Average retirement age in Australia

.

Retirement in Australia

Retirement refers to the period in life when one stops working and begins to draw on their superannuation, which is a fund set up to provide money for retirement. The age at which you can access your super depends on your preservation age, which varies depending on when you were born.

In addition to superannuation, some individuals may also qualify for government support such as age and service pensions or benefits, and tax offsets. Planning for retirement involves considering factors such as when you can access your super, how much tax you will pay on amounts you receive, and whether certain conditions or concessions apply to you.

What is the average retirement age in Australia?

The average retirement age in Australia can vary depending on factors such as health, financial situation, and personal choice. However, to access the Australian Government age pension, you must be 66 years and 6 months or older as of 30 June 2021, and this will increase to 67 years or older from 1 July 2023. For the age service pension from the Department of Veterans’ Affairs, you must be at least 60 years old as of 30 June 2021. The age at which you can access your superannuation depends on your date of birth, with those born after 1 July 1964 having a preservation age of 60.

What is preservation age?

The preservation age, which is the minimum age at which you can access your superannuation benefits, plays a crucial role in planning your financial future and retirement savings. This age is a key factor in determining the Australian retirement age and can be calculated using a retirement age calculator. If you were born before 1 July 1960, your preservation age is 55, allowing for potential early retirement.

For those born between 1 July 1960 and 30 June 1964, the preservation age increases incrementally from 56 to 59. If you were born after 30 June 1964, your preservation age is 60. The average age for accessing superannuation benefits varies, but it’s important to note the age pension eligibility starts from age 66 and 6 months as of 30 June 2021, increasing to 67 years from 1 July 2023. Your preservation age and the age pension eligibility age are key factors in determining your retirement income.

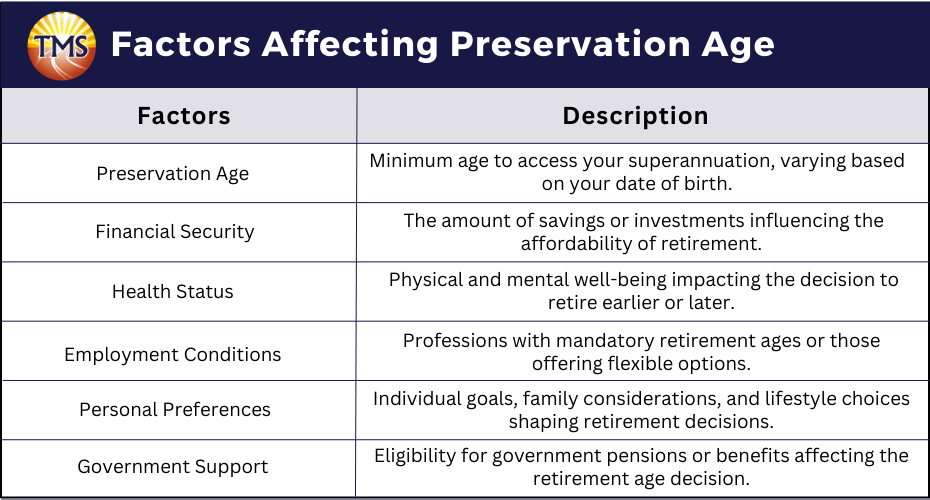

Factors influencing retirement age

Preservation age

This is the minimum age at which you can access your superannuation. It varies depending on your date of birth.

Financial security

The amount of savings or investments you have can determine when you can afford to retire.

Health status

Your physical and mental health can influence when you retire. If you’re in good health, you may choose to work longer, while health issues may necessitate earlier retirement.

Employment conditions

Some professions have a mandatory retirement age, while others may offer flexible or early retirement options.

Personal preferences

Your personal goals, family considerations, and lifestyle choices can also play a role in deciding when to retire.

Government support

Eligibility for government pensions or benefits can also affect your retirement age.

Government support and benefits for retirees

The Australian Government provides a range of support and benefits for retirees, which are crucial in shaping their retirement income. The age pension, a regular income support payment, is available for older Australians who meet certain age and income requirements. The average age for accessing this pension is 66 years and 6 months as of 30 June 2021, increasing to 67 years from 1 July 2023. Service pensions are provided to veterans based on their retirement age and disability status.

Tax Offsets are available to reduce the amount of tax retirees pay on their income, which can significantly boost retirement savings. Concessions are also provided to help lower the cost of living, including discounts on healthcare, public transport, utilities, and more.

In addition to these, the government provides healthcare benefits through the Medicare system, which offers access to healthcare at low or no cost. Older Australians can also access specific healthcare concessions, such as discounts on prescription medicines, bulk billed doctor visits, and a higher Medicare Safety Net.

The Pharmaceutical Benefits Scheme further reduces the cost of prescription medications. Specific healthcare cards like the Commonwealth Seniors Health Card provide additional benefits.

Superannuation preservation age, which is the minimum age at which you can access your superannuation funds, is another key factor in planning for retirement. According to the Australian Bureau of Statistics, if you were born before 1 July 1960, your preservation age is 55. For those born between 1 July 1960 and 30 June 1964, the preservation age increases incrementally from 56 to 59. If you were born after 30 June 1964, your preservation age is 60.

It’s important to note while some Government payments, such as pension payments, are tax-free, they still need to be declared in your tax return. This information is used to determine your eligibility for tax offsets and any government benefits or concessions. Given the complexity of these matters, obtaining personal financial advice can be beneficial.

Services Australia

Services Australia is a Government agency that delivers social and health-related payments and services. It provides access to a range of services, including Centrelink, Medicare, and Child Support. For retirees, Services Australia provides information and access to government age pensions, concessions, and other benefits. It plays a crucial role in helping Australians access the services they need in a timely and efficient manner.

Services Australia is responsible for delivering a range of important government services and payments to Australians. Its responsibilities include:

- Administering social welfare payments including Age Pension, Disability Support Pension, and unemployment benefits

- Delivering Medicare services including processing claims and payments for health-related services, tests, and prescriptions

- Managing the Child Support program including collecting and transferring child support payments between separated parents

- Providing services for the Australian Organ Donor Register and the Australian Immunisation Register

- Assisting people affected by emergencies and disasters by providing financial support and services

- Offering self-service options, digital services, and tools to make it easier for people to manage their dealings with the agency

- Providing multilingual and multicultural services to ensure all Australians can access the services they need

What is Retirement Income Covenant?

The Retirement Income Covenant (RIC) is a proposed legislation in Australia that will introduce a requirement for superannuation trustees to have a retirement income strategy for their members. This strategy must outline how the trustees plan to assist their members in retirement, considering how to balance maximising their retirement income, managing risks, and providing some flexible access to savings. The covenant is expected to take effect from 1 July 2022, subject to the passage of legislation. The draft legislation reflects feedback received from stakeholders, including that Self-Managed Super Funds (SMSFs) will no longer be subject to the covenant, and that inflation risk and the needs of defined benefits members who can commute their balance to a lump sum must be considered as part of the strategy.

Impact of the Retirement Income Covenant

The Retirement Income Covenant will have several impacts on superannuation trustees and their members.

- Trustees will be required to formulate, regularly review, and implement a retirement income strategy for their members. This means they will need to consider how to balance maximising retirement income, managing risks, and providing flexible access to savings for their members.

- The covenant will change the way trustees approach retirement planning, with a greater focus on providing income in retirement rather than accumulating savings.

- It will also impact Self-Managed Super Funds (SMSFs) as they will no longer be subject to the covenant.

- The inclusion of inflation risk as a consideration means trustees will need to factor in the potential impact of inflation on retirement income.

- The requirement to consider the needs of defined benefits members who can commute their balance to a lump sum will also change how trustees manage these types of funds.

Overall, the Retirement Income Covenant aims to enhance the retirement outcomes for superannuation members by ensuring trustees have a clear strategy in place to support their members in retirement.

Trans-Tasman retirement savings portability scheme

The Trans-Tasman retirement savings portability scheme is a system that allows individuals to transfer their retirement savings between Australia and New Zealand. This scheme has been in place since 1 July 2013 and is designed to assist individuals who emigrate between the two countries. To transfer your retirement savings to an Australian super fund, you will need an Australian Tax File Number (TFN).

The retirement savings you transfer are held in your super fund in two parts: the New Zealand-sourced component and the Australian-sourced component. The scheme covers Australian-sourced or New Zealand-sourced amounts that form part of the transfer, the tax-free component of an Australian-sourced amount, amounts not previously counted towards the non-concessional contributions cap, and restricted non-preserved or unrestricted non-preserved amounts.

Recent developments in retirement in Australia

Recent developments in retirement include the introduction of the Treasury Laws Amendment Bill 2021, which includes measures such as the removal of the $450 per month threshold for salary or wages and the introduction of the Retirement Income Covenant (RIC). The Australian Prudential Regulation Authority (APRA) is reviewing retirement income strategies in collaboration with the Australian Securities and Investments Commission (ASIC). The Australian Financial Complaints Authority (AFCA) reported over 5,200 complaints in the superannuation space last financial year.

The ATO’s 2022–2023 Corporate Plan focuses on expanding the use of Single Touch Payroll (STP) data.

From 1 July 2025, a 30% concessional tax rate will be applied to superannuation balances above $3 million, pending further consultation.

The eligibility age for the downsizer age threshold will decrease to 55 years from 1 January 2023.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.