How to pay yourself a salary as a company director

.

Are you a company director looking to draw your salary in the most tax-efficient way? Managing your income as a business owner can significantly affect both your personal cash flow and your company’s financial health.

By choosing to pay yourself a director’s fee or salary, you can simplify your tax obligations and manage your tax payable more easily. This method also allows for straightforward income tax reporting.

Navigating the complexities of company tax and director’s remuneration can be challenging. If you need guidance on structuring your earnings or understanding the tax consequences of different payment methods, reach out to us for personalised advice today.

Why pay a salary to yourself as a director?

As a company director, when you pay yourself a salary, it’s like receiving regular pay for your role in managing the business, much like how any other employee gets paid for their work. This salary is processed through the company’s payroll system and meets all employment and tax rules.

Choosing to pay yourself a salary is one of the most straightforward ways you can access your company’s earnings. As a director who actively works in the business, you’re contributing just as any employee would.

By paying yourself a salary, you’re keeping your financial affairs orderly. When it’s time to pay your staff, you’re on the list too. The amount you receive is your take-home pay, after PAYG withholding taxes are deducted, and it goes directly into your personal account. This makes it easier to distinguish between business and personal expenses and streamlines your financial management.

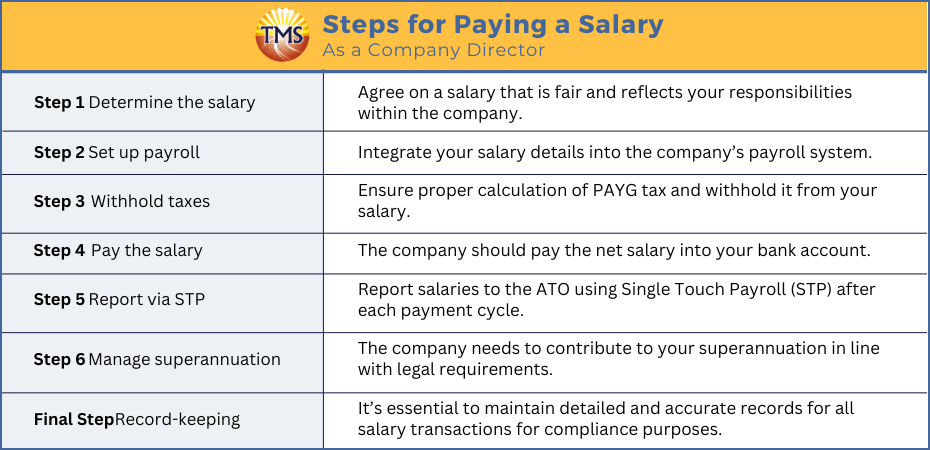

A step-by-step guide to paying yourself a salary as a company director

Paying yourself a salary as a company director involves a series of steps to ensure everything is managed properly and in compliance with the law. Here’s a simple guide to help you navigate this process:

- Step 1 Determine the salary – Agree on a salary that is fair and reflects your responsibilities within the company.

- Step 2 Set up payroll – Integrate your salary details into the company’s payroll system.

- Step 3 Withhold taxes – Ensure proper calculation of PAYG tax and withhold it from your salary.

- Step 4 Pay the salary – The company should pay the net salary into your bank account.

- Step 5 Report via STP – Report salaries to the ATO using Single Touch Payroll (STP) after each payment cycle.

- Step 6 Manage superannuation – The company needs to contribute to your superannuation in line with legal requirements.

- Step 7 Record-keeping – It’s essential to maintain detailed and accurate records for all salary transactions for compliance purposes.

Benefits and tax consequences of paying a director’s salary

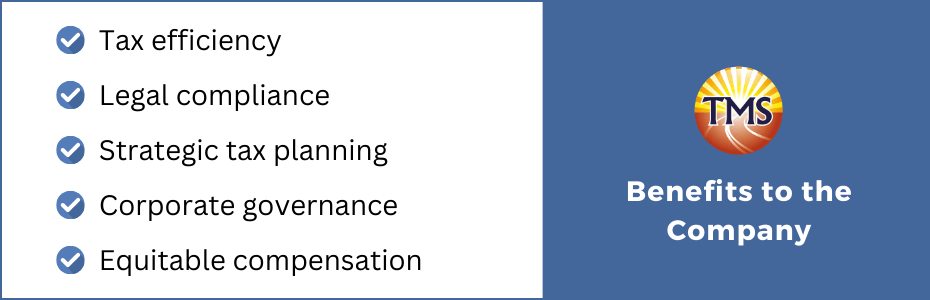

Benefits to the company

Tax efficiency – Salary disbursements to directors are generally tax-deductible, potentially reducing the company’s taxable income.

Legal compliance – Adhering to compensation laws, the company meets the standards for employee remuneration, tax withholdings, and superannuation contributions.

Strategic tax planning – Regularising director’s remuneration facilitates more predictable and strategic tax planning.

Corporate governance – Maintaining a clear compensation record enhances corporate transparency.

Equitable compensation – Paying a director salary reflects a commitment to equitable compensation across the company.

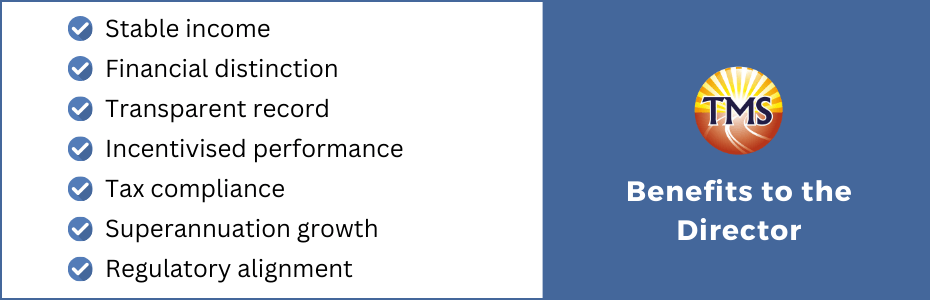

Benefits to the director:

Stable income – A salary ensures the director enjoys a stable and predictable income.

Financial distinction – Differentiating company funds from personal finances leads to increased financial clarity.

Transparent record – A salary provides a clear financial trail of remuneration, evidencing the director’s work and contribution.

Incentivised performance – A salary that reflects company success can motivate the director to align their efforts with the company’s goals.

Tax compliance – Regular salary payments streamline tax reporting and compliance for the director.

Superannuation growth – A salary facilitates pre-tax superannuation contributions, aiding in the director’s long-term financial health.

Regulatory alignment – A salaried director benefits from the legal protections associated with employee status.

Tax consequences

When you manage a company as a director, it’s crucial to grasp how your salary impacts both your business’s financial health and your personal financial responsibilities. Here’s how this plays out in terms of tax implications.

Salaries paid to directors are typically deductible expenses. This means that these costs can be subtracted from the company profits, potentially reducing the overall corporation tax the company must pay.

Your salary as a director counts as taxable income. The PAYG (Pay As You Go) tax that is withheld and paid throughout the year helps moderate your annual tax bill, reducing the amount you might owe when you lodge your tax return.

By making pre-tax contributions to your superannuation, you can decrease your taxable income. This not only helps save for your retirement, it also reduces your tax liability each financial year.

At the end of the financial year, your final tax liability will depend on your total income, including salary, dividends, and other earnings, minus the tax already paid and credits received. This is important to ensure that you comply with your tax obligations and accurately report your earnings to the ATO.

By understanding these aspects, you can better manage your finances as both a director and a shareholder, ensuring your decisions are beneficial both for you personally and for your business.

Challenges and considerations

Reasonableness of Salary

The salary must be commensurate with the director’s role, responsibilities, and the value they bring to the company. It should also align with industry standards and be defendable to shareholders and tax authorities.

Payroll Management

A robust payroll system needs to be in place to manage the director’s salary. This includes accurate calculations, timely tax withholdings, and regular reporting to the relevant tax bodies.

Cash Flow Impact

Regular payments to the director must be budgeted and planned to avoid negatively impacting the company’s cash flow. This is especially important for businesses with fluctuating revenue streams.

Compliance with Tax Laws

The company must adhere to tax laws, including reporting and remitting PAYG taxes and making superannuation contributions, to avoid penalties.

Legal and Contractual Obligations

The salary agreement must comply with employment laws and the director’s contract to prevent legal disputes.

Performance and Remuneration Link

There should be a clear link between the director’s pay and their performance, ensuring that remuneration incentives are driving the desired outcomes for the company.

Equity Among Executives

The director’s salary should be set in the context of other executive compensation packages to maintain internal equity.

Documentation and Transparency

Maintain clear records of how the salary was determined, including any performance metrics used, to ensure transparency and accountability.

Director’s Personal Tax Planning

The director should consider the personal tax implications of their salary and structure it in a way that is tax-efficient for their circumstances.

Superannuation Strategy

Contributions to the director’s superannuation should be managed effectively to optimise retirement benefits while adhering to contribution limits and tax implications.

Next steps

There are many ways you can pay yourself as a company director. A common alternate method to paying yourself a director’s salary, if business profits allow, is by considering dividend payments, which can prove to be a tax-savvy strategy. Dividends can be franked or unfranked, which may impact your personal tax return depending on your shareholder’s marginal rate.

Ultimately, the way you pay yourself as a company director comes down to your central personal and professional goals: whether it be optimising your tax liabilities with respect to the Australian Taxation Office (ATO) requirements, streamlining income tax reporting requirements, or some goal. If you’re an aspiring or current small business owner or a sole trader who’s looking to set up a company stucture and want to know the best way to access the company’s profits without triggering a loan agreement, or you want to learn the most tax efficient way to pay yourself as a company director, reach out to us today.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.