Understanding the New Tax on Super Over 3 Million

.

Starting from 1 July 2025 the new tax on super over 3 million will be subjected to a 30% tax rate, meaning any surplus earnings will generally be liable to an overall tax rate of 30%. Income linked to Total Superannuation Balances (TSBs) under $3 million will still be subject to the regular 15% tax rate, or no tax if associated with super balances in the pension retirement phase.

The proposed changes involve taxing the disparity between a member’s TSB from the current financial year and the previous one, which is then adjusted for net contributions (excluding contributions tax paid by the fund on the member’s behalf) and withdrawals.

Application of the 30% Tax Rate to Excess Earnings

Taxation of Super Fund Earnings Under Current Concessional Rules

Taxable income stemming from superannuation fund assets employed to back accumulation entitlements is subject to the concessional tax rate of 15%.

Any regular or statutory income arising from superannuation fund assets that sustain pensions in the retirement phase is exempt from taxation for the fund.

Superannuation Limits, Caps, and Regulations in Effect

Contribution Caps

TSB Constraint for Non-Concessional Contributions

Transfer Balance Cap for Retirement Phase Pensions

It’s worth noting that all of your super account balances are considered when calculating whether you are within the transfer balance cap. If you exceed this cap, there may be implications and restrictions on making further transfers into the retirement phase.

Tax Implications – Breaching the Transfer Balance Cap

This excess of $100,000 would attract an excess transfer balance tax, typically charged at 15% on a notional earnings amount calculated from the surplus. To address this, the individual would need to transfer the excess amount back into the accumulation phase or potentially remove it from the superannuation system altogether.

Determining Eligibility for the 15% Additional Tax from July 2025

For instance, should an individual’s TSB on 30 June 2026, surpass $3 million, they will be liable for the 15% additional tax on calculated earnings that exceed $3 million (as detailed below) for the 2026 fiscal year. This approach allows individuals to determine their responsibility for the 15% additional tax by referencing their TSB at the end of each income year, commencing from 30 June 2026.

Calculating TSB for Individuals Under the Government’s Proposal

It’s crucial to note that a person’s TSB encompasses all their superannuation assets, rather than being calculated separately for each individual asset. This implies that the $3 million cap is set for each person as a whole, not for each separate account or fund they may have.

To reduce the effect on most members who won’t be affected and to avoid costly and major changes to systems, the government plans to stick with the current reporting rules for funds. Given that funds usually do not report or compute taxable earnings at the level of individual members, the suggested approach introduces an alternative method for assessing taxable earnings for those individuals who are affected.

The ‘Catch-Up’ Concession

Such provisions highlight the government’s intention to optimise superannuation tax concessions and facilitate tailored contributions for individuals. This ‘catch-up’ approach, coupled with the specified TSB threshold, aims to strike a balance between offering advantageous concessions and preventing excessive accumulation within the superannuation system.

Non-Concessional Contributions Cap (under the ‘Bring-Forward Rule’)

Implementing the $3 Million Total Super Balance Threshold

Unindexed Threshold

Individual-Specific Application

Interplay with Transfer Balance Cap

TSB Monitoring

Transfer Balance Cap Consideration

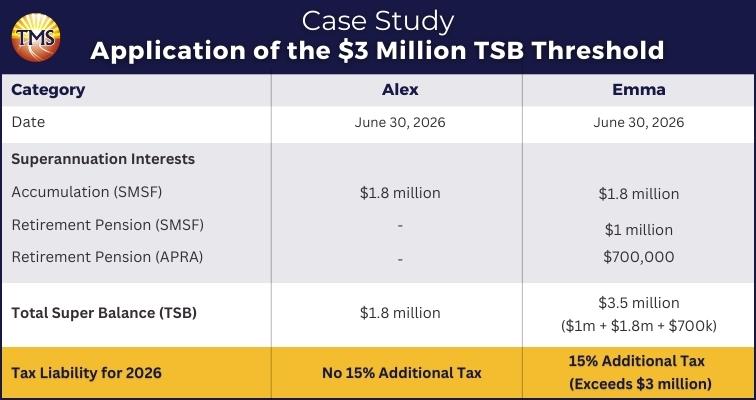

Case Study: Application of the $3 Million TSB Threshold

Alex holds an accumulation interest in an SMSF with a value of $1.8 million (and possesses no other interests).

Emma’s superannuation interests encompass the following accumulation and pension elements:

A retirement phase pension interest in the SMSF valued at $1 million.

An accumulation interest in the SMSF valued at $1.8 million.

Emma also holds a retirement phase pension interest in an APRA-regulated fund with a value of $700,000.

Is Alex liable for the 15% additional tax in the 2026 income year?

Is Emma liable for the 15% additional tax in the 2026 income year?

Handling Losses in a Financial Year

Impact on Defined Benefit Accounts

Impact on Retirement Phase Balances

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Stay Ahead of New Tax Changes!

Consult with TMS Financials experts now and Book Your FREE Review Today!

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.