Understanding the bring forward rule for better retirement planning

.

The bring forward rule, also known as the bring forward arrangement, is a strategic method to increase your superannuation contributions, particularly your non-concessional contributions, within a shorter timeframe. This rule is governed by specific guidelines, including factors like your age, past non-concessional contributions, and the total amount in your super fund, which is often influenced by the general transfer balance cap.

It’s important to understand these rules to avoid excess contributions. Exceeding the non-concessional contributions cap can lead to additional tax liabilities due to excess non-concessional contributions. Being aware of the bring forward non concessional contributions and how it applies to your financial situation, especially in relation to the contributions caps and your super balance, is crucial. This understanding helps in maximising your retirement savings while preventing the need to pay extra tax.

Remember, the implications of these rules can vary based on individual circumstances, such as your super balance and your previous financial year’s contributions. Staying informed about these guidelines ensures you make the most of your super fund without encountering unforeseen tax implications.

Understanding the non-concessional contributions cap

The non-concessional contributions cap is the limit on the amount of money you can contribute to your superannuation from your after-tax income without incurring additional tax. From 1 July 2021, you’re allowed to contribute up to $110,000 each year. This cap can vary occasionally, as it’s linked to the Average Weekly Ordinary Time Earnings (AWOTE), reflecting changes in average wages. If your contributions exceed this cap, you may be required to pay extra tax.

Below is a summary of the non-concessional cap amounts since the 2018-19 financial year:

If you contribute more than the annual non-concessional contributions cap, you might qualify to use future year caps in advance. This option is referred to as the bring-forward arrangement. It enables you to make additional non-concessional contributions without the burden of extra tax, provided you meet specific eligibility criteria. However, if your total super balance equals or exceeds the general transfer balance cap (which is $1.7 million for the 2021–22 period and increases to $1.9 million from 2023–24) at the end of the previous financial year, then your non-concessional contributions cap for the current year is zero ($0).

Understanding the differences: carry forward rule vs. bring forward rule

The carry forward rule and the bring forward rule both relate to superannuation contributions, but they address different types of contributions and function in unique ways.

The carry forward rule is associated with concessional (before-tax) contributions. If your total super balance is less than $500,000, this rule enables you to carry forward any unused concessional contributions cap on a rolling basis over five years. In essence, if you don’t fully use your concessional contributions cap in a given year, you can transfer the remaining amount and use it in a subsequent year.

On the other hand, the bring forward rule pertains to non-concessional (after-tax) contributions. It allows individuals under 75 years to make substantial contributions in one year by borrowing from their caps for the next two years. This means you can contribute up to three times the annual non-concessional contributions cap in a single year.

In summary, while the carry forward rule lets you transfer unused concessional contribution limits to future years, the bring forward rule enables you to use your future non-concessional contribution caps in advance.

Case Example: Alex’s pre-retirement boost

Alex, aged 60, has recently sold an investment property and received $300,000 in after-tax proceeds. Planning to retire in the next five years, Alex aims to enhance his superannuation savings. His total super balance currently stands at $1.2 million, and he has not made any non-concessional contributions in this financial year.

Benefits of using the bring forward rule

The bring forward rule is a strategic approach in superannuation management that offers several advantages:

Tax efficiency

Super fund earnings are taxed at a maximum of 15%, often lower than personal tax rates. By shifting funds into your super, you can potentially have a tax deduction on your investment earnings.

Maximising retirement savings

This rule enables you to contribute a substantial amount (up to $330,000) as a non-concessional contribution. Such a significant increase in your super balance leverages compound interest, which can be especially beneficial in the years before retirement.

Estate planning

Superannuation serves as an effective tool in estate planning. It allows the transfer of funds to dependents in a tax-effective manner, which is crucial in the event of one’s passing.

Application of the bring forward rule

Alex decides to apply the bring forward rule by contributing the entire $300,000 from the property sale to his super in a single move. This approach uses three years’ worth of non-concessional contributions cap at once. Consequently, Alex won’t be able to make additional non-concessional contributions in the next two years. However, this is not a concern for Alex, as he does not expect to have other substantial amounts to contribute in that period.

The benefit for Alex

Through this decision, Alex has:

-

Used his lower total super balance to make a significant non-concessional contribution, staying within the cap limits.

-

Increased his superannuation balance substantially in one transaction, now having more assets earning at the low tax rate of 15% within the super.

-

Enhanced his financial security as he approaches retirement, without impacting his personal cash flow or incurring higher tax rates.

In essence, the bring forward rule is advantageous for individuals like Alex who aim to maximise their super contributions in a tax-efficient manner, particularly when nearing retirement and having access to larger sums for investment.

Understanding the eligibility and key considerations for the bring forward rule

Navigating the bring forward rule requires understanding its specific eligibility criteria and considerations. These factors determine how and when you can maximise your non-concessional superannuation contributions. Let’s break down these critical aspects:

Age eligibility

To qualify for the bring forward rule, you must be under 75 years old as of the previous 1st of July. Additionally, any non-concessional contributions should be made within 28 days after turning 75.

Additional contributions during a Bring-Forward Period

If you are in the second or third year of the bring-forward period, your Total Super Balance (TSB) must be below the general Transfer Balance Cap (TBC) as of 30 June of the previous financial year to make additional non-concessional contributions. Even if contributing further pushes your TSB over the TBC, it’s permitted as long as the TSB was below the TBC on the preceding 30 June.

About indexation

Increases in the annual non-concessional contributions cap due to indexation do not affect the limit for a bring-forward arrangement already in progress. The limit for the bring-forward period is set based on the cap at the time the period started.

These considerations are essential for those planning to use the bring forward rule, particularly in the context of changing superannuation regulations and caps.

Roles and responsibilities in managing the bring forward rule

Managing and overseeing the bring-forward rule involves distinct roles and responsibilities shared between the Australian Taxation Office (ATO), super fund trustees, and individuals. The ATO takes the lead in handling contribution data, including the specifics of the bring forward rule. They monitor non-concessional contributions and issue excess notices of assessment when contributions exceed the prescribed limits based on caps and an individual’s Total Super Balance (TSB). Super fund trustees, on their part, are not responsible for determining the eligibility of contributions under this rule, but they do play a crucial role in reporting personal contributions to the ATO.

This reporting is essential for compliance with contribution limits. Individuals also have a role to play; they can access their contribution and bring-forward details through the myGov portal. However, they need to exercise caution as these reports might not always reflect the latest TSB due to reporting delays from funds.

As a result, individuals are encouraged to maintain comprehensive records and regularly confirm details with all their super funds to ensure accuracy. This collaborative approach between the ATO, super fund trustees, and individuals is key to effectively managing the bring forward rule.

Determining your bring forward cap based on Total Super Balance (TSB)

The bring-forward rule’s contribution limits are directly influenced by your Total Super Balance (TSB) as of the end of the previous financial year. Here’s how it works:

TSB below $1.68 million

If your TSB was under $1.68 million as of 30 June of the last financial year, you can contribute up to three times the annual non-concessional cap over three years. For example, in the 2023–24 financial year, with a TSB under $1.68 million as of 30 June 2023, your bring-forward cap is $330,000 for the next three years.

TSB between $1.68 million and $1.79 million

For TSBs in this range as of 30 June of the previous year, you can contribute double the annual cap, which amounts to $220,000, over a two-year period.

TSB of $1.79 million or more

If your TSB was $1.79 million or higher by 30 June of the last year, the bring-forward option isn’t available to you. However, you can still contribute up to the standard annual limit of $110,000 for the current year.

These caps are in line with the non-concessional cap set at $110,000 and the general transfer balance cap of $1.9 million.

Key points after activating the bring forward rule:

Adjustments to the non-concessional cap during your bring-forward period don’t affect your cap. The total amount you can contribute is fixed based on the cap from the year you started the bring forward.

Your contributions in the following 1 or 2 years can’t exceed your remaining bring-forward amount. For instance, if you contribute the maximum in the first year, you cannot contribute in the following two years.

From the 2017–18 financial year onwards, if your TSB equals or exceeds the general transfer balance cap by 30 June of the preceding year, your remaining cap for the second or third year of the bring forward period becomes zero.

Important considerations regarding the bring forward rule

When managing your superannuation contributions, it’s vital to be mindful of the bring forward rule to avoid unintentional activation. Here are key points to consider:

Cumulative contributions across super funds

Take into account all non-concessional contributions made to all your super funds. The total of these contributions across different funds is what determines whether the bring-forward rule is triggered.

Impact of excess concessional contributions

Unreleased excess concessional contributions also count towards your non-concessional cap. This means they can inadvertently activate the bring forward rule if they push your total contributions beyond the annual non-concessional limit.

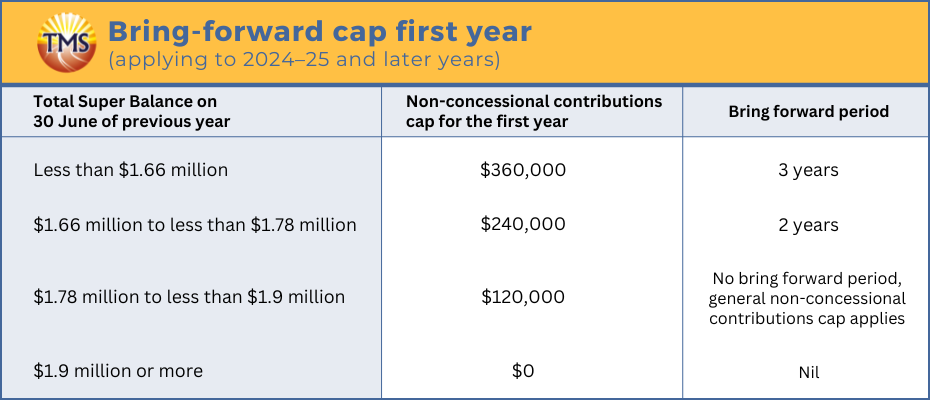

The tables below provide a summary of the bring forward caps applicable in the first year, based on your total super balance. These tables are essential for understanding how much you can contribute without triggering additional tax liabilities or surpassing contribution limits.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

How high-income earners can boost their super through salary sacrifice

How high-income earners can boost their super...

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

How high-income earners can benefit from voluntary super contributions

How high-income earners can benefit from...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.