Understand how Div 7a interest rates can impact loan agreements

.

For private companies managing a complying Division 7A loan, staying informed about the Div 7A interest rate is crucial. The Div 7A benchmark interest rate, set by the Australian Taxation Office (ATO) each year, directly affects the minimum yearly repayments required to keep loans compliant. Failing to meet these repayments can lead to loans being treated as deemed dividends, increasing your tax burden and potentially affecting your personal cashflow.

Companies must carefully plan how to manage these loans. Strategies such as early repayments, debt-to-equity conversions, or using dividends to offset payments can help reduce financial strain. Regularly monitoring the benchmark interest rate is also essential, as any increase could result in higher repayments, directly impacting the company’s financial management.

For businesses looking to optimise tax strategies and stay compliant with Division 7A rules, schedule a consultation with us today and ensure you meet repayment obligations will help avoid penalties and keep your company’s finances on track.

Book a consultation with TMS Financials today!

How to identify the right benchmark interest rate for division 7a loans

When dealing with Division 7A loans, private companiesmust use the benchmark interest rate to stay compliant with the Income Tax Assessment Act. This rate is determined by the owner-occupier rate published by the Reserve Bank of Australia before the start of the financial year. Once set, it remains fixed for the year, regardless of any later interest rate changes.

The benchmark interest rate is crucial for calculating the minimum yearly repayments on Division 7A loans. If a loan fails to meet these repayment requirements within the specified timeframe, it could be classified as a deemed dividend, increasing the company’s taxable income. To avoid this, companies must ensure their loan repayments align with the benchmark interest rate throughout the financial year.

Effectively managing Division 7A loans requires careful planning in accordance with the Income Tax Assessment Act. By meeting the minimum repayment obligations and considering strategies like early repayment or loan restructuring, businesses can reduce the risk of tax penalties and maintain healthy financial management while ensuring compliance with Division 7A rules.

Strategies for early repayment of division 7a loans

Repaying a Division 7A loan usually involves making regular repayments on both the principal and interest over a set term. However, many taxpayers prefer not to make these repayments from their wages. Instead, they often rely on larger trust distributions or dividends from the company to meet their minimum yearly repayments.

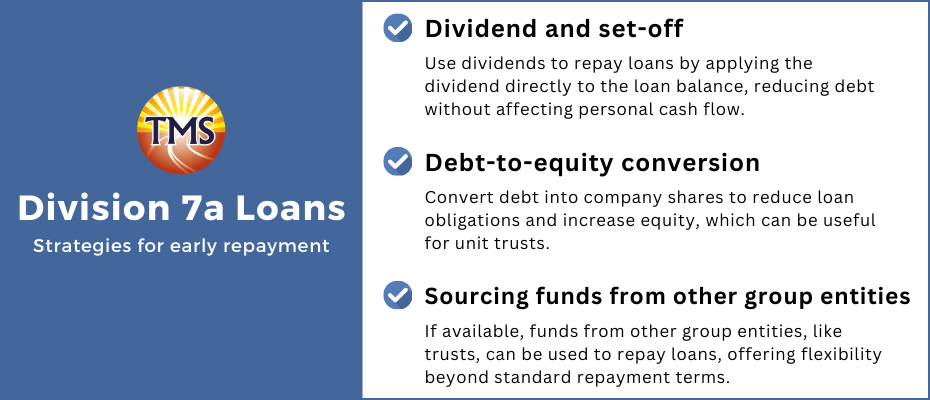

To avoid rising interest costs, taxpayers can make early repayments through the following strategies:

Dividend and set-off

One effective strategy is to use dividends to manage loan repayments. In this approach, the company announces a dividend, and the shareholder uses that dividend to offset the outstanding loan balance. This can help reduce the loan without affecting personal cash flow, as the dividend is applied directly to the debt.

Debt-to-equity conversion

Converting debt into equity is another option for managing rising interest rates. This method involves transforming the outstanding loan amount into company shares. By doing this, you can reduce the company’s debt obligations while increasing equity, especially useful for unit trusts.

Sourcing funds from other group entities

If your company has access to other group entities, such as a trust without Unpaid Present Entitlements (UPEs), you may be able to source funds from these entities. This allows the company to repay the Division 7A loan without needing to follow the standard repayment terms, providing additional flexibility.

How substituted accounting periods affect division 7a benchmark interest rates

When a private company uses a substituted accounting period, the benchmark interest rate is determined by the owner-occupier rate last published by the Reserve Bank of Australia before the start of that period. This rate is crucial for calculating the applicable interest on the company’s Division 7A loans for the entire income year.

- Example 1: A company with a substituted accounting period starting on 1 November 2022 will use the benchmark interest rate published before that date. For Company XYZ, the interest rate published in September 2022, which was 6.77%, will apply to the entire income year beginning on 1 November 2022.

- Example 2: For a company with a substituted accounting period starting on 1 May 2023, the benchmark interest rate published in April 2023 (for March 2023) will apply. This rate, at 8.02%, governs the income year starting from 1 May 2023 for Company ABC.

These rates ensure compliance with Division 7A loan requirements and help in tax planning by setting the minimum repayment obligations for each income year.

Struggling with Division 7a loan repayment issues?

If you’re struggling with Division 7A loan repayments or dealing with the pressure of rising interest rates, you’re not alone. Many businesses find it challenging to meet the minimum yearly repayments required by the Division 7A rules. Addressing these issues early helps prevent deemed dividends and ensures your company stays compliant, while also improving cash flow.

At TMS Financials, we specialise in helping businesses manage Division 7A loans and implement effective strategies for tax management. Whether you’re exploring early repayments, dealing with the benchmark interest rate, or looking for guidance on managing loan repayments to avoid issues with the Australian Taxation Office, our team is here to assist.

Contact TMS Financials today and book a consultation to discuss your Division 7A loan issues, or visit our Division 7A loan agreement page to discover how we can support your business.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

How high-income earners can boost their super through salary sacrifice

How high-income earners can boost their super...

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

How high-income earners can benefit from voluntary super contributions

How high-income earners can benefit from...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.