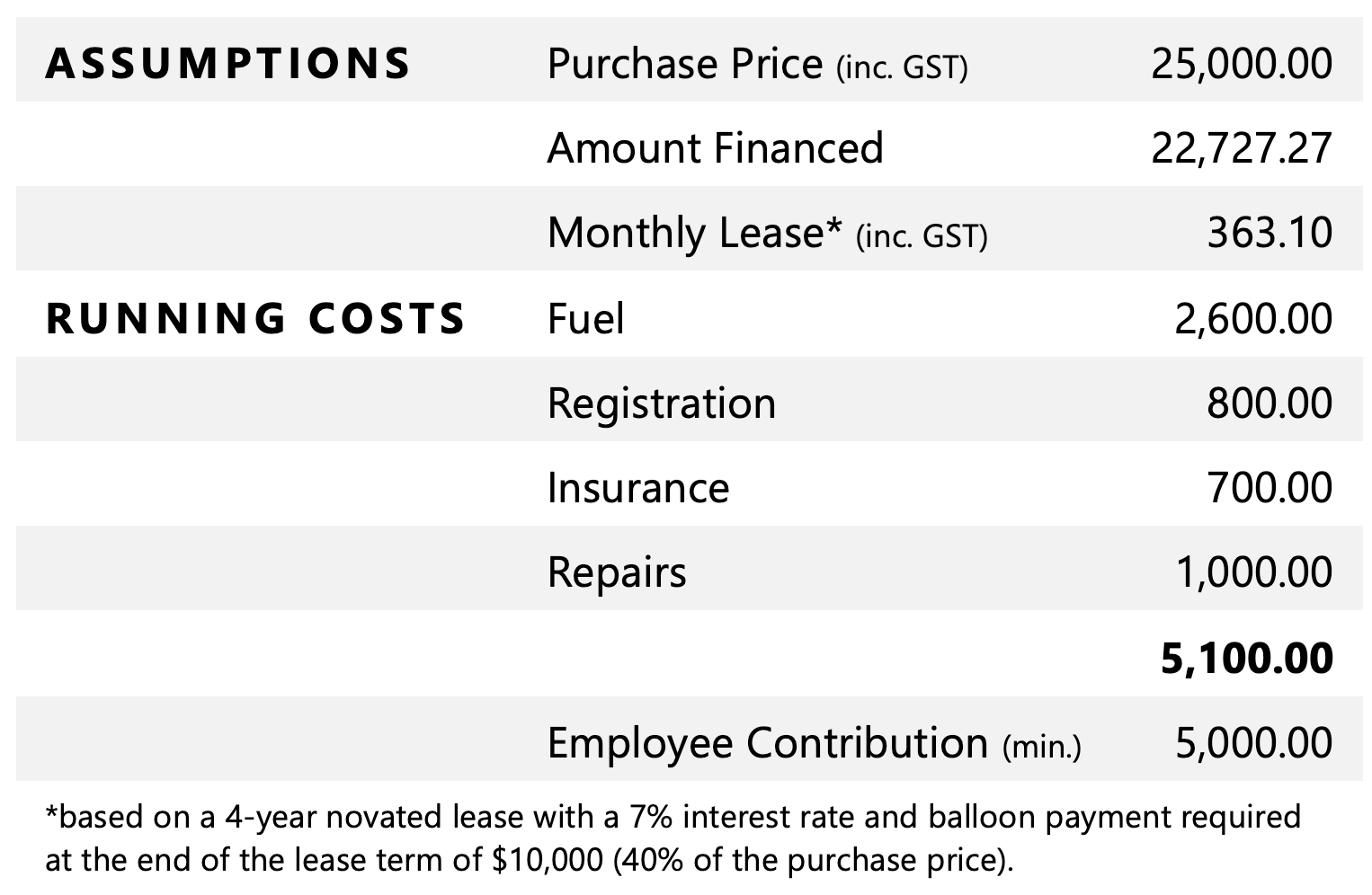

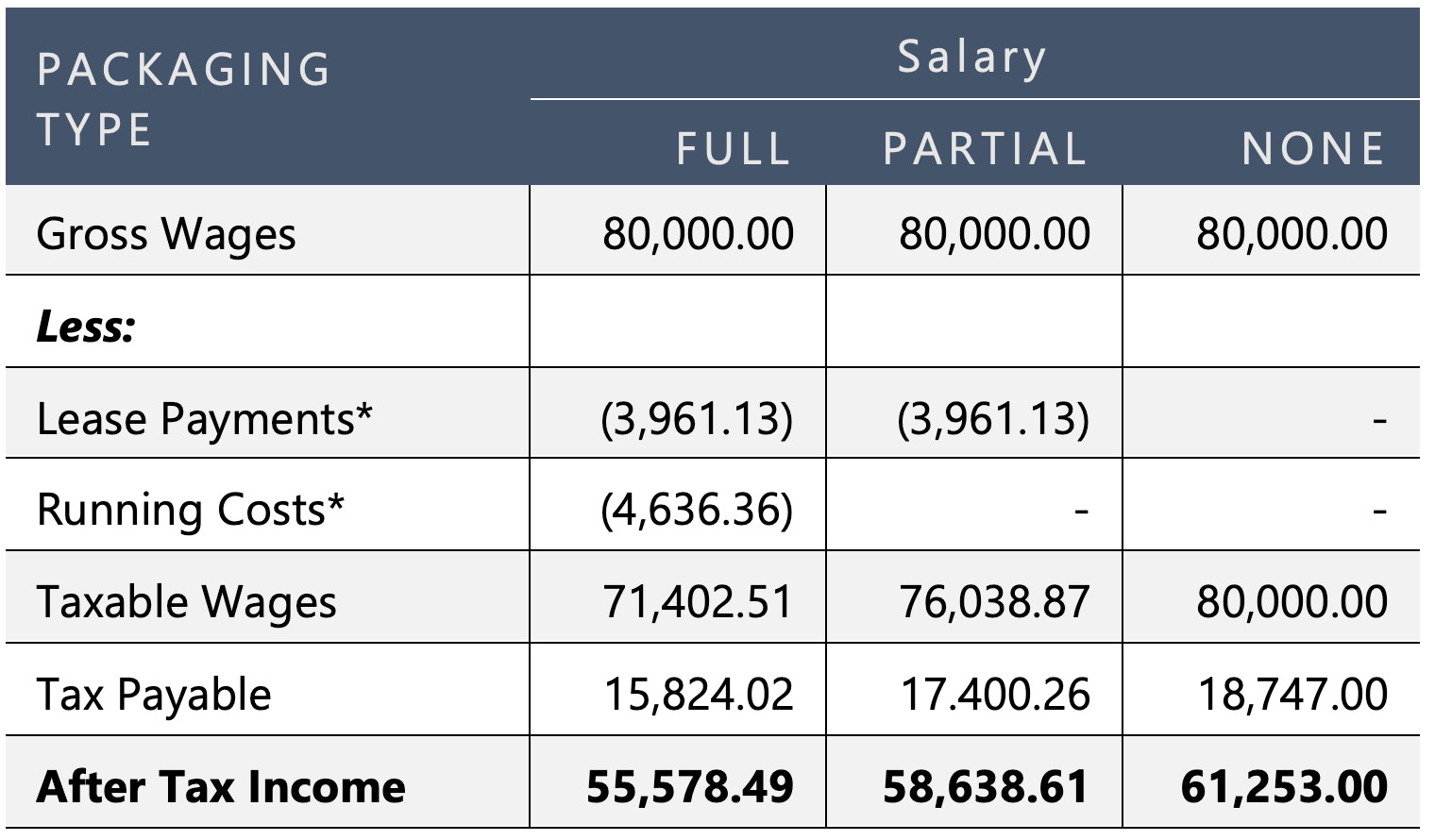

The employee’s car benefits can be packaged in such a way that no FBT is payable, and at no additional cost to the employer, as illustrated below.

|

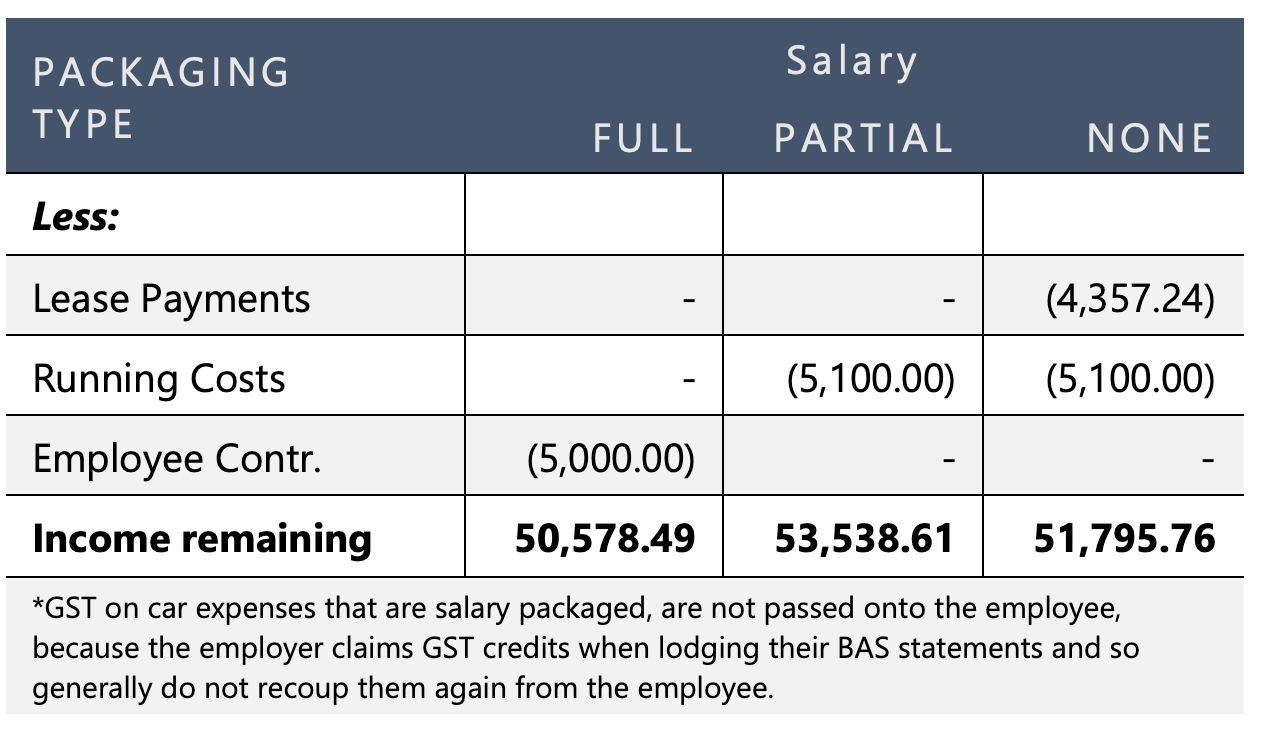

|

|

As you can see, by allowing employees to partially salary package the cost of their cars (in this case, the lease repayments) the employee is almost $1,750 better off each year. Over a 4-year lease, this would total a $7,000 in tax savings simply by allowing the employee to package their lease payments. Also, provided the purchase price of the car is less than $57,581, the novated lease payments are deductible in full to the employer when paid. As there is no difference to the tax position for the employer whether claiming lease premiums or employee wages, your business can become an employer of choice, attracting the best employees by allowing salary packaging. |

Transforming your business can be done at no cost, if all FBT charges are avoided, since lease premiums and wages are treated the same for income tax purposes (though watch out for that car cost limit of $57,581 (exc. GST) before entering any lease agreements as the tax treatment for lease premiums would then change).

NEXT STEPS

To find out if your business need to lodge FBT return for year 2023,

Please Click here Or Book a Free 15 minutes consultation.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.