Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties

.

Why You Can’t Simply Take Money Out of Your Company?

As a business owner, you may be wondering why you can’t just take money out of your private company whenever you want. The reason is that your company is a separate legal entity, the company is not the individual director, associate or family member, the company is it’s own entity and there are certain rules and regulations that must be followed in order to withdraw money from the company.

a free consultation with us today to learn

how you can pay just what's necessary.

What is Division 7A?

Division 7A is a section of the Income Tax Assessment Act 1936 that aims to prevent private companies from providing profits or assets tax-free to shareholders or their associates. This can include payments, loans, advances, gifts, and debt forgiveness. If a private company provides a payment or benefit to a shareholder or associate, it can be treated by the ATO as an unfranked dividend for income tax purposes, making it assessable income for the shareholder or associate. This means that the shareholder or associate will have to declare it as income and pay tax on it at their marginal tax rate, rather than receiving a credit for the company tax already paid on the money. Additionally, the company may also be required to pay additional tax on the payment or benefit at the company tax rate, which may result in double taxation.

To avoid this, it’s best to pay the payment or benefit as a normal dividend with a franking credit, if available, and include it in the shareholder or associate’s assessable income.

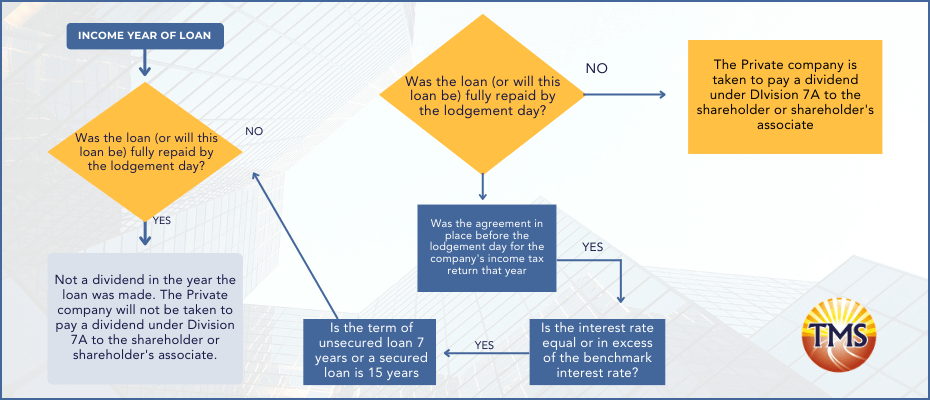

However, no deemed dividend will arise if the loan is either repaid or placed under a complying loan agreement before the due date for lodgement of the company’s income tax return for that year. Complying loan agreements require repayments of principal and interest over a limited number of years.

What is a Division 7A loan?

A Division 7A loan is a loan provided by a private company to a shareholder or associate. These loans are subject to specific rules and regulations set by Division 7A of the Income Tax Assessment Act 1936. In order to comply with these rules, the loan must have a loan agreement in place, the borrower must make the minimum yearly repayment as required by the agreement, and the loan must be charged with interest at the benchmark interest rate.

Division 7A extends the meaning of ‘loan’ to include :

- an advance of money.

- a provision of credit, or

- any other form, of financial accommodation.

- a payment for a shareholder or their associate, if they have an obligation to repay the amount whether it’s on their account.

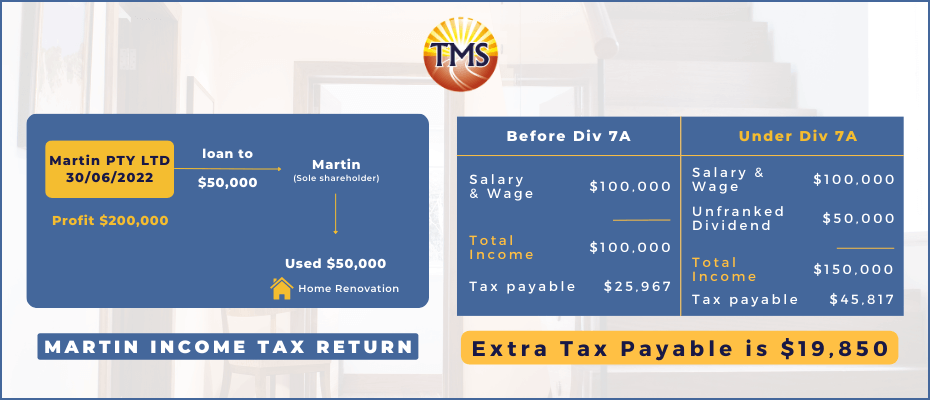

Case study: Minimising Personal Tax Liability for Shareholder of Private Company

Martin is the sole shareholder of Martin Pty Ltd, a company that pays him an annual salary of $100,000. Martin decides to withdraw $50,000 from the company’s bank account to pay for some home renovations. Under division 7A of the Australian tax laws, this $50,000 is treated as unfranked dividends in Martin’s tax return, increasing his taxable income to $150,000 (salary of $100,000 + $50,000).

Problem

This increase in taxable income can result in significant personal tax liability for the shareholder. Taxable Income $100,000 , tax payable is $25,967 Taxable income $150,000 , Tax payable is $45,817 Extra tax payable is $19,850 In this case, Martin would like to minimize his personal tax liability and ensure he is only taxed on his salary of $100,000.

Options for Avoiding Extra Tax Liability

Martin has a few options available to him. He can repay the $50,000 back to the company’s bank account before lodging the company’s income tax return. Alternatively, he can borrow the $50,000 as part of a complying loan agreement.

What is a complying loan agreement?

A complying loan agreement is a loan that meets certain requirements set out by the Australian Taxation Office (ATO). A complying loan agreement is a loan agreement that requires a minimum annual repayment of principal and interest over a term of up to seven years. This type of loan agreement is a way to avoid a deemed dividend and comply with Division 7A.

There are two types of complying Division 7A loans:

- Unsecured loans, which have a maximum term of seven years, and

- Secured loans, which can have a term of up to 25 years depending on the security used.

A Division 7A loan agreement must be made in writing before the company’s lodgement date , The purpose loan agreement between a company and it’s shareholders. The agreement ensures that any payment is not treated as a dividend under Division 7A of the Income Tax assessment Act 1936. The Loan agreement should included:

- setting out the essential conditions of the loan,

- specifying the loan amount,

- repayment requirements,

- interest payable (at a rate no less than the benchmark rate), and

- the term of the loan (which must be no more than seven years if not secured by real property).

Pitfalls to Avoid While borrowing through a complying loan agreement can minimise personal tax liability

There are pitfalls to avoid. For example, if Martin repays the $50,000 he withdrew for home renovations a week before lodging the company’s income tax return, but he also borrowed an additional $50,000 from the company a month earlier, a reasonable person would conclude that this new loan was obtained so that he could repay the original $50,000 loan. In this case, Martin would still be deemed to have received the $50,000 from the company because the repayment would not be taken into account.

Solution To avoid these issues

Martin Pty Ltd can pay actual dividends to Martin, pay salary and wages, or pay director’s fees. These types of payments are made for reasons other than facilitating the repayment of the loan. Repayments funded from dividends, salary, wages, etc. will therefore be able to be taken into account as a repayment.

This case study highlights the importance of understanding and complying with division 7A for shareholders of private companies. By repaying the money back to the company or borrowing through a complying loan agreement, Martin can minimize his personal tax liability and ensure he is only taxed on his salary of $100,000. However, it’s important to avoid pitfalls such as using new borrowings from the company to repay loans, as this can result in the repayment not being taken into account. By paying actual dividends, salary, or director‘s fees, Martin can ensure that repayment is taken into account and minimize his personal tax liability.

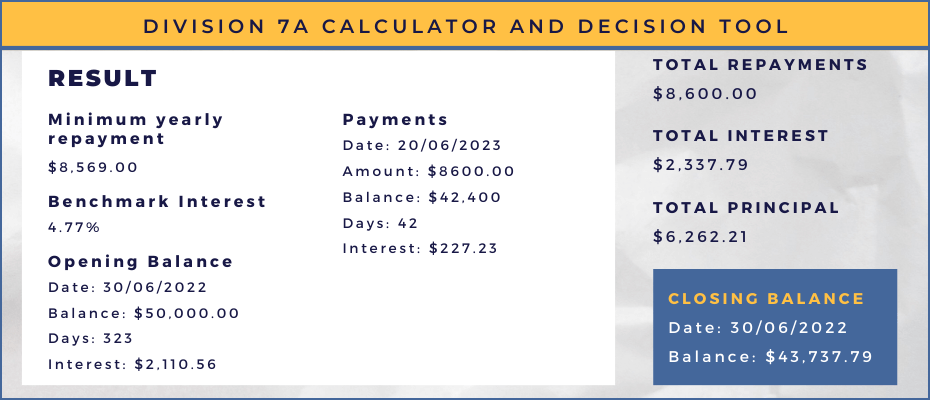

How to calculate loan repayment

To calculate the minimum yearly repayment required, you can use the Division 7A calculator provided by the ATO website.

For example:

In Martin’s case, let’s assume that $50,000 taken from the company that he used for his home renovation, Let’s say the company 2022-2023 Income tax return is due on 15 May 2023, and will be lodged on that day. Accordingly , Martin has until 14 May 2023 to either repay the loan or execute a complying Loan agreement,

Let’s assume that a Complying loan agreement will be executed by 14 May 2023, with a term of seven years. The first annual repayment of principal and interest is due by 30 June 2023, and a repayment required in each of the subsequent six income years to fully repay the loan.

The minimum annual repayment required under the complying loan agreement, using the formula in s109E(6)ITAA36 is $8,569.

Let’s assume on 20 May 2023 Martin made a loan repayment of $8,600. The minimum yearly repayment met. The amount of the loan not repaid at the end of the income year 2022-23 is $43,738

The loan will not be taken to be a dividend because the total repayments made are greater than the minimum yearly repayment required for income year 2022-23.

Interest received by the private company Martin Pty Ltd must be included in the income tax return for 22-23.

The interest paid by Martin to the company amount of $2,337 is not deductible to Martin because the fund was used for personal,

RESULT

How can you withdraw money from your company?

As a business owner, you may be wondering if you can withdraw money for personal use from your own company. The answer is yes, but the process of doing so safely and without heavy financial implications requires a more detailed explanation.

Since your company is a separate legal entity, you need to know the proper ways to access its funds.

Here are the top methods used by Australian business owners to withdraw money from their company:

- Pay yourself a salary or wages: This is subject to PAYG withholding tax and is a legitimate way to take money out of the company.

- Receive director’s fees: This is also subject to PAYG withholding tax and is a legitimate way to take money out of the company.

- Receive allowances, commissions, or bonuses: These are legitimate forms of compensation and are not subject to Division 7A.

- Declaring Franked Dividends: A company can choose to issue a dividend payment to shareholders, which is generally franked to avoid double taxation on the funds earned. The amount a company can issue will depend on the company’s retained earnings and franking credit balance. Remember to report these dividends as income.

5. Reimbursement: Shareholders or directors can withdraw previously contributed funds if they were contributed as a loan. This means you can take back the money initially used to start your business. Lending money is a tax-free transaction, so the return of this money is also tax-free.

6. Treat it as a Division 7a loan: If you need to take a large sum of money out of the company, you can do so by treating it as a loan. This must be done through a loan agreement and the minimum yearly repayment must be made.

It’s important to note that if you take money out of the company without following these guidelines, the ATO may treat it as an unfranked dividend, which will be assessable income and subject to tax. By following these guidelines and complying with Division 7A, you can avoid penalties and ensure that your withdrawals from the company are done in a legal and tax-compliant manner.

What are the minimum yearly repayments required for a Division 7A loan?

The minimum yearly repayments required for a Division 7A loan are calculated using the benchmark interest rate and the loan amount. The benchmark interest rate is set by the ATO and changes each financial year. The loan amount and interest rate must be included in the company’s accounts for the income year in which the loan is made.

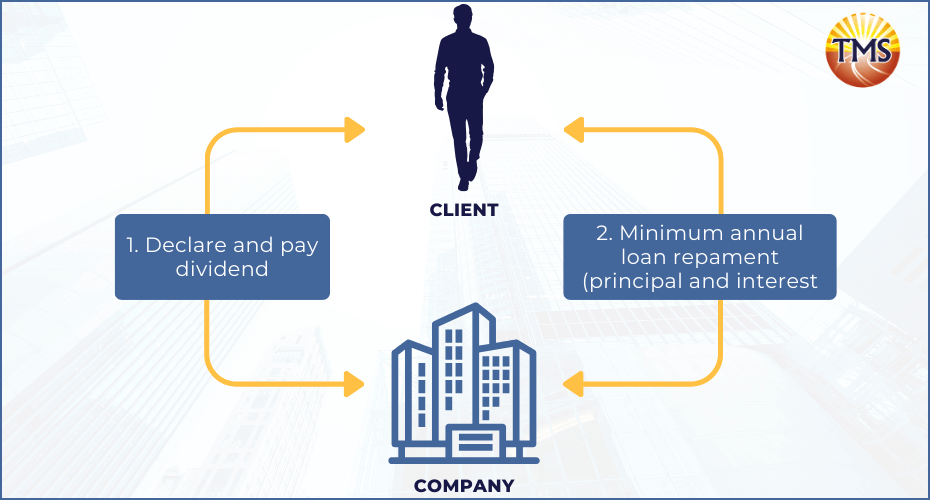

What is the common way to avoid deemed dividends when providing loans to shareholders in compliance with Division 7A?

To avoid this deemed dividend, a common approach is to execute a complying loan agreement. This requires a minimum annual repayment of principal and interest over a term of up to seven years. Instead of repaying the loan in cash, the company declares a fully franked dividend each year equal to the required repayment. This results in a “top-up” tax liability for the client, as they must pay the difference between the company’s tax rate of 30% and their personal tax rate of up to 46.5%.

Another alternative is to have a loan agreement that meets the requirements as described in Division 7A, this will also avoid deemed dividends. It’s important to note that the rules are complex and it’s best to consult with a professional to ensure compliance.

What is the alternative way to avoid paying extra taxes on money taken out of a company and how can it be beneficial?

There is a way that some people choose to avoid paying extra tax on money they take out of a company. Instead of paying back the money to the company, they sell assets to the company for the same amount of the loan. This way, they don’t have to pay extra tax and they don’t have to pay interest on the loan. Additionally, they can take advantage of any tax breaks that come with selling assets.

However, it’s important to talk to a tax expert before doing this to make sure it’s the right choice and that it follows the rules set by the government. This alternative approach can be more beneficial for some people’s specific case, but it’s important to ensure compliance with the relevant laws.

What other factors should be considered when dealing with Division 7A and payments made by a private company to shareholders or associates?

It’s important to note that Division 7A does not apply to payments made by the private company to shareholders or associates in their capacity as employees. Instead, fringe benefits tax (FBT) may apply. Additionally, Division 7A does not apply to normal dividends or director’s fees that are already subject to income tax.

Can a Division 7A loan be forgiven?

Division 7A loans are treated as a benefit provided by a private company to a shareholder or associate. If a private company forgives a Division 7A loan, it can be treated as a dividend for income tax purposes, making it assessable income for the shareholder or associate. However, a Division 7A loan can be forgiven if the company can demonstrate that it is a genuine loan and that it has a loan agreement in place with the shareholder or associate, and that the company has made the minimum yearly repayment required under the agreement.

Why should you be concerned about Division 7A?

If a private company makes a loan to a shareholder or associate and it is not repaid or placed under a complying loan agreement before the due date for the company’s income tax return, the loan may be treated as a dividend by the Australian Taxation Office (ATO). This means that the loan will be subject to income tax and may result in additional tax liabilities for the shareholder or associate.

What are the consequences of not complying with Division 7A?

If a private company does not comply with Division 7A, payments or benefits provided to shareholders or associates can be treated as unfranked dividends for income tax purposes, resulting in the shareholder or associate having to pay income tax on the payment or benefit. Additionally, the company may be subject to penalties and interest charges.

Conclusion

Division 7A is a complex area of tax law and it’s important for private company shareholders and associates to understand the potential application of Division 7A and seek advice where necessary. The common approach to repaying Division 7A loans is to execute a complying loan agreement and make minimum annual repayments of principal and interest. However, there is a novel alternative approach of selling assets to the company for an amount equal to the loan which can be tax efficient and must be considered after consulting with a tax advisor to ensure compliance with relevant tax laws.

Don’t let Division 7A penalties catch you off guard. Contact us today to schedule a consultation and get personalized advice on how to withdraw money from your private company safely and compliantly.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.