How to withdraw money from your company using a division 7a loan agreement

.

Are you planning to use your business’s funds for a personal purchase such as buying a luxury boat? It’s crucial to manage personal purchases correctly to avoid steep tax implications under tax law, especially concerning Division 7A of the Income Tax Assessment Act.

When you transfer money from your private company for personal use without adhering to legal requirements, such as a complying loan agreement under Division 7A, the Australian Taxation Office (ATO) may treat this transfer as a deemed dividend. This makes the entire amount subject to your personal tax rate. However, a properly structured Div 7A loan can include a minimum yearly repayment plan, ensuring the loan complies with the benchmark interest rate and other stipulations to prevent additional tax liabilities. This approach protects your funds by aligning with the legal frameworks of income tax laws and the specifics of private company loans.

If you need guidance on structuring a Div 7A loan or understanding your tax obligations with a private company loan, TMS Financials is here to assist. We provide expert tax advice to ensure your financial maneuvers are protected from unnecessary tax burdens and are in compliance with the Income Tax Assessment Act. Contact us today to discuss how you can secure your transactions and leverage your earnings effectively while remaining compliant with tax regulations.

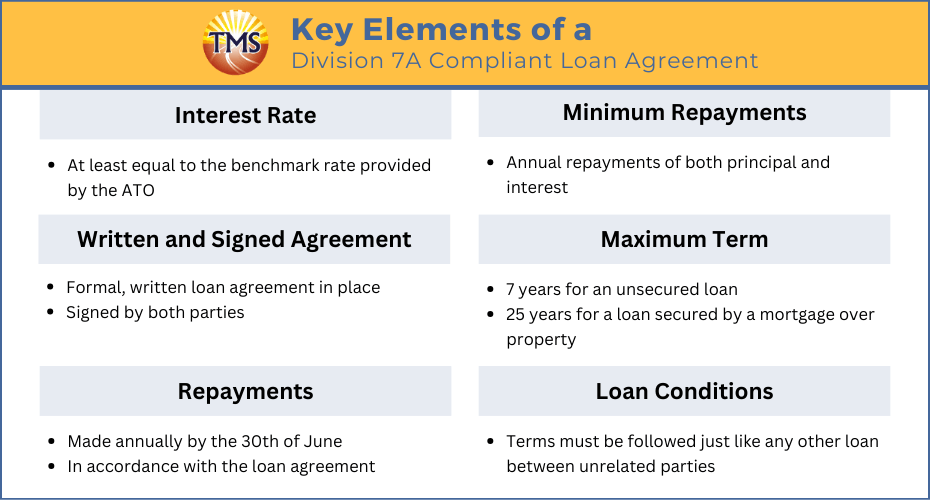

What is a Division 7A compliant loan agreement?

A Division 7A compliant loan agreements refers to a loan that meets specific requirements set out by the Australian Taxation Office (ATO) to prevent it from being treated as a dividend. To be considered a “complying” loan under Division 7A, the agreement must satisfy the following criteria:

Written and signed agreement

There needs to be a formal, written loan agreement in place, which is signed by both parties. This document should outline all the terms of the loan.

Interest rate

The loan must have an interest rate at least equal to the benchmark rate provided by the ATO. This rate can change each year, so it’s important to stay updated.

Minimum repayments

The loan agreement must require minimum annual repayments of both principal and interest payable over the term of the loan.

Maximum term

The maximum term for an unsecured loan is seven years. If the loan is secured by a mortgage over a property, it can have a maximum term of 25 years.

Repayments

Repayments must be made in accordance with the loan agreement, and at least the minimum yearly repayment required must be made each year by the end of the lender’s income year (typically 30 June).

Loan conditions

The loan terms must be followed just like any other loan between unrelated parties.

If a loan from a private company to a shareholder or their associate doesn’t meet these requirements, it might be treated as a dividend by the ATO, which means it could be subject to tax at the shareholder’s marginal tax rate.

It’s always a good idea to consult with a tax professional to ensure that a loan agreement complies with Division 7A. We can provide guidance specific to your situation.

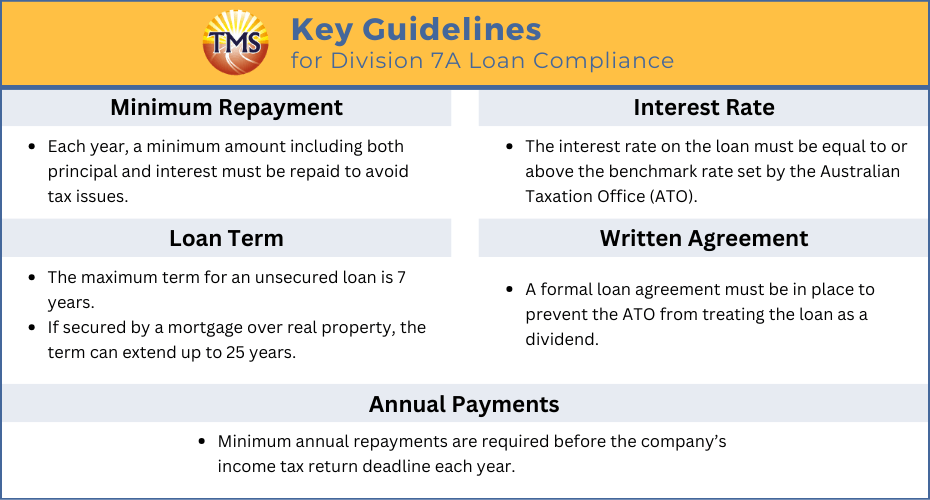

What are the Division 7A loan terms?

Division 7A is a set of rules in Australian tax law that comes into play when a private company gives a loan to a shareholder or their associate. In simple terms, it’s designed to prevent private companies from distributing untaxed profits to shareholders through loans or other payments, which would otherwise be treated as dividends.

Here’s a rundown of what you need to know about Division 7A loan terms:

Minimum repayment

Each year, there’s a minimum amount that needs to be paid back to avoid tax issues. This includes both principal (the amount borrowed) and interest.

Interest rate

The loan must have an interest rate equal to or above the benchmark rate set by the Australian Taxation Office (ATO) for it to be considered a genuine loan and not a disguised dividend.

Loan term

Unsecured loans can’t have a term longer than 7 years. If the loan is secured by a mortgage over real property, the term can be up to 25 years.

Written agreement

It’s important to have a formal loan agreement in place. Without this, the ATO may treat the loan as a dividend from the get-go.

Annual payments

You need to make at least the minimum annual repayment required before the company’s income tax return is due each year.

If these terms aren’t met, the ATO may consider the loan as a dividend, which could lead to unexpected tax bills for the shareholder or their associate. It’s like the ATO saying, “If you don’t play by the rules, we’ll treat it as if you’ve taken profits from the company and tax you on it.

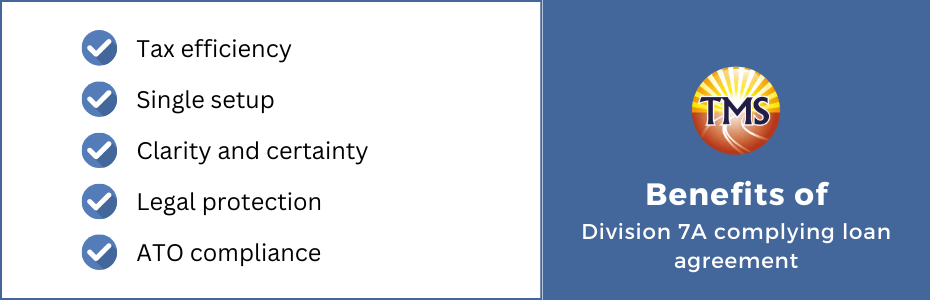

Why use a Division 7A complying loan agreement?

Using a Division 7A complying loan agreement is essential when withdrawing funds from your private company. This arrangement ensures the money is not considered a dividend for income tax purposes, which would otherwise lead to higher taxes. Here are some benefits of ensuring your loan meets Division 7A requirements:

- Tax efficiency: by using this agreement, the loan amount won’t be taxed as a dividend, saving you from higher personal tax rates.

- Single setup: once established, the agreement is ongoing, avoiding the need to set up a new one each year and ensuring you remain compliant without additional hassle.

- Clarity and certainty: the agreement provides clear terms, including repayment schedules and interest rates, offering financial predictability.

- Legal protection: it’s a legally binding agreement, protecting both the company and the borrower from potential legal disputes.

- ATO compliance: it keeps you aligned with the ATO guidelines, reducing the risk of tax disputes or penalties.

Our Division 7A Loan Agreement Service encompasses all the advantages we’ve listed above, ensuring tax efficiency, legal protection, ATO compliance, automatic updates, and flexibility in loan types. Our agreements are made by specialist lawyers dedicated to Division 7A compliance, providing you with the peace of mind that your financial transactions are in expert hands.

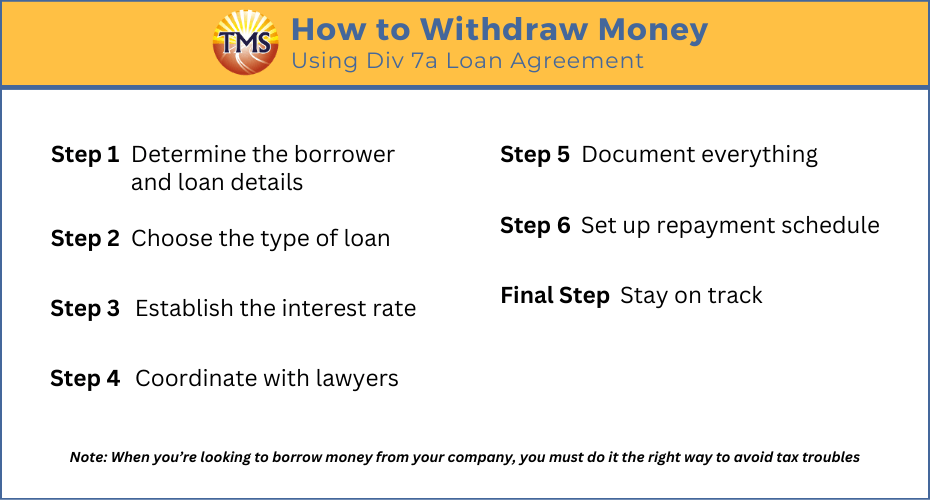

How to withdraw money using a Div 7A loan agreement: A Step-by-Step Guide

When you’re looking to borrow money from your company, you must do it the right way to avoid tax troubles. Here’s a step-by-step guide on how we make this happen for you.

Step 1: Determine the borrower and loan details

First, we need to identify who’s borrowing from the company. Is it you, a family member, or someone else? We’ll also need your company’s details to get started.

Step 2: Choose the type of loan

There are two main types of loans under Division 7A:

-

Unsecured loan: this has a maximum term of 7 years. It’s quicker to set up as it doesn’t require any collateral.

-

Secured loan: with a term of 25 years, this usually involves securing the loan against property. It’s a bit more involved, as it requires proper collateral documentation.

Step 3: Establish the interest rate

The loan must have an interest rate that meets or exceeds the Division 7A benchmark, similar to home loan rates. This rate is not just a number; it plays a role in keeping your loan compliant and also contributes to your company’s taxable income.

Step 4: Coordinate with lawyers

As your accountant, we’ll coordinate with a legal team who will draft your Division 7A Loan Agreement. They’ll ensure the loan is compliant with ATO guidelines, providing legal assurance right from the start.

Here’s the best part — the legal agreement is designed to be a one-time setup. This means you won’t have to repeat this process annually. It’s an ongoing agreement that adapts to your needs year after year, saving you time and providing peace of mind.

Step 5: Document everything

The lawyers will handle all the necessary paperwork, from the terms of the loan to the repayment schedule. Clear documentation is key to prevent the ATO from classifying the loan as a dividend.

Step 6: Set up repayment schedule

Together, we’ll work out a repayment plan that fits within the Division 7A requirements, ensuring that each payment is documented and made on time.

Step 7: Stay on track

Once the loan is in place, we’ll help you keep track of the annual benchmarks and minimum loan repayment requirements, so you can stay focused on running your business without worrying about compliance.

Remember, the goal here is to ensure you can withdraw the money you need without incurring unnecessary tax or risking non-compliance. By following these steps, we’ll help you navigate the process smoothly and keep everything above board.

To proceed with ordering the Division 7A loan agreement, Click Here To Order Now. This will formalise the arrangement and provide a clear framework for accessing and repaying the funds in compliance with Division 7A rules.

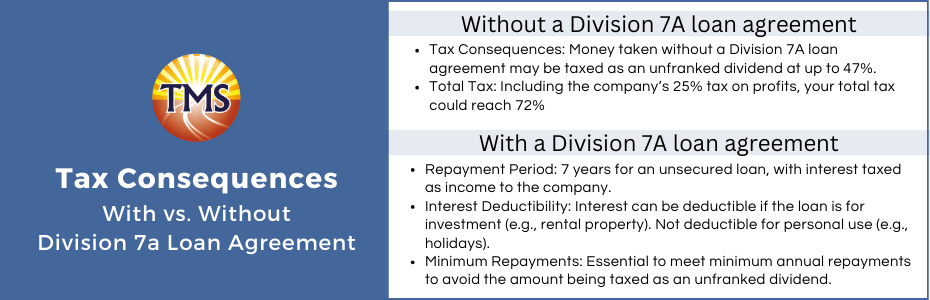

What are the tax consequences: with or without a Division 7A loan agreement?

Let’s break down the tax implications of withdrawing money from your company, with and without a Division 7A loan agreement.

Without a Division 7A loan agreement

If you take money out of your company without this agreement, the ATO might see it as an unfranked dividend. That means the money could be taxed at your highest personal tax rate, which could be up to 47%. Remember, your company has already paid 25% tax on its profits. So, in total, you might end up paying 72% in tax on the money you withdraw. That’s a huge chunk of your cash gone to tax!

With a Division 7A loan agreement

On the other hand, if you’ve set up a Division 7A loan agreement, here’s what happens:

-

Unsecured loan: you have 7 years to pay back the loan, along with interest. The company must report the interest you pay as income, which means they’ll pay tax on it.

-

Interest deductibility: if you’re using the loan for investment purposes, like buying rental property, the interest you pay can be tax-deductible. However, if you’re using the loan for personal expenses, like a new boat, school fees, or a holiday, then you can’t deduct the interest you pay on your tax return.

Minimum repayments

Each year, you must make a minimum repayment on your loan. We have a Div 7A calculator to help you figure out what this amount is. If you don’t meet the required minimum yearly repayments, any unpaid amount is considered an unfranked dividend by the ATO, and you’ll be taxed on it. So even with a loan agreement in place, it’s crucial to keep up with your repayments to avoid extra taxes.

In simple terms, having a Division 7A loan agreement and sticking to its terms means you can borrow money from your company without a massive tax headache. Without a loan agreement, or if you don’t follow the rules, you could end up paying a lot more to the ATO.

Challenges and considerations

Navigating a Division 7A loan agreement can be tricky, and there are common pitfalls you’ll want to avoid to stay compliant:

-

Timing of agreement – The Division 7A loan agreement must be set before you lodge your company’s tax return. This ensures the loan is recognised for the correct financial year.

-

Repayment schedule – It’s crucial to keep up with the minimum yearly repayments. Falling behind can lead to unintended tax consequences. Using a calculator specifically designed for Division 7A can help you stay on track.

-

Interest rates – The loan agreement should include a clause that automatically adjusts the interest rate annually to match the ATO’s benchmark rate. This is vital for maintaining compliance each year.

-

Interest payments – Make sure to pay the ‘benchmark interest rate’ as set by the ATO. This rate changes, so it’s important to stay updated and make the correct payments.

-

Extending the agreement – If family members are receiving money from the company, they also need a Division 7A loan agreement. This keeps all transactions clear and within ATO guidelines.

-

Streamlining paperwork – Opt for a ‘revolving’ loan agreement, which rolls over each year without the need for a new agreement. This reduces paperwork and ensures continuous compliance.

-

Record keeping – Maintain meticulous records. Document every transaction, agreement, and repayment. Solid record-keeping is your best defense in an audit and proves you’re following the rules.

By paying attention to these areas, you can effectively manage your Division 7A loan agreement, ensuring compliance and avoiding the stress of dealing with ATO disputes or penalties.

Case Study : A complying Division 7A loan agreement

Scenario

Peter operates a Pty Ltd company that sells computers and IT accessories. This year, the business had a highly successful year, generating a substantial net profit of $500,000. Peter, the business owner, has already paid himself a salary of $200,000 this year, putting him in the highest tax bracket of 47%. The company has a net profit of $500,000 and has $420,000 in its bank account. Peter wishes to withdraw $300,000 from the company for personal use. To facilitate this, he has approached us to arrange a complying Division 7A loan agreement.

Strategy

To address Peter’s financial needs, we have proposed a complying Division 7A loan agreement with the following terms: a seven-year loan with an interest rate benchmarked at 8.27%, as per ATO guidelines in November 2023. It’s essential to note the interest on this loan will be treated as income for the company, and Peter will not be able to claim it as a tax deduction. To ensure compliance with Division 7A rules, Peter must commit to making minimum loan repayments, including both principal and interest, and repay the entire loan amount within the specified seven-year term.

Outcome

With this strategy in place, Peter can access the required $300,000 for personal use. By adhering to the terms of the Division 7A loan agreement, including timely repayments and full repayment within seven years, he will remain compliant with Division 7A rules, avoiding any breaches.

Tax considerations

The Division 7A rules ensure that loans between a company and its shareholders or associates are properly managed for tax purposes. In this case, the interest on the loan will be treated as income for the company, and Peter cannot claim it as a tax deduction. It’s important to be aware of these tax implications when using a Division 7A loan.

Next steps

To obtain your Division 7A complying loan agreement, take action now. Click here to order and set yourself on the road to financial stability and peace of mind. Don’t miss out on this crucial step in effectively managing your finances.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Frequently Asked Questions (FAQ)

What is Division 7A and how does it affect private companies?

When does a private company have to treat a loan as a dividend under Division 7A?

A company may have to treat a loan as a dividend if:

a) The recipient is a shareholder or closely connected with a shareholder.

b) It appears that the loan was made because of the shareholder’s connection to the company.

If your company lends money to your brother, or even to a friend, if it seems like the loan was related to their connection to the company, it might be subject to Division 7A rules.

Is there a limit to the dividends a company can be required to pay under Division 7A?

Yes, there’s a cap on dividends. Under Division 7A, the total dividends a company can be required to distribute can’t exceed its distributable surplus for the financial year. For instance, if your company’s distributable surplus is $50,000 for the year, and it has made loans worth $53,000 to shareholders and their associates, Division 7A mandates treating these loans as dividends. However, the maximum dividend amount is capped at the distributable surplus of $50,000. Therefore, even if the loans total $53,000, the dividends paid will only be $50,000.

What does Division 7A consider as a 'loan'?

Division 7A defines a ‘loan’ in several ways:

a) It can be an advance of money.

b) It can include providing credit or any form of financial assistance.

c) It can involve making a payment on behalf of a shareholder or their associate if they have an obligation to repay that amount.

d) It can be any transaction, regardless of its form or terms, that is equivalent to lending money.

What happens if a private company makes multiple loans to a shareholder or their associate during a year?

If a company provides one or more loans to a shareholder or their associate in a single income year, these loans may be combined or amalgamated for Division 7A purposes. For example, suppose your private company lends your brother $10,000 in March and another $5,000 in October. Division 7A might treat these as a single $15,000 loan.

When does a loan become a dividend under Division 7A?

A loan is treated as a dividend by Division 7A when:

a) It is made to a shareholder or an associate of a shareholder.

b) It is not fully repaid before the company’s lodgment day for the year when the loan is made.

c) It is not specifically excluded by other sections of Division 7A.

When is a loan not treated as a dividend under Division 7A?

Under Division 7A of the Income Tax Assessment Act, a loan from a private company is not always considered a dividend. Key exceptions include :

- Loans made to non-trustee companies.

- Amounts already taxed under other laws or specifically excluded from tax.

- Standard business transactions with unrelated parties.

- Loans meeting minimum yearly repayments, maximum terms, and documented by the tax lodgement deadline.

- Loans connected with company liquidations, employee share schemes, or structured as amalgamated loans with scheduled repayments.

- Pre-1997 loans unchanged.

- Shortfalls in repayments due to uncontrollable circumstances may be exempted by the Commissioner if promptly corrected or if repayment causes undue hardship.

For instance, a loan issued by a private company for regular business with an unrelated entity does not qualify as a dividend under Division 7A.

Can payments made by a company be converted into loans to avoid them being treated as dividends under Division 7A?

Yes, payments made by a company can be converted into complying loans before the company’s lodgment day to prevent them from being considered as dividends.

What happens when a payment is converted into a complying loan under Division 7A?

When a payment is converted into a complying loan under Division 7A, it means the company is now following the specific rules and requirements outlined by Division 7A regarding loans. These rules include factors such as ATO benchmark interest rates, a maximum loan term of 7 years for unsecured loans, meeting the minimum loan repayment, and other regulations designed to ensure the loan arrangement complies with tax laws. In essence, this conversion changes the treatment of the payment from being considered a dividend to being treated as a complying loan, which must meet the criteria set out in Division 7A to avoid adverse tax consequences.

What are the key criteria for a loan to be a complying loan under Division 7A?

To be a complying loan under Division 7A, a loan must meet these main criteria:

a) It should have an interest rate equal to or greater than the benchmark interest rate for each year.

b) The maximum loan term is 25 years for property-secured loans and 7 years for other loans.

c) The loan must be documented in a written agreement before the company’s lodgment date, covering essential loan terms, and signed by the parties.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.