New tax rules for bucket companies receiving trust distribution in FY 2025

.

The Australian Taxation Office (ATO) provides specific compliance guidelines under section 100A of the income tax assessment act 1936 for trust distributions. Among these guidelines are the “green zone” scenarios, which apply when a trust distribution to a bucket company or corporate beneficiary remains within the trust.

This article outlines these green zone scenarios, focusing on the criteria needed to qualify for this status. Meeting these requirements helps business owners and trustees manage their tax obligations effectively and can safeguard against paying additional tax unnecessarily.

The ATO also identifies scenarios that can complicate compliance with section 100A, especially when distributions involve non-resident taxpayers. Understanding these complexities is vital for managing trust distributions, optimising tax liabilities, and considering the impact on your own personal tax rate. Seek professional advice to navigate these tax laws and ensure proper handling of your trust’s net income and distributions.

Setting up a bucket company for tax benefits

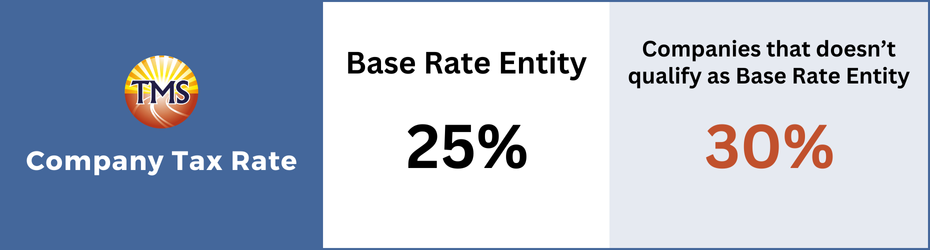

A bucket company structure allows access to a capped tax rate of 25% or 30%, depending on the company’s classification. If the company is a base rate entity, it’s taxed at 25%. For those that don’t qualify as base rate entities, the tax rate is 30%.

The corporate tax rate has seen changes in recent years. From the 2017–18 to 2019–20 income years, the rate was 27.5%, then decreased to 26% in the 2020–21 income year.

For more information on the benefits of setting up a bucket company, visit our service page on bucket company setup.

Section 100A complexities in trust distributions

Trustees may think that placing funds equivalent to an outstanding present entitlement for a bucket company on compliant loan terms under section 109N allows unrestricted use of these funds. This is incorrect.

The distribution’s context and how the trustee plans to use the funds must be considered to determine if section 100A applies. The purpose of the retained funds is crucial. If the funds are to be lent out, factors such as the loan recipient, their marginal tax rate, and the intended use of the funds must be evaluated.

To understand how section 100A can affect your trust, read our articles on trust distributions to the controllers of a discretionary trust and to adult children and grandparents.

Common issues with the working capital condition

Certain situations can disqualify bucket company distributions from meeting the ‘working capital condition.’

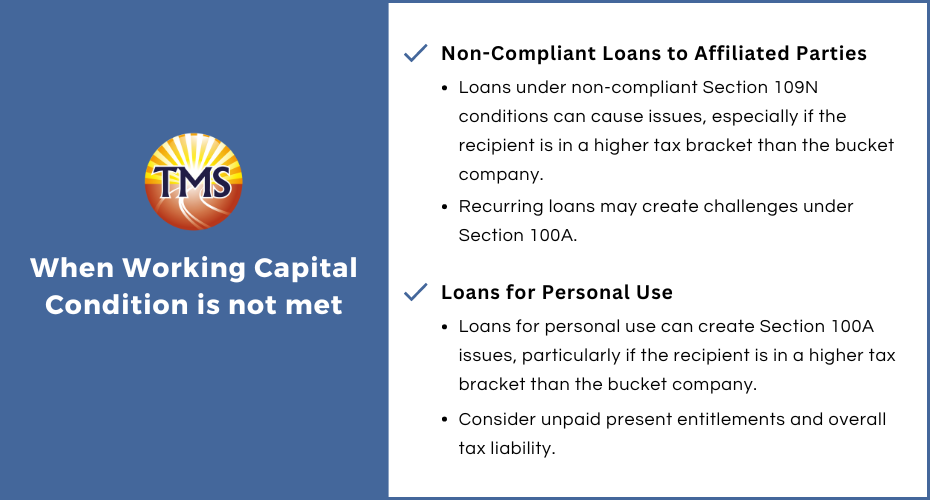

Non-compliant loans to affiliated parties

Issues can arise if a trustee retains a trust distribution meant for a bucket company and lends it to an affiliated party under non-compliant section 109N conditions. This is especially relevant if the loan recipient, like a parent, has a higher marginal tax rate than the bucket company and benefits from the trust’s income. These situations may lead to challenges under section 100A of the income tax assessment act, particularly if they become recurring patterns.

Loans for personal use

If a trust distribution meant for a bucket company is held by the trustee and loaned to a connected individual for personal use, such as buying a car, potential issues under section 100A may arise. This is especially true if the loan recipient, such as a parent, is in a higher tax bracket than the bucket company and benefits from the trust’s income. These situations, particularly if repeated, require careful consideration of unpaid present entitlements and overall tax liability.

In such cases, the risks associated with section 100A should be assessed individually. It’s also important to consider Division 7A to ensure loans are structured correctly and comply with tax laws. Properly managing trust distributions and understanding the implications of corporate tax rates, personal tax rates, and tax payable is crucial for effective tax optimisation.

Contact us today for professional advice on managing your trust distributions and ensuring compliance with section 100A and other tax regulations. Use the link here to schedule a consultation.

Example of a bucket company in the green zone

The Smith Discretionary Trust operates a retail business focused on selling home goods. The beneficiaries of the trust include members of the Smith family and their associated entities, such as John and Jane Smith, along with Smith Pty Ltd (the ‘Bucket Company’). John oversees the trust, while his spouse, Jane, serves as the sole director and shareholder of the Bucket Company.

On 30 June 2023, the trustee of the trust resolved to allocate the entirety of its trust income to the Bucket Company. At the time of this resolution, an arrangement was established whereby the Bucket Company would allow the unsettled portion of its entitlement to remain within the trust. Under a section 109N compliant loan agreement, the trustee retained the disbursed funds and used them to improve the working capital of the business managed by the trust.

Throughout the 2024 financial year and subsequent income periods, the trust’s trustee used the earnings derived from the trust’s business revenue to meet its repayment obligations in accordance with the Division 7A loan agreement.

ATO’s stance on section 100A for bucket company distributions

The Australian Taxation Office (ATO) considers certain bucket company distributions as low-risk under section 100A of the income tax assessment act 1936. One such scenario is when the distribution meets the ‘working capital condition.’

In this setup, the distributed amount is used for the trust’s working capital, and the bucket company is controlled by the spouse of the individual managing the trust. The retained distribution is structured in compliance with section 109N terms, ensuring no unpaid present entitlement issues.

As long as these conditions are met, the ATO will not invalidate the distribution under section 100A. This arrangement helps minimise tax liability while staying compliant with relevant tax laws and regulations.

What are the considerations when using the bucket company strategy?

The bucket company strategy helps optimise tax by managing trust distributions. By distributing trust income to a bucket company, you can benefit from the lower corporate tax rate, resulting in significant tax savings compared to higher personal tax rates. This strategy also helps manage capital gains and avoid the highest marginal tax rate and the medicare levy. However, it’s essential to comply with specific requirements to ensure the approach’s effectiveness and legality.

Key considerations include adhering to the income tax assessment act, section 100A, and section 109N. Proper management of trust income, trust entitlements, and unpaid present entitlements is crucial. Additionally, understanding the implications of distributing income to a corporate beneficiary and ensuring the funds are used in a tax-effective manner is important.

Seeking professional advice is recommended to navigate these complexities. If you’re concerned that section 100A may affect your trust distributions, contact us today for guidance.

Commitment to trust distributions

To comply with the australian taxation office (ATO) and the income tax assessment act, ensure the trust income distributed to a bucket company is transferred to the bucket company’s bank account before lodging the tax return. This step helps manage tax payable and keeps financial statements accurate.

Setting up a Division 7A loan

If the bucket company cannot meet ATO obligations, consider setting up a Division 7A loan between the trust and the bucket company. This loan must be repaid within seven years, with interest charged at benchmark rates. The Division 7A loan agreement manages the unpaid present entitlement and ensures compliance with tax laws, providing a structured repayment plan to avoid potential tax issues.

A Division 7A loan is necessary when the trust does not distribute all income in cash to the bucket company before lodging the tax return. This arrangement helps manage the trust’s income and tax liability effectively.

For more information on setting up a Division 7A loan agreement, visit our page.

Division 7A loan requirements and benefits

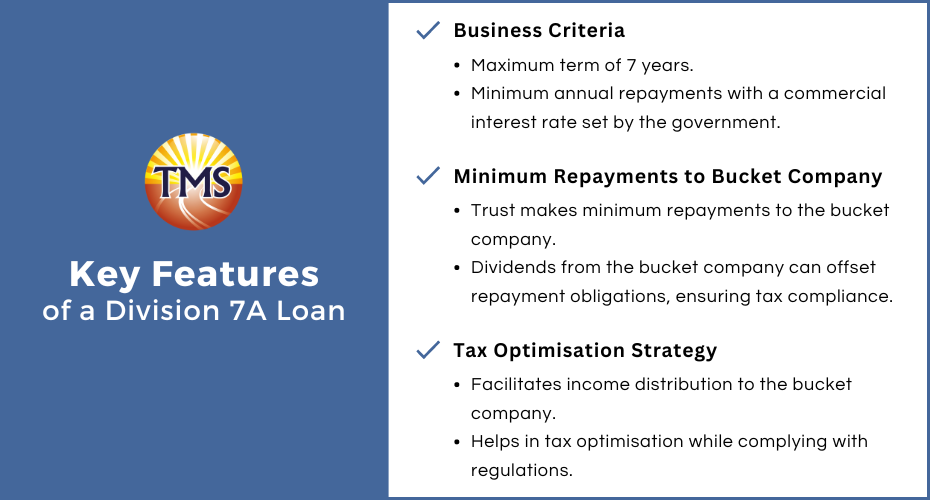

Division 7A loan agreements have specific requirements, including a maximum term of seven years and a minimum annual repayment plan. The interest rate for these repayments is set at a commercial rate prescribed by the government, ensuring the trust meets its obligations.

Each year, the trust must make the minimum repayments to the bucket company. The bucket company can declare fully franked dividends, which may offset these repayment obligations. This process ensures that tax laws are followed and helps manage the trust’s tax liability effectively.

Using a Division 7A loan as part of a tax minimisation strategy allows the trust to distribute income to the bucket company while staying compliant with the income tax assessment act. Properly managing these loans can lead to significant tax savings, optimise taxable income, and provide benefits for the family trust and its corporate beneficiaries.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.