Your Guide to BAS Due Dates 2024: A Must-Read for Small Business Owners

Are you a small business owner in Australia struggling to manage your tax obligations effectively? The Business Activity Statement (BAS) is a crucial document that businesses must prepare and submit to the Australian Taxation Office (ATO) regularly.

As a small business owner, understanding and preparing your BAS accurately and on time is essential to avoid penalties, manage your cash flow, and gain insights into your business’s financial performance.

In this article, we’ll take a look at common problems you may face and how to prepare and lodge your BAS effectively. We’ll also provide practical tips and guidance to help you stay on top of your tax compliance obligations and make informed decisions for your business. So, whether you’re a sole trader or a small business owner with employees, keep reading to learn more about how managing your BAS effectively can help keep your business on track.

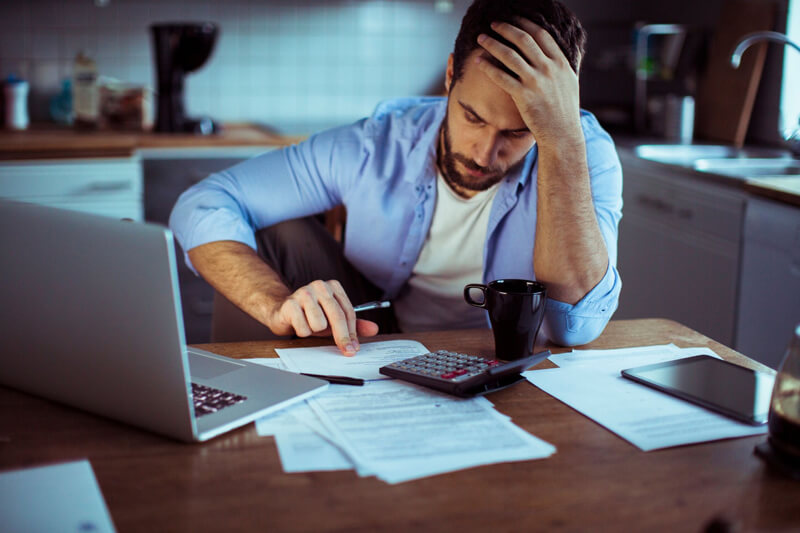

Common problems encountered when preparing your BAS

Challenges of navigating the Australian tax system and the complexity of BAS lodgement

Importance of organisation and record-keeping

Cash flow issues and the need to pay GST monthly and quarterly

To overcome these issues, you can take several steps. Firstly, you can seek professional assistance from an accountant or bookkeeper to help you navigate the tax system and ensure that your BAS is accurate and complete. Secondly, you can use technology tools such as accounting software or cloud-based solutions to streamline your record-keeping and financial reporting processes. Finally, you can prioritise effective cash flow management to ensure you can pay your tax liabilities on time and avoid penalties and fines from the ATO.

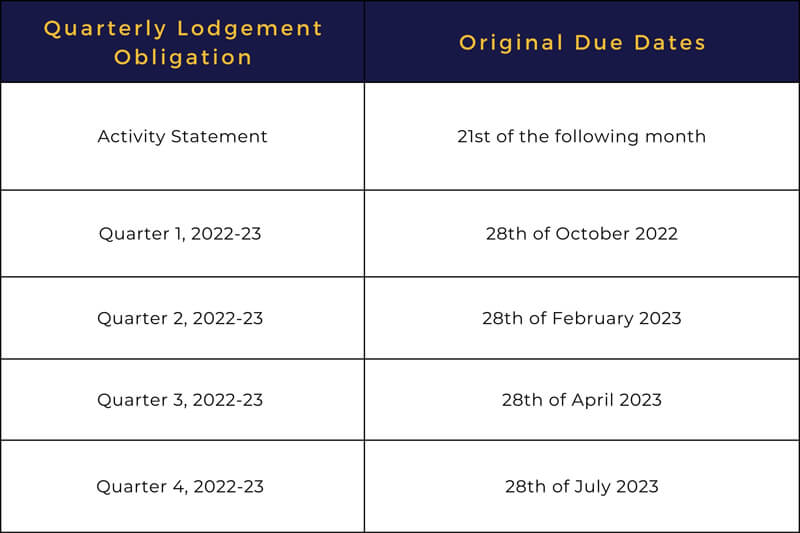

Important dates and deadlines for BAS in Financial Year 2023

Lodgement dates and the importance of meeting due dates to avoid penalties

By planning ahead and meeting deadlines, you can reduce stress levels, build trust with your clients or customers, and improve productivity, which can help you achieve your business goals. Therefore, it is essential to prioritize being aware of due dates and planning accordingly to ensure the success and growth of your business.

Consequences of missing the due dates – Avoid ATO Penalties!

If a business misses the due date for lodging and paying their BAS, it can have severe consequences. The ATO may impose a range of penalties, including late lodgment penalties, general interest charges (GIC), and even legal action.

The late lodgment penalty is calculated based on the number of days the BAS is overdue and the business’s annual turnover. For small businesses with an annual turnover of less than $10 million, the penalty can range from $210 to $1,050 per BAS statement.

In addition to late lodgment penalties, the ATO may also charge GIC on any unpaid amounts. GIC is calculated daily and applied to the outstanding balance, including the unpaid penalty amounts. The GIC rate is updated quarterly and is currently set at 7.76% per annum.

The ATO may also impose an administrative penalty if a business provides false or misleading information on their BAS or fails to provide information requested by the ATO. The administrative penalty can range from $210 to $10,500, depending on the severity of the breach.

If a business fails to lodge and pay their BAS for an extended period, the ATO may take legal action to recover the outstanding amounts, including garnishing wages, issuing a director penalty notice, or even liquidating the business.

Overall, the consequences of missing the due dates for BAS can be severe, therefore, it is important to plan ahead, meet the due dates for BAS, and ensure compliance with all taxation requirements.

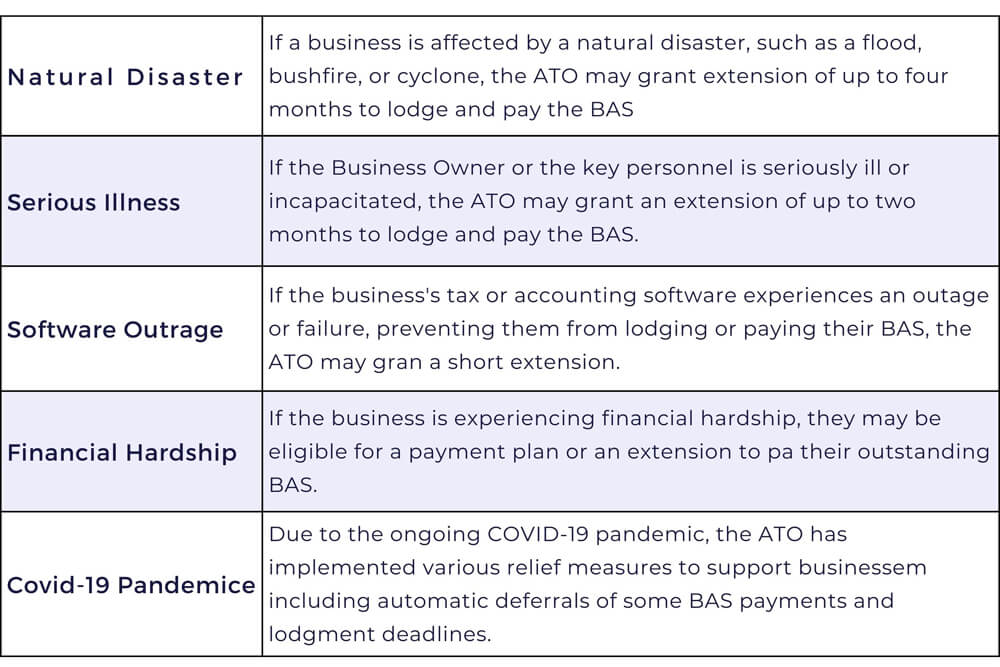

Businesses may be eligible for exceptions or extensions for the BAS due dates, including the role of a tax agent

Here are some situations where businesses may be eligible for an exception or extension for the BAS due dates:

Different ways to lodge the BAS

Online

Your Registered Tax Agent

Through Phone

By Mail

How to make payments

Online

BPAY

Direct Debit

Benefits of quarterly reporting for small businesses with a GST turnover of less than $10 million.

Wrangling your BAS can be a real headache, but it’s super important for small business owners in Australia to stay on top of it. By knowing the BAS due dates, keeping your records organized, and leveraging tech tools like accounting software, you can take the hassle out of BAS lodgement.

If your business makes less than $10 million in GST turnover, quarterly reporting can help you stay on top of your cash flow and streamline your BAS lodgement process. Keeping up with your BAS obligations is a must if you want to avoid getting slapped with fees and penalties from the ATO, and it’ll give you peace of mind knowing your finances are in good shape.

Complying with BAS obligations and maintaining a healthy financial position for small businesses

Complying with your BAS obligations is of utmost importance for business owners in Australia. To avoid penalties and interest charges from the ATO, it’s crucial to ensure that you lodge your BAS on time and pay any outstanding amounts by the due date.

Seeking professional advice from taxation experts can provide invaluable support in navigating the complexities of BAS lodgement and payment. By proactively staying on top of your BAS obligations and maintaining compliance, you’ll be taking a significant step towards safeguarding your business’s financial position.

Who are TMS Financials?

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and financial planning. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Want to avoid unnecessary penalties and interest rates

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.