Can you buy property with your Self Managed Super Fund?

.

For many Australians, investing in property has led to the biggest gains in capital growth. The Australian property market has shown strong growth over the past few decades, leading many to consider using their Self Managed Super Funds (SMSFs) to purchase residential or commercial property. But what are the tax benefits and disadvantages of using your SMSF to buy property?

While we can’t provide direct financial advice, we can guide you through the rules relating to SMSF property investment, the potential tax advantages and disadvantages, and how recent changes in SMSF property loans might impact your decision. Understanding the tax implications, such as Capital Gains Tax liability, and ensuring compliance with the Australian Taxation Office’s regulations, including the sole purpose test, is crucial for SMSF trustees.

If you’re thinking about purchasing property through your SMSF, it’s essential to seek professional advice tailored to your financial situation. Schedule a consultation with us to explore the options available for SMSF property investments, and we’ll also connect you with Sydney’s leading financial planners for more personalised advice.

Residential vs commercial real estate in an SMSF

When considering property investment through your Self Managed Super Fund (SMSF), there are differences between what you can and can’t do depending on whether you purchase a residential investment property or a commercial property using your Self Managed Super Fund.

If you’re looking to buy residential property through your SMSF, it’s crucial that the investment meets the sole purpose test, meaning the property must be used soley for providing retirement benefits. This means the property cannot be rented to a related party or occupied by any fund members or their relatives. These strict rules are designed to keep the investment focused on long-term financial security, free from personal use.

On the other hand, buying commercial property offers more flexibility in terms of what you can and can’t do when purchasing via your Self Managed Super Fund. You can use your SMSF to purchase business premises and rent it back to your business at market rates, providing a dual benefit of securing a property for your business and growing your retirement savings. However, it’s important to consider the associated costs, such as legal fees, stamp duty, and ongoing property management expenses, before making a decision.

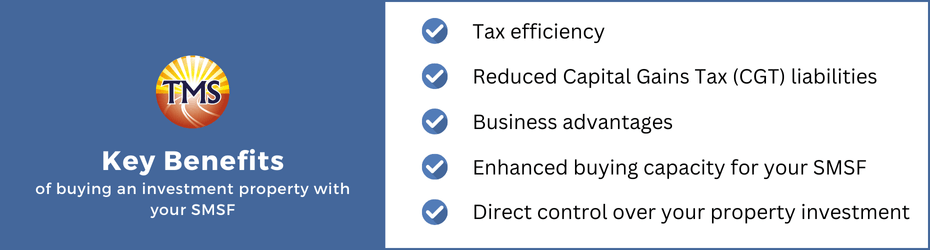

Key benefits of buying an investment property with your SMSF

Investing in property through your Self Managed Super Fund (SMSF) can offer several benefits, making it an attractive option for Australian investors.

Here are some key reasons why people consider SMSF property investment:

Tax efficiency

Owning investment properties through your SMSF can be more tax-efficient than personal investments. Within an SMSF, rental income and other earnings are taxed at a concessional rate of between 0% and 15%, which is significantly lower than personal income tax rates. However, it’s important to note there are some limitations. For example, if your SMSF incurs losses from the property, you can’t use negative gearing to offset your personal tax liability; instead, any negative gearing applies only to the SMSF’s tax liabilities.

Reduced Capital Gains Tax (CGT) liabilities

Holding property within an SMSF can also lead to reduced Capital Gains Tax (CGT) liabilities. If your SMSF holds the property for more than 12 months, the capital gain is eligible for a one-third discount, effectively capping the maximum CGT rate at 10%. This can result in significant tax savings when you decide to sell the property.

Business advantages

For business owners, using a Self Managed Super Fund (SMSF) to purchase commercial property can be highly beneficial. One key advantage is the opportunity to buy your business premises through your SMSF and lease them back to your business. By doing this, the rent you would normally pay to an external landlord goes into your SMSF instead, effectively boosting your retirement savings. It’s important to ensure the rent paid is at market rate to comply with SMSF regulations.

Enhanced buying capacity for your SMSF

An SMSF allows you to pool resources with up to five other members, significantly increasing your collective buying power. This increased capital can provide access to more investment opportunities, enabling your SMSF to purchase higher-value properties or diversify into multiple assets. The potential for capital growth in property value can lead to greater returns for your fund, further enhancing your retirement savings.

Direct control over your property investment

One of the tax benefits of an SMSF is the direct control it offers over your investment decisions, including the ability to invest directly in property. This control allows you to tailor your investment strategy and diversify your portfolio according to your specific financial goals. However, with this control comes added responsibility. The property must meet the sole purpose test of providing retirement benefits, and it cannot be used for personal purposes or provide any immediate benefit to fund members or their relatives.

Given the complexities and risks involved in SMSF property investments, seeking professional financial advice can be a good idea to ensure you’re making the best decisions for your unique situation.

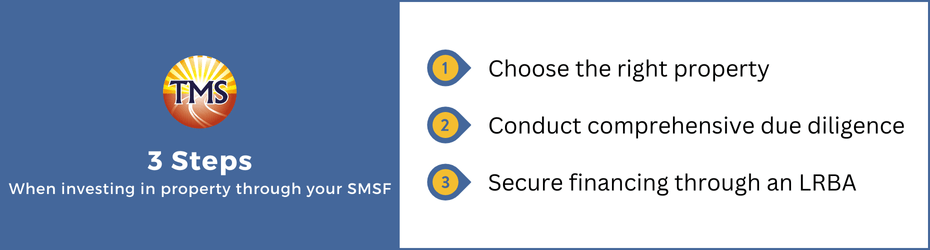

Steps to follow when investing in property through your SMSF

Investing in property through a Self Managed Super Fund (SMSF) requires careful planning and adherence to specific guidelines.

Here are the key steps to follow:

Choose the right property

Begin by selecting a property that aligns with your SMSF’s investment strategy and meets the sole purpose test, which ensures the property is solely for providing retirement benefits to fund members.

Conduct comprehensive due diligence

Thoroughly evaluate the chosen property before proceeding. This includes assessing the property’s market value, potential rental income, and its compliance with SMSF regulations. Ensure the property qualifies as business real property, if applicable, and check for any legal issues or encumbrances that could affect the investment.

Secure financing through an LRBA

If additional funding is required, consider using a Limited Recourse Borrowing Arrangement (LRBA). This loan structure allows your SMSF to borrow for property investment under strict conditions, with the lender’s recourse in case of default limited to the property itself. This arrangement helps protect the other assets within your SMSF from potential risk.

Considerations before investing in property with an SMSF

Before setting up a Self Managed Super Fund (SMSF) to purchase property, it’s essential to consult with your accountant, mortgage broker, and financial adviser, if you have one. A mortgage broker can assess whether your current industry super fund has sufficient funds for banks or other lenders to consider it eligible for the loan required to purchase the property. This initial step is crucial to ensure that your SMSF is financially prepared for the investment.

Understanding the costs of SMSF property investment

Investing in property through an SMSF involves a range of costs that can significantly impact your retirement savings. It’s important for fund members to have a clear understanding of these expenses, whether you’re considering residential or commercial property.

Initial and legal fees

At the outset, you’ll incur costs for purchasing the property and obtaining legal consultations. These fees ensure compliance with SMSF regulations and help safeguard your investment.

Advisory fees

If you engage a financial adviser you will incur advisory fees which can bring down the overall return on your investment. Unlike a tax accountant, a financial planner isn’t essential for setting up an SMSF, however a good financial advisor should be able to help you make informed decisions that align with your retirement goals.

Stamp duty and ongoing management costs

Stamp duty, imposed by the government, along with regular expenses such as maintenance, council rates, and insurance, are essential to maintain the property’s value over time. These costs should be factored into your investment strategy.

Financing charges

If you’re purchasing property through a Limited Recourse Borrowing Arrangement (LRBA), be mindful of the bank fees and interest payments associated with the loan. These financing charges can impact the assets within your SMSF, so careful consideration is necessary to ensure the investment remains beneficial to your retirement savings.

By understanding and planning for these costs, you can make more informed decisions when investing in property through your SMSF, helping to secure your long-term financial future.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

How high-income earners can boost their super through salary sacrifice

How high-income earners can boost their super...

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

How high-income earners can benefit from voluntary super contributions

How high-income earners can benefit from...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.