Sole Trader | All you need to know

Sole Trader | All you need to know. What is a Sole Trader?A sole trader is an individual who operates and manages their own business and is considered self-employed. Operating as a sole trader is the simplest and cheapest business structure you can set up. As a sole...

Setting Up a Family Trust: A Practical Guide

Setting Up a Family Trust: A Practical Guide. When it comes to securing your financial future and planning ahead, a family trust is a powerful tool. It’s a smart way to protect what you own, save on tax, and leave a legacy. One increasingly popular approach is the...

Maximise Your Tax Savings and Grow Your Wealth with Strategic Tax Planning

Maximise Your Tax Savings and Grow Your Wealth with Strategic Tax Planning. Are you looking to optimise your financial outcomes, reduce tax liabilities, and accelerate wealth growth? With the financial year-end approaching, now is the perfect time to take proactive...

Understanding Goods and Services Tax (GST) and Maximising GST Credits

Understanding Goods and Services Tax (GST) and Maximising GST Credits. What is GST or Goods and services taxGST, or Goods and Services Tax, is a type of value-added tax imposed on goods and services in many countries. It is designed to streamline the taxation system...

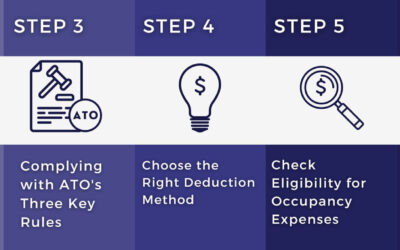

7 Steps to Maximise Your Work-From-Home Tax Deductions

7 Steps to Maximise Your Work-From-Home Tax Deductions. Tax time is around the corner, and I've been working from home - how can I ensure I'm claiming everything I can?" This is a question we hear a lot. And if you've found yourself asking the same thing, you're in...

The 4 Keys to Maximise Your Tax Savings in Australian

The 4 Keys to Maximise Your Tax Savings in Australian. Tax time can be stressful, but you can save money and reduce stress by knowing the FOUR tax-saving keys. These strategies will help you minimise taxable income, pay less tax, and increase your take-home pay in...

How to Use The Instant Asset Write-Off for Small Business Owners

How to Use The Instant Asset Write-Off for Small Business Owners. The Instant Asset Write-Off incentive is one of the best tax-saving opportunities available to Australian businesses. With the 30 June, 2025 deadline approaching, now is the time to understand how this...

Your Guide to BAS Due Dates 2023: A Must-Read for Small Business Owners

Your Guide to BAS Due Dates 2024: A Must-Read for Small Business Owners. The importance of the Business Activity Statement (BAS) for small businesses in AustraliaAre you a small business owner in Australia struggling to manage your tax obligations effectively? The...

SME Business Guide to STP Finalisation

SME Business Guide to STP Finalisation. If you're a small business owner in Australia, you're likely familiar with Single Touch Payroll (STP), the government initiative requiring employers to report payroll information to the Australian Taxation Office (ATO) in...