How high-income earners can boost their super through salary sacrifice

.

Want to lower your taxable income while growing your retirement savings? By making before tax contributions to your super account through salary sacrifice, you can boost your super fund balance while reducing your annual tax bill. This strategy allows you to contribute directly from your salary before it hits your take home pay, meaning these concessional contributions are taxed at just 15% instead of your usual income tax rate.

Want to learn more about maximising your super and optimising your tax? Book a consultation with us today.

How salary sacrifice works for high earners

When you set up a salary sacrifice arrangement with your payroll office, your before tax contributions go directly into your super account. Instead of paying your marginal tax rate, these concessional contributions are taxed at just 15%, giving you a significant tax benefit while reducing your taxable income.

Making salary sacrifice contributions affects your take home pay, but the tax benefits can make it worthwhile. For example, if you’re salary sacrificing $25,000 of your before tax pay in the current financial year, you may pay less tax overall. While your employer pays these contributions into your super fund, you’re building retirement savings more efficiently than making after tax contributions.

Keep in mind your annual cap on concessional super contributions. If your income, including salary sacrificed amounts, exceeds $250,000, Division 293 tax adds 15% to your contribution tax rate. Even then, the total 30% tax rate beats the normal tax rate plus Medicare levy for high earners.

Your payroll team will need to process your salary sacrifice arrangement correctly to ensure proper tax treatment of your voluntary super contributions.

How much can you put in your super?

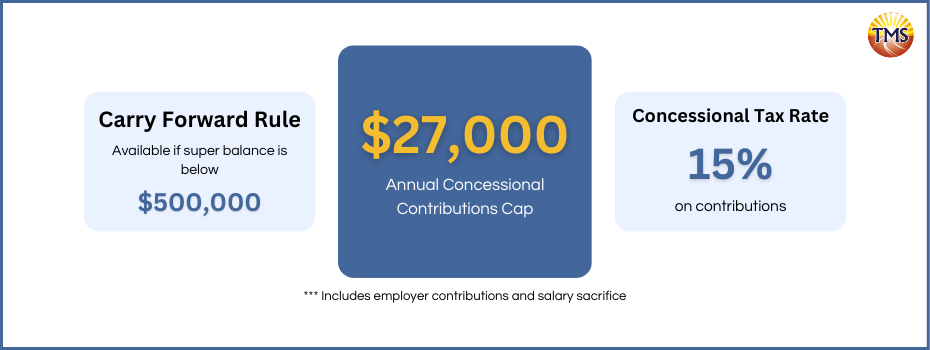

Each financial year your combined super contributions have limits. Your employer’s payments plus any salary sacrifice contributions count toward your annual concessional contributions cap. If you haven’t used your full cap in past years, you might be able to put in extra through carry-forward contributions. This lets you catch up on contributions while still getting the tax benefits of salary sacrifice super.

Concessional contributions cap

The concessional contributions cap limits how much pre-tax money can go into your super each financial year. Currently set at $27,500, this cap includes both your salary sacrifice super contributions and your employer’s regular super payments.

Going over this cap means paying your normal tax rate instead of the lower 15% super rate. You’ll need to report these extra contributions on your tax return and might face additional tax. To keep the tax benefits of salary sacrificing to super, track your total contributions throughout the year – both your salary sacrifice amounts and what your employer pays.

Making up missed super contributions

If your super balance sits below $500,000 on 30 June of the previous financial year, you can use any leftover contribution room from past years. This carry-forward rule lets you catch up on contributions you didn’t make in earlier years.

By combining these unused caps with your current financial year limit, you can make larger super contributions when your income is higher. This strategy helps lower your taxable income through salary sacrifice while building your retirement savings faster. Your payroll team can help calculate your available contribution room, or you can use online calculators to work out potential tax savings.

Book a consultation with us to day to learn more.

Tax rules that can impact high-income earners

Earning a higher income means tax planning becomes crucial. Making a salary sacrifice contribution to super can significantly reduce your tax bill, but specific tax rules like Division 293 tax need careful attention to avoid unexpected costs.

How salary sacrifice changes your taxable income

Redirecting part of your pay to super through salary sacrifice drops your taxable income. Since you’re making these contributions before tax, you’ll pay less in both your effective tax rate and overall tax amount.

How to manage your super contributions

Track your super contributions carefully to maximise your tax benefits and avoid excess contribution penalties while growing your retirement savings.

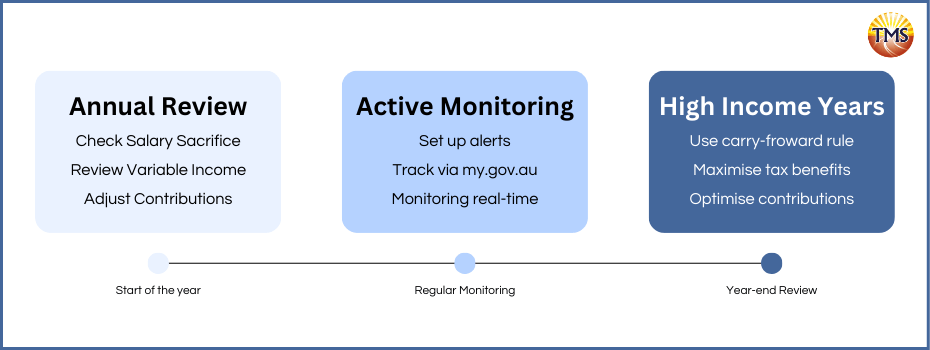

Review your contributions yearly

Changes in your income – including bonuses or variable earnings – affect both your employer’s super guarantee and your super contributions. A yearly review helps ensure you stay within your concessional contributions cap and avoid extra tax. This helps keep your contributions aligned with your financial year goals.

Set up super contribution monitoring

Your super fund portal and my.gov.au help track your concessional contributions. Monitor your salary sacrificed amounts, before tax contributions, and employer payments in real-time. Regular checks let you adjust your contributions before reaching cap limits, helping maintain tax benefits while growing your super account.

Plan for high-income years

Use high-income periods to salary sacrifice to super while reducing your taxable income. With a total super balance under $500,000, the carry-forward rule lets you use unused concessional contribution amounts from previous financial years. Combined with your current salary sacrifice arrangements, this helps maximise both your retirement savings and gives you a greater tax deduction within annual caps.

Setting up a compliant salary sacrifice arrangement

A proper salary sacrifice super arrangement maximises tax benefits for your super contributions. For those with a Self Managed Superannuation Fund (SMSF), proper documentation ensures you get the full tax benefits of salary sacrificing to super.

If you’re considering an SMSF, contact our team to discuss your options.

Document your salary package arrangement

Your salary sacrifice arrangement needs a formal agreement before starting any before tax contributions. This details how much of your pre-tax pay goes to super and your contribution schedule. Without proper documentation, these amounts count as normal taxable income, affecting your tax return and losing concessional tax benefits.

Keep your agreement signed and review it when changing jobs or adjusting your voluntary contributions. Good records keep your salary packaging super compliant and tax-effective.

Ensure your super fund is compliant

Your contributions must go to a compliant super fund for proper tax treatment. Compliant funds meet ATO requirements, ensuring your salary sacrificed contributions and employer super guarantee payments get concessional tax rates. These funds protect your retirement savings with strict access rules.

Non-compliant funds risk higher tax rates and endanger your contributions. You might miss tax concessions, and your super account could lack important protections.

What to consider before starting salary sacrifice

Salary sacrificing to super helps grow your retirement savings while reducing your taxable income, but it changes your take home pay. Since salary sacrificed contributions come from your before tax pay, you’ll have less money for daily expenses and unexpected costs. Use a salary sacrifice calculator to work out how much of your salary you can contribute without affecting your budget.

Remember that money you put into super through a salary sacrifice arrangement stays locked in your super fund until you reach preservation age (55-60 depending on your birth year) and meet the release conditions. Since you can’t access these super contributions until retirement, salary sacrifice works best with income you won’t need soon. Balance your salary sacrifice deduction against your current needs to get the tax benefits of concessional contributions while maintaining financial flexibility.

Making the most of salary sacrifice super

A clear strategy for salary sacrificing to super helps maximise both tax benefits and retirement savings. When making salary sacrifice contributions, watch your concessional contributions cap and Division 293 tax if you’re a high-income earner. Regular reviews of your salary sacrifice arrangement help ensure you reduce your taxable income effectively while growing your super fund balance.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

How high-income earners can benefit from voluntary super contributions

How high-income earners can benefit from...

How can you access your super early

How can you access your super early?. An early...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.