Capital Gain Tax – Thinking of Selling your business?

For the majority of small to medium sized business owners, the value of your business is your biggest asset, and very likely, your retirement fund.

Upon sale of your business it is critical you receive the maximum available net proceeds. However, many taxpayers miss this once in a lifetime chance through poor transactions planning and the holding of assets in inappropriate structures. Just because you consider yourself a small business does not mean you have automatic access to all available CGT concessions.

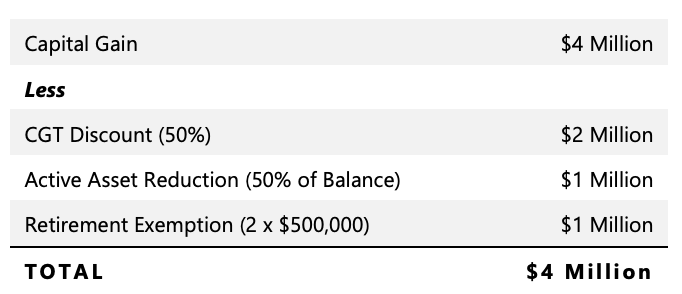

While the rules are complex, if the correct planning is in place, a husband and wife team can receive up to $4 million tax free after the sale of their business. (If you’ve run your business for at least 15 years, all the sale proceeds might be tax free!)

Key Considerations

- Companies do not receive the 50% general discount

- The owner(s) need to have owned the business / asset for more than 1 year – CGT discount 50%

- Taxpayer group:

- Must be under $6M in net value; or

- Under $2M turnover threshold

- Any assets sold must be ‘active assets’ used in the business for a certain period

- To maximise the concessions, the business owner(s) might need to use the ‘retirement exemption’, rolling up to $500,000 per individual of their sale proceeds into superannuation

Ultimate CGT Position

Effective planning for the sale of your business can make a huge difference to your after-tax return – up to $4M

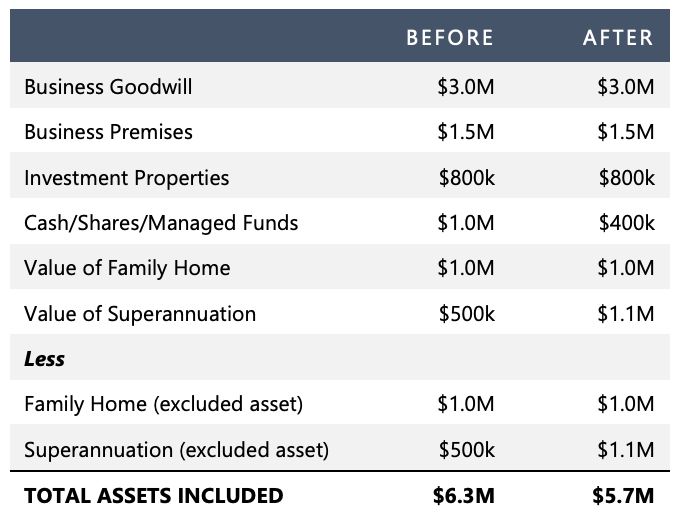

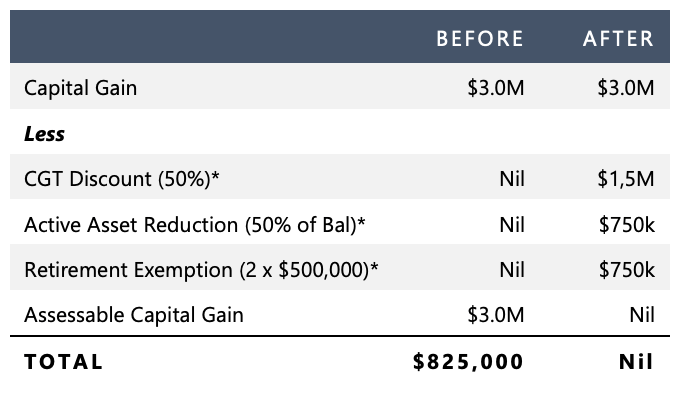

Here is an Example

* Without proper advice, the business was unable to meet the conditions to access small business CGT concessions – as such, the entire capital gain has become taxable in the hands of the company.

1. You leave it too late to inform your advisors about your intention to sell; or

2. Your advisors do not have a thorough understanding of the legislation and the possible restructuring opportunities

As taxation specialists, our focus is on providing the best possible outcome for business owners.

Selling your Business for Maximum Net Worth

Timing is critical, almost all restructure options are lost once you have signed a contract, even super contributions made post contract date are invalid when looking at the $6M net asset test.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.