Why You Need an SMSF Accountant for Effective Fund Management

.

Managing a Self Managed Super Fund (SMSF) offers unparalleled control over your investments, but it comes with complex compliance and taxation obligations. With stringent requirements set by the Australian Tax Office, many SMSF trustees find themselves mired in detailed accounting work, missing out on maximising their fund’s potential. That’s where an experienced SMSF accountant can help. Specialising in SMSF setup, ongoing SMSF administration, and SMSF accounting, a qualified accountant can become your cornerstone for effective fund management.

An SMSF specialist is someone who can assist you with the technicalities of SMSF administration all while ensuring quality service and adherence to compliance requirements.

Read on to learn why hiring an SMSF accountant can simplify the process of managing your Self Managed Super Fund and offer invaluable services to help you meet your financial goals.

What is a Self Managed Super Fund?

A Self Managed Super Fund (SMSF) is a type of superannuation fund, distinct from the managed super funds often overseen by corporate authorised representatives. As an SMSF trustee, you hold a unique position, one that offers unparalleled control over your super fund. However, with this control comes the added responsibility of overseeing the fund’s investments, ensuring legal compliance, and fulfilling other requisite duties.

Managing an SMSF isn’t for the faint-hearted. The whole process demands a solid grounding in financial planning and a deep understanding of SMSF accounting. Unlike other superannuation options, an SMSF requires a meticulous approach, with many SMSF trustees leaning on the expertise of chartered accountants for guidance. These specialists ensure that the accounting of the SMSF aligns with the annual return and tax compliance requirements. An SMSF specialist is adept at handling the complexities of SMSF setup and ongoing SMSF administration.

One of the standout features of an SMSF is the flexibility it offers in terms of investment choices. SMSF trustees can diversify their portfolio, investing in assets like stocks and even commercial property. All investment decisions must prioritise the best interests of the SMSF members. To navigate the maze of compliance and ensure that the fund invests wisely, tapping into the services of an SMSF expert is a wise move.

Is an SMSF the Right Choice for You?

Determining whether an SMSF aligns with your financial needs can pose a challenge. It’s wise to consult a licensed and qualified financial advisor, as our expertise is primarily focused on taxation advice. Through our strategic partnerships with prominent Financial Planning firms in Sydney, we can connect you with the one that suits your circumstances.

SMSF setup and administration

Considering the substantial time commitment involved in managing an SMSF, an SMSF accountant can significantly assist in shouldering administrative responsibilities and help ease the overall burden of running the fund, enabling you to focus on other aspects of your financial journey. Moreover, entrusting your SMSF’s compliance to a capable professional ensures the fund operates within the necessary regulatory framework.

SMSF Accounting responsibilities

The significance of partnering with a seasoned accountant cannot be overstated. Their adeptness in navigating the complexities of SMSF accounting is invaluable for ensuring adherence to regulatory guidelines and optimising the fund’s performance. Engaging with firms with extensive SMSF experience offers the dual advantage of streamlining SMSF management intricacies and effectively addressing taxation implications.

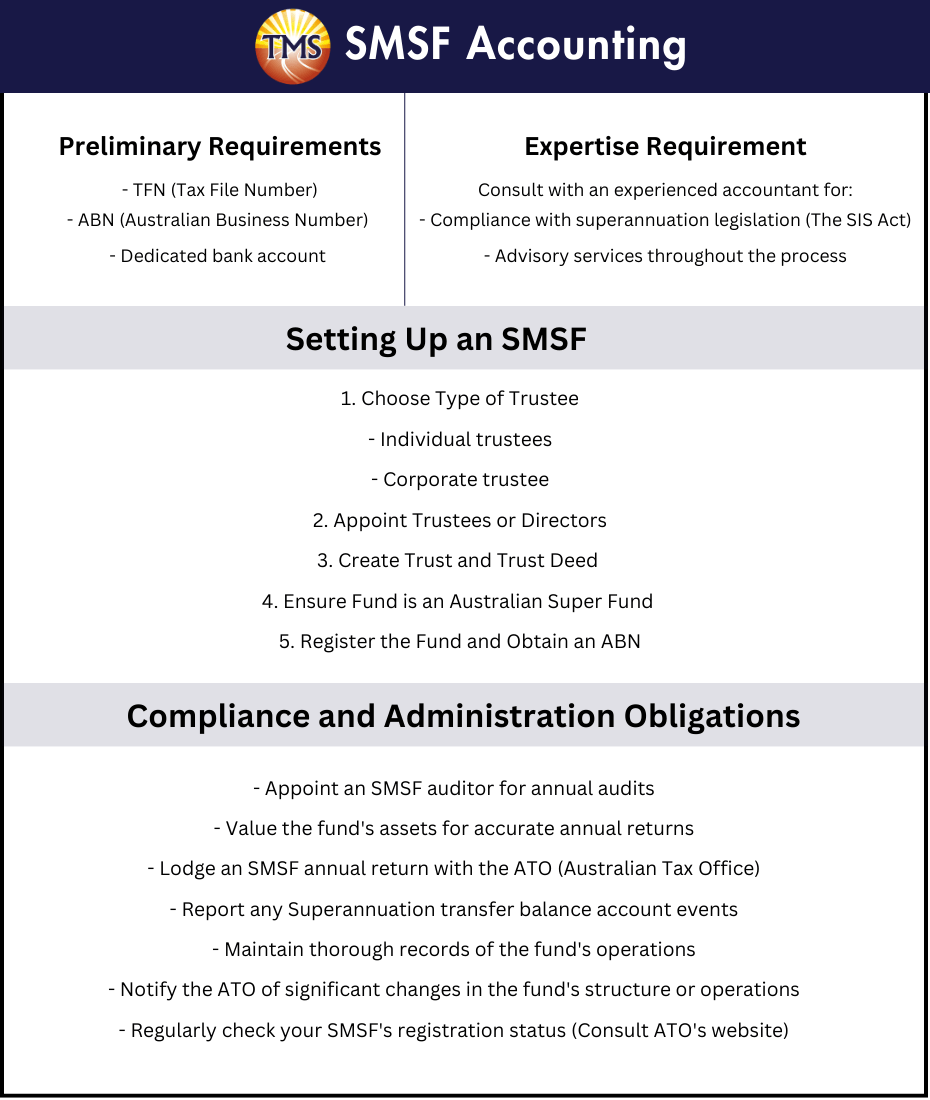

Establishing an SMSF: Step-by-Step

- Decide between individual trustees or a corporate trustee structure.

- Nominate and appoint your chosen trustees or directors.

- Craft the trust and its accompanying trust deed.

- Confirm your fund meets the criteria to be recognised as an Australian super fund.

- Register your fund and secure an Australian Business Number (ABN).

- Arrange for the setup of a dedicated bank account.

- Develop a comprehensive exit strategy.

SMSF Compliance and Administrative Duties

- Engaging an SMSF auditor for conducting annual audits.

- Accurately valuing the assets held within the fund to ensure precise annual returns.

- Filing an SMSF annual return with the Australian Tax Office (ATO).

- Reporting Superannuation transfer balance account events as required.

- Maintaining meticulous records of the fund’s operational activities.

- Promptly informing the ATO about significant changes in the fund’s structure or operations.

- Regularly reviewing the registration status of your SMSF. For detailed guidance on this aspect, you can refer to the ATO’s official website.

Exploring SMSF Taxation

Typically, a Self Managed Super Fund (SMSF) that adheres to compliance requirements enjoys the advantage of a concessional tax rate, set at 15%, on its generated income. This favorable rate applies to a diverse range of assessable income streams within the fund, spanning assessable contributions, net capital gains, interest, dividends, and rental income. It’s paramount to note that maintaining adherence to stipulated rules and regulations is key to accessing this concessional rate. Non-compliance can subject the fund to taxation at the highest marginal tax rate.

The knowledge and expertise of an SMSF accountant is pivotal in maneuvering through the intricate landscape of compliance and taxation.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Unlock the full potential of your SMSF with expert guidance.

Related Articles

How high-income earners can boost their super through salary sacrifice

How high-income earners can boost their super...

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

How high-income earners can benefit from voluntary super contributions

How high-income earners can benefit from...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.