How S.100 changes affect controllers of a discretionary trust

.

What is Section 100A?

Section 100A (S.100A) functions as an anti-avoidance measure embedded in the framework of the Income Tax Assessment Act 1936. Its purpose is to address situations where one individual gains an economic benefit from a trust, while another is presently entitled to assessable income. This rule becomes applicable when the present entitlement is associated with an agreement, arrangement, or understanding, and an economic benefit is conferred upon someone else, all with the intent of diminishing or delaying income tax.

Should S.100A apply, the beneficiary’s entitlement to trust income is overlooked, and the trustee is then assessed on the beneficiary’s share of the trust’s taxable income, facing the highest marginal tax rate.

This rule becomes important in discretionary trusts, especially when distributions go to companies or non-residents. It usually happens through reimbursement agreements outside regular family or business dealings.

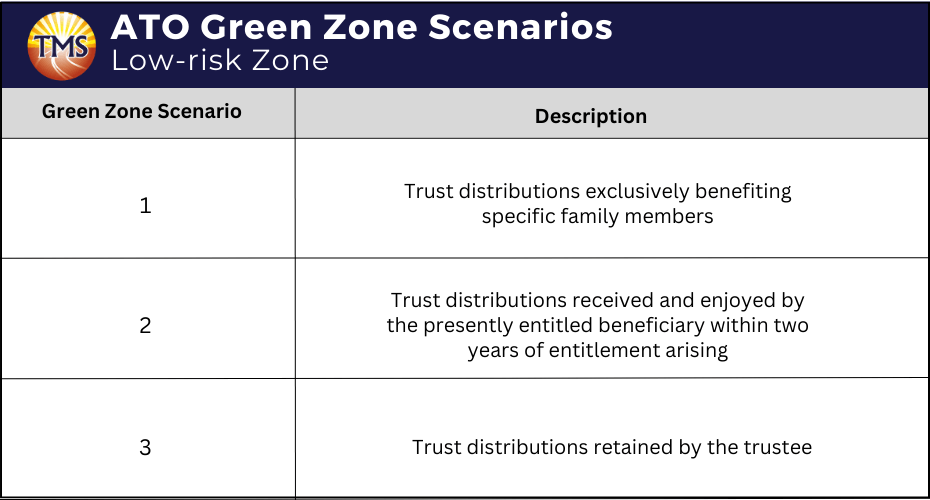

Low risk Green Zone scenarios

The ATO has outlined low-risk (green zone) scenarios under Section 100A (S.100A) guidelines in the Income Tax Assessment Act. These involve trust distributions benefiting an individual, often the trust controller like ‘Mum and/or Dad’ in a typical family setup. Green zone scenarios include:

- Trust distributions exclusively benefiting specific family members.

- Trust distributions received and enjoyed by the presently entitled beneficiary within two years of entitlement arising.

- Trust distributions retained by the trustee.

It’s crucial to note that all green-zone scenarios assume none of the outlined exclusions apply, necessitating meeting various requirements such as notification and lodgment.

The ensuing discussion revolves around a typical family discretionary trust managed by ‘Mum and Dad,’ created to benefit their family. This family unit comprises a minor child, an adult child, and grandparents.

For more information on the ATO compliance risk zones, check our article here.

Green Zone Scenario 1: Distributions exclusive to specific family members

Section 100A disregards benefits derived from a reimbursement agreement, redirecting the net income to the trustee at the top marginal tax rate. The ATO’s compliance approach is outlined in the Practical Compliance Guideline, using three color-coded zones to elucidate their strategy. If an arrangement aligns with the low-risk zones (white or green) and lacks exclusions, individuals can trust that the ATO won’t allocate compliance resources unless to verify adherence to specific zone requirements. Trust distributions with specific purposes retain a low-risk status, with the ATO refraining from active provision application.

Tax insight: Exclusion boundaries

The ATO cautions that benefits outlined in Green Zone scenario 1, revolving around everyday family interactions, are confined to the beneficiary, their spouse, and dependents. Distributions reaching individuals or entities beyond these categories (such as an adult independent child, trustee of the distributing trust, another trust or company, or a superannuation fund) won’t qualify for the Green Zone scenario 1 exemption.

These boundaries align with the ATO’s guidance on routine family dealings and are integral to a compliance approach promoting fairness and transparency in trust distribution arrangements. The ATO prioritizes high-risk scenarios in its compliance endeavors, offering practical guidelines for those in the low-risk Green Zone.

For seamless year-end tax planning and optimal tax outcomes, consider the exclusion to ordinary family or commercial dealings. However, it’s advisable to seek professional guidance, especially in complex situations that entail multiple family members, corporate beneficiaries, and intricate trust distribution plans.

The compliance approach underscores the significance of meticulous documentation and adherence to tax regulations to remain securely within the low-risk green zone, avoiding arrangements that may attract the ATO’s attention.

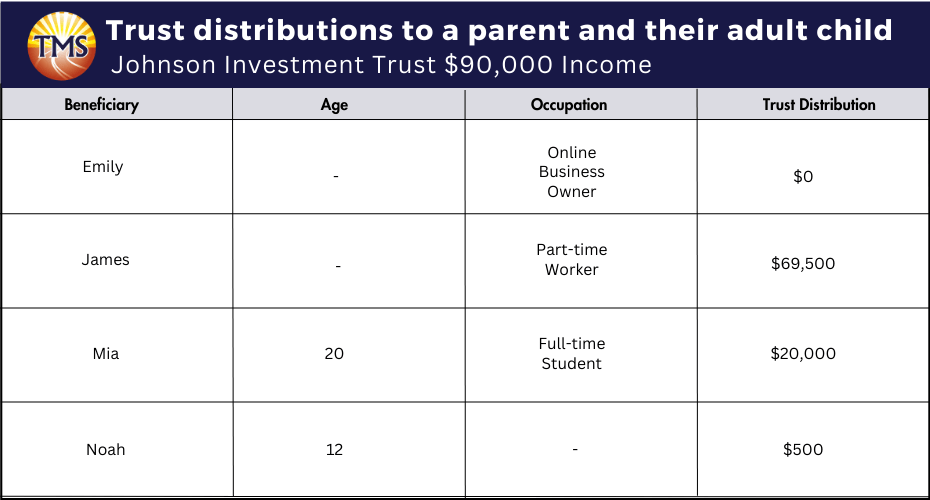

Example: trust distributions to a parent and their adult child

The Johnson Investment Trust (the ‘trust’) is an investment trust established to benefit the Johnson family. The beneficiaries of the trust comprise members of the Johnson family, Emily, and her spouse, James (the controllers of the trust), and their two children, Noah (aged 12) and Mia (aged 20).

Mia is pursuing full-time studies and currently has no spouse or children. She presently resides with her parents and relies on them for financial support. Emily, due to her activities outside the trust (operating a successful online business as a sole trader), falls into the top marginal tax rate. James, who works part-time, is subject to a lower marginal tax rate than Emily.

Emily and James jointly manage their financial responsibilities and sustain their lifestyle from a shared pool of assets. For the 2023 income year, the trust generated income of $90,000, with a net (taxable) income also amounting to $90,000.

The trustee decided to allocate the trust income as follows:

- The initial $500 to Noah Johnson

- The subsequent $20,000 to Mia Johnson

- The remainder to James Johnson (totaling $69,500)

The trustee satisfied James’s trust entitlement by transferring $69,500 into a bank account jointly held by Emily and James.

Green Zone Scenario 2: Trust distributions to presently entitled beneficiary within two years

The ATO has established criteria for trust distributions retained by the trustee, categorizing them as low-risk under S.100A, assuming the application of the ordinary family or commercial dealings exclusion. In the context of Green Zone Scenario 2, which deals with retention for a period less than two years, a trust distribution to an individual beneficiary, such as a parent (the ‘controllers’ of a trust), not disbursed by the trustee, falls within the low-risk green zone scenario 2 if the following conditions are met:

The beneficiary ‘receives their entitlement’ within two years of becoming presently entitled

It’s important to note that the ‘two-year window’ may not cover distributions lent back to the trustee for less than two years—an aspect not explicitly addressed in the guidelines but likely considered in relation to the ‘two-year window.’

The beneficiary ‘uses the entitlement’ upon receipt

This condition is satisfied when the entitlement is retained or utilized for purposes such as meeting liabilities, making purchases, or investing for the beneficiary, their spouse, or dependants. Exclusive use by a beneficiary’s spouse is acceptable, given shared financial responsibilities and a common pool of assets. However, the condition is not met if the trustee retains funds beyond the two-year requirement or if distributed funds are used for an investment or transaction with a related party, where the consideration paid exceeds market value or involves non-commercial terms.

Tax advisory: strategic trust fund management and compliance guidelines

In line with the latest ATO guidance on trust structures, trustees receive comprehensive insights into net income, trust income, and the trust’s income for tax purposes. The ATO emphasises the importance of understanding present entitlements, particularly in the context of discretionary trusts and family trusts.

To align with tax law requirements, trustees should carefully navigate the complexities of corporate beneficiaries and unpaid present entitlements. The practical compliance guideline serves as a crucial reference for trustees when making decisions about net income allocation and capital gains within the trust.

Trustees are urged to consider factors such as expenses incurred, maintaining adequate working capital, and ensuring that the funds genuinely represent the taxpayer’s circumstances. This approach aligns with the ordinary family dealings exclusion, promoting fair and transparent trust distribution arrangements.

Trustees should also be mindful of reimbursement agreements, especially when addressing scenarios involving net income and capital gains for tax purposes. The ATO’s guidance on ordinary family dealings is essential in this regard, as trustees plan for the future responsibly, considering the parents’ benefit.

Understanding the trust deed and its provisions is crucial in determining the right trust structure, and trustees should be aware of the potential involvement of the federal court in case of disputes.

Trustees are encouraged to adopt a strategic approach to fund utilization, considering the principles outlined in the practical compliance guideline to minimise risks and promote effective tax planning within the bounds of the law.

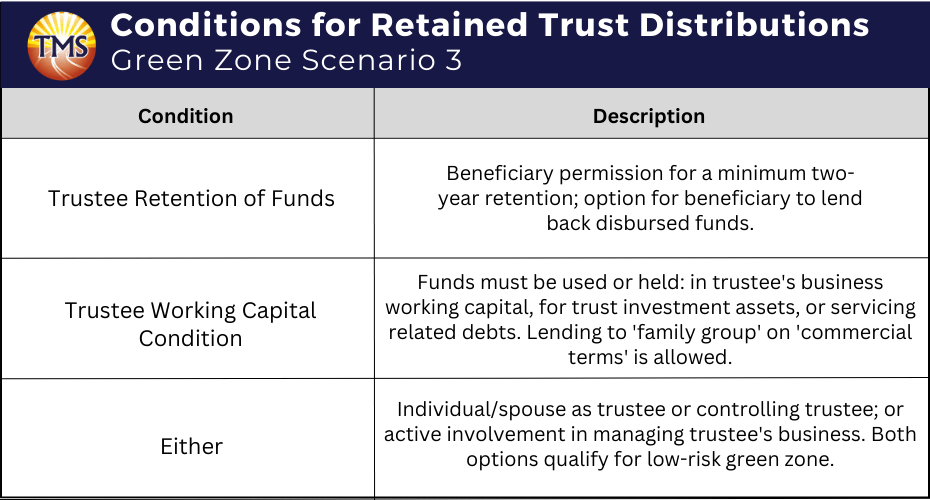

Retained trust distributions for a duration of at least two years

Within Green Zone Scenario 3, specific situations arise where a trustee retains a trust distribution for a period of two years or longer, encompassing scenarios with individual beneficiaries such as parents. To qualify for the low-risk green zone in these instances, certain conditions must be met:

Condition 1: Trustee retention of funds

The first condition necessitates the beneficiary’s explicit permission for the trustee to retain the trust distribution for two years or more. In cases where the distribution is disbursed, an interesting provision allows the beneficiary to lend the funds back to the trustee for the stipulated period.

Condition 2: Trustee working capital condition

Moving on, the trustee must adhere to the working capital condition, dictating specific ways in which the funds representing the beneficiary’s entitlement can be utilized or held. This includes utilizing the funds in the working capital of a business actively conducted by the trustee, for the acquisition, maintenance, or enhancement of trust investment assets, or servicing debt related to these assets. Another avenue is lending the funds to another entity within the ‘family group’ on ‘commercial terms,’ where the borrowing entity aligns with specific criteria.

Condition 3: Either

The final condition presents a unique flexibility by offering two options, both of which satisfy the criteria for the low-risk green zone. The individual and/or their spouse can either serve as a trustee of the trust or control the trustee, where control involves the trustee acting in accordance with their wishes or the individual having the power to appoint and remove the trustee. Alternatively, the individual can be actively engaged in the management of a business conducted by the trustee.

These conditions provide a comprehensive framework for trustees to navigate the complexities of retained trust distributions. By understanding and adhering to these conditions, trustees can ensure compliance with tax regulations while effectively managing trust funds within the low-risk green zone.

Trust Distributions and Controllers in the Low-Risk Green Zone

When addressing trust distributions to the ‘controllers’ of a discretionary trust, such as parents, it becomes apparent that the likelihood of the arrangement falling within the low-risk green zone is heightened.

For example, if a trustee opts to distribute trust income to the controller of a discretionary trust and/or their spouse, the trustee can retain the use of those funds and remain within the low-risk green zone, provided that:

- The beneficiary is presently entitled to the distribution.

- The funds are utilized by the trustee for working capital or investment purposes.

- The funds are lent to another entity within the ‘family group’ under ‘commercial terms,’ aligning with S.109N, and used for working capital or investment purposes.

However, an arrangement would not qualify for the green zone if a trust distribution is made to an individual controller of a trust (or their spouse), and the funds are held by the trustee and subsequently lent for private purposes or interest-free on-lending. In such cases, the risk of S.100A applying to that distribution significantly increases, especially if the recipient of the loan is on a higher marginal tax rate than the beneficiary, and the arrangement is recurrent. This heightened risk falls within the high-risk category.

It’s vital to emphasize that compliance resources should be dedicated to ensuring that these arrangements align with the low-risk green zone criteria, and ordinary family dealings within the same family group are eligible for exclusions. A trustee should consider the applicable integrity provisions and exercise caution to avoid falling into the high-risk category. The arrangement’s adherence to the trust deed and the trustee’s use of distributable income play a pivotal role in maintaining a low-risk green zone status.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Protect Your Assets and Loves Ones

ESTABLIS A FAMILY TRUST NOW!

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.