Claim Now – Small Business Tax Offset in Australia FY24-25

What is the small business tax offset for sole traders and individuals?

The small business income tax offset, also known as the unincorporated small business tax discount, allows sole traders and small business owners to reduce their tax by up to $1,000 each year. This offset is calculated based on the proportion of tax payable on your net small business income. To be eligible, you must be carrying on a small business as a sole trader or have a share of net small business income from a partnership or trust, with an aggregated turnover of less than $5 million. The offset rate has progressively increased, reaching 16% from the 2021–22 income year onwards. The offset amount is automatically calculated and applied when you lodge your tax return, with the details provided on your notice of assessment.

Who is eligible for the small business tax offset?

The Australian small business income tax offset is available to individuals who operate small businesses as sole traders or receive a share of net small business income through trusts and partnerships. To qualify, the business must have an aggregated turnover of less than $5 million. Unlike companies that benefit from corporate tax rate reductions, this offset specifically applies to unincorporated small businesses, providing eligible individuals with a reduction in their tax payable by up to $1,000 each year.

How to calculate small business tax offset?

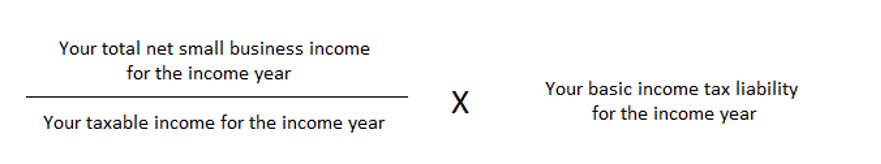

Up to a maximum of $1000, you calculate the offset using the following formula:

For instance, let’s say that you are a sole trader and operate a single small business entity in the primary production sector, from which your net income is $50,000. Let’s assume that you don’t have any farm management deposits and repayments or any foreign income. However, you have $5000 in other business deductions, after which your net small business income will be $45,000.

Based on this, you might work out your taxable income for the year to be $13,500. So, you would divide $45,000 (your total net small business income) by $13,500 (your taxable income), which would give you 3.33.

You would then multiply this by your basic income tax liability for the income year. Let’s say that’s $100, so 3.33 x $100 is $330.

Thus, you are likely to receive around $330 under the Australian small business tax offset. Remember, the maximum that you can receive under the offset is $1000, meaning that even if the result of your calculation exceeds this amount, the ATO will cap your offset at this amount.

How do you apply for the small business tax offset?

The amount that you are eligible to receive under the Australian small business tax offset will be calculated automatically by the Australian Taxation Office from your tax return, with the offset amount shown in your notice of assessment.

If you complete your tax return yourself using myTax, you will use the small business income tax calculator. Whilst this doesn’t work out the amount you are eligible to receive under the tax offset for you, it will tell you where to include it in your tax return.

We hope that this guide helps your business to take advantage of the Australian small business tax offset. However, we know it can be tricky, especially if this is your first time claiming. If you would like assistance with calculating how much your small business can receive under the offset, or if you need professional help setting up a company, trust, or self-managed super fund, look no further and contact TMS Financial. TMS Financial has a team of accounting and finance professionals to assist with your accounting needs. Find out how by calling (02) 9725 6169.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.