Tax cuts starting July 2024

.

Starting 1 July 2024, the Australian Government is set to roll out significant updates to the personal tax rates and thresholds, affecting virtually all taxpayers in the country. These updates are part of the government’s commitment to delivering tax cuts in an attempt to help ease cost of living pressures. Key changes include reducing the 19 per cent tax rate to 16 per cent and the 32.5 per cent rate to 30 per cent. There will also be increases in the income thresholds for the 37 per cent and 45 per cent tax brackets, allowing more Australians to retain more of their earnings. These changes are a crucial element of the broader federal budget initiative aimed at providing financial relief. Approximately 13.6 million Australian taxpayers stand to benefit, with the adjustments designed to enhance the amount of take-home pay for individuals nationwide.When you’ll see the impact of new tax rates

The time when you actually see these benefits might differ based on your individual situation. For some, the impact of the tax cuts will be visible only after submitting the tax return for the financial year 2024-2025. For those wanting a precise understanding of how these changes will affect their budget, the Australian Government has made available a tax cut calculator. This tool allows you to estimate how much you will save each year with the adjusted tax rates and thresholds.Tax rates and thresholds for 2023-24 and 2024-25

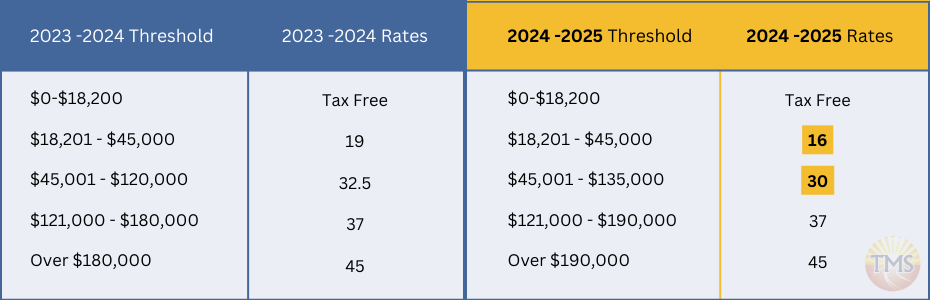

The financial year 2024-2025 will bring new individual tax rates and thresholds. Below is a comparison of the current tax rates and thresholds for the 2023-24 financial year with the revised figures for 2024-25. These changes aim to lessen the tax load for Australian taxpayers and modify the points at which various tax rates take effect.Understanding new tax rates and thresholds from July 2024

From 1 July 2024, Australia will see updated individual income tax rates and thresholds, impacting how much tax you pay. It’s important to understand these changes to manage your finances effectively.

Firstly, everyone has a tax-free threshold of $18,200, meaning you can earn up to this amount each year without paying any income tax.

Here’s a breakdown of the new tax structure:

-

For incomes between $18,201 and $45,000: The first $18,200 is tax-free. Any income over this amount up to $45,000 is taxed at 16 per cent.

-

For incomes between $45,001 and $135,000: You still do not pay tax on the first $18,200. You pay 16 per cent on income from $18,201 to $45,000, and 30 per cent on income between $45,001 and $135,000.

-

For incomes between $135,001 and $190,000: The first $18,200 remains tax-free. Income up to $45,000 is taxed at 16 per cent, income between $45,001 and $135,000 at 30 per cent, and income between $135,001 and $190,000 at 37 per cent.

-

For those earning over $190,000: Income up to $45,000 is taxed at 16 per cent, between $45,001 and $135,000 at 30 per cent, between $135,001 and $190,000 at 37 per cent, and any income over $190,000 is taxed at 45 per cent.

Additionally, low-income earners and seniors may be eligible for tax offsets, which can reduce the overall tax payable.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.

[wpforms id=”265615″ title=”false”]