How to apply the CGT discount to reduce your Capital Gains Tax (CGT)

.

The Capital Gains Tax (CGT) discount allows eligible Australian residents to reduce the tax they pay on a capital gain by up to 50%. To qualify, you must have held the asset for at least 12 months before the CGT event happens i.e. when you sell the asset. This discount applies to the net capital gain after subtracting any capital losses, resulting in tax savings at your marginal income tax rate. For example, if you have a capital gain of $70,000, the 50% CGT discount reduces your taxable gain to $35,000.

If you have multiple assets, it’s essential to carefully work out your CGT for each. You can subtract capital losses carried forward from previous years or losses from other assets to reduce your capital gain further. By properly calculating your CGT, you can maximise the benefits of the CGT discount and ensure compliance with Australian tax laws.

How to calculate your CGT discount

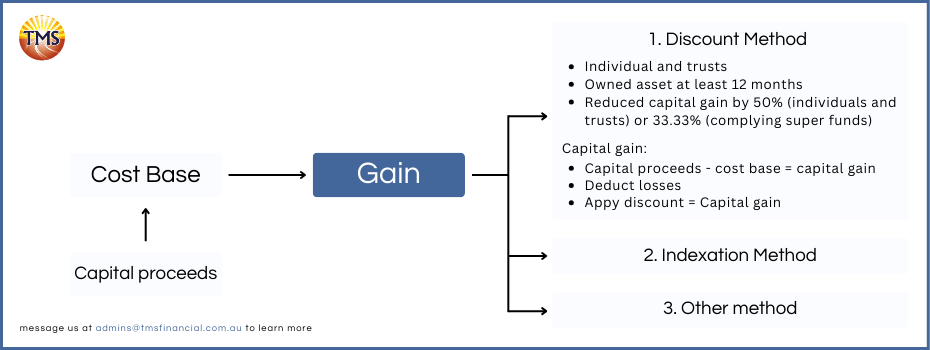

To calculate your Capital Gains Tax (CGT) discount, start by determining your capital proceeds, which is the amount you received from selling the asset or from another CGT event, such as an insurance payout if the asset was destroyed. If the asset was sold below market value or given away, you may want to use the market value instead. Next, calculate the cost base, which includes the purchase price plus costs associated with acquiring, holding, and selling the asset (e.g., stamp duty, legal fees, and commissions). If the asset was purchased before 21 September 1999, you can choose to index the cost base for inflation instead of applying the CGT discount.

Subtract the cost base from the capital proceeds to determine if you have a capital gain or loss. If the result is positive, it is a capital gain, while a negative result is a capital loss. Subtract any capital losses, including those carried forward from previous years, from your capital gains. The resulting amount is your net capital gain. Prioritise gains not eligible for the CGT discount when offsetting losses to minimise tax liability. This process should be repeated for every CGT event that occurred during the financial year.

Finally, if a net capital gain remains after applying losses, you can apply the CGT discount (50% for individuals, 33.33% for complying super funds, or up to 60% for affordable housing investments). To qualify, the asset must have been held for at least 12 months. Report your net capital gains or losses on your income tax return, with taxable gains calculated at your marginal income tax rate, and carry forward unused losses to offset future capital gains. Tools like the ATO’s online calculator can help streamline the process.

Case study – working out CGT for a single asset

Alex purchases an investment property for $500,000 and sells it 5 years later for $600,000. Alex has no other capital gains or losses to consider.

Using the outlined steps, Alex calculates the capital gain as follows:

- Capital proceeds from the CGT event: $600,000

- Cost base: $530,000, which includes:

- Purchase costs: $500,000 + $15,000 stamp duty + $1,200 conveyancing fees

- Sale costs: $1,300 conveyancing fees + $12,500 agent’s commission

Capital gain:

$600,000 − $530,000 = $70,000

Since Alex has no other capital gains or losses, he applies the CGT discount directly. As an Australian resident who owned the property for more than 12 months, Alex is eligible for the 50% CGT discount:

$70,000 × 50% = $35,000

Alex reports a net capital gain of $35,000 and a capital gain of $70,000 in the supplementary section of his tax return at question 18, labels A and H, respectively. Alex will pay tax on the $35,000 net capital gain at their marginal income tax rate.

It’s important to note the capital gain is recognised on the contract date, not the settlement date. For example, if contracts are exchanged on 4 June 2024 and settlement occurs on 6 July 2024, Alex must report the capital gain in his tax return for the financial year ending 30 June 2024.

Case study – working out CGT for multiple assets

Alex sells an investment property and some shares in the same financial year.

Shares:

- Original purchase: 1,000 shares at $10 each, including stamp duty and brokerage, for a total cost of $10,000.

- Sale: Shares sold for $5,500, with no brokerage or other sale costs.

Capital loss on shares:

$5,500 (capital proceeds) − $10,000 (reduced cost base) = ($4,500)

Investment property:

- Capital gain: $70,000 (calculated previously).

Net capital gain:

- Subtract the capital loss from the shares from the capital gain on the property:

$70,000 − $4,500 = $65,500

Since Alex has a remaining capital gain, he applies the 50% CGT discount as an Australian resident who held the property for more than 12 months:

$65,500 × 50% = $32,750

Alex reports a net capital gain of $32,750 and a capital gain of $70,000 at question 18 (labels A and H) in the supplementary section of his income tax return. Tax will be calculated on the net capital gain of $32,750 at Alex’s marginal income tax rate.

Exclusions that may prevent you from applying the CGT discount

There are specific circumstances where the Capital Gains Tax (CGT) discount cannot be applied, including:

Home first used for rental or business in the last 12 months

If the property was previously your home and was converted to rental or business use less than 12 months before the CGT event, you’re not eligible for the CGT discount. The 12-month ownership rule applies strictly in this scenario.

Using the indexation method instead

For assets acquired before 21 September 1999, you may choose to index the cost base for inflation rather than applying the CGT discount. While this can reduce the taxable capital gain, the CGT discount often provides better outcomes, depending on the circumstances.

Foreign or temporary residents

Foreign and temporary residents are excluded from claiming the full CGT discount on gains made after 8 May 2012. If you fall into this category, your access to the discount is restricted.

Creation of a new asset

The CGT discount doesn’t apply to gains from CGT events that result in the creation of a new asset. For example, receiving payment for agreeing to conditions like granting a lease or a restrictive covenant may not qualify, as the new asset has not been held for at least 12 months before the CGT event.

Disposal of interest in a non-widely held entity

If you sell shares or trust interests in companies or trusts with fewer than 300 members, known as non-widely held entities, the CGT discount may not apply to the resulting capital gain.

Conversion of an income asset

Deliberately reclassifying an income asset as a capital asset to claim the CGT discount can result in denial of the discount under Part IVA of the Income Tax Assessment Act 1936. This measure prevents tax avoidance strategies involving asset reclassification.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

How high-income earners can boost their super through salary sacrifice

How high-income earners can boost their super...

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

How high-income earners can benefit from voluntary super contributions

How high-income earners can benefit from...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.