Increase in instant asset write off threshold from $1,000 to $20,000 for FY 2025

.

On 14 May 2024, the Australian government declared an extension of the $20,000 instant asset write-off for another year, with the new deadline set for 30 June 2025. This policy allows small businesses to claim an immediate deduction for the entire cost of eligible assets up to $20,000, aiming to improve cash flow and reduce compliance costs. It’s important to note that this change is not yet legally binding. For specific guidance on how this can benefit your business, book a free consultation with TMS Financials. Click here to schedule your session.How does the instant asset write-off threshold work?

Eligible businesses can benefit from the instant asset write-off scheme by claiming a tax deduction for assets used for business purposes. This allows you to immediately deduct the full cost of an eligible asset in your next tax return, providing faster access to cash.

The instant asset write-off can be used for multiple assets, provided each asset’s cost is below the specified threshold. This applies to both new and second-hand assets. To qualify, assets must be purchased and installed ready for use within the same income year the write-off is claimed.

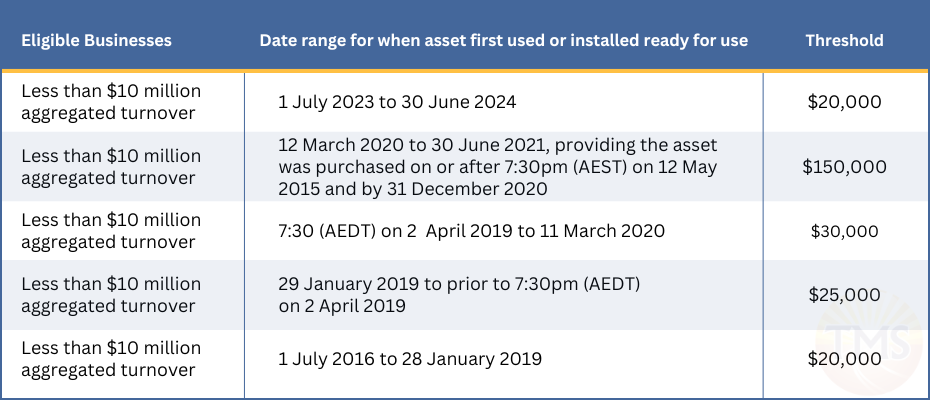

Please note: From 12 March 2020 to 30 June 2021, the instant asset write-off was suspended, with temporary full expensing available from 1 July 2021 to 30 June 2023.

What are the qualifications for the instant asset write-off?

To qualify for the instant asset write-off, your business must meet specific criteria, including:- The aggregated turnover of your business and any associated businesses must be below $10 million.

- The asset must be purchased, used, or installed between 1 July 2023 and 30 June 2024.

- The cost of the asset must be less than $20,000.

- The threshold applies on a per-asset basis.

Example of instant asset write-off for business

On 18 May 2018, John, a sole trader, bought a new computer and a printer for his business. The computer cost $6,800, and John used it 80% of the time for business purposes. The printer, which cost $700, was used entirely for business purposes. For the instant asset write-off, John calculated the business portion of the computer’s cost, which was $5,440 (80% of $6,800). The full cost of the printer, $700, was also eligible for the write-off. In his tax return for that income year, John claimed a total deduction of $6,140 for the eligible assets. As a sole trader, John should also be aware of superannuation contributions, such as employer contributions, SG contributions, and after-tax contributions. These are subject to various caps and rules set by the Australian Taxation Office (ATO) for the financial year. It’s important for John to consult with a professional to ensure compliance and to maximise available tax benefits.How do you handle costs that exceed the threshold?

As a small business, you need to follow simplified depreciation rules to claim the instant asset write-off. If an asset’s cost meets or exceeds the instant asset write-off threshold, you must add the asset to the small business depreciation pool.How to use simplified depreciation rules

If you have a small business, you can use simplified depreciation rules to claim the instant asset write-off. Here’s how you qualify:- For income years starting from 1 July 2016, your business must have an aggregated turnover of less than $10 million.

- For previous income years, your business must have an aggregated turnover of less than $2 million.

- An instant asset write-off for assets that cost less than the relevant threshold.

- A general small business pool with simplified calculations to determine the depreciation deduction.

What are the temporary tax depreciation incentives?

Between the 2019–20 and 2022–23 income years, eligible small businesses could benefit from three temporary tax depreciation incentives under simplified depreciation rules:- Temporary full expensing

- Increased instant asset write-off

- Backing business investment

List of exclusions and limits of the modified instant asset write-off rules

Certain asset categories are either not eligible or have modified rules for the instant asset write-off and temporary full expensing schemes. These include:- Cars that exceed the car limit

- Buildings and other assets eligible for capital works deductions

- Assets located outside Australia

- Specific primary production assets, like fencing and water facilities, which have their own instant asset write-off schemes

- Assets not used for business purposes

What are the rules for expensive cars?

Expensive cars, or vehicles exceeding the car limit, cannot be fully depreciated. For the 2023 financial year, the car limit is set at $64,741, and for the 2024 financial year, it is $68,108. This rule prevents businesses from using taxpayer funds to buy luxury vehicles and applies to the Temporary Full Expensing (TFE) scheme. However, commercial vehicles such as vans, buses, and trucks used for business purposes are not subject to this limit. Their entire cost can be depreciated regardless of the amount. Some larger utes with a carrying capacity of more than one ton are considered commercial vehicles rather than cars. If a business purchases such a ute, even if it costs more than the car limit, they may be able to immediately deduct the full cost using TFE.Assets not used in a business

The TFE scheme does not apply to capital assets used in a non-business capacity, such as those bought by investment property owners or assets used for employment purposes. For instance, office furniture is eligible for TFE when bought by a business, but not when acquired by an individual for employment purposes. If an asset is used for both business and personal purposes, any deduction claimed under TFE must be proportionate to its business use. For example, if you purchase a new computer for $2,500 and use it 50% for business and 50% for personal purposes, you can only claim a deduction for $1,250.Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.

[wpforms id=”265615″ title=”false”]