Asset protection for growing businesses and investments

.

If you’re a business owner, understanding asset protection strategies is important for protecting both your personal and business assets. Managing a growing business can be busy, but it’s important to have an asset protection plan to reduce risks to your business and personal assets. Using a limited liability company structure is one way to protect assets. With a limited liability company, the company, not you, is responsible for its debts. So, if the company can’t pay its debts, your personal assets are usually safe. You can also protect your assets by transferring assets such as your family home from someone who faces business risks to someone who doesn’t.Understanding the need for asset protection in Business

Effective asset protection strategies are designed to reduce risk by safeguarding your business and personal assets from potential claims by creditors. Many small business owners are not fully aware of the risks to their business operations and don’t know how to protect themselves. Setting up an asset protection strategy before any legal issues or claims arise can prevent potential claimants from targeting your assets or stop them from being taken following a legal judgment.

It’s wise to put your asset protection plan in place early.

Different legal structures, such as companies and family trusts, can form part of asset protection strategies. The best structure for you depends on what assets you have and the kind of creditors that might be a risk to you.

How to set up a business trading trust

Step 1: Choosing the right trustee

When you’re setting up a business trading trust, picking the right trustee is very important. You can choose either an individual or a company as the trustee. However, a corporate trustee, such as a Pty Ltd company, is often preferred because it offers benefits such as asset protection and continuity. For business owners, it’s vital to use asset protection strategies to keep personal assets safe from business risks. The trustee is responsible for managing the trust’s assets, ensuring they’re protected, and distributing income and capital gains to the beneficiaries.

To set up a corporate trustee, you need to create a Pty Ltd company. This company will act as the corporate trustee for your business trading trust. You’ll need to appoint directors, a secretary, and a shareholder. The trustee must manage the trust carefully, always looking after the beneficiaries’ best interests. The management need to follow the rules set out in the trust deed, a legal document that defines the trust’s terms.

Trustees are personally liable for the family trust’s debts, so having strong asset protection strategies is essential. A corporate trustee offers limited liability, which means the personal assets of the company’s directors and shareholders are protected. Choosing the right trustee and business structure is key to getting the most out of tax benefits, managing tax properly, and protecting assets in various situations, such as owning investment properties, during relationship breakdowns, and if there are personal injury claims.

Step 2: Establishing the business trading trust

The process of creating a business trading trust begins with a settlor providing an initial amount, usually a small sum like $10. The settlor’s main task is to sign the trust deed, a legal document that outlines the trust’s terms and conditions, and to give this initial amount to the trustee. After setting up the trust, the settlor has no more responsibilities or involvement in how the trust is run.

To avoid any conflicts of interest or legal complications, the settlor should not be the trustee, a beneficiary, or the appointer of the trust. They also shouldn’t be involved in any decisions about how the trust operates, its assets, or how income is distributed. The settlor’s role is only to help start the trust. Continuing to take part in the trust could affect its legality, the protection of its assets, or its tax advantages.

Step 3: Identifying the appointer in the business trading trust

The appointer plays a key role in a business trading trust, having significant control over its decision-making. Their main responsibilities are to appoint and remove trustees. This includes the power to dismiss any trustee who is not acting in the best interests of the trust.

Step 4: Identifying the beneficiaries of the business trading trust

Beneficiaries are the individuals, companies, or related entities that receive income from the trust’s assets. It’s important to note that beneficiaries do not have control over the trust. They are simply entitled to benefits as outlined in the trust deed. The trust itself isn’t taxed on its income. Instead, the beneficiaries are responsible for paying tax on the income they receive from the trust.

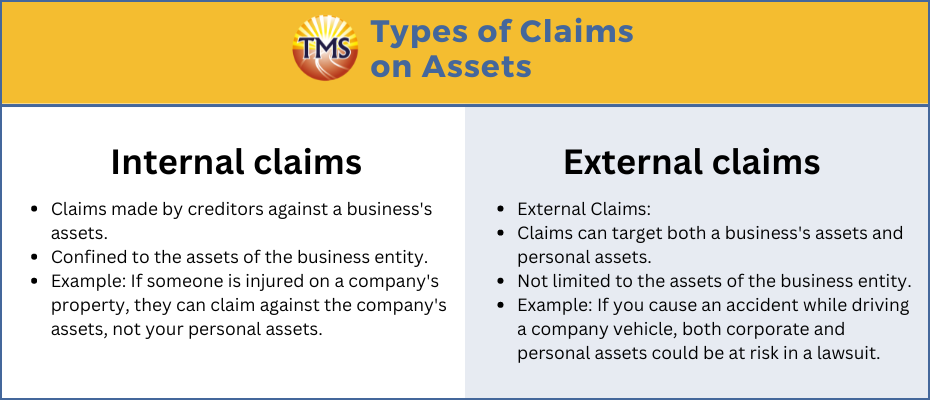

Types of claims on assets

Internal claims

Internal claims refer to demands made by creditors against the assets of a specific entity, like a corporation. For instance, imagine a corporation owns a property. If someone gets injured on this property, they can make a claim against the assets of the corporation, even significant assets such as the property itself. This is only the case if you, personally, were not directly responsible for the injury.

External claims

External claims are different because they aren’t restricted to the assets of a single entity. In these cases, claimants can target both the assets of the entity and your own individual assets. For example, if you were driving a company’s truck and caused harm due to negligence, the injured parties could sue both the company and you personally. This means that both the company’s and your personal assets could be at risk to settle the lawsuit.

Frequently Asked Questions (FAQ)

Is it safe to be in a partnership?

What are the safest asset protection strategies?

What are the risks if I buy an investment property in my own name?

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.