How to pay yourself a salary as a company director. Are you considering setting up a company in Australia? is it needed for establish your own business, acquire an existing business, or contract through a Pty Ltd company for job opportunities? Maybe your Trust or SMSF...

Discover How an ATO Payment Plan Can Help You

Discover How an ATO Payment Plan Can Help You. An important part of managing your small business is ensuring you are up to date with paying external entities, commonly referred to as ‘creditors.' Creditors can be suppliers, personnel, fixed overhead expenses like rent...

Thinking About Setting up a SMSF (Self-Managed Super Fund)? Here’s What You Need to Know

Thinking About Setting up a SMSF (Self-Managed Super Fund)? Here’s What You Need to Know. If you're considering setting up a SMSF Self-Managed Super Fund , it's important to understand the ins and outs of Self-managed super fund. While tax agents can't provide...

Setting Up a Family Trust: A Practical Guide

Setting Up a Family Trust: A Practical Guide. When it comes to securing your financial future and planning ahead, a family trust is a powerful tool. It’s a smart way to protect what you own, save on tax, and leave a legacy. One increasingly popular approach is the...

Maximise Your Tax Savings and Grow Your Wealth with Strategic Tax Planning

Maximise Your Tax Savings and Grow Your Wealth with Strategic Tax Planning. Are you looking to optimise your financial outcomes, reduce tax liabilities, and accelerate wealth growth? With the financial year-end approaching, now is the perfect time to take proactive...

Understanding Goods and Services Tax (GST) and Maximising GST Credits

Understanding Goods and Services Tax (GST) and Maximising GST Credits. What is GST or Goods and services taxGST, or Goods and Services Tax, is a type of value-added tax imposed on goods and services in many countries. It is designed to streamline the taxation system...

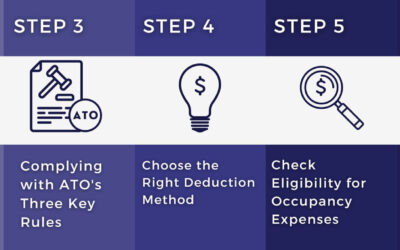

7 Steps to Maximise Your Work-From-Home Tax Deductions

7 Steps to Maximise Your Work-From-Home Tax Deductions. Tax time is around the corner, and I've been working from home - how can I ensure I'm claiming everything I can?" This is a question we hear a lot. And if you've found yourself asking the same thing, you're in...

The 4 Keys to Maximise Your Tax Savings in Australian

The 4 Keys to Maximise Your Tax Savings in Australian. Tax time can be stressful, but you can save money and reduce stress by knowing the FOUR tax-saving keys. These strategies will help you minimise taxable income, pay less tax, and increase your take-home pay in...

How to Use The Instant Asset Write-Off for Small Business Owners

How to Use The Instant Asset Write-Off for Small Business Owners. The Instant Asset Write-Off incentive is one of the best tax-saving opportunities available to Australian businesses. With the 30 June, 2025 deadline approaching, now is the time to understand how this...