How to Use The Instant Asset Write-Off for Small Business Owners

What is the Instant Asset Write-Off Incentive?

For assets costing less than $20,000, small businesses can write off the entire cost in the year the asset is used or installed, rather than depreciating it over time. This immediate deduction provides significant cash flow benefits, allowing businesses to reinvest sooner. The incentive also applies to multiple assets, provided each asset’s cost is under the relevant threshold. It’s important to note that businesses must apply the simplified depreciation rules to qualify, and some exclusions, such as the car limit, may apply.

The eligibility criteria and thresholds for the instant asset write-off have changed over time. Businesses need to ensure they meet the current requirements and apply the relevant thresholds based on when the asset was purchased, first used, or installed. If an asset’s cost exceeds the applicable threshold, the asset must be placed in the small business depreciation pool.

Who is Eligible for the Instant Asset Write-Off?

To be eligible for the program, your business needs to have an aggregated annual turnover of less than $5 billion. The high turnover threshold means that almost every Australian business is included in the scheme. However, if your business’s aggregated turnover is less than $50 million, eligible second-hand assets can also be written off under the rules. Most Australian businesses can now immediately deduct the full business-related costs of all purchases of capital items.

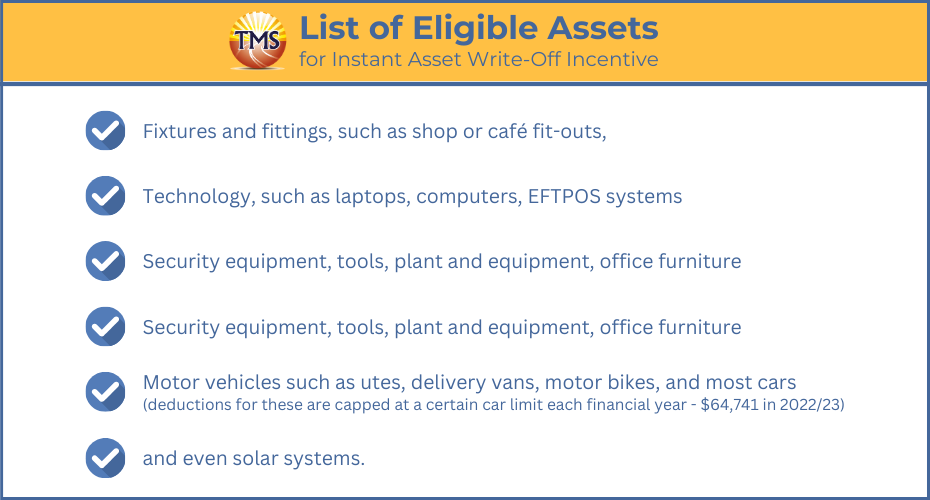

Here are the list of eligible assets for Instant Asset Write-Off Incentive:

Why is the Instant Asset Write-Off Important for Your Business?

How can you make the most of the instant asset write-off incentive before the deadline on 30 June 2024?

As a business owner, you might be wondering how to take full advantage of the instant asset write-off program before the current deadline on 30 June 2024. Here are some key points to help you maximise this opportunity and reduce your tax liability:

Claim the deduction in the financial year it was used for business purposes

Buy and use the assets before the deadline

Keep accurate records of your purchases

It’s crucial to keep proper records of all purchases made under the instant asset write-off scheme, including receipts, invoices, and any other relevant documentation. By keeping accurate records, you can ensure that you’re claiming the correct amount and avoid any issues with the Australian Taxation Office (ATO) if you’re audited.

Consider buying second-hand assets

If you’re looking for a cost-effective way to acquire assets for your business, you may consider buying eligible second-hand assets. You can claim the full cost of these assets in the same year you buy them, as long as they’re used or installed and ready for use before 30 June , 2023. However, it’s important to ensure that the assets are in good condition and fit for purpose, and that you keep proper records of the purchase and use.

By following these tips, you can make the most of the instant asset write-off program and maximise your tax savings before the deadline. Don’t miss out on this opportunity to grow your business and improve your cash flow. Contact TMS today to learn more about how we can help you take advantage of this program and other tax incentives available to your business.

Borrowing Money for Assets and Claiming Instant Asset Write-Off

Financing Options for Business Assets

Claiming the Instant Asset Write-Off for Financed Business Assets

Claiming GST Input Tax Credit for Financed Business Assets

If your business is registered for GST and the assets are for business purposes, you can claim the input tax credit for the GST portion of the purchase price. Remember to report the GST amount on your business activity statement. As with the instant asset write-off, we recommend seeking professional advice to ensure your business is compliant with GST regulations and properly claiming the input tax credit.

Maximising the Benefits of Instant Asset Write-Off and GST Input Tax Credit

- Confirm your business’s eligibility based on the aggregated annual turnover.

- Ensure the assets are purchased for business use.

- Deduct the full business-related cost of capital items.

- Register your business for GST.

- Report the GST amount on your business activity statement.

Real-Life Examples of the Instant Asset Write-Off in Action

How Adam Expanded His Delivery Business and Lowered Tax Liability Using the Instant Asset Write-Off

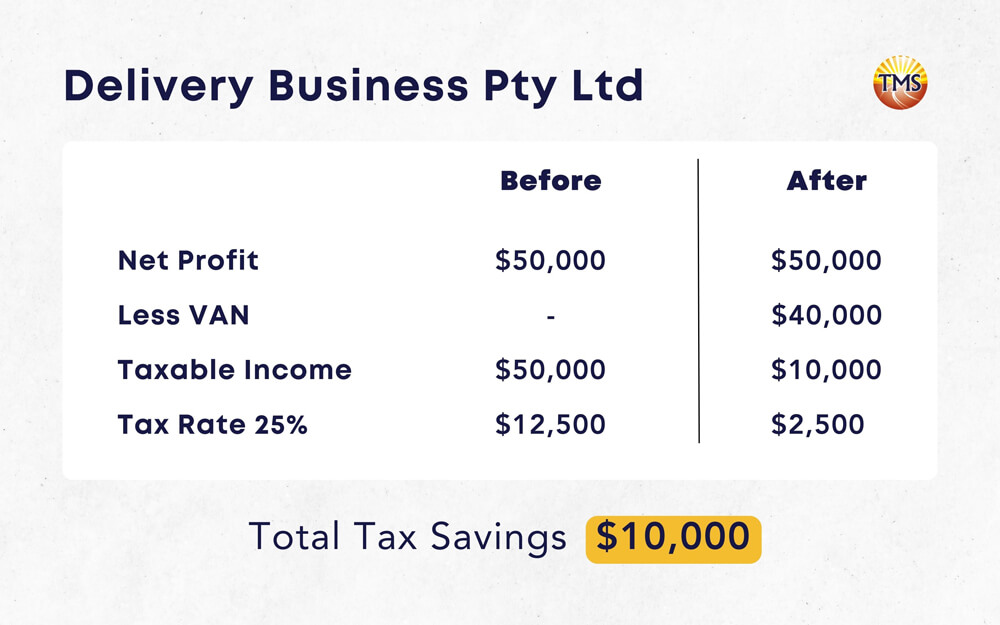

Adam is a hardworking entrepreneur who runs a small delivery business as the sole director of Delivery Business Pty Ltd. With an increasing demand for his services, Adam decides it’s time to expand his fleet by purchasing a new delivery van. He chooses a van that costs $44,000 (including GST) and plans to use it entirely for business purposes. Since his company’s aggregated turnover is less than $50 million annually, Adam’s business qualifies for the instant asset write-off.

Taking advantage of the instant asset write-off, Adam can claim an immediate tax deduction of $40,000 for the van in the financial year when the purchase is made, and the van is used or installed and ready for use. This deduction will reduce the company’s taxable income, lowering the amount of tax his business needs to pay for that financial year.

Operating as a company with a tax rate of 25%, the full deduction of $40,000 results in tax savings of $10,000. Let’s say Delivery Business Pty Ltd’s net profit is $50,000; with a tax rate of 25%, the tax liability would be $12,500.

By purchasing the van for $40,000 and claiming the instant asset write-off, Adam reduces the company’s taxable income to $10,000, and the tax payable becomes only $2,500. Moreover, since Delivery Business Pty Ltd is registered for GST and the van is used solely for business purposes, Adam can also claim an input tax credit of $4,000 for the GST portion of the van’s purchase price. This credit would be reported on the business activity statement (BAS) and effectively reduces the amount of GST Adam’s business needs to pay.

In conclusion, by utilising the instant asset write-off and input tax credit, Adam’s Delivery Business Pty Ltd can experience significant cash flow benefits, allowing him to further invest and grow his business.

What’s the purchase threshold for the Instant Asset Write-Off?

Even if the combined asset costs of all the multiple assets you purchase exceed $150,000, you can still claim the instant asset write-off for each individual asset, as long as the cost of each asset is at or below the threshold.

Transforming Business Growth and Tax Savings: A Case Study of John and Jenny’s Restaurant Success with Proactive Tax Planning

They are looking for a way to reduce their tax liability while also investing in their business to make it more profitable. They work hard, seven days a week, but they still feel like they’re not getting ahead financially. They need to upgrade their kitchen equipment for both restaurants and are interested in finding a solution that benefits their business and helps save on taxes.

John and Jenny decide to purchase the following assets for their restaurants:

Commercial ovens costing $66,000 each (including GST) – one for each restaurant: $66,000 x 2 = $132,000

Industrial-grade dishwashers costing $16,500 each (including GST) – one for each restaurant: $16,500 x 2 = $33,000

Customised stainless steel benches and shelving costing $27,500 per restaurant (including GST): $27,500 x 2 = $55,000

High-end exhaust systems costing $44,000 per restaurant (including GST): $44,000 x 2 = $88,000

The total cost of all assets is $308,000 (including GST).

Claiming the Instant Asset Write-Off incentive:

Although the total cost of all assets exceeds $150,000, the purchase threshold for the Instant Asset Write-Off applies to each individual asset. In this case, every asset’s cost is below the $150,000 threshold, allowing the business to claim an immediate deduction for the full cost of each asset (net of GST) under the instant asset write-off.

This means that in the financial year when the assets are first used or installed ready for use, the business can claim a total tax deduction of $280,000 (net of GST) for the asset purchases. The GST amount of $28,000 can be claimed as an input tax credit if the trust is registered for GST.

By utilising the Instant Asset Write-Off incentive, John and Jenny can significantly reduce their tax liability while investing in the growth of their business. This allows them to upgrade their kitchen equipment, improve efficiency and profitability, and ultimately achieve their financial goals.

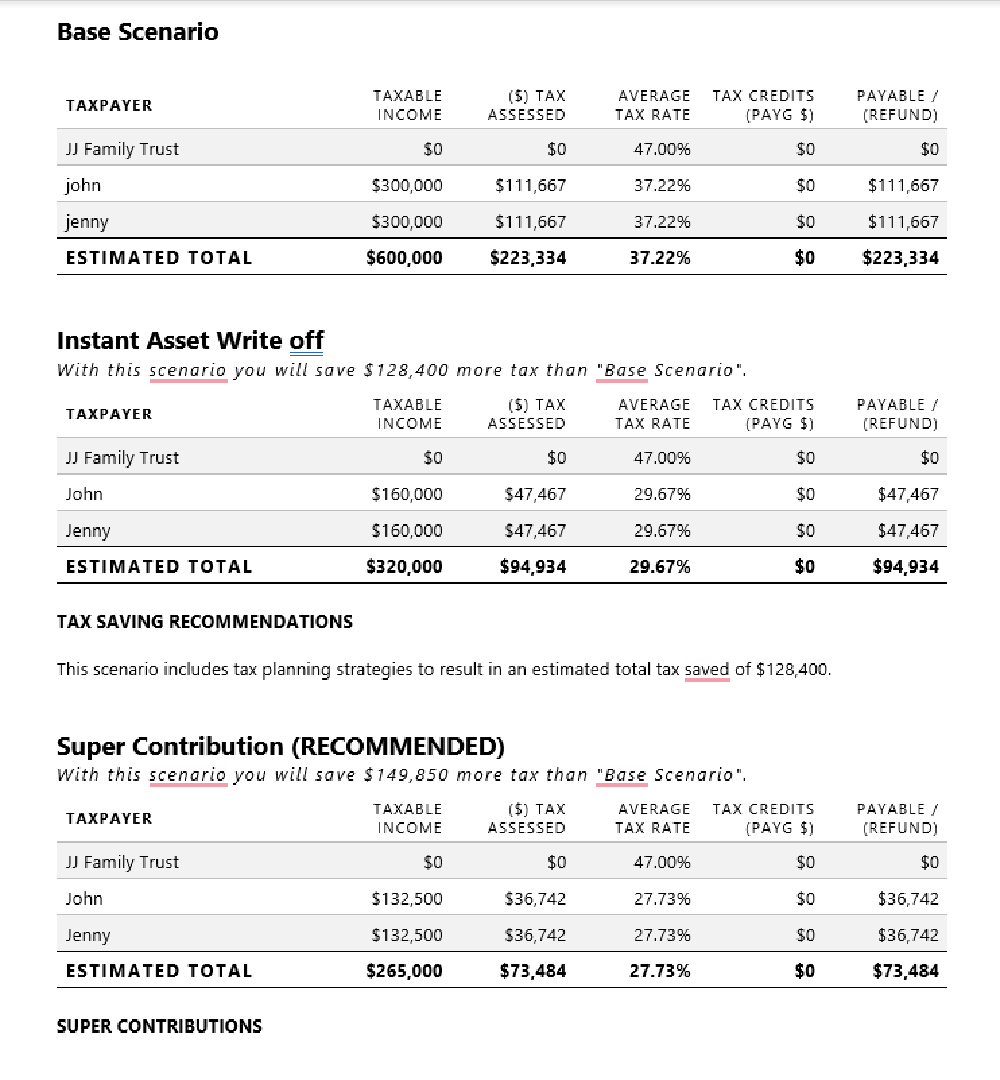

We did the tax planning calculation, after we put in $280,000 as a tax deduction in our tax plan calculation, the estimated income for the trust net profit is $320,000, if we distribute $160,000 each to them then tax payable is $47,467 each total tax payable is $94,934.

The total tax savings of $128,400 is a substantial amount, and we also advised John and Jenny about additional strategies that could further reduce their tax liability. For instance, we suggested setting up a corporate beneficiary to cap their tax rate at 30% and making the maximum superannuation contribution of $27,500 each.

They decided to contribute the maximum amount to their super funds to enhance their retirement savings, ultimately enabling a comfortable retirement. After implementing these strategies, their individual tax payable was reduced to $36,742, bringing the total tax payable to $73,484.

In comparison to a scenario without tax planning, their total tax savings amounted to $149,850.

These tax savings could be used for various purposes, such as:

- Reducing their home loan,

- Making a deposit for an investment property,

- covering their children’s education expenses,

- or reinvesting in their business.

Their other concern was that, while they could have a tax saving of $149,850 they didn’t have enough cash flow to pay for all those assets’ costs. We suggested they seek financing from a bank, which might enable them to obtain finance to purchase those assets and still be eligible for the instant asset write-off and GST input tax credit of $28,000 if they use the correct financing method like a bank loan, chattel mortgage, or hire purchase. We advised them to talk to a bank or loan broker.

John and Jenny approached their bank and discussed their financing options for purchasing the kitchen equipment. The bank suggested they consider a chattel mortgage or hire purchase, which would allow them to claim the Instant Asset Write-Off and GST input tax credit while spreading the cost of the equipment over a manageable repayment period. They decided to go with a chattel mortgage, which provided them with the best financing terms and met their cash flow requirements.

With the financing in place, John and Jenny proceeded with the purchase and installation of the new kitchen equipment for their restaurants. The upgrades resulted in increased efficiency, better quality food, and an improved customer experience, which in turn led to higher revenues for their business.

John and Jenny were thrilled with the results of the tax planning and financial strategies we provided. They were able to save a significant amount in taxes, invest in their business, and improve their financial position for the future. They also appreciated the ongoing support and advice we offered to help them navigate the complexities of tax and business finance. Their experience highlights the importance of proactive tax planning and working with a knowledgeable professional to achieve the best possible financial outcome for both business owners and their families.

As part of our ongoing services, we provided John and Jenny with a cash flow forecast to help them manage their cash flow better and ensure they have enough funds to cover their asset purchases and other business expenses.

This case demonstrates how working with TMS CPA accounting firm can provide valuable guidance and support for business owners like John and Jenny, helping them make informed decisions and take advantage of opportunities to grow and succeed. Our goal is to inspire other business owners to seek professional advice to maximise their financial potential and achieve their desired outcomes.

We want to emphasise that making informed, smart choices about how to use money is crucial for growing your wealth or preventing financial setbacks. As responsible accountants, our priority is to help our clients make the best decisions based on their unique circumstances and objectives. It is essential to carefully consider your business goals and ensure that any asset purchases align with those goals before taking advantage of the Instant Asset Write-Off or other tax-saving strategies. Remember, the key is to make decisions that will positively impact your business in the long run, rather than just focusing on short-term tax deductions.

Get Professional Advice from TMS Financials

At TMS Financials, we can help you determine if the Instant Asset Write-Off is right for your business. We’ll work with you to assess your personal circumstances and advise you on the best course of action. Our team of experienced accountants can help you plan your cash flow, assess the rate of return on your investment, and ensure you meet all the eligibility criteria for the Instant asset write-off incentive.

Don’t wait until it’s too late to take advantage of this valuable tax break free financial health review now.

Disclaimer

Take Action Now And

Take advantage of this

Valuable tax break

Schedule a one on one review with our Certified Tax Agent now!

Related Articles

Understanding asset protection for your growing business

Asset protection for growing businesses and...

Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties

Taking Money Out of Your Private Company: How to...

Unlock the Benefits of a Bucket Company: Maximise Tax Savings and Protect Your Assets

Unlock the Benefits of a Bucket Company:...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.