Important Deadline for Director ID

.

A Director Identification Number (DIN), also known as a Director ID, serves as a unique identifier for individuals serving in director roles within various types of organizations. This identification number is a legal requirement established under the Corporations Act. The Director ID obligation is applicable to existing directors and those intending to become directors, as well as to eligible officers.

The eligible officer term refers to anyone appointed as a director or an alternate director who is actively fulfilling the responsibilities of that director role. In specific situations, you’ll need a Director ID even if you serve as the director of your corporate trustee for a Self-Managed Super Fund (SMSF) or family trust.

The various entities for which a Director ID is required are as follows:

- A Company

- A Registered Australian Body

- A Registered Foreign Company

- An Aboriginal and Torres Strait Islander Corporation

The Director ID initiative is a key part of a larger government program backed by the Australian Business Registry Services (ABRS). The primary aim of this initiative is to trace directors’ relationships within the corporate world. The system allows for easier detection of fraudulent director identities and other forms of unlawful activity. This includes, but is not limited to, activities like illegal phoenix operations.

To apply for a Director ID, individuals must personally navigate the application process. Regrettably, neither your Accountant nor your Professional Services Provider can serve as an authorised agent for this specific task. The director details typically required for the application usually include your residential address and various identity documents for validation.

By implementing the Director ID, the Australian Business Registry hopes to fortify its capabilities in recognising and rectifying improper director conduct, thereby enhancing the overall corporate governance landscape in Australia.

Understanding When You’re Required to Obtain a Director ID?

The need to obtain a Director Identification Number (Director ID) is determined by the Corporations Act and is relevant to certain positions. If you are in a position as a director or an eligible officer within a company, a registered Australian entity, a registered foreign company, or an Aboriginal and Torres Strait Islander corporation, obtaining a Director ID is obligatory. The process to apply for a Director ID can be done online through the Australian Business Registry Services (ABRS).

It’s crucial to note that a Director ID functions as a unique identifier that you will retain indefinitely; a single Director ID will suffice for your lifetime. This holds true even if you change companies, assume new roles in various corporations, or are appointed as an existing director in additional organisations. Consequently, there’s no need to apply for multiple Director IDs.

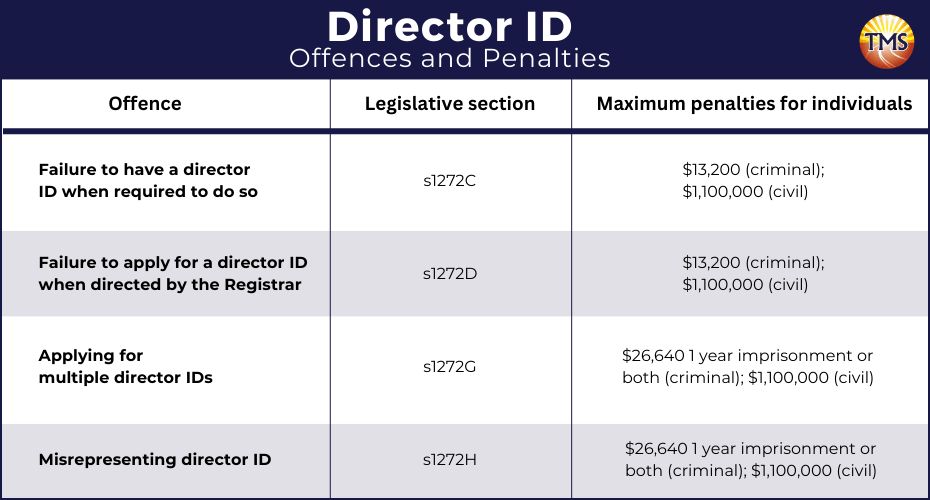

Non-compliance with these identification number Director ID regulations can lead to penalties. These enforcement mechanisms aim to counteract fraudulent director identities and other illegal activities, enhancing the ability to trace directors’ relationships with companies.

If you are neither an active company director nor an eligible officer, the Director ID obligation does not pertain to you. However, you still have the option to apply for a Director ID should you choose to. For those unsure about their directorial status, a consultation with the ASIC Companies Register can provide clarity.

For applicants unfamiliar with the procedures, a variety of identity documents will be needed to verify your residential address and other director details. If necessary, an authorised agent or contact person can offer support during the application process.

Understanding Director ID Violations and Consequences

Application Deadlines for Obtaining a Director ID

- Intending new directors must complete their Director ID application before their official appointment.

- If you assumed the role of a director on or prior to 31 October 2021, you have until 30 November 2022, to meet your Director ID requirement.

- For directors newly appointed between 1 November 2021, and 4 April 2022, there is a 28-day window from the date of appointment to submit an application for a Director ID.

Are extensions available?

Steps to Secure Your Director ID

As previously emphasized, directors themselves must navigate the application process to validate their identities, meaning an authorised agent can’t complete the process on your behalf. The key director details required for an online application include:

- A MyGov ID with either standard or strong identity strength. If you don’t already possess one, eligible directors can establish their MyGov ID at http://www.mygovid.gov.au/set-up.

- Your Tax File Number (TFN)

- Your residential address, as recorded by the ATO

- Information extracted from two distinct identity documents to corroborate your identity

- Bank account particulars

- An ATO Notice of Assessment

- Details from your Superannuation account

- A Dividend Statement

- A Centrelink Payment Summary

- A PAYG Payment Summary

By adhering to this procedure, you will successfully fulfill your Director ID obligation, thereby mitigating the risk of penalties related to fraudulent director identities or other types of unlawful activity. Compliance with this identification number Director ID regime aids in enhancing the traceability of directors’ relationships with companies.

What if I am a director of an Australian company but don’t reside in Australia?

Director ID Obligations

- apply for a Director ID within the relevant time frame, or when directed by the ABRS Registrar to do so;

- not apply for more than one Director ID (unless directed by the Registrar to do so);

- Avoid providing false information about the Director ID to a Commonwealth entity, company, registered Australian entity, or Aboriginal and Torres Strait Islander corporation; and

- not be involved in a breach of the above obligations.

Am I required to provide my Director ID to ASIC?

Privacy

The ABRS will only disclose your Director ID to you or to:

- someone the director gives permission to disclose

- certain Commonwealth, State and Territory government bodies, and

- Court and Tribunals.

What to do once you have received your director ID

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Ready to Secure Your Director ID?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.