Maximising your property Investment: Trust vs Company – Which structure is right for you?

.

What is a trust and how does it work for property investment in Australia?

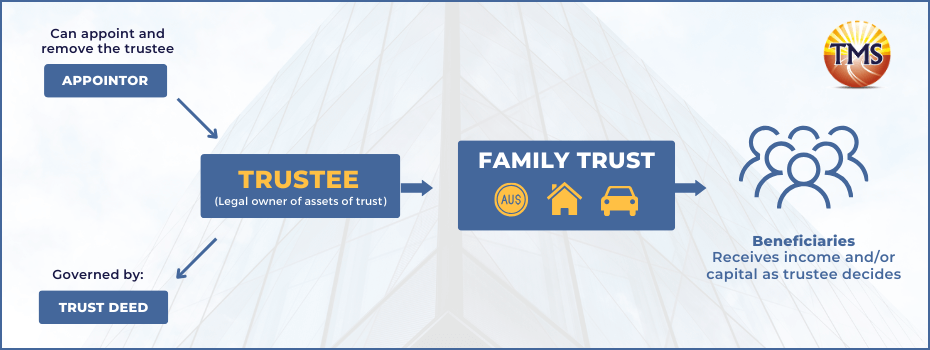

A trust is a legal arrangement in which a trustee holds assets on behalf of beneficiaries. Trusts come in many different forms, including unit trust, discretionary trust, and family trust. The trust structure is governed by a trust deed, which sets out the rules and obligations of the trustee. In the context of property investment, a trust can be used as a business structure for holding and managing property assets.

One of the key benefits of a trust is that it can provide asset protection. Trust assets are generally separate from the personal assets of the trustee and beneficiaries, which means that they are protected from creditors in the event of bankruptcy or legal action. Trusts can also provide flexibility in terms of income distribution, which can be tax-effective.

Read our article on Business Trading Trust as we go in depth in discussing the benefits and how the trust structure works.

What is a company and how does it work for property investment?

A company, on the other hand, is a separate legal entity that can own and operate assets, including property. A company structure can provide many of the same benefits as a trust, including asset protection and tax-effective income distribution.

One of the key features of a company is that it is a separate legal entity, which means that it can enter into contracts and own assets in its own right. This can be useful for property investment, as it allows the company to enter into leases and manage property assets without involving the shareholders. Additionally, a company structure offers limited liability, meaning that shareholders are not personally liable for the company’s debts or liabilities. This can provide greater protection for shareholders compared to a sole trader or partnership structure.

Another feature of a company is that it can provide greater flexibility in terms of shareholding and ownership. For example, a family business can use a company structure to hold property assets, with shares in the company being held by family members. This can also provide greater opportunities for income distribution, as shareholders can receive dividends from the company’s profits.

property investment? Schedule a consultation

with TMS Financials today.

Key differences between trust and company for property investment

When considering a trust or company structure for property investment, it’s important to understand the key differences between the two.

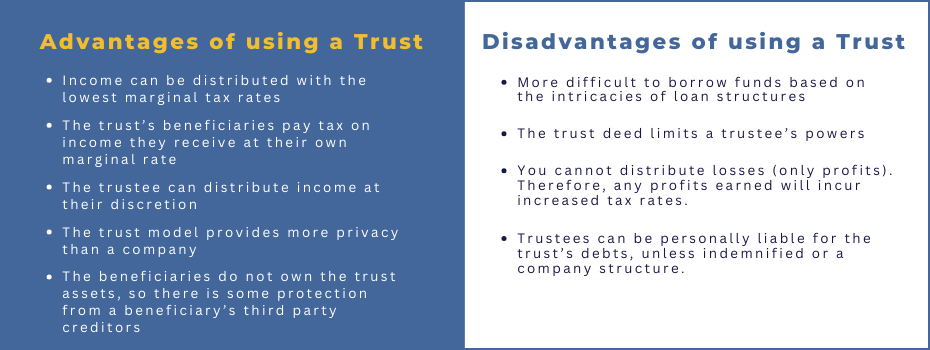

Advantages of using a trust

- Income can be distributed with the lowest marginal tax rates

- The trust’s beneficiaries pay tax on income they receive at their own marginal rate

- The trustee can distribute income at their discretion

- he trust model provides more privacy than a company

- The beneficiaries do not own the trust assets, so there is some protection from a beneficiary’s third party creditors

Drawbacks or disadvantages of a trust

- More difficult to borrow funds based on the intricacies of loan structures

- The trust deed limits a trustee’s powers

- You cannot distribute losses (only profits). Therefore, any profits earned will incur increased tax rates.

- Trustees can be personally liable for the trust’s debts, unless indemnified or a company structure.

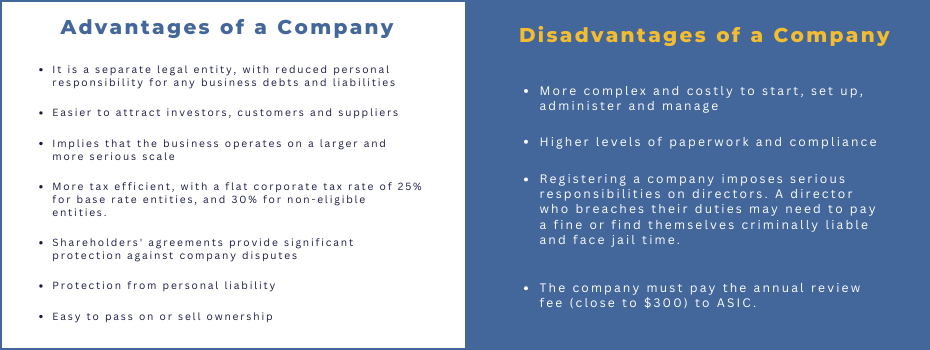

Advantages of a company

- It is a separate legal entity, with reduced personal responsibility for any business debts and liabilities

- Easier to attract investors, customers and suppliers

- Implies that the business operates on a larger and more serious scale

- More tax efficient, with a flat corporate tax rate of 25% for base rate entities, and 30% for non-eligible entities.

- Shareholders’ agreements provide significant protection against company disputes

- Protection from personal liability

- Easy to pass on or sell ownership

Drawbacks or disadvantages of a company

- More complex and costly to start, set up, administer and manage

- Higher levels of paperwork and compliance

- Registering a company imposes serious responsibilities on directors. A director who breaches their duties may need to pay a fine or find themselves criminally liable and face jail time.

- The company must pay the annual review fee (close to $300) to ASIC.

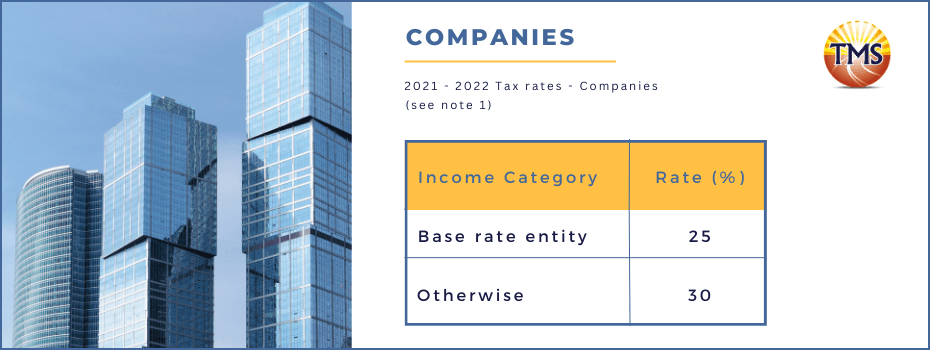

Tax treatment for trust and company

-

For Trusts: Beneficiaries pay marginal tax on income distributed to them, and capital gains tax (CGT) discount of 50% is available for beneficiaries.

For Companies: Income tax rates of 25% for small business entities and 30% for non-eligible entities, and no CGT concessions or discounts.

It’s worth noting again that depending on what you want to achieve, either of them can be useful. Trust is best when you want to protect assets and minimise taxes, while company is best when you want to run a business and make profits.

Choosing the right structure for your property Investment: considerations and takeaways

When choosing a business structure for your property investment, it’s important to consider factors such as your investment goals, the type of property you’re investing in, and your personal circumstances. For example, if you’re looking for a structure that provides asset protection and flexibility in terms of the income distribution, a trust may be a more suitable option. On the other hand, if you’re looking for a structure that offers a separate legal entity, greater flexibility in terms of shareholding and ownership, and limited liability, a company may be a better option.

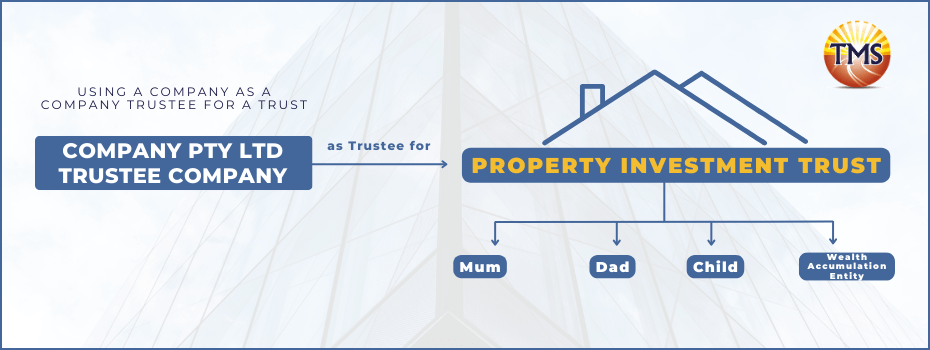

Maximising property investment with trust and company: Using a company as trustee company

When investing in property, combining the use of trusts and companies can provide a number of benefits. By using a company as the corporate trustee for a trust, investors can take advantage of the best of both structures. This approach allows property investors to gain the best of both worlds – asset protection and tax minimisation from trusts, and limited liability and ease of ownership transfer from companies.

By using a company as a corporate trustee, property investors can achieve:

- Continuity in the management of their assets

- Increased asset protection

- Simplified administration of their investments

- Limited liability to the assets of the company.

This combination of trust and company enables investors to optimise their investments and achieve their goals.

When it comes to small business, the choice of trust vs company is important, trusts provide asset protection and flexibility in terms of income distribution, while companies provide a separate legal entity and greater flexibility in terms of shareholding and ownership. Ultimately, the right structure for your property investment will depend on your individual circumstances and goals.

Both trust and company can be useful structures for property investment, and the best option for you will depend on your specific circumstances, it’s important to consider factors such as capital gains tax, income tax, the potential tax benefits, ongoing operating costs and administration requirements, and most importantly seek professional advice when making the decision.

It’s important to consult with a professional accountant or financial advisor to determine which structure is best for your specific circumstances and to ensure that you take advantage of all the tax benefits available to you.

Investing in property can be a complex decision, and choosing the right business structure is an important part of that decision. If you’re considering investing in property and need assistance in determining whether a trust or company structure is best for you, please contact TMS Financials for a consultation. Our team of experts can help you understand the key differences and benefits of trusts and companies, and guide you in making the best decision for your specific needs.

If you are still undecided on which structure works for you, you can continue reading our article “Utilising a Business Trading Trust for Asset Protection“.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.