How to pay yourself a salary as a company director

.

Are you considering setting up a company in Australia? is it needed for establish your own business, acquire an existing business, or contract through a Pty Ltd company for job opportunities? Maybe your Trust or SMSF also demands a corporate trustee?

Register a company might seem easy—just register on ASIC’s website. But there’s more to it. Some important steps are often missed, such as getting written consents from officeholders and making a company constitution. Just having a company certificate isn’t sufficient. If you lack the correct documents and don’t organize and store them with the company register, you could violate the Corporations Act 2001 (Cth).

This guide breaks down the steps for setting up a Company in Australia. We’ll use a real case—Sarah’s journey—to illustrate each stage. Let’s begin.

Meet Sarah and Her Family: A Coffee Lover’s Journey

Sarah has a chance to buy an existing coffee shop, “Aroma Haven Café.” But she’s uncertain about the best business structure. She wants to protect their assets – three properties – and avoid risking everything if the café doesn’t succeed. She’s looking for a smart setup that offers asset protection, good tax outcomes, and flexibility for growth. Making the right choice now is crucial to prevent expensive corrections in the future.

Sarah’s Goals and Concerns

- Control: Sarah aims to lead her coffee shop, fulfilling her unique vision.

- Asset Protection: With three properties, Sarah is eager to protect her assets as she structures “Aroma Haven Café”

- Tax Efficiency: Sarah works to maximize her café’s earnings by using smart tax strategies.

- Growth: Beyond a single café, Sarah imagines expanding her coffee business to multiple locations.

- Exit Flexibility: While committed, Sarah wants the freedom to sell her café or explore new ventures.

By understanding Sarah’s aims, we’ll explore suitable Australian business structures, ensuring the enduring success of “Aroma Haven Café.”

Sarah’s Priorities:

When asked to put her concerns in order, Sarah was clear about her ranking:

- Protecting family assets

- Minimizing income tax

- Simplifying administration

Our Recommendation:

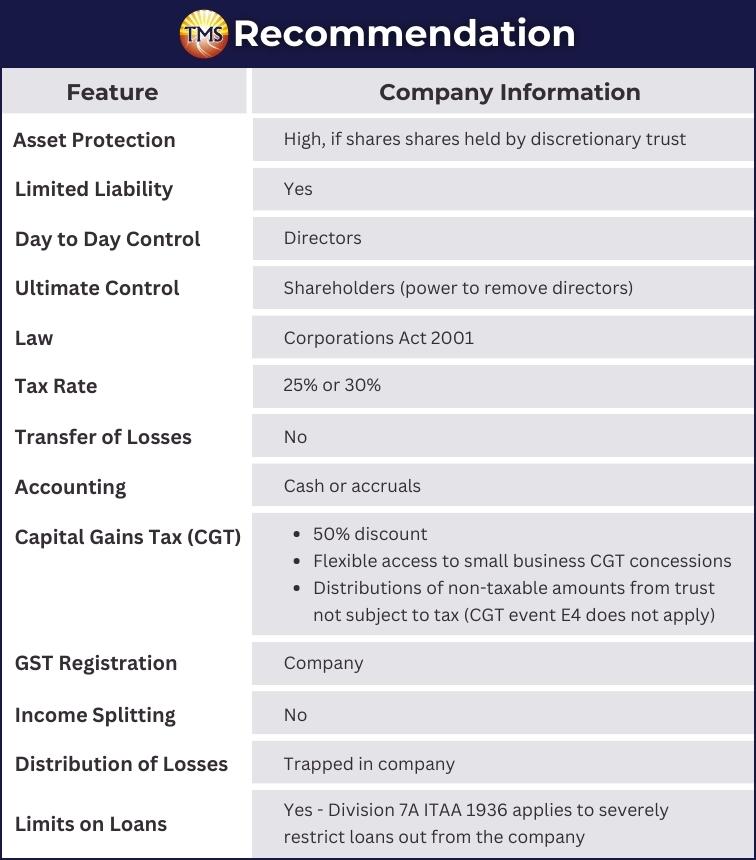

Considering Sarah’s goals, we recommend setting up an Australian company. This structure meets her needs.

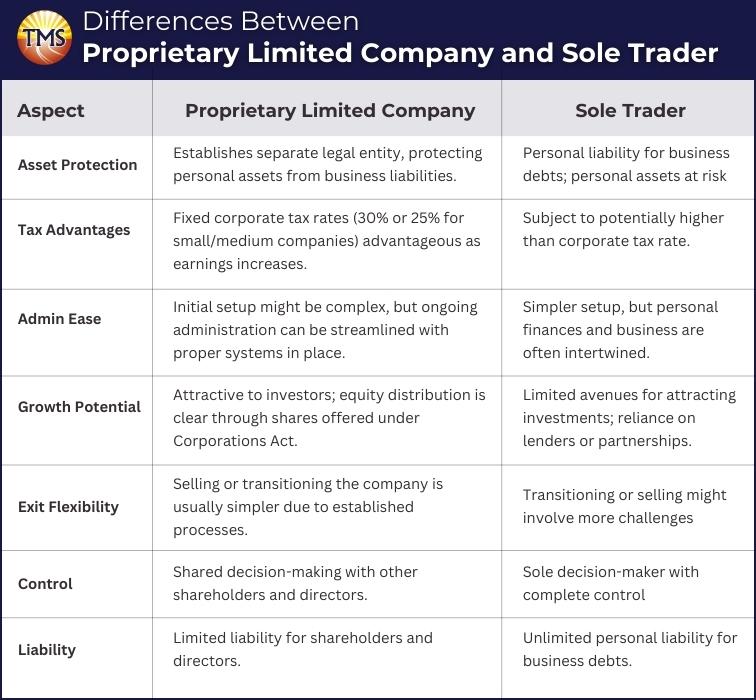

Why a Company in Australia and Not a Sole Trader?

- Asset Protection: Especially a proprietary limited company in Australia establishes a separate legal entity, ensuring a distinct division between Sarah’s personal assets and those of the company. This protection shields her family’s assets if “Aroma Haven Café” encounters financial challenges. In contrast, sole traders face unlimited personal liability for their business debts and obligations.

- Tax Advantages: Companies have fixed corporate tax rates, advantageous as earnings increase. Corporate tax rates are currently 30%, or 25% for small and medium companies, sole traders are subject to their personal marginal tax rate, which might surpass the corporate tax rate.

- Admin Ease: While initial setup might seem complex, ongoing administration with the right systems is streamlined.

- Growth Potential: Companies are attractive to investors, offering clarity in equity distribution. Company can attract investment by offering shares to third parties, regulated under the Corporations Act. On the other hand, sole traders seeking additional capital must rely on lenders, join partnerships, or restructure their business.

- Exit Flexibility: Selling or transitioning a company is simpler than for a sole trader.

What is a Company in Australia?

This legal status enables companies, like Sarah’s “Aroma Haven Café,” to conduct various activities such as making contracts, owning and selling assets, and engaging in business operations. They even have the capacity to initiate or face lawsuits, all under the company’s name instead of Sarah’s personal name. This arrangement protects her personal assets, like her home, from potential business-related risks.

When Sarah’s café is registered as a company, it receives a unique company name recognized by the Australian Securities and Investments Commission (ASIC). After registration, the company obtains an Australian Company Number (ACN), which is like an address specifically tailored to the café.

In the company’s ongoing operations, even though directors and shareholders may change, at least one director must always be present. This consistent presence ensures the company’s stability. This director, identified through a Director Identification Number (DIN), shoulders the company’s legal responsibilities.

Digging deeper, the most common type of company in Australia is the proprietary limited company, often abbreviated as ‘Pty Ltd company.’ Think of it as an exclusive café where Sarah invites a chosen group of shareholders. These shareholders contribute share capital, similar to the funds she uses for coffee beans and furniture. Decisions about these resources are collectively made by Sarah and the shareholders.

However, there’s a limit. Just as there’s a maximum capacity for Sarah’s café, a proprietary company with shares is capped at 50 members. If this number is exceeded, the business structure must transition from a private company to a public company with shares.

How Do I Begin the Company Registration Process in Australia?

Step 1 Propose a Company Name:

- Pick a proposed company name distinct from current Australian company names.

- Use the National Names Index on the ASIC website to ensure the name isn’t taken.

- For example, if Sarah suggests “Aroma Haven Café”, we’ll verify its availability. If unavailable, Sarah needs to propose a different company name.

Step 2. Decide on the Officers, Members, and Location of the Company:

Director

Basic Requirements for Directors when Registering a Company:

One director should typically be an Australian resident.

Directors must be 18 years old or above.

Directors must provide written consent for their role.

Director Responsibilities under the Corporations Act:

- Acting with honesty and transparency in all company matters.

- Prioritizing the company’s best interests over personal gains.

- Responsible handling of company information and records.

- Avoiding situations where personal interests conflict with the company’s goals.

- Making well-considered decisions to safeguard the company’s legal standing.

- Ensuring the financial health of the company to prevent personal liability.

Consequences of Failing Directorial Obligations:

- Directors can be held personally liable, potentially facing fines or imprisonment.

- Monetary penalties, which might extend up to $200,000, can also be imposed.

Shareholder:

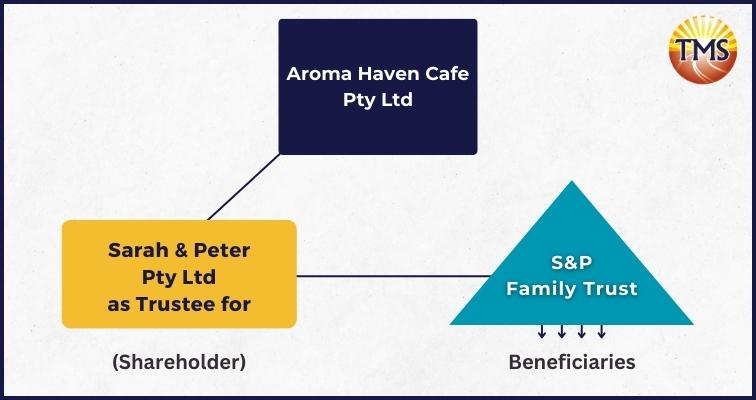

Sarah’s Recommended Structure:

Company Secretary:

Though not mandatory, having a secretary is useful for sole directors like Sarah. Secretaries must be at least 18 years old and provide written consent.

In cases like Sarah’s, where there’s only one secretary, they must reside in Australia. If there are multiple secretaries, one must be an Australian resident.

Duties include informing ASIC about company detail changes and maintaining honesty, diligence, and confidentiality.

Failure to comply can lead to fines and up to 5 years of imprisonment.

Public Officer:

The Public Officer is like the manager of the company’s tax stuff. They keep really good track of the company’s money records, which helps the accountant make the yearly financial reports and tax forms. Basically, the Public Officer helps make sure all the tax things go smoothly with the tax office.

Appointment Requirements

- Every Australian company must appoint a Public Officer.

- Only one Public Officer is allowed per company.

- The Public Officer needs an Australian residential address.

- Minimum age requirement is 18 years.

Non-Compliance Consequences

Example: Sarah’s Role

Registered Office Address:

In Sarah’s situation, we’ve suggested using our address as her registered office. This way, we can handle all regular correspondence for her Company efficiently.

Principal Place of Business:

- Represents the core location where the company conducts business. This is distinct from the registered office address.

- It signifies where primary business decisions are made and where most operations, financial records, and transactions take place.

- Director & Secretary: Sarah

- Shareholder: Sarah Trustee Company ATF the Family Trust

- Public Officer: Sarah

- Registered Office: Accountant’s business address

- Place of Business: Sarah’s shop address

Step 3.Creating the Company Constitution

Starting a company in Australia requires a strong foundation. One key pillar of this foundation is the company constitution. Think of it as the rulebook for your company, laying down all the guidelines and procedures that govern its operation.

Every company in Australia, be it private, proprietary limited, or public, has options:

- Follow Replaceable Rules – These are standard rules set by the Corporations Act.

- Draft Their Own Constitution – A tailor-made set of rules unique to the company.

- Blend of Both – Combine both replaceable rules and their own guidelines.

Why is the company constitution so important?

- It provides clarity on how the company operates, detailing roles and responsibilities.

- It’s flexible and unique to your company. Unlike replaceable rules, which need new laws to change, you can modify your constitution to suit evolving needs.

- The Australian Securities and Investment Commission (ASIC) mandates certain companies to have a constitution.

Example of Company constitution, written in plain English, includes:

- Purpose: The company’s mission and reason for existing.

- Shares: The ins and outs of different share types.

- Transfer of Shares: Guidelines on share movement.

- Directors: Selection, roles, and pay.

- Powers of Directors: What they can and can’t do.

- Documents & Records: Managing paperwork.

- Dividends & Reserves: Handling profits and savings.

- … and many more, summing up to 90 clear rules.

Remember, when you’re laying the foundation for your company, having a clear, easy-to-understand constitution is vital. It ensures that everyone involved knows their role and how the company operates.

Step 4: Obtain You Director Identification Number (DIN)

Starting 5 April 2022, getting a DIN is needed before you can register a company. Not following this rule can lead to legal problems, as outlined by the Australian Securities and Investments Commission (ASIC). Get your DIN online through the Australian Business Registry Services (ABRS) for quickness. This step highlights the legal duties and responsibilities in the company structure, essential for keeping a strong business structure in Australia.

Step 5. Company Registration with ASIC

Preparation is Key: Before you register the company with ASIC, you need the following:

1.Your Chosen Company Name: It should be unique and represent your business well.

- Registration Location: Which State or Territory will your company register? Is it NSW?

- Physical Addresses: Secure both your registered office and principal business addresses. Remember, no P.O Boxes allowed.

- Officeholders’ Details: For each director, public officer, and secretary, collate:

- Their complete full name, home address, date and place of birth, and director ID.

- Specifics of each officeholder’s share: type, quantity, and rate per share.

- Shareholder Info: If there are shareholders who aren’t officeholders, provide their name, ACN/ABN (if it’s a company), address, and share particulars.

2. Get consent from officeholders, members and Registered Office

- Ensure you have written consent from individuals taking on these roles:

- Director (above 18 years old)

- Secretary (also above 18)

- Member (your company needs at least one).

- Remember, for a proprietary company, at least one director and secretary should live in Australia.

- Registered Office Consent: If your registered office isn’t the company’s property (say, your accountant’s place), obtain their written approval to use the address.

3. Organize Company Records: Your company’s paper trail is essential. Ensure you have:

- Company Constitution

- Resolutions of members and directors upon incorporation

- Registers for directors, secretaries, and members

- Consents from officeholders and members

- A letter designating a public officer to the ATO

- Share allotment journal

- Share certificates

4. Go Online: With everything in place, you’re set to register your company online

5. Stay Compliant: Just having an ASIC Certificate of Registration isn’t enough. According to the Corporations Act 2001 (Cth), your company must maintain specific records, including:

- Officeholder consent forms

- Company Constitution

- Applications for shares

- Minutes of meetings of Directors

- Share Certificates

- Members Register

- Occupiers consent to use the registered office (if the company is not the occupier)

- And more, based on your business structure.

Starting Right Matters: Setting up a company in Australia is the foundation of your business journey. A small oversight now can become a costly problem later, both in terms of fixing it and potential penalties. It’s not just about paperwork; it’s about creating a solid base for your future growth. Mistakes at the start can hold you back and eat into your profits. For the sake of your business’s future, it’s crucial to get the setup right. Consider seeking expert guidance – it’s an investment in getting things right from the start.

Step 6: Applying for TFN, ABN, and GST

It’s recommended to consult with a legal or financial professional during this process to ensure that you’re fulfilling all the necessary obligations and making informed decisions for your company’s tax and regulatory matters.

Step 7: Open a Bank Account for Your Company

Opening a business bank account is a critical step in maintaining your company’s financial integrity and ensuring smooth financial operations. Having a separate bank account simplifies tracking income and expenses, making tax reporting and financial management more efficient.

Next Step is to Contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Unsure About Setting Up Your Company in Australia?

Take the first step forwards setting up your company the smart way.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.