Instalment Activity Statements (IAS) for Individuals & Businesses

.

What is an Instalment Activity Statement?

An Instalment Activity Statement or IAS is a pre-printed document sent out by the Australian Taxation Office (ATO) each month which applies to you if you deal with any of the following:

- You are not registered for Goods and Services Tax (GST), but you need to report PAYG Instalments, PAYG Withholding, ABN Withholding, and/or FBT Instalments.

- You submit quarterly Business Activity Statements (BAS), but you must also pay PAYG withholding tax monthly since you are classified as a medium withholder.

PAYG Instalments (PAYGI)

PAYG Instalments are the income taxes on your business and investment income that you pay in instalments which lessens the burden of having a large bill when you lodge your tax return at the end of the financial reporting period. If you don’t register for GST, use the IAS form to lodge PAYGI.

PAYG Withholding (PAYGW)

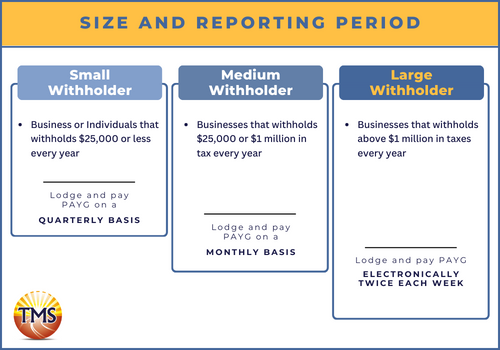

PAYG Withholding is the amount you take from the payments given to your employees and other workers, which will then be paid directly to the ATO on their behalf. If you’re not registered for GST and need to report PAYG withholding, you must use IAS. In addition, if you withhold more than $25,000 to $1 million a year, even though you are GST-registered and preparing BAS quarterly, you must lodge IAS for the month’s interval.

For more details on PAYG Instalment or PAYG Withholding, please see this article.

ABN Withholding

Whenever a supplier does not provide you with their ABN in the invoice or other document that relates to any goods and services paid which is more than $75 excluding GST, you need to withhold a rate of 47% from that payment and must be reported through your IAS or BAS, subject to exclusions.

For example, if a contractor billed you for a job amounting to $1,000 but was not able to provide you with their ABN (or if ABN provided is invalid), you must withhold an amount of $470 ($1,000 x 47%) and pay to the ATO by reporting it in the IAS.

FBT Instalments

Fringe Benefit Tax is the tax you as an employer pay for benefits you provide to your employees – even their families or associates. You can claim tax deductions for the FBT paid and the cost of fringe benefits provided.

Some examples of fringe benefits:

- You lend an employee a loan at a discounted amount,

- Reimburse an expense that your employee incurs, for example, gym fees,

- You let your employee use a work car for private purposes.

If you have an FBT of $3,000 or more in the previous financial year, FBT instalments will automatically be generated in your IAS (if you are required to report monthly) or your BAS (if quarterly). In other cases, you can report and pay in the annual FBT return. To learn more about FBT, read our Article “Why you should lodge FBT Return?”

What should I do if I receive an IAS form?

The ATO has a comprehensive record of information about Australian companies and individuals, such as business or physical address, date of birth, spouse details, and other relevant information in their system database. With this, the ATO can prefill personal details in the IAS form and even provide you with the instalment amounts, in the case of PAYG and FBT Instalments. Ensure essential information concerning your company is updated before completing any ATO forms.

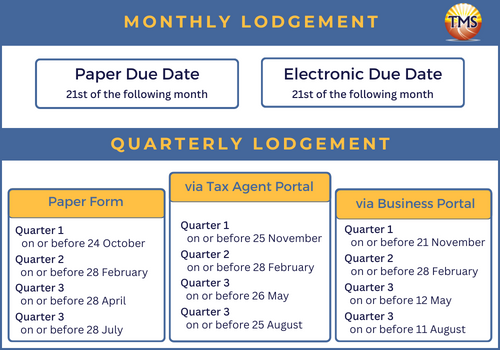

Each form required by the ATO must be submitted on or before the due date to avoid late fees, so be sure that it is completed ahead since they also give the IAS forms in advance.

When to lodge IAS’s?

Knowing the due dates of any reports or statements to to manage your lodgments properly is vital. As such, see below the IAS lodgment due dates for your reference.

How do I file an IAS to the ATO?

Here are the common ways to file an IAS return:

a) By paper form – The ATO will send you a paper form via mail with prefilled instalment amounts. Make sure it is appropriately lodged before the due date.

b) In the ATO Online Services – Online services for Individuals and Sole Traders and Online Services for businesses can be used by those who prefer online filing of IAS. You can access these through myGov.

c) Through your Tax or BAS agent – your registered tax or BAS agent can do IAS lodgments for you. They can also vary the amount and even pay on your behalf through their chosen electronic medium like the Tax Agent Portal or an SBR-enabled software.

With the surge of the Covid-19 Pandemic, many individuals and businesses opt to lodge their IAS forms online via their tax agents or the ATO online services.

It will be a good practice to keep copies of your IAS documents and records to keep track of your payments and have proper documentation.

Conclusion

To conclude, instalment activity statements are for businesses and taxpayers that are not GST registered but have some other tax obligations. Taxes paid on time, quarterly or on a monthly basis can help you avoid unnecessary default charges from the ATO. Having a good plan ahead for your tax obligations is a must, as tax rates and requirements are changing nowadays due to unforeseen events, like the Covid-19 crisis.

IAS obligations are sometimes affected by how you structure your business. Did you know that you can reduce your IAS liabilities when you’re using the right structure? Let our team of professionals help you work out the best tax planning and restructuring for your business. Book an appointment now!

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.