How to pay director fees and allowances as a company director

.

Are you confident that your compensation as a company director aligns with the required standards and laws? Director’s fees are not just payments for your leadership and advisory roles; they also align with specific tax and legal requirements such as the Income Tax Assessment Act and payroll tax obligations.

Director’s fees should be set up to ensure they are treated correctly for income tax purposes and that all PAYG Tax withholding is correctly handled. This includes making sure that superannuation contributions are made and Fringe Benefits Tax (FBT) is accounted for, if applicable. For private companies, it’s also vital to manage how these payments affect the overall tax liability of the business and comply with tax law, including specific provisions like Division 7A, which deals with payments to shareholders and their associates.

If you’re unsure about how your director’s fees are structured or need help understanding your tax obligations, it’s wise to consult with a professional. An accounting expert can provide you with the advice you need to ensure your payments are not only fair, but also fully compliant with Australian taxation standards.

What are director’s fees?

Director’s fees are payments made to directors for their governance and advisory roles within a company. These fees compensate directors for their time, expertise, and responsibilities in overseeing the company’s operations and strategic direction. Director’s fees are distinct from wages or salaries, which remunerate directors for their operational involvement in the company.

Why pay director’s fees?

Paying director’s fees can make sense for several reasons. Paying directo’rs fees provides fair compensation to directors for their governance and advisory services, aligning with corporate governance principles. Additionally, paying director’s fees helps companies comply with the Income Tax Assessment Act and other tax obligations. By structuring director’s fees appropriately, companies can optimise tax outcomes and ensure compliance with tax laws.

How are director’s fees structured and paid according to Australian law?

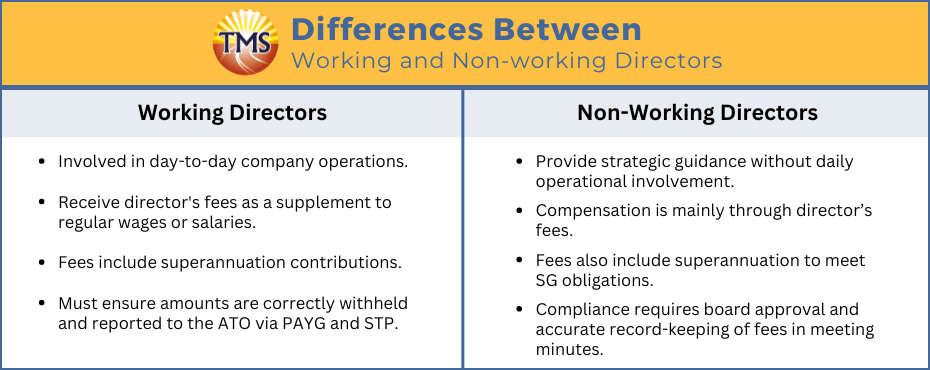

Working directors

In Australia, director’s fees are typically structured to reflect the level of involvement of the director in company operations. For working directors who perform employee duties and actively engage in day-to-day activities, director’s fees may supplement their wages or salaries. These fees, along with superannuation contributions, are essential components of their overall tax liability and must be withheld and reported accurately to the Australian Taxation Office (ATO).

Non-working directors

For non-working or non-executive directors, who do not actively engage in daily management but provide strategic guidance and governance, compensation typically consists solely of director’s fees. However, akin to working directors, these fees also include superannuation contributions to fulfill Superannuation Guarantee (SG) obligations mandated by Australian law.

All payments to both working and non-working directors must adhere to corporate governance standards and Australian tax legislation. This entails accurately calculating and remitting Pay As You Go (PAYG) withholding taxes, as well as reporting to the Australian Taxation Office (ATO) via Single Touch Payroll (STP). Furthermore, the disbursement of director’s fees necessitates approval from the company’s board and meticulous documentation in meeting minutes, reflecting a transparent and formalised compensation arrangement in line with the company’s constitution and shareholders’ agreements.

By following these guidelines, companies ensure the structure and payment of director’s fees meet the statutory requirements and uphold the principles of transparent and responsible corporate governance.

Benefits of paying director’s fees for the director and the company

Paying director’s fees offers several benefits for both directors and companies. For directors, it provides fair compensation for their services and expertise. It also offers tax planning opportunities, as director’s fees are generally tax-deductible for the company. Additionally, paying director’s fees promotes transparent remuneration practices and ensures compliance with corporate governance standards.

Tax consequences for the company

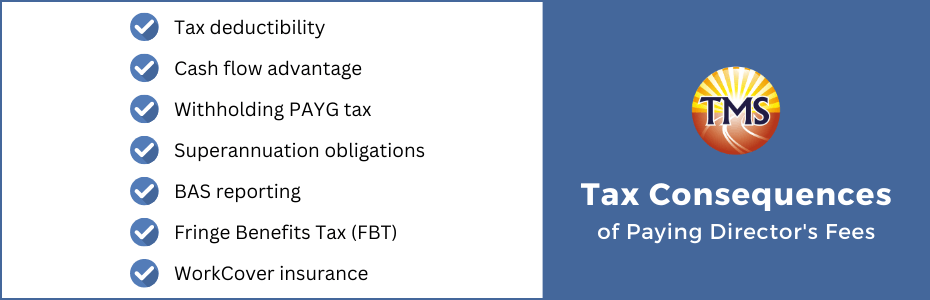

Tax deductibility

Paying director’s fees is tax-deductible for the company, reducing its net taxable income and lowering the amount of company tax payable.

Cash flow advantage

Companies can claim director’s fees as a tax deduction in the year they are intended to be paid, providing a cash flow advantage if they can demonstrate the intention to pay.

Withholding PAYG tax

The company must withhold Pay-As-You-Go (PAYG) withholding tax from director’s fees and report it to the Australian Taxation Office (ATO). Failure to do so can result in the company not being able to claim the fees as a tax deduction

Superannuation obligations

Superannuation contributions at a rate of 11% must be paid on directors fees. This ensures compliance with superannuation requirements.

BAS reporting

Directors fees need to be reported on the company’s BAS (Business Activity Statement) and lodged with the ATO as per Single Touch Payroll rules.

Fringe Benefits Tax (FBT)

If directors receive fringe benefits, these must be reported in the company’s annual FBT return.

WorkCover insurance

Companies must ensure that directors have adequate WorkCover insurance for insurance purposes.

Tax consequences for the director

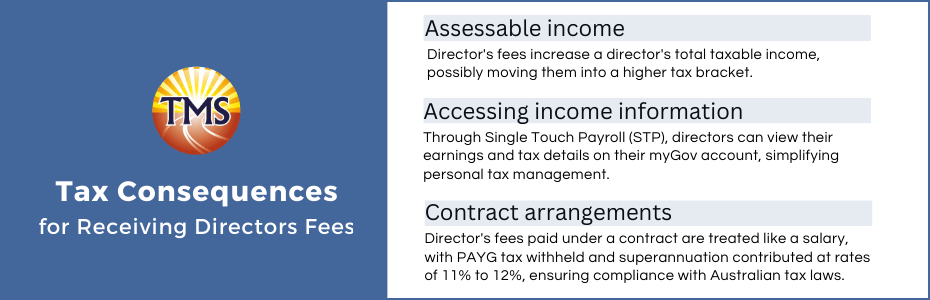

Assessable income

Director’s fees form part of the director’s assessable income and are taxed at their individual tax rate.

Accessing income information

Director’s fees form part of the director’s assessable income and are taxed at their individual tax rate. Directors can access their income information, including the amount earned and tax withheld, through their myGov account, thanks to Single Touch Payroll (STP) reporting by the company.

Contract arrangements

If paid directors fees are handled through a contract arrangement, they are treated as a salary, with PAYG tax withheld on the gross amount and a superannuation rate of 11%.

It’s important for both the company and the director to adhere to these tax obligations and reporting requirements to ensure compliance with Australian tax laws. Consulting with a tax professional can be beneficial to navigating these obligations effectively.

Challenges and considerations in paying director fees

When a company compensates its directors with fees, there are numerous essential factors and challenges to consider, ensuring compliance with the Income Tax Assessment Act and other regulatory requirements. Here’s a comprehensive breakdown of the critical points:

Documentation and reporting

Proper documentation and reporting are essential when it comes to paying director’s fees. All payments to directors should be well-documented and clearly outlined in written contracts. This documentation not only helps in complying with legal requirements, it also demonstrates transparency in financial transactions.

PAYG Withholding

Calculating the correct PAYG (Pay As You Go) withholding for directors fees is crucial. The withholding amount depends on the director’s individual tax circumstances and should adhere to the ATO’s guidelines. Accurate withholding is necessary to avoid potential tax issues for both the company and the director.

Superannuation

Directors may be entitled to superannuation contributions. It’s important for the company to carefully calculate and contribute the required superannuation amount by Australian law. Compliance with superannuation obligations is vital to avoid penalties and ensure the director’s financial well-being.

In addition to these considerations, it’s worth noting that directors’ fees can be claimed as a tax deduction in the year they are paid or intended to be paid, provided the company has correctly withheld and reported PAYG withholding tax to the ATO. Proper reporting and compliance with tax obligations are crucial to ensure that director’s fees are tax-deductible and that all legal requirements are met.

Case study: director’s fees for a small business owner

Scenario

Emma is the sole director of “Emma’s Engineering Solutions Pty Ltd,” specialising in engineering consultancy services. The company has a diverse portfolio of clients and has experienced steady growth over the past year.Strategy

In addition to handling daily tasks, Emma is crucial in creating long-term plans and steering the company’s growth path. Recognising how important her work is, Emma chooses to give herself director’s fees as payment for leading and making important decisions.Outcome

The director’s fees show that Emma is valued for all the different jobs she does at the company. They recognise not just her work in running things day-to-day, but also her big-picture ideas for where the business is going. These fees add to whatever pay she gets for her regular work, making sure she’s fairly rewarded for everything she brings to the table.Tax considerations

From a tax perspective, the director’s fees incurred by the company constitute a deductible expense, thereby reducing its taxable income. As for Emma, she must report these fees as part of her assessable income on her tax return. However, she may also be eligible to claim deductions for any expenses incurred in fulfilling her directorial duties, such as travel expenses or professional development costs. By using director’s fees in this way, Emma ensures she’s fairly compensated for her work and also optimises the company’s tax situation, following the rules laid out in the Income Tax Assessment Act and other relevant laws. This smart strategy shows Emma’s dedication to managing finances wisely and keeping the company’s operations transparent. Emma carefully documents everything and follows tax regulations closely when dealing with director’s fees. This helps her navigate the complexities of these payments confidently, ensuring both her own financial security and the ongoing success of the company.Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Frequently Asked Questions (FAQ)

How are director’s fees different from a salary?

Can director’s fees be paid to both executive and non-executive directors?

Are director’s fees a tax-deductible expense for the company?

How are director’s fees taxed for the director?

How are director's fees considered a form of withdrawing funds from the company?

What are the reporting requirements for director’s fees?

Is there a cap on the amount a company can pay in director’s fees?

How can we ensure compliance with ATO regulations when paying director’s fees?

Do director’s fees affect the director’s superannuation contributions?

Should I pay myself a director's fee?

How much should I pay myself as a director's fee?

Can I pay director's fees if my company is making a loss?

What are the tax implications of paying myself a director's fee?

How can you assist me in setting up and managing director’s fees?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.

[wpforms id=”265615″ title=”false”]