How the proposed Div 296 tax could affect your super balance over $3 million

.

When managing your superannuation balance, it’s important to understand how the Division 296 tax could affect you, especially since it includes unrealised gains or losses. The 15% Division 296 tax applies to changes in asset valuations that haven’t yet been realised, which may create cash flow challenges. This means you might need to pay tax on assets that haven’t generated actual income.

The recent amendments to the Division 296 tax will have a significant impact on individuals with superannuation balances exceeding $3 million. Starting from 1 July 2025, an additional 15% tax will apply to superannuation earnings related to the portion of a Total Superannuation Balance (TSB) above $3 million, increasing the effective tax rate on these earnings to 30%.

For those with a superannuation balance over $3 million, it’s important to understand how these changes might affect your financial plans. The Division 296 tax targets the growth in your TSB above the $3 million threshold, which could affect the tax effectiveness of your retirement savings. Conducting detailed financial modelling and seeking professional advice is advisable to navigate these changes.

To explore how the Division 296 tax might impact your superannuation balance, schedule a consultation with us today for personalised advice.

Will the new Division 296 tax affect your superannuation earnings?

The Government announced on 28 February 2023, a significant change to the taxation of superannuation earnings for individuals with a Total Superannuation Balance (TSB) exceeding $3 million. Effective from 1 July 2025, the proposed legislation introduces an additional 15% tax on certain superannuation earnings associated with TSBs over $3 million, as outlined in Division 296 of the Income Tax Assessment Act. This adjustment will result in these earnings being taxed at an effective rate of 30%.

For individuals with superannuation balances below $3 million, the current tax concessions will remain unchanged. These concessions include the general 15% fund rate or even tax-free status when earnings are derived from assets supporting retirement phase pensions. The draft legislation aims to better target superannuation concessions, particularly focusing on addressing high super balances. Given the potential impact on those with substantial superannuation interests, it is crucial to undertake detailed financial modelling and seek professional advice to fully understand the consequences of these changes.

Considering the complexity and potential impact of the Division 296 tax, it’s important for those affected to avoid hasty decisions. Instead, focus on making objective, informed choices based on your specific circumstances.

When does the new Division 296 tax take effect?

The new Division 296 tax will take effect from 1 July 2025. Starting from this date, individuals with a Total Superannuation Balance (TSB) exceeding $3 million at the end of the income year (e.g., on 30 June 2026, for the 2026 income year) may be subject to an additional 15% tax on superannuation earnings associated with the portion of their TSB above $3 million.

Certain individuals, however, are exempt from this tax, even if their TSB exceeds the $3 million threshold. These exemptions include child recipients of superannuation income streams, individuals who receive structured settlement contributions, and those who pass away before the end of the income year.

How is the Division 296 tax calculated on superannuation earnings?

The calculation of the Division 296 tax relies on an individual’s Total Superannuation Balance (TSB). The TSB is essential in determining whether a person is subject to the Division 296 tax, specifically if their TSB exceeds $3 million at the end of the income year. The tax applies to the portion of superannuation earnings related to the amount above this $3 million threshold, with an additional 15% tax under Division 296.

The TSB, defined in section 307-230 of the Income Tax Assessment Act, has traditionally been used to determine eligibility for several superannuation-related concessions. These concessions include, for example, the non-concessional contributions cap, which generally can only be accessed if the TSB on 30 June of the preceding year is below the general transfer balance cap for the current year.

Non-concessional contributions cap

The non-concessional contributions cap sets a limit on the amount an individual can contribute to their superannuation without incurring additional tax. Generally, you can only access this cap if your Total Superannuation Balance (TSB) on 30 June of the previous financial year is below the general transfer balance cap for the current year.

How does the catch-up concession for concessional contributions affect your superannuation?

The catch-up concession for concessional contributions offers eligible individuals the opportunity to boost their superannuation by making additional contributions, using unused cap amounts from the previous five income years. This concession is particularly useful for those who haven’t maximised their concessional contributions in the past and wish to contribute more to their super fund.

However, to qualify for this concession, your Total Superannuation Balance (TSB) must be under $500,000 as of 30 June of the preceding income year. If your TSB exceeds this threshold, you won’t be eligible to make catch-up concessional contributions.

For those subject to the Division 296 tax, the calculation of your TSB will generally follow the existing method, but with some specific amendments as outlined in the proposed legislation:

- TSB value: This includes the full value of all your superannuation interests, such as accumulation interests and retirement phase pension interests that are tax-free, excluding any interests held in foreign superannuation funds. Essentially, it’s the total amount you would receive if you were to cash out your superannuation entitlements.

- Addition of rollover benefits: If any rollover superannuation benefits were paid to your fund at or before a certain time but received by the fund after that time, they will be included in your TSB calculation.

- Exclusion of structured settlement contributions: Structured settlement contributions are subtracted from your TSB to ensure they do not inflate your balance artificially.

These adjustments ensure that your TSB accurately reflects the true value of your superannuation interests, particularly for the purposes of applying the Division 296 tax. Understanding these calculations is crucial for making informed decisions about your superannuation strategy and potential tax obligations.

What is the payment process for the Division 296 tax?

Starting from 1 July 2025, individuals with a Total Superannuation Balance (TSB) exceeding $3 million at the end of the income year (e.g., on 30 June of the relevant income year) may be required to pay the Division 296 tax. Unlike traditional taxes based on taxable income, the Division 296 tax is specifically calculated on the growth in your TSB that exceeds the $3 million threshold during the income year.

The payment of the Division 296 tax, starting from the 2026 income year, involves a three-step process:

Step 1: Calculating your superannuation earnings for Division 296 tax

The first step in calculating the 15% Division 296 tax liability is to determine your superannuation earnings for the income year. This calculation follows a specific formula outlined in section 296-40 of the Income Tax Assessment Act. When determining your Total Superannuation Balance (TSB) or adjusted TSB for Division 296 purposes, it’s important to note that any amounts related to a Limited Recourse Borrowing Arrangement (LRBA) are excluded from the calculation.

A Division 296 tax liability only applies if your calculated superannuation earnings are positive, meaning there must be at least $1 of earnings for the tax to be triggered. If there are no earnings or if the earnings are negative, no Division 296 tax will be due for that income year. This step is crucial in identifying whether you will be liable for the additional 15% tax under Division 296.

A. How to apply the deemed $3 million TSB adjustment for Division 296 tax

When calculating superannuation earnings for Division 296 tax purposes, a deemed adjustment is applied if an individual’s adjusted year-end Total Superannuation Balance (TSB) or their TSB just before the start of the income year is less than $3 million. In such cases, the TSB is deemed to be $3 million, ensuring that only the earnings exceeding this threshold are subject to the Division 296 tax.

For instance, if an individual’s TSB on 30 June 2025 is $2.8 million and their adjusted TSB on 30 June 2026 is $3.2 million, the TSB for 30 June 2025 will be increased to $3 million for calculation purposes. As a result, the individual’s superannuation earnings for the 2026 income year would be calculated as $200,000 ($3.2 million – $3 million). This adjustment is crucial for determining the portion of earnings that will be taxed under Division 296.

B. Calculating the adjusted TSB

To accurately determine an individual’s adjusted Total Superannuation Balance (TSB) at the end of the income year for Division 296 tax purposes, certain withdrawals from superannuation are added back, and certain contributions are deducted. These adjustments prevent the underestimation or overestimation of superannuation earnings due to withdrawals or contributions throughout the year.

- Withdrawals Total: This category includes amounts paid from the individual’s superannuation interests during the year, such as lump sum benefits, pension payments, spouse contribution-splitting benefits, family law superannuation payments, and death benefits. However, some reductions, such as those resulting from fraud or dishonesty under specific conditions, are excluded. To avoid double counting, if a withdrawal fits into more than one category, it is counted only once.

- Contributions Total: This category involves amounts added to the individual’s superannuation interests during the year, including the after-tax amount of concessional contributions, non-concessional contributions, spouse contribution-splitting benefits, family law superannuation payments, death benefit pensions, and insurance proceeds. Similar to withdrawals, contributions that fall into more than one category are counted only once.

These adjustments are crucial for calculating the correct Division 296 tax liability, ensuring that only the appropriate portion of superannuation earnings is subject to the additional 15% tax under this division.

Step 2: How to calculate your taxable super earnings

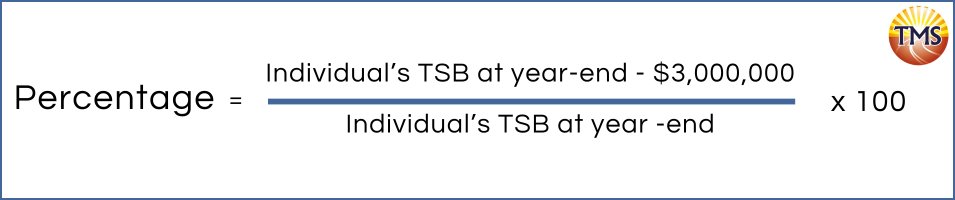

If your Total Superannuation Balance (TSB) exceeds $3 million at the end of the income year, starting from the 2026 income year, and you have positive superannuation earnings, the next step in calculating your Division 296 tax liability is to determine the portion of your super earnings that corresponds to the excess TSB above $3 million. This calculation is done using a specific formula outlined in section 296-35 of the Income Tax Assessment Act.

The result of this calculation is rounded to two decimal places, with rounding up if the third decimal place is five or more. This percentage is then applied to your super earnings amount, calculated in Step 1, to determine your ‘taxable superannuation earnings’ for the year.

This step is critical for accurately assessing the amount of superannuation earnings that will be subject to the additional 15% tax under Division 296.

Step 3: How to apply the 15% Division 296 tax

In the final step of determining your Division 296 tax liability, the 15% tax rate is applied to the taxable superannuation earnings calculated in Step 2. The formula for this calculation is straightforward and ensures that the correct amount of tax is imposed on the portion of your superannuation earnings that exceeds the $3 million TSB threshold.

By applying the 15% tax rate to the taxable superannuation earnings, you arrive at the total Division 296 tax liability for the income year. This step concludes the process, ensuring that the appropriate tax is levied on high superannuation balances as mandated by the Division 296 rules.

What is the current status of the Division 296 tax legislation

As of now, the Division 296 tax is not yet finalised law and may undergo changes before it is enacted. Several organisations have raised concerns and are advocating for modifications, including:

-

Excluding unrealised gains from taxable superannuation earnings.

-

Introducing a loss carry-back or refund system if unrealised gains are taxed, rather than the proposed carry-forward loss approach, which could result in tax being paid on gains that may later turn into losses.

-

Indexing the $3 million threshold to adjust for inflation.

Currently, Division 296 is part of the proposed Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill 2023 (Cth). As the Bill progresses through Parliament, it is crucial to stay informed about any developments or amendments. For the latest updates, you can follow the Bill’s progress on the Parliamentary Business – Bills and Legislation website.

Important factors in handling your super balance and Div 296 tax

If you experience negative earnings in a financial year, those losses will be carried forward to offset future earnings. However, the proposed legislation doesn’t allow for a tax refund if your total superannuation balance incurs a loss. Additionally, if your superannuation balance falls below the $3 million threshold, you might not fully benefit from these carried-forward losses.

Another critical consideration is that there is currently no mechanism to adjust or index the $3 million threshold for inflation, which could impact how the Division 296 tax applies over time. Understanding these factors is crucial for effective superannuation management and planning.

Should you wait until 30 June 2026 to address Division 296 tax?

While some suggest restructuring your superannuation before 1 July 2025 to mitigate the impact of the new Division 296 tax, this may not be the optimal approach. The more critical date is likely 30 June 2026. The Division 296 tax is only applicable if your Total Superannuation Balance (TSB) exceeds $3 million at the end of the income year. For instance, if you have $4 million in a Self-Managed Super Fund (SMSF) during most of the 2026 financial year but withdraw $1 million on 15 June 2026, you could potentially avoid the Division 296 tax altogether.

Some argue that withdrawals are added back for the purpose of calculating superannuation earnings under section 296-40(2) of the Income Tax Assessment Act, but this provision doesn’t apply to section 296-35(1)(a). Therefore, if your TSB is no more than $3 million at the end of the relevant year, you would not be liable for the Division 296 tax. Advising clients to withdraw funds before 1 July 2025 may result in missed opportunities, though there may be strategic reasons to consider withdrawals before 1 July 2025 or 30 June 2026 to manage Division 296 tax implications while maintaining a TSB above the $3 million threshold.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.