Should a discretionary trust have individual or corporate trustees?

.

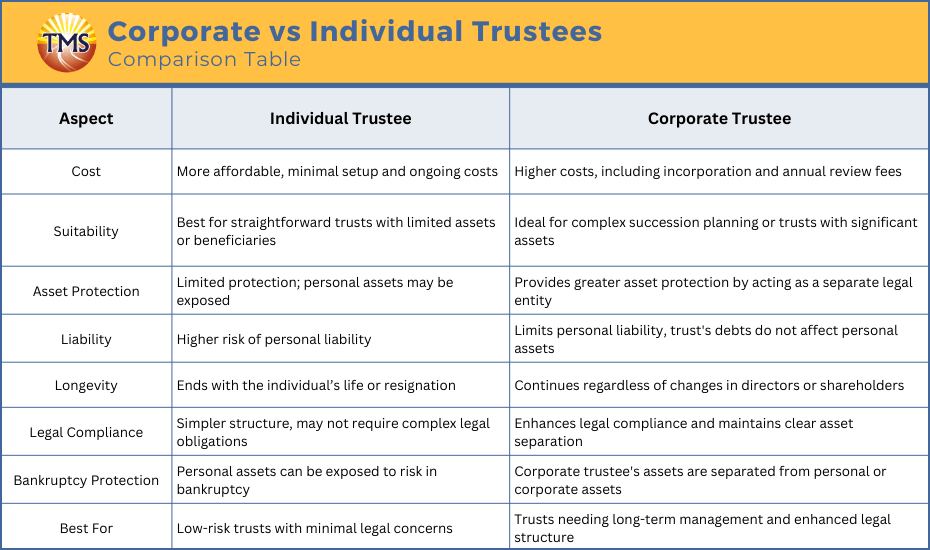

When setting up a discretionary trust, one of the most important decisions you’ll face is choosing the right trustee structure. Whether you opt for a corporate trustee or an individual trustee can significantly impact how your trust is managed, the level of asset protection you enjoy, and your exposure to personal liability. If you’re concerned about safeguarding your personal assets or have specific succession planning needs, it’s crucial to understand the differences between these options.

This article explores the pros and cons of corporate and individual trustees, detailing how each trustee structure can affect your trust’s operations and long-term benefits. We’ll discuss the implications of trustee liability, asset separation, and the complexities involved in succession planning. By the end, you’ll have a clearer understanding of which option best suits your circumstances and goals.

If you’re uncertain about which trustee structure is right for your trust, TMS Financials can help. Book a consultation with us today to explore your options and ensure your trust is set up to protect your assets and serve the best interests of your beneficiaries.

What is a discretionary trust?

A discretionary trust is a flexible arrangement where the trustee decides how much of the trust’s income or assets to distribute to each beneficiary. When establishing such a trust, choosing between a corporate trustee and an individual trustee is crucial. A corporate trustee, as a separate legal entity, offers limited liability, meaning the company acts solely in the trust’s best interests, protecting the individual trustee’s personal assets from liability. In contrast, an individual trustee might be personally liable for any debts or legal actions, risking their personal assets.

Understanding the differences corporate and individual trustee

Individual trustees

An individual trustee is responsible for managing the trust’s assets and adhering to the trust deed. This option involves lower upfront establishment costs and a straightforward process, often just requiring the signing of the trust deed.

However, individual trustees face several challenges:

Personal liability

An individual trustee is personally liable for any legal issues or debts arising from the trust, which can put their personal assets at risk. If legal action is taken, the individual trustee’s personal assets might be used to settle claims.

Difficulty separating assets

It can be challenging to distinguish between the individual trustee’s personal assets and the trust assets since both are in the trustee’s name. This lack of separation can pose risks in situations like bankruptcy or legal disputes.

Complex succession planning

When an individual trustee passes away, the trust’s assets must be transferred to a new trustee, which can involve significant administrative work. This is particularly burdensome for assets like shares and real estate, complicating the succession plan.

Corporate trustees

A corporate trustee, also known as a company trustee, is a company specifically established to act as the trustee of a trust. The corporate trustee acts solely in the trust’s best interests and is separate from its directors and shareholders, provides a clear distinction between personal and trust assets.

The benefits of a corporate trustee include:

1. Limited liability

The company’s directors and shareholders are generally not personally liable for the trust’s debts or legal actions, offering greater protection if a legal dispute arises.

2. Simplified succession

Because a company cannot “die,” the corporate trustee continues to exist, allowing for straightforward management if a director resigns or passes away. This eliminates the need to transfer assets to a new trustee.

3. Greater asset protection

By maintaining a clear distinction between personal and trust assets, a corporate trustee provides more robust asset protection. For example, if a director is sued personally, the assets held in trust are not at risk.

4. Separation of assets

Since trust assets are held in the company’s name, it’s easier to prove the separation of assets, ensuring compliance with regulations and preventing inadvertent mixing of personal and trust assets.

When to choose a corporate trustee vs individual trustee

Pros of using an individual trustee

If cost is a major concern, selecting an individual trustee can be more affordable since the setup and ongoing costs are minimal compared to a corporate trustee, which involves incorporating a company and paying annual review fees. For straightforward trusts with limited assets or beneficiaries, the simplicity of an individual trustee structure may be sufficient. Additionally, if the trust’s activities are low-risk and the likelihood of legal disputes is minimal, appointing an individual trustee can effectively manage the trust without exposing your personal assets to unnecessary liability.

Pros of using a corporate trustee

When asset protection is a priority, a corporate trustee provides better safeguards by acting as a separate legal entity, which limits personal liability and protects your personal assets from the trust’s debts or legal actions. Corporate trustees offer greater asset protection and ensure the trust’s assets remain distinct from personal or corporate assets. They are ideal for complex succession planning needs, as a trustee company continues to exist regardless of changes in directors or shareholders, simplifying the management of trust assets over generations. Additionally, corporate trustees enhance legal compliance and maintain a clear separation of assets, which is crucial for avoiding bankruptcy risks and ensuring long-term benefits for beneficiaries.

Considerations for your trustee choice

Choosing the right trustee structure depends on your circumstances and goals. If you prioritise low upfront establishment costs and straightforward management, an individual trustee might be suitable. However, if you seek limited liability, robust asset protection, and less burdensome succession planning, a corporate trustee is likely the better option. Assess factors such as trustee liability, ongoing fees, the complexity of your trust deed, and the long-term interests of your beneficiaries to make an informed decision that aligns with your business and personal objectives.

Conclusion

While both individual and corporate trustees have their advantages, the decision should be based on the specific goals and circumstances of the trust. For those seeking greater asset protection, simplified succession, and limited liability, a corporate trustee is generally the superior choice. However, for trusts with minimal risk, fewer assets, or where cost is a significant factor, individual trustees may be sufficient.

If you need help deciding which trustee structure is best for your discretionary trust, contact us to schedule a consultation. We’re here to guide you through the decision-making process and ensure your trust is set up for success.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.