Unlock the Benefits of a Bucket Company: Maximise Tax Savings and Protect Your Assets

.

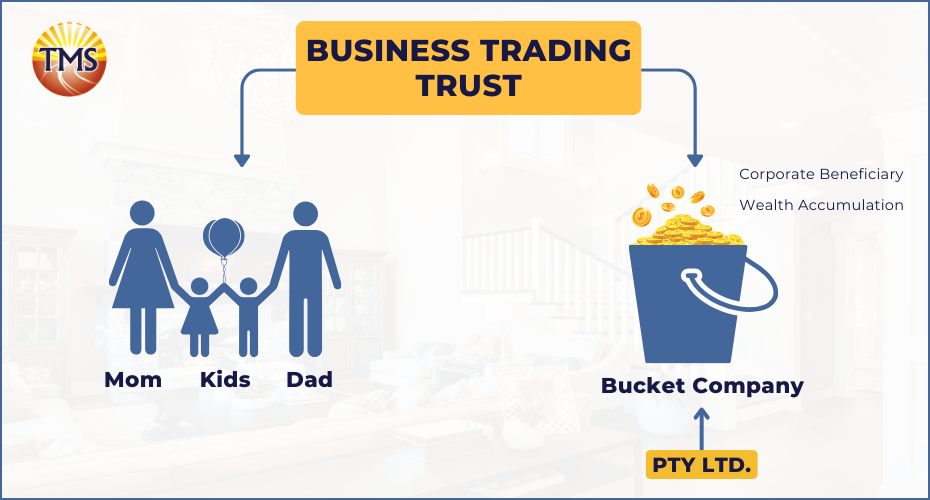

What can you do to maximise profits and minimise tax burden for your trust-operated business?

Are you making a lot of profit this year and looking for a proper way to minimise your tax burden through proper tax planning? If you operate your business through a trust, you may be facing an issue of limited beneficiaries for distributing profits.

One solution to consider is setting up a bucket company. A bucket company allows for the distribution of profits at a lower corporate tax rate, rather than individual tax rates. This can be especially beneficial for those with few beneficiaries, such as just a spouse or parents. By using a bucket company, you can effectively minimise your tax burden and maximise the distribution of profits to your chosen beneficiaries.”

What is a Bucket Company?

A bucket company in Australia is a type of company structure that is typically used for tax planning purposes. It allows for the distribution of profits at a lower corporate tax rate, rather than individual tax rates. This can be especially beneficial for those with few beneficiaries, such as just a spouse or parents. By using a bucket company, the business owner can effectively minimise their tax burden and maximise the distribution of profits to their chosen beneficiaries. It is a legal way to minimise tax and protect assets.

Benefits of a Bucket Company

- Tax Savings: A bucket company allows the trust to distribute income to the company at a lower tax rate than the individual beneficiaries. This can result in significant tax savings for the trust beneficiaries.

- Asset Protection: A bucket company can be used to protect assets from creditors and provide a higher level of asset protection than an individual trust.

- Flexibility: A bucket company can provide flexibility in terms of how the trust’s income is distributed, allowing you to achieve your financial goals.

How a bucket company can be used for tax planning and asset protection?

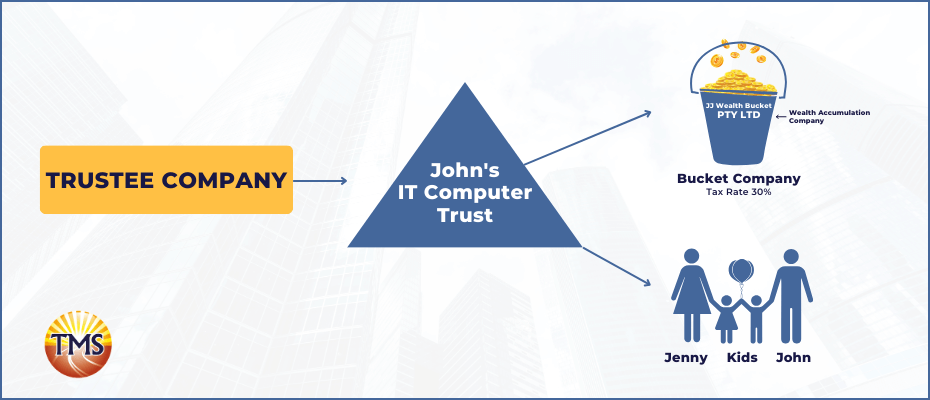

Case Study: John’s IT Computer & Retail Business

Meet John, a business owner and the head of his family. He runs an IT Computer & Retail business that operates as a Trust. the Trust had a profitable year with a business profit of $600,000.

John wants to make the most of this money and has several goals in mind. He wants to pay off their home loan faster so they can own their house outright, treat his family to a nice holiday, and save money for his retirement.

As a business owner, John wants to ensure that he and his family are not paying more tax than necessary, and also wants to protect his assets.

To achieve these goals, John talked to TMS Financials about tax planning strategies.

We suggested that John set up a new company, called a “bucket company” or “wealth accumulation company,” which the Trust can distribute income to the company. By doing this, the company will only have to pay 30% company tax rate on the income, which is a more tax-effective manner. We also showed John a few different scenarios for how to distribute the money and save on taxes, in order to minimise the amount of tax paid.

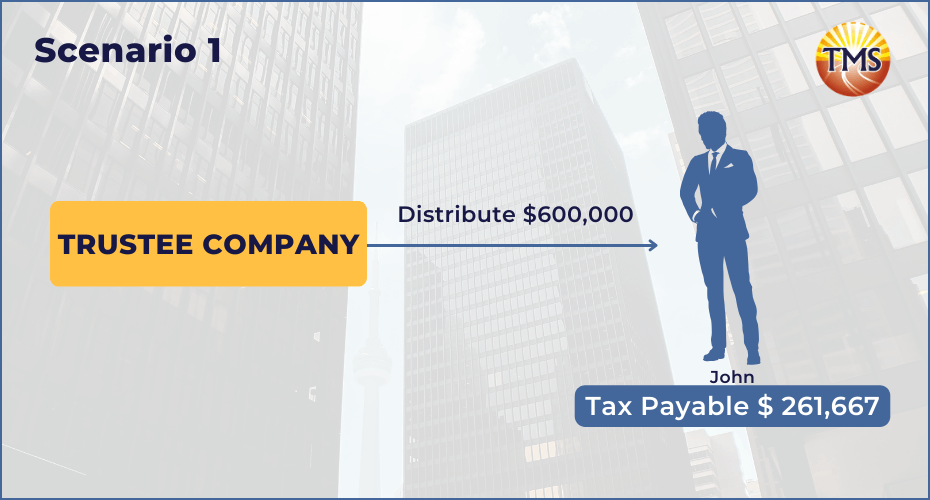

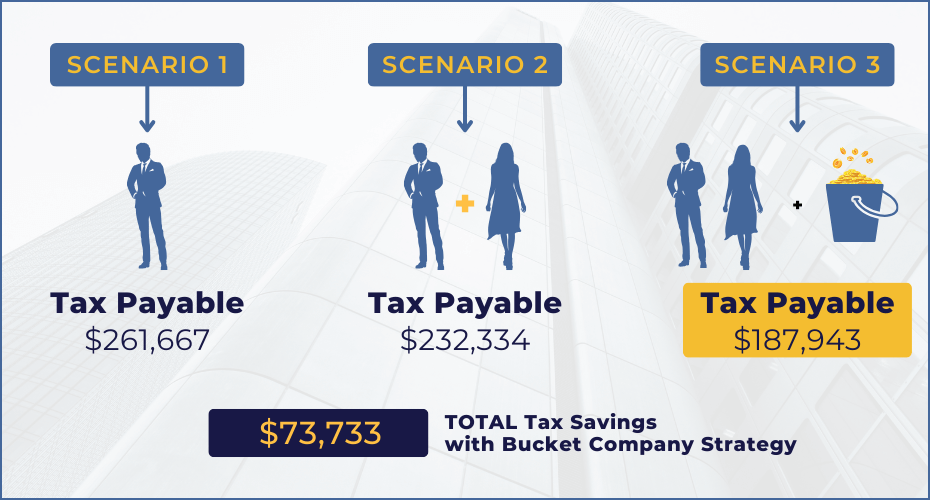

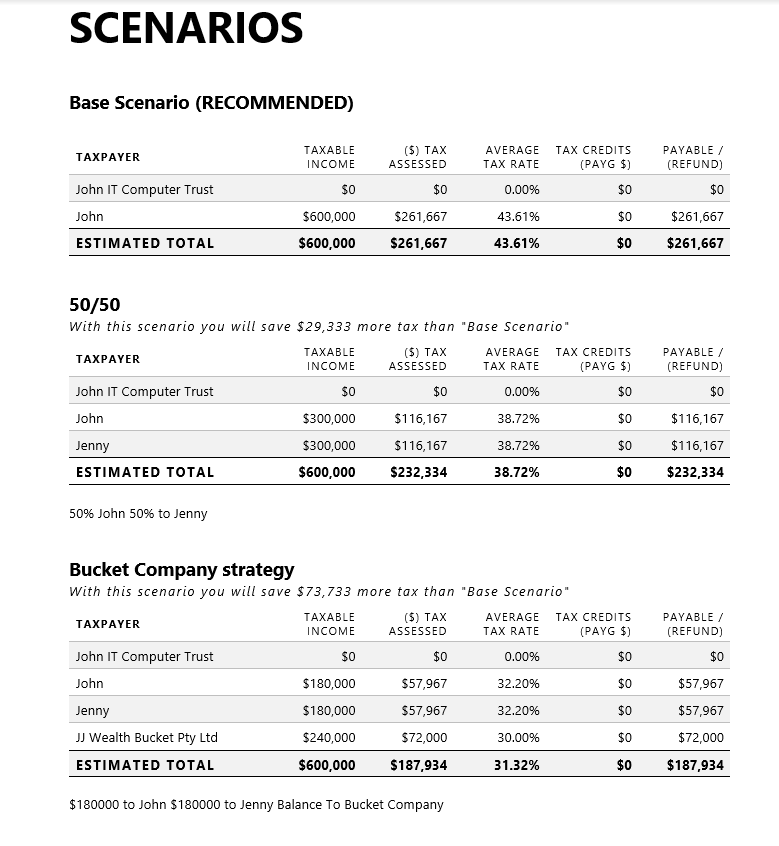

Scenario 1 Tax paid without Bucket Company 100% distribute to John

John IT Computer Trust distributes business income of 100% to John, the business owner. John is subject to the highest marginal tax rate, resulting in a tax payable of $261,667 including the Medicare levy. This amount is calculated based on John’s taxable income and his own personal tax rate, which is determined by the marginal tax rates. John will need to lodge a tax return and pay this amount of tax to the Australian Taxation Office. The total tax paid by John in this scenario would be $261,667.

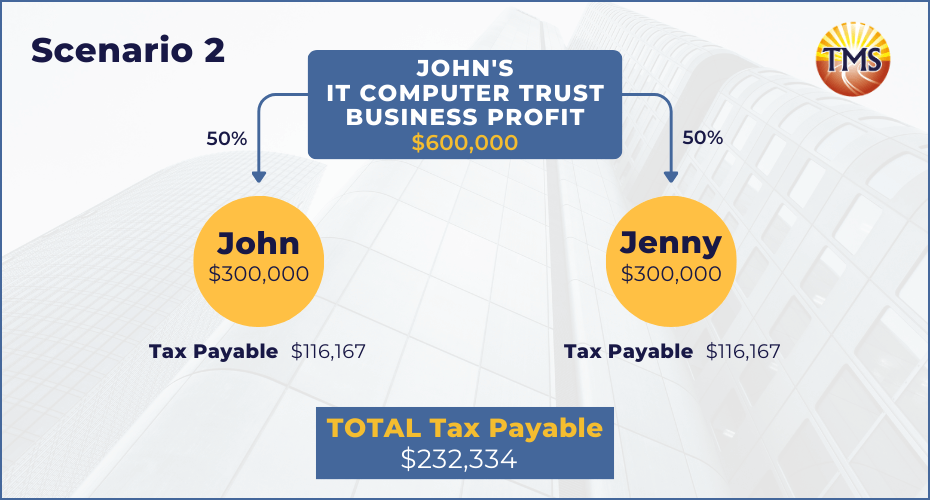

Scenario 2 Tax paid without Bucket Company 50/50 to John and His wife Jenny

John IT Computer Trust will distribute 50% of the business income, which is $300,000, to John and 50% of the trust business income, which is $300,000, to Jenny. The tax payable on this income, including the Medicare levy, is $116,167 for each of them. The total personal tax payable for both of them is $232,334.

When it comes to trust distribution income, it is important to understand the personal tax rate and how it applies to this type of income. Each individual’s own personal tax rate will determine how much tax they need to pay on the trust distribution income they receive. The total tax paid is based on the taxable income, which is calculated by taking into account the trust distribution income and any other income received.

In this scenario, the trust distribution income received by John and Jenny will be included in their taxable income and will be subject to income tax at their highest marginal tax rate. The marginal tax rate is the rate at which the next dollar of income is taxed, which can be different for each individual based on their taxable income. The marginal tax rate will determine the tax payable on the trust distribution income.

In this scenario, John and Jenny will need to include the trust distribution income in their tax return and pay the tax payable on that income, as calculated using their own personal marginal tax rate. It is important for them to ensure that they are aware of their tax obligations and file their tax returns correctly, to avoid any penalties or fines.

Distribute 50/50 to John and his wife Jenny Total tax payable $232,334

Scenario 3 Tax paid with Bucket Company Strategy

John IT Computer Trust distributes $180,000 to John and $180,000 to Jenny, with the remaining $240,000 going to the JJ Wealth Bucket Pty Ltd. This is a tax minimisation strategy that uses the different tax rates for personal beneficiaries and a corporate beneficiary.

John and Jenny, as personal beneficiaries, have a marginal tax rate of 32% and each have a tax payable of $57,967 including the Medicare levy. JJ Wealth Bucket Pty Ltd, as a corporate beneficiary, is subject to a company tax rate of 30% and has a tax payable of $72,000.

The total tax payable in this scenario is $187,934, which is a significant saving of $73,733 compared to Scenario 1. This is achieved by using a bucket company structure and moving as much business income as possible through the company, rather than having it taxed at the personal tax rate of the beneficiaries.

In this scenario, JJ Wealth Bucket Pty Ltd is an investment company and can use its net income to pay dividends to the shareholders (John and Jenny) in the most tax-effective manner. This could include using a minimum annual repayment plan or a Div 7A loan, both of which are options under the family trust structure.

It’s also worth noting that the JJ Wealth Bucket Pty Ltd is a corporate beneficiary and the shareholder percentages and unpaid present entitlement(UPE) can be used to distribute the income in a tax-effective way. Dividend income is taxed at a lower rate than other types of income, and by declaring dividends through the JJ Wealth Bucket Pty Ltd, the overall tax paid can be minimised.

TOTAL TAX SAVINGS COMPARE TO SCENARIO 1 IS $73,733

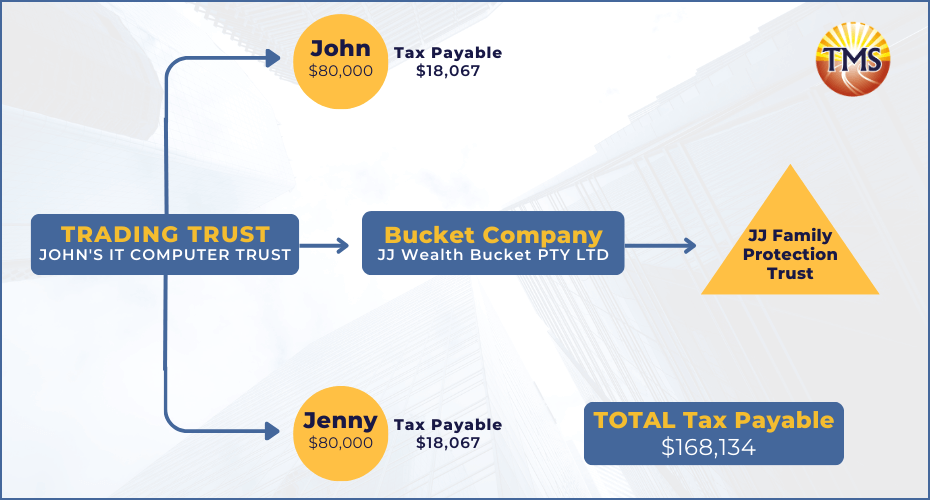

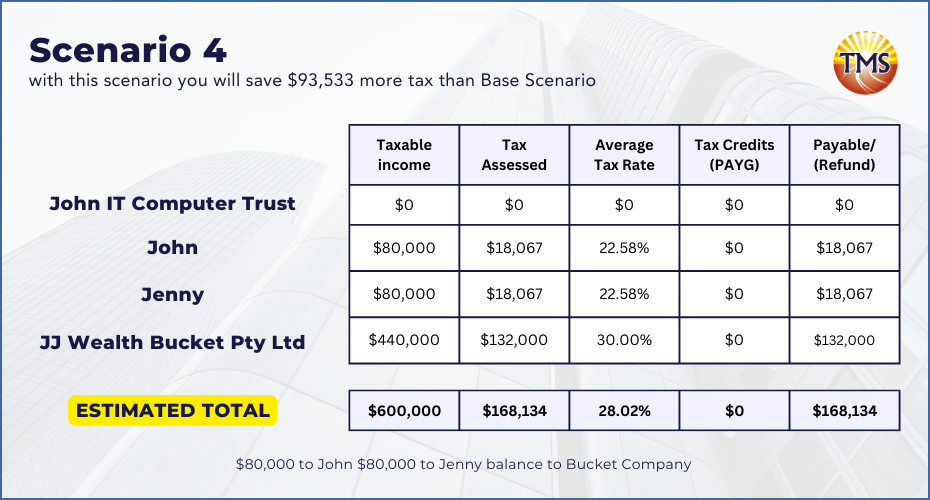

Scenario 4 Tax Paid with Bucket Company strategy – shareholder for company is a Family Trust

In this scenario, John wants to use a bucket company, JJ Wealth Bucket Pty Ltd, to accumulate wealth and pay as little tax as possible. He plans to distribute only enough income to him and his wife, and the rest will be distributed to the bucket company. The bucket company will be subject to a corporate income tax rate of 30%, rather than the lower rate for base rate entities. By doing this, John is also able to protect his assets by making his family protection trust the shareholder of JJ Wealth Bucket Pty Ltd. This allows the company to distribute franked dividends to the trust, which can then be distributed to his family members later on.

Total Tax payable $168,134

Compare to Scenario 1 Total Tax saving $93,533

Proper tax planning can help an individual save money that can then be used for various financial goals such as reducing home loans, increasing retirement savings, saving for a vacation, investing in property, paying for children’s education, or upgrading a car. In this scenario, John would save $93,533 in taxes which can be used for these or other financial goals.

John is now considering these Scenarios and working with TMS Financials to find the best plan to achieve his goals, while also making sure that his assets are protected and his family is paying the least amount of tax possible.

Are Bucket Companies Legal?

Bucket companies, are legal in Australia as long as they are set up and operated in accordance with the laws and regulations governing companies. These types of companies are often used for long-term investments and to manage the financial situation of a family group. As a legal structure, it allows for private investments and the ability to pay dividends in a tax-effective manner, as compared to other types of company structures. However, it’s important to consult with a professional advisor before setting up a bucket company to ensure compliance with all relevant laws and regulations and to evaluate if it aligns with your overall financial situation.

What Do You Do With Money in a Bucket Company?

Once the money is in a bucket company, it can be used for a variety of purposes, such as investing in assets, paying dividends to shareholders, or making loans to related parties. One specific use of the money in a bucket company is through a Division 7A loan. A Division 7A loan is a loan made by a private company to its shareholders or associates. These loans are subject to strict compliance requirements, including a minimum interest rate and the need to be repaid within 7 years.

Another use of the money in a bucket company is through declared dividends. Dividends are payments made by a company to its shareholders out of its profits. In order to declare a dividend, the company must have sufficient profits and cash reserves to pay the dividend. The dividends are typically paid out of profits that have already been taxed at the company tax rate, and shareholders may also be eligible for franking credits, which are tax credits that can be used to reduce the personal income tax liability of the shareholder.

It is important to maintain accurate records of all transactions and to comply with all relevant laws and regulations, including those related to taxation and asset protection. Additionally, it is important to consider the interest rate on any loans made by the bucket company, as well as the repayment terms and any potential impact on the company’s liquidity. Overall, it’s important to seek professional advice before making any financial decision regarding the use of money in a bucket company.

Continue reading our article “Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties” to know all of the benefits and risk involve in Div 7A.

What Can a Bucket Company Buy?

A bucket company can buy any assets that are legal and within the scope of its business operations. This can include investments in shares, bonds, real estate, and other assets. It is important to consider the tax implications of any investments and to ensure compliance with all relevant laws and regulations.

A bucket company can also act as a finance company, lending money to its directors, shareholders, or associates as long as it is done through a complying loan agreement with division 7A of the Income Tax Assessment Act 1936. This can provide an additional source of financing for the business and the shareholders or directors. It is important to consult with a professional advisor to ensure compliance with all relevant laws and regulations, and to understand the tax implications of any loans made.

How Can a Bucket Company Provide Tax Benefits?

A bucket company can provide tax benefits by allowing for the distribution of profits at a lower corporate tax rate, rather than individual tax rates. This can be especially beneficial for those with few beneficiaries, such as just a spouse or parents. Additionally, the bucket company can be structured in a way that allows for the distribution of dividends to shareholders, which may also be taxed at a lower rate.

How do you build a ‘bucket company’ for your family trust?

To build a bucket company for your family trust, you will need to follow these steps:

- Choose a name for the company and ensure that it is available and not already in use by another company.

- Obtain an Australian Company Number (ACN) and register the company with the Australian Securities and Investments Commission (ASIC).

- Appoint directors for the company and ensure that they meet the legal requirements set out by the Corporations Act 2001.

- Prepare and execute the company’s constitution, which sets out the rules and regulations for the company’s operation.

- Apply for an Australian Business Number (ABN) and register for Goods and Services Tax (GST) if necessary.

- Open a bank account in the company’s name and transfer the initial capital into it.

- Create a complying loan agreement with division 7a and ensure that all loans from the bucket company to directors, shareholders or associates of the family trust are made in accordance with the agreement.

- Keep accurate records of all transactions and financial statements, and ensure compliance with all relevant laws and regulations.

It’s important to note that you should consult with an accountant or lawyer before setting up a bucket company, as the process can be complex and there are many legal and tax considerations to take into account.

Challenges of a Bucket Company

A bucket company is a type of company that can be used for tax planning and asset protection. While it can offer significant benefits, there are also some challenges and risks involved in setting up and maintaining a bucket company.

One potential challenge is compliance and reporting requirements. For example, you will need to maintain accurate records of all transactions and keep proper documentation for tax purposes.

Another challenge is that a bucket company may be subject to additional regulations and oversight from government agencies, such as the Australian Taxation Office (ATO). The ATO may scrutinize bucket companies more closely to ensure compliance with tax laws and regulations.

Additionally, there is a risk that if not set up correctly, a bucket company may not be compliant with tax laws, which can result in penalties and fines.

It is important to consider these challenges and risks when deciding whether a bucket company is the right choice for your business or investment needs, and to work with a professional advisor to ensure compliance with all relevant laws and regulations.

Despite these challenges, many business owners and investors find that the benefits of a bucket company outweigh the costs and complexities involved.

Set up a Bucket Company to Access the 25% or 30% Capped Tax Rate

One of the key benefits of a bucket company is that it can allow you to access the 25% or 30% capped tax rate. This is a lower tax rate that applies to certain types of income, such as dividends and capital gains.

To access this lower tax rate, you will need to set up your bucket company in a way that allows for the distribution of dividends and capital gains. This can involve transferring assets and profits from your trust to the bucket company, and structuring loans as complying loan agreements.

It is important to note that the process of setting up a bucket company to access the 25% or 30% capped tax rate can be complex, and it is recommended that you seek professional advice before proceeding.

Who Should Hold the Company Shares?

When setting up a bucket company, one of the key decisions that you will need to make is who should hold the company shares. This can be a complex issue that will depend on your specific circumstances and goals.

One option is to have the individual beneficiaries of your trust hold the company shares. This can provide greater flexibility in terms of control and distribution of dividends. However, it may also result in higher taxes for those beneficiaries, as they will be subject to individual tax rates.

Another option is to have the trust hold the company shares. This can provide greater asset protection and can help minimise taxes for the beneficiaries. However, it may also result in less flexibility in terms of control and distribution of dividends.

It is important to carefully consider your options and seek professional advice before making a decision on who should hold the company shares.

What Tax Rate Does a Bucket Company Pay?

A bucket company is typically taxed at the corporate income tax rate, which is currently 30% in Australia. However, it is important to note that a bucket company may not qualify as a base rate entity, which would result in a lower tax rate of 25%.

By using a bucket company, it is possible to achieve significant tax savings by distributing income to the company and paying the lower corporate tax rate. This can be beneficial for individuals and families who are looking to minimise their tax liability and maximise their wealth. Additionally, using a bucket company can also provide additional benefits such as asset protection and financial planning opportunities. However, it is important to consult with a professional advisor to understand the specific tax implications and compliance requirements of using a bucket company.

Don’t miss out on the opportunity to achieve your financial goals through proper tax planning. At our firm, we understand that everyone’s situation is unique. By assessing your individual circumstances, financial goals, and tax situation, we can create a personalised tax plan that can save you a significant amount of money.

One strategy to consider is using a bucket company, which can provide tax savings, asset protection, and flexibility in reaching your financial objectives. But that’s just one strategy among many available. Don’t wait, book an appointment with us today and let us help you make the most of your money. In conclusion, a bucket company can be the ultimate solution for tax savings and wealth accumulation for your family’s finances, but the best thing is to talk to us to find the best solution for you.

Continue reading our article “Utilising a Business Trading Trust for Asset Protection and Maximising Your Hard-Earned Wealth” to learn more ways on how you can protect your asset and wealth.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

During the session, we will gain an in-depth understanding of your specific needs and develop a plan outlining your priorities and next steps.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.