Thinking About Setting up a SMSF (Self-Managed Super Fund)? Here’s What You Need to Know

.

If you’re considering setting up a SMSF Self-Managed Super Fund , it’s important to understand the ins and outs of Self-managed super fund. While tax agents can’t provide financial advice on SMSF setup and investment strategies unless they’re qualified financial advisors, they can guide you through the taxation and compliance aspects.

What is an SMSF?

With an SMSF, you’re in charge. You make the choices about where your money goes, like picking which plants to grow in your garden.

Think of it this way: In a retail super fund, someone else is the gardener and decides what flowers to plant. But with an SMSF, you’re the gardener, and you get to choose the flowers you want to grow. Just remember, being the gardener also means you need to follow some rules and laws to make sure everything grows nicely.

So, having a Self-Managed Super Fund is like having your very own garden where you can plant and grow your superannuation savings however you like. It’s a way for people who want to be in control of their super fund and make their own decisions to do just that!

Investment Flexibility of SMSFs

You can invest things like term deposits, shares (both Australian and international), properties (residential or commercial), and even special plants like managed funds and precious metals. Just like in a garden, where you plan which flowers go where, you also need to plan before you start planting your money. This is called your investment strategy – it’s like deciding which sections of your garden get which types of plants.

Your investment strategy helps guide your decisions and makes sure your garden (SMSF) grows the way you want it to. It’s like drawing a map for your garden adventure. And just like in a garden, where you take care of your plants so they thrive, you also need to keep an eye on your investments to help them grow. With your SMSF garden, you’re not just growing plants, you’re growing your superannuation savings in a way that suits you best.

Motivations for Starting an SMSF

A common motivation for starting an SMSF is the desire to use your superannuation fund to invest in properties. Property investment holds a straightforward appeal: you purchase a house, apartment, or commercial office or shop, rent it out, gather rent income, and watch the property’s value rise over time, leading to potential capital gains.

Many SMSF initiators are individuals already engaged in property investment; their familiarity with this domain makes them inclined to channel their retirement funds into property ventures. Although these funds are reserved until retirement, aligning superannuation with property investment makes sense, as property investments are typically intended for the long term.

The driving force behind establishing an SMSF, particularly for property enthusiasts, lies in the autonomy it offers. By controlling their SMSF, individuals oversee their bank accounts, property investment choices, and decision-making processes. This sense of control fosters peace of mind and a reassuring sense of security, ultimately providing a sense of empowerment and the freedom to make choices that align with their financial aspirations.

Wondering how SMFSs can amplify your financial control?

7 Big Benefits of Self-Managed Super Fund (SMSF)

1. You’re in Charge of Your Money

With SMSFs, you become the boss of your own savings. Instead of someone else making decisions for you, you get to choose where your money goes and how it grows. It’s like being the captain of your financial ship!

2. More Investment Choices

You know those big super funds you’ve heard about? Well, SMSFs give you even more choices. You can invest in different things like shares, property, or even cool stuff like collectibles. It’s like having a special menu of investment options to pick from.

3. Possibility for friends and family to join and invest together.

With SMSFs, you become the boss of your own savings. Instead of someone else making decisions for you, you get to choose where your money goes and how it grows. It’s like being the captain of your financial ship!

4. Special insurance options for protection and risk management

Life can be unpredictable, but SMSFs can help you prepare. You can get special insurance that’s kind to your wallet. And if something happens to you, your family gets the money you’ve saved without any worries.

5. Property investment opportunities and growth potential within SMSFs

Ever thought about owning property as part of your super plan? SMSFs can make it happen. You can even borrow money to buy property and watch its value grow over time. It’s like having a super-powered way to invest in real estate.

6. Tax advantages and reduced tax burdens with SMSFs

Nobody likes paying extra taxes, right? With SMSF, you can be smart about tax and pay less on your investments. That means more money stays in your SMSF where it should be.

7. Looking After Your Family’s Future

SMSFs are like a special tool for planning ahead. You can decide who gets your money when you’re not around anymore, so there’s no confusion or arguments. And if you ever need professional help in managing your super, you can choose someone you trust to take care of it for you.

Setting Up Your SMSF: A Step-by-Step Exploration

Step 1: Determining Membership and exploring member contributions.

Step 2: Choosing the Right Trustee Structure, including corporate trustee

The choice between individual trustees and a corporate trustee structure is a pivotal decision. A corporate trustee, often recommended for its benefits, can simplify administrative matters and enhance the management of the SMSF.

Step 3: Selecting the Right SMSF Trust Deed and understanding its importance.

Step 4: Applying to Establish Your SMSF, considering the Australian Business Number and Electronic Service Address

Step 5: Execution of Documents and the role of SMSF trustees

Step 6: Establishing a Bank Account and Managing Rollovers, including tax file number considerations

Step 7: Communication with Employers and handling employer contributions

Step 8: Embracing Active Management and developing a suitable investment strategy

Step 9: Compliance, Auditing, and Ongoing Costs

SMSFs are subject to various obligations under the regulations set forth by the Australian Taxation Office (ATO) and superannuation law. Ensuring compliance with ATO guidelines is essential to avoid potential non-compliance issues. Regular audits, financial statements, and compliance checks are integral components of SMSF management, albeit with associated ongoing costs.

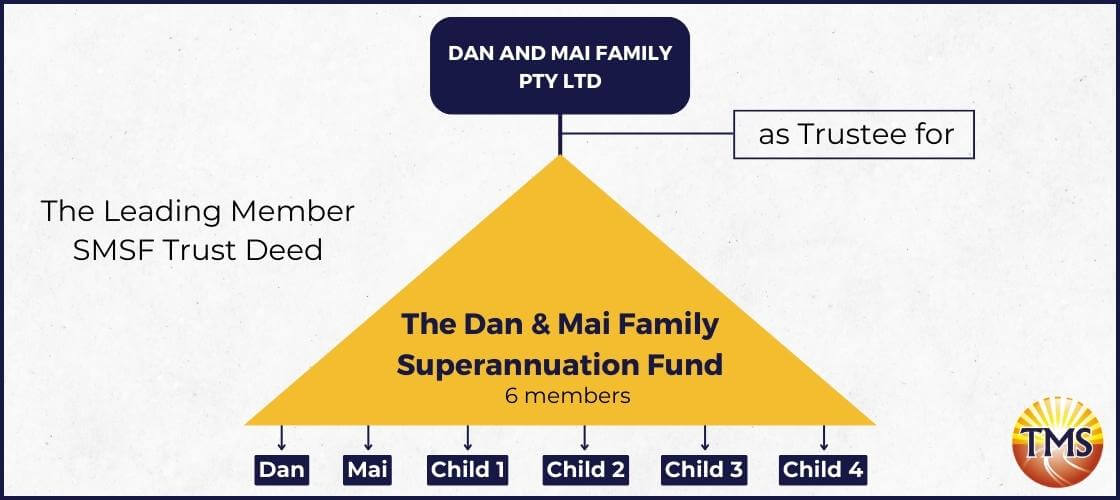

Case Study – Meet Dan and Mai: A Journey to Creating Their Own SMSF

After talking a lot and doing careful research, Dan and Mai learned about a Self-Managed Super Fund SMSF. They were really interested in the idea of having more say in how their super fund and investments worked. It was even more important to them because they had four grown-up children who were also working hard. They all wanted to have a strong financial future together. So, Dan and Mai decided to start their own Self managed superannuation funds adventure, excited to plan their future and make sure their family would be taken care of for a long time.

Transforming from mere fund members to proactive SMSF trustees

This decision had a big advantage. By pooling their money together, they could invest like a strong team with a much larger amount. As everyone contributed more money to the family super fund, their ability to invest grew even stronger. Instead of having multiple small accounts with fees that eat into earnings, they combined their resources to aim for better returns. This smart strategy allowed them to target high-quality opportunities that could lead to nice profits. Think of it as blending their financial strength to get the most out of their super fund.

And this approach brought even more benefits. It didn’t just help each person on their own, but it also brought their family closer financially. Remember, when you’re a members of a self managed superannuation funds, you also take on the role of an SMSF trustee. That means everyone works together to make decisions that lead to the best outcomes for everyone involved. So, Dan and Mai’s decision to team up and build their family SMSF was about much more than money—it was about building a stronger and more united financial future for their whole family.

Navigating the choice between individual trustees and a corporate trustee

In Dan and Mai’s case, they decided to go with a corporate trustee. Why? Well, because it makes things simpler when it comes to the boring paperwork stuff. Plus, there are some extra benefits. You see, with individual trustees, things can get really messy and confusing. It’s like mixing up your personal stuff with your SMSF stuff. Imagine if one of the family members wants to leave the fund – especially if they get married and want to do their own thing.

But with a corporate trustee, things are different. It’s like setting up a special club just for your SMSF. All six family members become directors of this club, and they’re all part of the decision-making. This is great, especially if you’re looking to invest in things like property. The cool thing is that when you buy a property, the title only has the corporate trustee’s name on it. So, if one of the members decides to leave, you don’t have to go through all the trouble of changing the ownership details on the property. It’s like super easy to manage.

Having a corporate trustee has loads of benefits compared to going the individual trustee route. So, for Dan and Mai, it was a no-brainer – they wanted things smooth and hassle-free, and the corporate trustee structure was the way to go.

Ensuring the perpetuation of family wealth through generations

So, instead of going for the standard trust deed, they went for something special called “The Leading Member SMSF Trust deed”. This trust deed is like a superhero for their family’s financial future. It’s all about making sure their super money goes to their kids and their kids’ kids. Imagine, even if something like divorce, sickness, or money troubles happens, this trust deed still keeps things on track.

And guess what? Dan and Mai get to be in charge of this superhero trust deed. They decide who can join the SMSF super fund (mostly their family), and they even have the power to call someone in their family, like their spouse, a part of the bloodline. It’s like giving extra special protection and benefits to their loved ones.

So, Dan and Mai thought long and hard about it, and they decided this Leading Member SMSF trust deed was just what they needed. It’s like a promise to their family that their super fund money will stay in the family and take care of their bloodline for years to come.

Initiating the process of setting up their SMSF

Once we received their application form, we guided them through the next steps. They signed an engagement proposal, showing their commitment, and took care of the setup fee. After that, we teamed up with experienced lawyers who created special documents, including the unique Leading Member SMSF trust deed, just for Dan and Mai.

After setting up the corporate trustee, establishing the SMSF, we proceeded to apply for an Australian Business Number (ABN), a Tax File Number (TFN) specific to the SMSF, as well as obtaining an electronic service address. These essential steps equipped their SMSF with the necessary tools for smooth operation and compliance with important rules.

Formalizing ownership through document signing and dating.

Establishing a dedicated bank account for the SMSF

Collaborative contributions for amplified financial growth

Regular review and adjustment of investment strategies

Involvement of an accountant for financial accounts and tax returns

The Roles of SMSF Professionals

The accountant’s role involves preparing the annual financial accounts and filing the tax return for the SMSF.

The SMSF auditor is responsible for conducting an audit of the fund to ensure its compliance and accuracy.

In addition, Dan and Mai also consulted with a financial adviser to make well-informed investment decisions and ensure that their SMSF was aligned with their long-term goals. This collaborative effort with SMSF professionals gave them peace of mind and confidence in managing their SMSF effectively.

Routine financial statements, audits, and compliance checks

In Conclusion: Your SMSF Journey Awaits

Dan and Mai’s real-life journey exemplifies the power of determination and strategic planning. If you’re considering embarking on your own SMSF journey, take a moment to explore our informative quiz to assess your readiness or reach out to us for professional advice and personalized guidance. Your financial future awaits, and with the right steps, you can set up and manage your SMSF to shape your own destiny.

Disclaimer

In conclusion, this article is intended to provide general awareness and a starting point for understanding SMSFs, but it should not be considered a substitute for professional advice. It is recommended that readers engage with qualified professionals to assess their individual circumstances and make well-informed decisions.

Explore your SMSF opportunities with TMS Financials.

Schedule a consultation today to discuss your financial goals

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.