How Will the Revised Stage 3 Tax Cuts Affect You in July 2024?

.

Starting in July 2024, the revised Stage 3 tax cuts will impact many Australians. In recent years, Australians have faced a sharp increase in income tax, with an average increase of 8% in 2023. And if you’re a high-income earner, you’re likely paying significant taxes. The increase in income that many Australians have experienced in the years since COVID has pushed many taxpayers into higher tax brackets, a situation known as “bracket creep.” To address this, the Australian government is continuing with the Stage 3 tax cuts introduced in the 2019 federal budget, although the changes will provide less savings for higher earners than initially proposed.

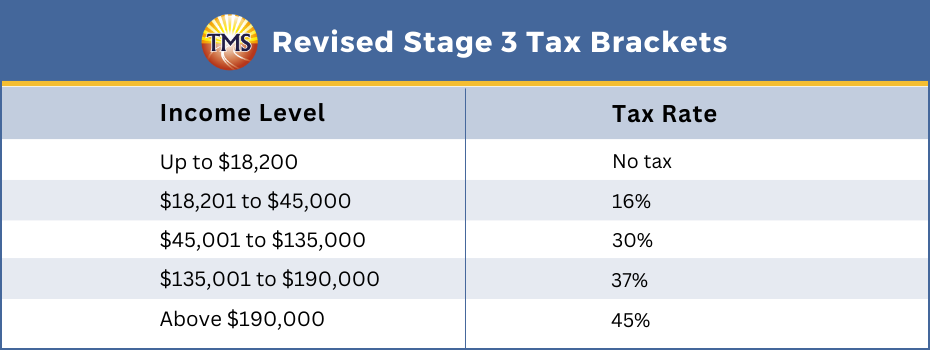

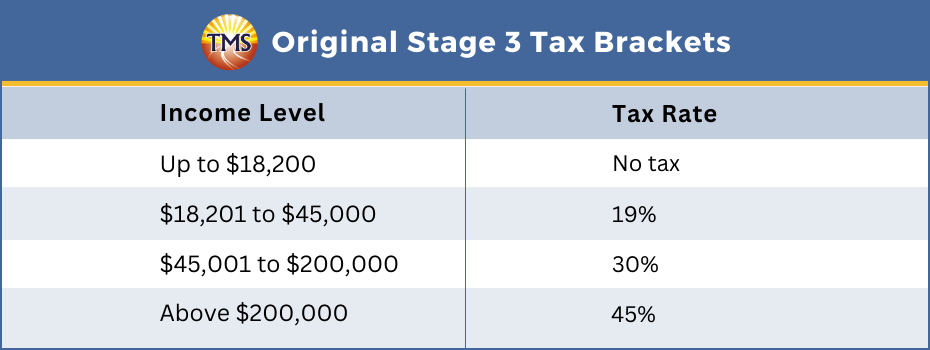

The revised Stage 3 tax cuts aim to simplify the tax system by reducing the number of tax brackets and adjusting the per cent tax rate. Middle income taxpayers will see some benefits, but high-income earners may not experience significant savings due to changes in individual income tax rates and taxable income thresholds.

Schedule a consultation with TMS Financials today!

Contact us today for a tax review

If you’re earning a high income and paying a lot of tax, there are legal ways to reduce your taxable income that don’t depend on government tax cuts. Our tax experts have been helping high-income earners navigate the Australian tax system for over three decades. With rising living costs, it’s important to know all the deductions available to you.

We prepare tax returns daily and can identify deductions, rebates, offsets, and credits you may have missed. As a Registered Tax Agent, we can also negotiate payment plans, extend your tax return lodgement due date from October to May the following year, and ensure you stay compliant with the Australian Taxation Office (ATO).

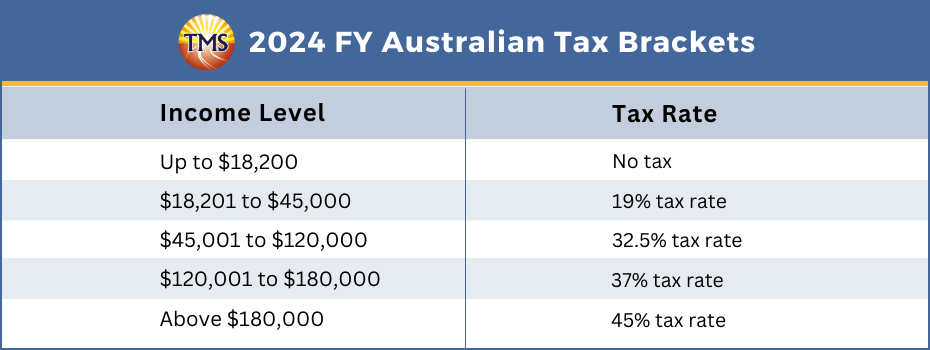

Understanding taxable income brackets

The tax cuts outlined in the 2019 federal budget, which were implemented on 1 July 2024, will reduce the 32.5% tax bracket to 30%, while the 37% tax rate will remain. This change means individuals with incomes between $45,000 and $200,000 will have a marginal tax rate of 30%, excluding Medicare levy. The tax-free threshold stays at $18,200, allowing you to earn up to this amount without paying income tax.

Specifically, if you earn $100,000, you can expect to save $2,179 in taxes. Those with incomes of $150,000 will save $3,729, and individuals earning $180,000 will also save $3,729, instead of the original proposed savings of $6,075.

Stage one tax cuts and the Low and Middle-Income Tax Offset (LMITO)

The first stage of the tax cut introduced the Low and Middle-Income Tax Offset (LMITO), which was available to individuals earning between $37,000 and $126,000. The LMITO provided a maximum tax reduction of $1,500 but concluded in the financial year 2022.

Stage two tax cuts for middle-income earners

The second phase of tax cuts, starting in July 2020, raised the upper limit for the 19% and 32.5% tax brackets. Individuals earning between $37,000 and $45,000, previously subject to a marginal rate of 32.5%, now face a 19% marginal rate. Similarly, those with incomes between $90,000 and $120,000 saw their tax rates reduced from 37% to 32.5%.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.