Business Activity Statement

Minimise Your Tax Liability

Expert Tax Agents

Avoid BAS late Payment Penalty

Welcome to TMS Financials, your trusted partner for handling Business Activity Statement (BAS) services. As an Australian business, you’re required to report and remit various tax obligations to the Australian Taxation Office (ATO) using the BAS. This includes Goods and Services Tax (GST), Pay As You Go (PAYG) withholding and instalments, Fringe Benefits Tax (FBT), Luxury Car Tax (LCT), Wine Equalisation Tax (WET), and Fuel Tax Credits (FTC).

Depending on your business’s turnover, you may need to lodge your BAS monthly or quarterly. While you can lodge online, through a tax agent, or by mail, missing the deadline can lead to penalties. At TMS Financials, we’re here to ensure timely and accurate BAS lodgement, and can assist with seeking extensions or payment plans from the ATO if needed. Trust us to simplify your tax obligations.

Do I Need To Lodge BAS?

Business Owners

Business owners in Australia who are registered for the Goods and Services Tax (GST) are required to lodge a Business Activity Statement (BAS).

Over $75,000 or more annually

Sell Goods and Services

Made payments to contractors or employees

Investors

Incurred expenses related to earning investment

Did you earn any interest, dividends, rental income or other investment

Key Taxes Reported in a Business Activity Statement

Goods and Services Tax (GST)

Pay As You Go (PAYG) Withholding and Instalments

Fringe Benefits Tax (FBT)

Wine Equalisation Tax (WET)

Fuel Tax Credits (FTC)

Luxury Car Tax (LCT)

BAS Due Dates

At TMS Financials, we take the stress out of managing BAS due dates for business owners and investors. With our expertise and meticulous approach, you can enjoy peace of mind knowing that your BAS lodgement will be handled promptly and in compliance with ATO requirements. Trust us to keep you on track and provide the peace of mind you need.

Here is a brief overview of the BAS due dates and quarterly deadlines in Australia:

Quarterly BAS

Most small businesses lodge their BAS on a quarterly basis. The quarters are generally divided as follows:

- July to September (Q1): The due date for lodgement and payment is usually the end of October.

- October to December (Q2): The due date for lodgement and payment is usually the end of February of the following year.

- January to March (Q3): The due date for lodgement and payment is usually the end of April.

- April to June (Q4): The due date for lodgement and payment is usually the end of July

Monthly BAS

Some businesses with higher annual sales may be required to lodge their BAS on a monthly basis. The due date for monthly BAS is generally the 21st day of the following month.

Visit our BAS Due Dates page for more information on the specific deadlines for your Business Activity Statement.

Do I need a tax agent for BAS Lodgement?

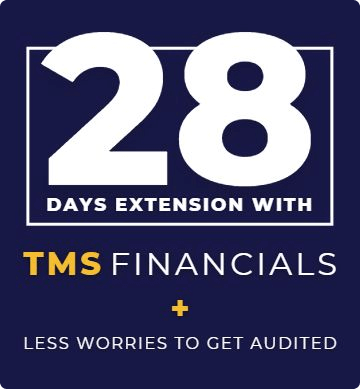

Extended Deadlines

Tax agents often have extended deadlines, providing more time for accurate preparation and lodgement of BAS.

For more information see the ATO’s Page on BAS Due Dates

ATO Representation

Lodge Your BAS With Confidence By Choosing A Trusted Tax Agent.

Late-Lodgement And Non-Lodgement ATO Penalties

One of the penalties that can be imposed is the Failure to Lodge (FTL) penalty. This penalty is calculated based on the number of days that the BAS is overdue. The penalty amount increases the longer the BAS remains outstanding. The current penalty rate is $222 for each 28-day period or part thereof that the BAS remains outstanding, up to a maximum of $1,110.

Late Lodgment

$210 for each period of 28 days or part thereof that the statement remains outstanding, up to a maximum of $1,050.

PENALTY

Failure to pay on time

Penalty can be up to 20% of the unpaid tax amount for failure to pay on time.

PENALTY

General interest charge (GIC)

Daily interest accrues on unpaid taxes, including penalties and interest charges. The rate is updated quarterly and is generally higher than standard interest rates.

PENALTY

Administrative Penalties

The penalty can range from $250 to $4,500, depending on the entity type and the seriousness of the failure.

PENALTY

How to Avoid ATO Penalties

At TMS Financials, we understand the challenges and risks involved. That’s why we are here to provide you with a comprehensive understanding of the penalties associated with late or non-lodgement, empowering you to take control and eliminate the risk of fines in the future.

Stay Organized

Establish a systematic approach to record-keeping and document management. Keep track of your financial transactions, invoices, and relevant records in an organized manner, ensuring you have all the necessary information readily available when it’s time to lodge your BAS.

TIPS

Set Reminders and Deadlines

Create calendar reminders or use digital tools to set alerts for BAS lodgement due dates. Stay proactive and ensure you have ample time to gather the required information, complete the necessary calculations, and submit your BAS before the deadline.

TIPS

Engage a Tax Agent

Consider partnering with a tax agent, such as TMS Financials, who specializes in BAS lodgement. They can provide expert guidance, manage deadlines on your behalf, and ensure accurate and timely lodgement while keeping you compliant with ATO requirements.

TIPS

Plan Ahead and Seek Assistance

Anticipate potential challenges and seek assistance in advance. If you foresee any issues or complexities with your BAS, such as reconciling complex transactions or understanding specific tax requirements, consult with a tax professional well in advance of the lodgement due date.

TIPS