The 4 Keys to Maximise Your Tax Savings in Australian

.

Tax time can be stressful, but you can save money and reduce stress by knowing the FOUR tax-saving keys. These strategies will help you minimise taxable income, pay less tax, and increase your take-home pay in Australia.

There are four crucial Keys to have the most significant impact on your potential tax savings:

- Defer Income Strategies

- Maximising Deductions

- Superannuation

- Tax Effective Structure

At its core, the basic formula for calculating tax payable is:

Taxable Income = Income less Tax Deductions

Tax payable = Taxable Income * Tax Rate

By reducing your total income (Defer Income), increasing your tax deductions (Maximise Deductions), and lowering your tax rate (Efficient Entity Structure), you’ll see a substantial decrease in your tax payable.

It’s essential to understand and apply these 4 tax-saving keys to your financial situation. In this article, we will delve into each of these keys, equipping you with the knowledge to maximise your tax savings.

Key 1: Defer Your Income

One effective method for reduce taxable income is by decreasing your overall income. While this may appear challenging, there are several approaches to achieve this, such as:

Defer Income

Defer Bonuses When Possible

Many companies distribute bonuses within the first few months of the new financial year, so negotiating to receive your bonus after 1 July allows you to defer the income and decrease your taxable income for the current financial year.

If you intend to sell a property, think about deferring the exchange contract until after 1 July to defer capital gains and reduce your taxable income for the current financial year.

Case Example: Delaying Investment Property Sale to Reduce Capital Gains Tax

As a high-income earner with a 47% tax rate, John would need to pay $188,000 in Capital Gains Tax for this financial year. However, by delaying the exchange contract by just one day to 1 July, the capital gains would be declared for the financial year 2025, providing John more time for tax planning.

With this additional time, John could potentially make more super contributions or explore other tax-saving strategies. He could also save up money to pay the tax bill. Time is money, and having extra time can help solve problems. By deferring the exchange contract to 1 July, John employed a smart strategy.

However, keep in mind that deferring income can have drawbacks. For instance, if you’re applying for a loan, deferring income may not be the best approach, as lenders prefer to see your current income level.

Also, consider the potential long-term impacts of deferring income. While it can be advantageous in the short term to lower your tax liability, it may result in a higher taxable income in the subsequent financial year.

Now that we’ve explored the benefits and considerations of deferring income, it’s time to move on to the second key that will help you unlock even more tax savings: maximising deductions.

Key 2: Maximise Deductions to Boost Tax Savings

Another essential strategy for enhancing your tax savings is maximising your allowable deductions. By taking full advantage of tax deductions, such as work-related expenses, investment property expenses, and charitable donations, you can effectively reduce your taxable income and retain more of your hard-earned money.

To increase your deductions, it’s crucial to keep track of your expenses throughout the year, ensuring you have the necessary receipts and documentation. This way, you can substantiate your claims to the Australian Taxation Office (ATO) and claim every legitimate deduction.

For example, prepaying expenses like interest, rent, or accounting fees before June 30 can help you claim them as deductions in the current financial year. You can also claim deductions for expenses related to running a home office or making donations to eligible charities.

Purchasing assets eligible for instant asset write-offs can also increase your allowable deductions. If you’re a small business owner, you can claim immediate deductions for the full cost of eligible depreciating assets used or installed and ready for use before 30 June, 2023.

However, maximising your deductions requires accurate record-keeping of your expenses and substantiating your claims with the ATO. This includes maintaining detailed records of every expense, the portion of your home used for work purposes if you work from home, and all expenses and evidence related to work-related travel or car usage.

By maximising your deductible expenses, you can significantly reduce your taxable income and tax bill. TMS Financial offers a free tax deduction checklist tailored to your occupation to help you identify the deductions you’re eligible for. Simply visit https://www.tmsfinancial.com.au/tax-deductions/

To maximise deductions, remember to satisfy the following three conditions:

- You must have spent the money and not been reimbursed.

- The expense must be directly related to earning your income. (We can help you identify eligible deductions based on your occupation or business – simply email us your name, occupation, or description of what you do, and we’ll provide you with a complimentary checklist.)

- You need to keep records to show how you worked out your claim. These can include receipts, bank statements, and credit card statements.

Key 3: Superannuation Super Strategies for Maximising Tax Savings and Enhancing Your Financial Future

When making tax-deductible contributions, be aware of the rules and limits. Employer contributions and rollover payments cannot be claimed as tax deductions. Personal tax-deductible contributions can help offset capital gains and count towards your concessional contributions cap, currently set at $27,500 per year.

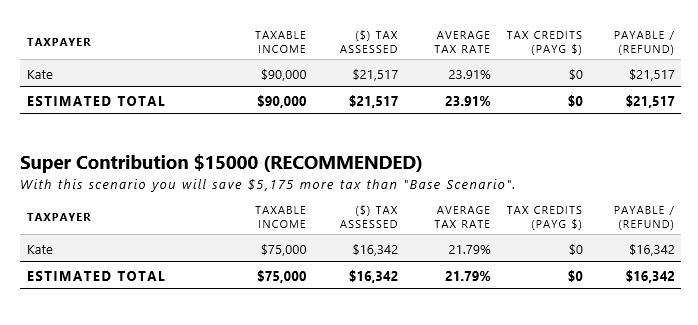

Consider the following example: Kate, a clothing designer earning $90,000 per year, contributes $15,000 of her after-tax income to her super fund and claims a tax deduction of $15,000 in her tax return. Her personal contribution is taxed at 15%, resulting in a contributions tax of $2,250, leaving a net contribution of $12,750.

By claiming the tax deduction, she reduces her taxable income to $75,000 for the year, resulting in significant tax savings. Since her marginal tax rate is 34.5% (including the Medicare levy), she pays $5,175 less in tax. After considering the $2,250 contributions tax, her net tax saving is $2,925.

Claiming Deductions and Offsetting Capital Gains

One method to potentially decrease your taxable income and save on taxes is by contributing some of your after-tax income or personal savings to your super fund and claiming a tax deduction. These contributions, known as personal deductible super contributions, are generally taxed at up to 15% in the fund, potentially lower than your marginal tax rate. However, these contributions count towards your concessional contributions cap, which was set at $27,500 for the 2023 financial year.

If you have allowable capital losses that are greater than your capital gains, resulting in a net capital loss, you can carry it forward to future income years. This net capital loss can be deducted from future capital gains. However, you can’t deduct these capital losses or a net capital loss from other assessable income.

You can use your current year capital losses to offset your current year capital gains. If you have capital losses from prior years, also known as net capital losses carried forward, you can use them to offset your current year capital gains as well.

Making personal tax-deductible contributions can be an excellent way to offset capital gains on assets held outside super. If you have unused concessional contributions from previous financial years, you may contribute more than the standard concessional contribution cap using the carry-forward rule.

Making After-Tax Contributions and Utilising Bring Forward Provisions

In some cases, you can bring forward three years of after-tax contributions into one year, known as the bring forward provision. This allows you to contribute up to $330,000 over a three-year period if you haven’t triggered the provision in the previous two years and your total super balance is below $1.7 million.

Obtaining Government Super Top-Ups, Boosting Spouse’s Super, and Equalising Balances

Consider other super strategies like receiving a super top-up from the government, boosting your spouse’s super and claiming a tax offset for yourself, and splitting contributions to your spouse to equalise super balances.

If you earn less than $54,837 in the 2022-23 financial year and make an after-tax contribution to your super, the government may contribute up to $500 to your super account. If your spouse’s assessable income is less than $40,000 in a financial year, you can make super contributions on their behalf and potentially claim a tax offset for yourself. You can also split up to 85% of concessional contributions (up to the concessional contribution cap) made during a financial year with a spouse, provided they are not over the age of 65 or have reached their preservation age and retired.

Key 4: Tax -Effective Structure

Unlocking Maximum Tax Savings by Choosing the Right Entity

To illustrate the importance of selecting the right tax-effective structure, let’s examine two different examples:

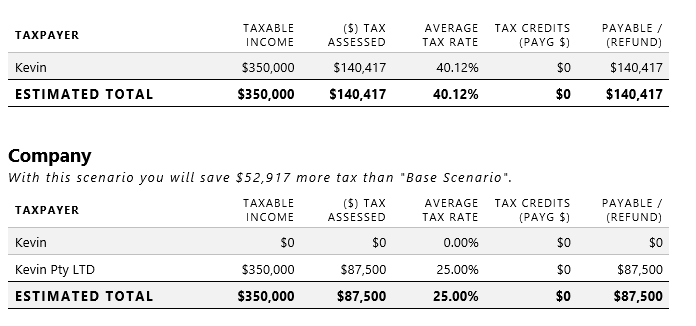

Case Example 1: Saving Taxes by Changing Business Structure from Sole Trader to Company

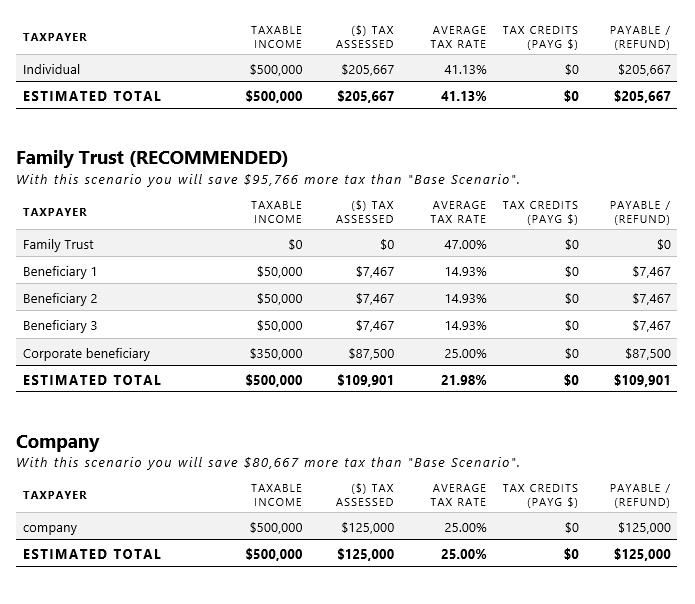

Case Example 2: Comparing Tax Payable for Different Business Structures: Individual, Company, and Family Trust

If you’re unsure about which business structure is best for you, check out our comprehensive article on Trust vs Company.

Choosing the Right Tax Structure: Considerations and Options

As demonstrated by these examples, the structure you choose has a significant impact on the tax rate. When selecting the right tax structure, it’s essential to consider factors like asset protection, estate planning, and succession planning. Tax reduction should not be the primary purpose, as the ATO can still apply Part IVA if the main objective of an activity is to reduce your tax, even if it’s legitimate.

This General Anti-Avoidance Rule (GAAR) is designed to prevent taxpayers from engaging in artificial or contrived arrangements solely or predominantly for the purpose of obtaining a tax benefit.

A sole trader is the simplest and most common type of entity, but it provides the least protection for personal assets. A partnership provides more flexibility than a sole trader, but it also provides less protection for personal assets.

A company is a separate legal entity that offers the most protection for personal assets but also comes with more compliance requirements and higher costs. A trust is a legal arrangement where a trustee holds assets on behalf of beneficiaries and can be used for asset protection, tax planning and wealth accumulation.

Each structure has its own advantages and disadvantages, and the right structure will depend on your individual circumstances and goals. For example, a company may be the best structure for a business with a high level of liability risk, while a trust may be the best structure for asset protection and tax planning.

Consulting a tax expert is crucial to determine the best structure for your situation, as there is no one-size-fits-all solution. The fourth key to big tax savings is a tax-effective structure that takes into account your specific circumstances and goals. By working with a tax professional, you can ensure you choose the right structure for maximum tax savings. Tax planning strategies, such as salary packaging and deductible expenses, can further minimise taxes and help you maximise your tax refund.

In addition, choosing the right structure can help you manage investment income and investment property, optimise capital gains taxes and tax offsets, and make the most of common tax deductions, such as work-related expenses and rental property costs. By implementing top tax planning strategies, you can reduce your taxable income, tax liabilities, and ultimately pay less tax.

Putting it All Together

As the financial year approaches, take advantage of tax time to review your current structure and consult with a tax agent. They can help you navigate marginal tax rates, the Medicare levy surcharge, and other tax-related expenses to make the most of your hard-earned money. With expert advice, you can better understand your tax returns, superannuation contributions, and the benefits of various investments, all while ensuring your take-home pay is maximised.

Now that you understand the importance of tax planning and the power of these four keys, it’s time to take action. Don’t let another financial year go by without optimising your tax situation. Contact the experts at TMS Financials to develop a personalised tax plan tailored to your unique circumstances.

Get Professional Advice from TMS Financials

Disclaimer

OPTIMISE YOUR

TAX SITUATION!

TAKE ADVANTAGE OF OUR 4 KEYS

TO MAXIMISE YOUR TAX SAVINGS

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.