Published on 10 May, 2021

Family Setup and Tax Return

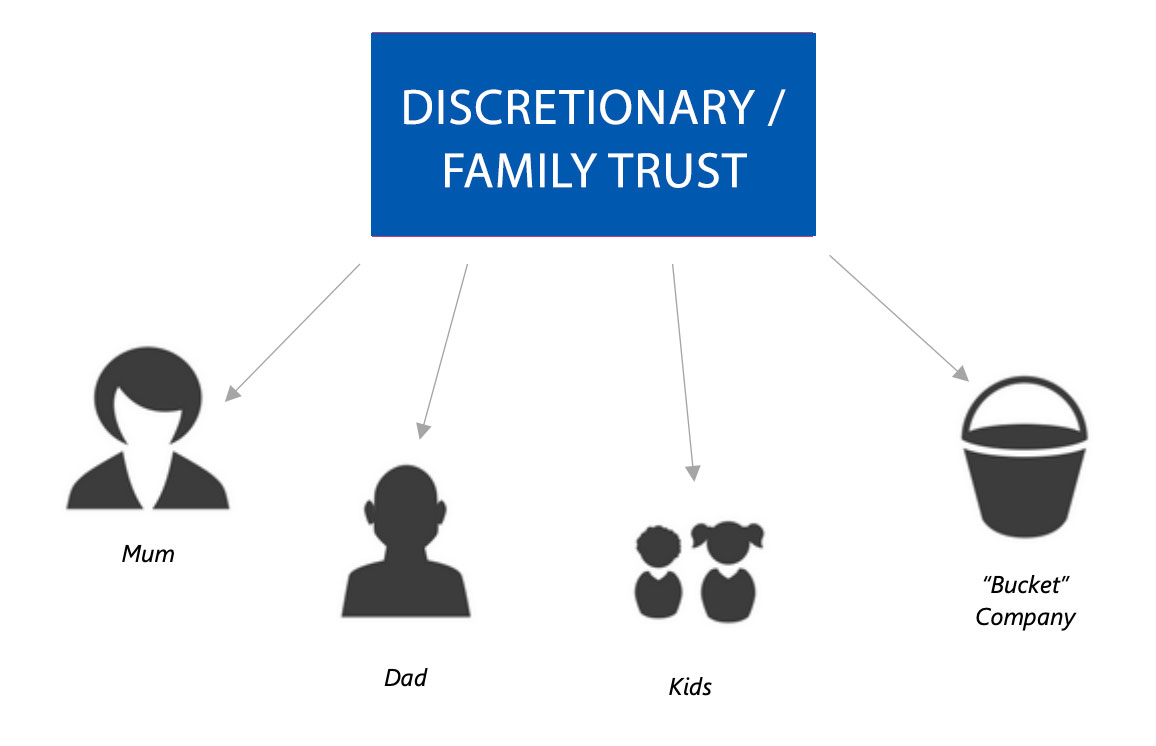

Trustees who distribute income of a Discretionary / Family Trust to beneficiaries should sign a resolution by 30 June 2021 for the distributions to be effective in determining who is to be assessed on the Trust’s income! If you don’t make a resolution, you could pay up to 47% tax on the Trust’s profits.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

[wpforms id="265551" title="false"]

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.

[wpforms id=”265615″ title=”false”]