Discover How an ATO Payment Plan Can Help You

.

An important part of managing your small business is ensuring you are up to date with paying external entities, commonly referred to as ‘creditors.’ Creditors can be suppliers, personnel, fixed overhead expenses like rent or equipment outlays, and additional working capital requirements.

The Australian Taxation Office is an important creditor that is frequently overlooked. And among many pressing financial obligations, it’s tempting to overlook tax-related debts; however, addressing them promptly can provide a wider array of options. This is where the ATO’s Payment Plan steps in.

What is an ATO Payment Plan?

Similar to other payment arrangements, the ATO payment plan sets a period during which you’ll make repayments. It’s important to note there will likely be interest applied to the amount you owe as well. Payment Plans can help you with managing your tax obligations.

How do I know if I need a Payment Plan?

Eligibility requirements for a Payment Plan

Here are some aspects they might consider:

- Gross Margins: Your business’s gross profits compared to costs.

- Cashflow: The movement of money in and out of your business.

- Assets and Liabilities: What your business owns and owes.

- Existing Debt Arrangements: Any ongoing debt agreements you have.

- Funding Availability: Your access to additional financial resources.

What are the interest rates of a Payment Plan?

Flexibility in ATO Payment Plans: What Can Be Adjusted?

Interest Deductibility and Considerations for ATO Payment Plans

Payment Timeline from the ATO: What to Expect

Furthermore, the ATO holds the ability to extend the terms of your payment plan under specific circumstances.

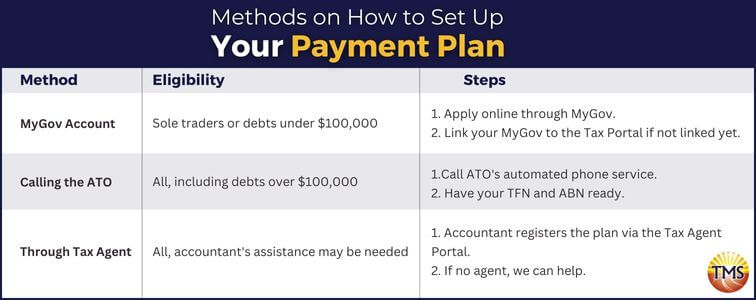

How to set up your Payment Plan

MyGov Account

Calling the ATO

You will need to call the ATO if your tax debt surpasses $100,000. If it’s slightly above this threshold, consider a one-time upfront payment to qualify for the payment plan.

Through a Registered Tax Agent

Remember, the ATO is committed to helping you repay the debt, and the payment plan is designed with your benefit in mind. Open communication and proactive steps will go a long way in this process.

Does a Payment Plan affect my credit rating?

Already Have a Payment Plan? Here’s What You Need to Know

Why Staying on Top of Payments Matters

Unlike other creditors, the ATO has direct access to your business’s income tax account. They can use any tax refund you’re owed to settle your debt without asking for your permission. With a payment plan, you can regain control and can, within certain limits, determine how you’ll pay back the tax debt.

The key is to find a suitable payment plan that aligns with your financial capability while still addressing your business’s cash flow requirements.

Consequences of Defaulting on Your Payment Plan

Additionally, failing to submit upcoming activity statements and tax returns on time, and not paying them by the due date, will also lead to a default on your existing payment plan. This information can be accessed through the online services for businesses portal.

In summary, challenges with settling tax debts can arise for small business owners. However, ignoring the debt can result in serious repercussions for both you and your business. The ATO might take legal actions, such as involving external collection agencies or issuing garnishee or Director Penalty Notices (DPN). In extreme cases, the ATO could even issue a bankruptcy notice and begin winding up your business.

Taking control of your business’s tax debt is crucial, and the ATO Payment Plan offers a valuable pathway to achieve this.

Is Tax Debt Relief Possible?

Meeting the ATO’s criteria for severe hardship necessitates showing that you’d be unable to provide basic necessities like food and shelter for your family. It’s important to note that selling your home might not automatically be considered an inability to provide accommodation in this context.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Struggling with Tax Debt?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.