Utilising a Business Trading Trust for Asset Protection and Maximising Your Hard-Earned Wealth

.

For business owner, it is crucial to protect your assets and preserve your hard-earned wealth. One effective approach to asset protection is employing a business trading trust. This strategy offers various benefits, such as tax optimization, adaptability, and privacy.

In this article, we will examine the different types of business trading trusts, their advantages, and factors to consider when using them.

What is a Business Trading Trust ?

A business trading trust is a trust structure designed to hold and manage business assets and revenue. Unlike other types of trusts, business trading trusts allow for ongoing trading activities and are typically used by businesses that generate income through trading or investment activities.

What are the benefits of using a business trading trust for your business?

Additionally, a business trading trust can provide flexibility in managing trust assets and income, allowing for ongoing trading activities and the ability to add or remove beneficiaries as needed. Lastly, a business trading trust can be used for succession planning, allowing for a smooth transition of ownership and management of the business.

How does a business trading trust work and who’s in charge?

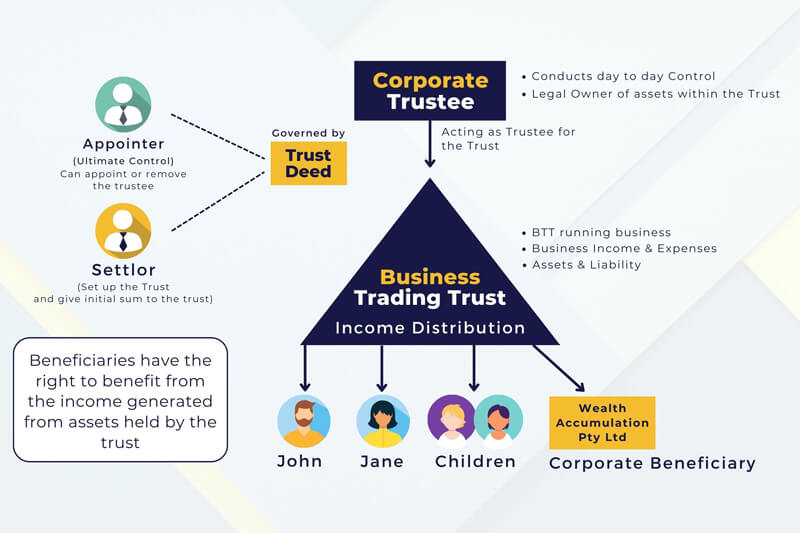

Key features of a business trading trust include the roles of the appointer, the trustee, and beneficiaries. The appointer is responsible for appointing and removing trustees who will administer the trust, and they hold the ultimate power as they control the decision-making process. The trustee is responsible for managing the trust assets and income, ensuring they are used for the benefit of the beneficiaries. Meanwhile, beneficiaries receive the trust income in accordance with the trust deed.

For more information on business trading trusts, watch our founder Eng Sivieng’s video below.

A step-by-step guide on how to set up a Business Trading Trust

Step 1: Choose the Right Trustee

Choosing the right trustee is crucial in establishing a business trading trust. The trustee can be an individual or a company, but a corporate trustee is recommended for benefits such as asset protection and continuity. Effective asset protection strategies are essential for business owners to safeguard their personal assets from business risks. A trustee is responsible for managing the trust’s assets, ensuring effective asset protection, and distributing income and capital gains to the beneficiaries.

To set up a corporate trustee, incorporate a company Pty Ltd to act as a corporate trustee for a business trading trust. Appoint company directors, a secretary, and a shareholder. The trustee must act with care and diligence in managing the trust in the best interests of the beneficiaries, as outlined in the trust deed, a legal agreement specifying the trust’s terms and conditions.

Trustees are personally liable for the trust’s debts, so it’s vital to implement effective asset protection strategies. A corporate trustee offers limited liability, protecting the personal assets of company directors and shareholders. By selecting the right trustee and business structure, you can optimize tax benefits, manage tax obligations, and protect assets in various circumstances, including investment properties, relationship breakdowns, and personal injury claims.

Step 2: Establish the Business Trading Trust

The settlor should not act as a trustee, beneficiary, or appointer of the trust to avoid any potential conflicts of interest or legal issues. The settlor must also refrain from participating in any decision-making processes or influencing the trust’s operations, assets, or income distribution. The settlor’s role is limited to the initial establishment of the trust, and any ongoing involvement could jeopardize the trust’s validity, asset protection, or tax benefits.

Step 3: Identify the Appointer

Step 4: Identify the Beneficiaries

Step 5: Consider Establishing a Wealth Accumulation Company

Setting up a separate company, known as a corporate beneficiary or bucket company, is an optional strategy for asset protection, wealth accumulation, and effective tax management. For more information on bucket companies, refer to our article “Unlock the Benefits of Bucket Companies.“

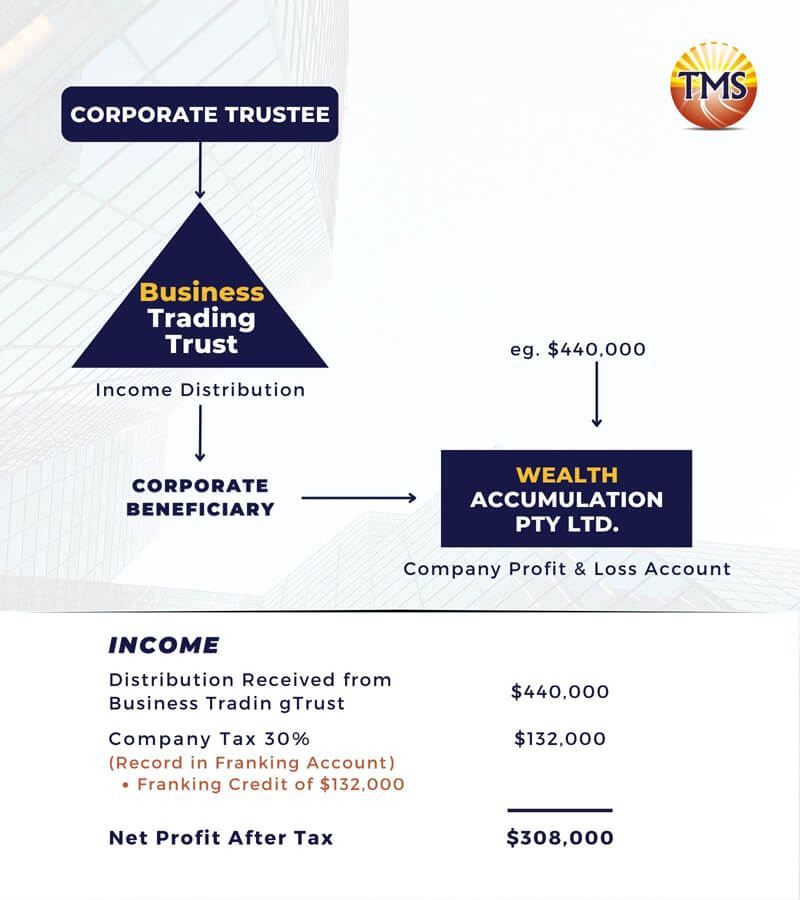

A Wealth Accumulation Company receives trust income distributions and pays tax at a 30% rate, offering tax advantages and savings. When accessing money from the bucket company, dividends can be paid to shareholders with franking credits applied, offsetting tax already paid at the company level. Alternatively, the company can act as a finance company, lending money while complying with Div 7A loan regulations.

When setting up a Wealth Accumulation Company, consider the shareholders and the company structure. For added asset protection and flexibility, create a separate discretionary trust to hold the company’s shares. This strategy allows the trust to distribute dividends tax-effectively, protect personal assets, and shield individuals from financial loss in legal proceedings.

A bucket company is an excellent vehicle for holding long-term investments, such as investment properties, shares, and private investments while minimizing business risks. However, be mindful of tax obligations when investing via a company, as companies are ineligible for the 50% capital gains tax discount available to trusts and individuals for assets held over 12 months. Companies are taxed at a 30% corporate tax rate. Consult an asset protection specialist or accountant to help you develop the best tax minimization and asset protection strategies for your situation.

Step 6: Register for Relevant Business Numbers and Licenses

After setting up your business trading trust, it’s essential to register for the relevant business numbers and licenses. This step is crucial, as failure to comply with the Australian Taxation Office (ATO) can result in penalties or legal action.

To operate a business trading trust, you need to apply for an Australian Business Number (ABN), Tax File Number (TFN), Goods and Services Tax (GST) registration, and Pay As You Go (PAYG) withholding registration with the ATO.

Additionally, some industries or professions require specific licenses or permits. For example, if you’re operating in the construction industry, you may need to obtain a builder’s license from the relevant authority. Be sure to research any industry-specific requirements and comply with all regulations to avoid potential legal or financial repercussions.

Step 7: Open a Business Bank Account for the Trust

Having a separate bank account for your business trading trust helps keep your personal and business finances separate, making it easier to manage your finances and track income and expenses for tax purposes.

Step 8: Implement a Record-Keeping System to Ensure Tax Compliance

Keeping accurate records is crucial when operating a business trading trust. It helps you keep track of income and expenses, monitor the trust’s financial performance, and comply with tax obligations.

To implement a record-keeping system, you can use a software system to record all transactions related to the trust. Keep all receipts and invoices related to the trust’s operations and maintain accurate records of all transactions. Failure to maintain accurate and complete financial records could lead to severe penalties, audits, and legal consequences with the ATO, potentially resulting in fines or even imprisonment for business owners. By having a robust record-keeping system in place, you’ll be better equipped to comply with tax obligations, minimise the risk of errors, and have a clear overview of the business’s financial performance.

Step 9: Ongoing Tax Compliance

Once your business trading trust is established and operational, you need to maintain ongoing compliance with all legal and regulatory requirements. This includes staying up to date with tax obligations and preparing financial statements and tax returns.

At TMS, we offer tax compliance services to help you meet your ongoing obligations. We can assist with annual financial statements and tax returns, Business Activity Statements (BAS), GST, FBT, and more. Our advanced tax planning strategies can also help you save on taxes.

In addition, we can provide advice and assistance with business structure setups, ASIC company documents and lodgements, Xero setup and training for easier record keeping, as well as bookkeeping, and payroll. With our help, you can ensure ongoing compliance and minimize the risk of penalties or legal action.

Overall, setting up a business trading trust requires careful consideration and attention to detail. By following the steps outlined in this guide, you can establish a business trading trust that provides asset protection, minimizes tax liabilities, as your business grows.

Different Types of Business Trading Trusts in Australia

Business Trading Discretionary Trust

The trust’s assets are owned by the trustee, who is responsible for using them for the benefit of the beneficiaries. The trustee maintains day-to-day control of the assets placed into the trust for trading purposes. The Trust can last for up to 80 years and provides taxation flexibility due to the range of beneficiaries, which may include family members, related entities, and others engaged in trading activities.

An additional person, often called the Principal or Appointer, has the power to change trustees and exercise ultimate control over the trust. The asset protection is provided because beneficiaries do not own or have a fixed interest in the trust’s properties. Instead, they have a mere expectation to be considered when the trustee decides to make a distribution.

The Business Trading Discretionary Trust is not suitable for businesses with multiple partners, as it lacks fixed entitlements.

Example

John and Jane appoint themselves as directors of the company . By using a corporate trustee, they can protect their personal assets from business risks.

They establish a Wealth Accumulation Company as a corporate beneficiary to the trust. This allows the trust to distribute income to the company at a fixed tax rate of 30%, which helps them to manage their taxes and accumulate wealth for their future financial goals.

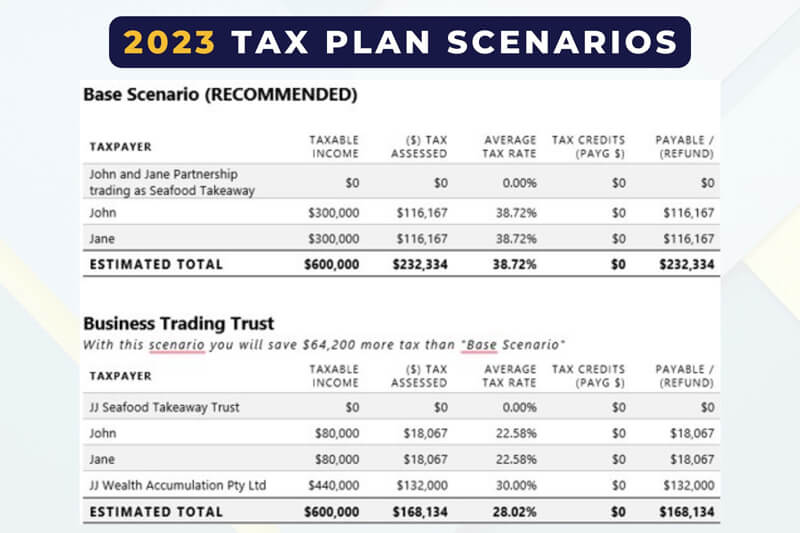

Assuming the business made a net profit of $600,000, the trustee distributes $80,000 to John and $80,000 to Jane, as agreed upon by the trust deed. The remaining balance of $440,000 is distributed to the Wealth Accumulation Company, which can be invested or used for future business ventures.

Business Trading Unit Trust

This trust structure is suitable for businesses with multiple partners or investors, as it provides fixed entitlements to the income and capital. The trustee owns the trust’s assets and must use them for the benefit of the unitholders engaged in trading activities. The Trust can last for up to 80 years, and the trustee maintains day-to-day control of the assets placed into the trust for trading purposes.

However, if a unitholder goes bankrupt, their units are treated as assets and could be sold to pay off their creditors. Unitholders generally have the power to remove and replace the trustee through a special resolution, which requires approval from unitholders holding at least 75% of the units.

Example

The Trust generates a net profit of $200,000 for the financial year. The Trust Deed specifies that profits are to be distributed in proportion to the unitholders’ unit holdings.

So, the profit distribution would be calculated as follows:

- Mike’s share of the profit = $200,000 x 60% = $120,000

- John’s share of the profit = $200,000 x 40% = $80,000

The Trustee would then distribute the profits to Mike and John accordingly.

Mike and John may also agree to reinvest some of the profits back into the Trust for future business growth, or they may choose to withdraw some of their profits as income.

It’s important to note that the profit distribution is subject to tax, and each unitholder would be responsible for paying tax on their share of the profits according to their individual tax rates.

Business Trading Hybrid Unit Trust

This structure is recommended for businesses with more than one family involved, where each family holds units in proportion to their interest in the business or investment. The unanimous consent of all unit holders is required for the trustee to exercise discretion in income distribution.

The Business Trading Hybrid Unit Trust offers maximum commercial flexibility, allowing for discretionary income distribution among unitholders and a broader range of other discretionary beneficiaries engaged in trading activities. Concessionally taxed receipts can be distributed to the trust’s discretionary beneficiaries without affecting the cost base or making the distributions assessable to the unitholders.

Is a Business Trading Trust Right for My Business?

Personal Services Income (PSI): If you earn income primarily through personal efforts or skills, a business trading trust may not be appropriate. In these cases, income is considered PSI, and the Australian Taxation Office has specific rules limiting the tax advantages a trust can provide.

Statutory or Regulatory Restrictions: In certain industries or professions, statutes or regulations may prohibit operating through a trust structure. Before deciding on a business trading trust, ensure that your specific industry or profession allows this type of structure. If it’s prohibited, a business trading trust would not be suitable.

In such cases, you might want to consider alternative structures like a business trading company. However, if your industry or profession also prohibits operating through a company structure, you may need to explore other options.

Given the complexities surrounding business structures, it’s crucial to seek professional advice to determine the most suitable option for your specific situation. Consulting with a professional can help you navigate any legal or regulatory restrictions and identify the best investment structure for your needs.

How can I confidently choose the right business structure?

To confidently choose the right business structure, it’s essential to understand the various types of structures available, weigh their potential advantages and disadvantages, and carefully consider your unique circumstances. By doing so, you’ll be better equipped to select a structure that maximizes asset protection, tax benefits, and investment potential.

Additionally, seeking guidance from a team of experienced professionals can help you navigate the complexities of different investment structures, ensuring you make the most informed decision for your business. With expert support, you can feel knowledgeable, empowered, and confident in your choice of business structure.

Continue reading with our article “Maximising Your Property Investment: Trust vs Company – Which Structure is Right for You?” to give you a better understanding on which structure would fit your business.

Next Steps

Your future success is just a call away. Don’t hesitate; embrace the opportunity to unlock your business’s full potential. Schedule a consultation with one of our asset protection specialists today and start your journey towards a brighter, more prosperous future.

Who are TMS Financials?

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and financial planning. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Do you need an effective asset protection strategy for your business?

Schedule a consultation with one of our asset protection specialists now!

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.