Guide on paying dividends as a company director

.

Do you want to improve your investment returns and reduce your tax liability? Fully franked dividends aren’t just a way you can extract payment from your company; they can play a key role in helping you manage your tax obligations more effectively.

Fully franked dividends are paid out of profits that have already been taxed under corporate rates, which means they come with a franking credit attached. This credit can offset your personal income tax, aligning with Division 7A of the Income Tax Assessment Act. This provision ensures that payments made by private companies to shareholders or their associates in the form of loans or dividends are treated appropriately for tax purposes. For shareholders, this means potentially lower tax liabilities and the possibility of tax-free distributions if managed correctly.

If you’re a shareholder in a private company and want to maximise your dividends while ensuring compliance with tax laws, professional guidance is crucial. Contact us today to ensure you’re paying yourself as a company director in the most tax-efficient way possible.

What exactly are fully franked dividends?

Fully franked dividends are dividends distributed by a company to its shareholders from profits that have already been taxed at the company level. These dividends come with franking credits. This prevents shareholders from being taxed twice on the same income.

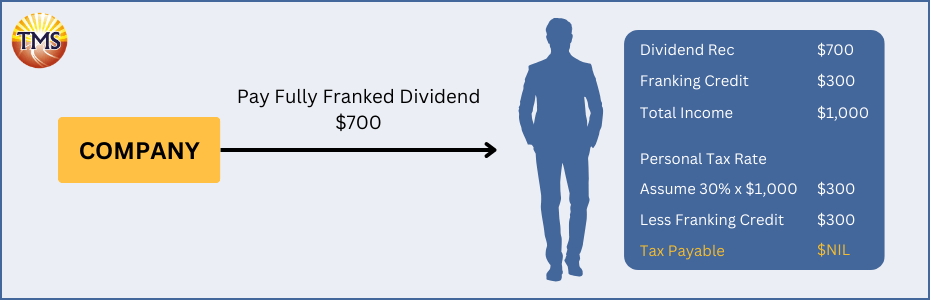

For example, if a company pays you a $700 fully franked dividend, and the corporate tax rate is 30%, it means the company has already paid $300 in tax on your behalf ($700/(100% – 30%) * 30%). When you declare this income on your tax return, you’ll report $1000 (the $700 dividend plus a $300 franking credit). If your tax rate is 30%, the tax on the dividend would be $300, which is covered by the franking credit, resulting in no additional tax on the dividend for you. If your tax rate is lower, you might even get a refund.

Why consider fully franked dividends?

Fully franked dividends are an effective method for private companies in Australia to distribute their profits to shareholders for income tax purposes. When a company has already paid tax on its earnings, these dividends come with credits that match the tax already paid, which can reduce or possibly even eliminate the tax that shareholders owe on this income.

This strategy not only allows shareholders to potentially receive a tax refund but also leverages the private company’s distributable surplus to maximise benefits. Additionally, this approach ensures that dividends received by associates are effectively tax-free, enhancing the overall financial benefits for those closely connected to the company.

How fully franked dividends are paid out

Declaration of dividends

A company declares dividends by the board’s decision, passing a resolution specifying the dividend amount, record date, and payment date, followed by an announcement to shareholders and distribution of dividends accordingly

Dividend payment

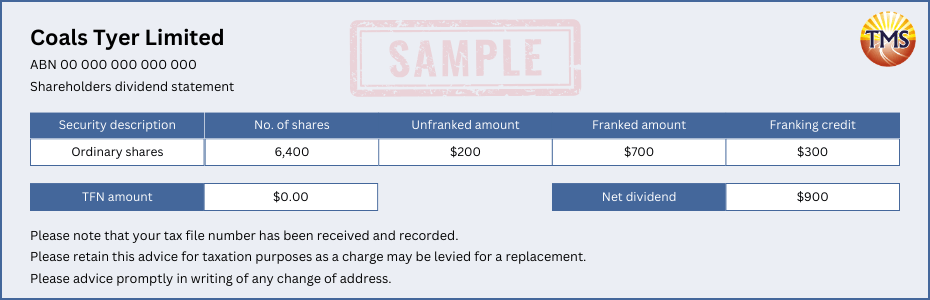

Shareholders receive the dividends with a ‘franking credit’ attached, representing the tax already paid by the company.

Tax offset

When shareholders lodge their tax returns, the franking credits can be used to offset their tax liabilities.

What are the challenges and considerations of paying fully franked dividends?

There are several challenges and considerations to keep in mind with fully franked dividends. The advantages they offer depend greatly on the individual tax situations of the shareholders. This means the benefit of the franking credits is directly related to the amount of tax the shareholder would have paid without them.

Additionally, these credits can only be passed to shareholders to the extent of the tax already paid by the company. Therefore, a company must maintain a sufficient balance in its franking account to issue these dividends. This requirement ensures that the dividends declared are indeed fully franked and capable of providing the intended tax benefits to shareholders.

Case study : John and Jenny’s homeware business

John and Jenny have spent years building a thriving homeware business, operated through their company, which has turned out to be very successful. Over the years, the business has amassed substantial profits and has a sizeable amount of retained earnings. The company has been diligent in its tax obligations, resulting in a significant balance in its franking credits account.

Now seeking to wind down their active involvement in the business, John and Jenny wish to start drawing income from their company’s accumulated wealth. They plan to do this by extracting $100,000 annually in total, split evenly between them, through fully franked dividends.

Financials

The financial situation can be summarised by the below points:

- Accumulated Retained Earnings: $1,500,000

- Franking Credit Account: $500,000

- Planned Annual Dividend Payout: $50,000 each

- The Fully Franked Dividend Strategy:

- Each receives a dividend of $50,000.

- The franking credit attached to this dividend is $16,666 for each, reflecting the tax the company has already paid.

- Their individual taxable income is grossed up to $66,666, which includes the net dividend plus franking credit.

Tax implications

The tax payable on the grossed-up income of $66,666 would be approximately $13,466 each. However, they are entitled to claim the franking credit of $16,666 each. This results in a tax refund of about $3,200 each, assuming they have no other income.

Outcome

The strategic use of fully franked dividends allows John and Jenny to not only receive income from their company without paying additional tax but also benefit from a tax refund. This scenario illustrates the effectiveness of tax planning and the advantages of using franking credits.

Note for similar business owners

If you’re like John and Jenny and have a company with retained profits, consider the benefits of fully franked dividends as part of your withdrawal strategy. With careful tax planning and guidance, you can optimise your tax position and potentially receive annual tax refunds. It’s important, however, to consult with a tax professional to ensure your plans are compliant with current legislation and tailored to your specific financial situation.

Next steps for maximising your benefits with fully franked dividends

Unlock the full potential of your hard-earned profits

John and Jenny’s story is more than just a case study; it’s a pathway to smart tax planning. If their strategy resonates with you, it’s time to take decisive action for your own business.

Consult with experts

The first step is to schedule a consultation with our team. We specialize in transforming complex tax situations into opportunities for business owners.

Strategic financial review

Let us conduct a thorough review of your company’s financial position, including retained earnings and the franking account, to tailor a dividend strategy that fits.

Personalised tax planning

We’ll align your personal financial goals with your business performance, ensuring that any dividends you receive work optimally for your tax situation.

Documentation and compliance

We handle the meticulous documentation needed to support your fully franked dividends, keeping you compliant and stress-free.

Ongoing support and adjustment

Tax laws and financial situations change all the time. Stay ahead with our ongoing advice and adjustments to your strategy, ensuring you continue to benefit year after year.

Take the first step towards a brighter financial future

By tapping into our expertise, you can potentially enhance your income through tax-efficient strategies. Imagine the peace of mind knowing that you’re not only extracting value from your company but also doing so in a way that could result in a tax refund.

Let’s make it happen

Don’t let complexity hold you back. Reach out to us and let’s start the conversation that could redefine your financial landscape. With us by your side, you’re not just planning; you’re taking control of your financial destiny.

Connect with us today and let’s turn your company’s profits into your gain, the smart way.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.

[wpforms id=”265615″ title=”false”]