So, why is this so important? Well, not doing it right can lead to extra costs, and nobody wants that. In our guide, we’ll show you why you must comply with the law and how you can find the money to make those repayments. Let’s dive in and make this process clear and straightforward for you.

Division 7A Minimum Yearly Repayment refers to the mandatory annual payment that shareholders must make when they’ve borrowed money from their company under Division 7A tax rules. This requirement ensures that shareholders are meeting their loan obligations and is an essential aspect of compliance.

Why is it Important to Make the Minimum Yearly Repayment?

What If You Don’t Make It?

Making the minimum yearly repayment is crucial for several reasons:

Tax Compliance

It helps shareholders stay compliant with Division 7A tax regulations, avoiding penalties and legal issues.

Avoiding Double Taxation

If you don’t make the minimum yearly repayment, it can lead to financial challenges, strained relationships, and legal consequences. Avoiding this situation is key.

How Division 7A Minimum Yearly Repayments Are Calculated

Calculating Division 7A Minimum Yearly Repayments Made Simple

To calculate your minimum yearly repayment, you’ll need the following information:

- The income year when the loan was obtained.

- The income year for which you want to calculate the minimum yearly repayment (e.g., 2023-24).

- The outstanding unsecured loan amount at the end of the previous income year.

- Details of any repayments made towards the loan, including dates and amounts.

Loan Terms:

Unsecured loans have a term of 7 years.

Secured loans have a term of 25 years.

Ready to calculate your minimum loan repayment or check if you’ve met the requirements? Use our Division 7A Calculator by clicking [here].

It’s a straightforward way to ensure compliance and peace of mind.

I want to Calculating Minimum Yearly Repayment Under Division 7A

access our calculator and effortlessly calculate your minimum yearly repayment obligation.

Funding Your Division 7A Minimum Yearly Repayment:

6 Practical Strategies.

Now that you’ve gained clarity on how to calculate your Division 7A minimum yearly repayment using our handy calculator, let’s explore six effective strategies to fund these repayments. These strategies ensure compliance while optimizing your financial management:

Fully Franked Dividend

Cover the minimum loan repayment using fully franked dividends from the company

Loan Repayment

Offset Your Minimum Loan Repayment Against Credit Loans in the Company

Paying Bonus

Get a bonus from your company to cover your minimum loan payment for compliance

Asset Transfer

Transfer your personal assets to the company, using them to repay the loan

Borrow from Bank

Borrow from the bank to cover minimum loan repayment.

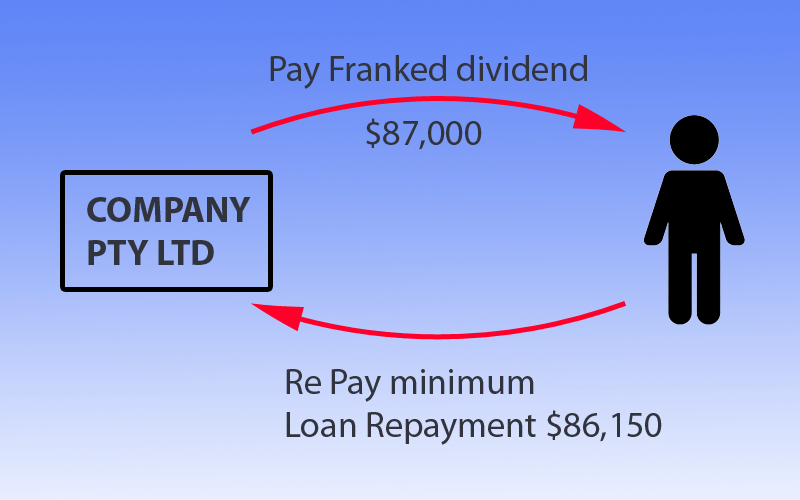

Paying Fully Franked Dividend for Your Division 7A Minimum Repayment

Using our TMS Div7A calculator, your minimum yearly loan repayment comes out to be $86,150, covering both the principal and interest. This is the amount you need to pay back to the company by 30 June, 2023.

Assuming You don’t have the $86,150 at hand to make that minimum loan repayment.

So, what can you do?

One strategy you can explore is getting your company to pay you fully franked dividends. This way, you can use this amount to meet your minimum loan repayment.

The Company's Perspective

To make this strategy work, the company needs to prepare dividend statements meticulously. These statements must accurately reflect the imputation credits associated with the dividend. In this case, the dividend statement shows a franked dividend of $87,000 and a franking credit (or imputation credit) of $29,000, based on a company tax rate of 25%.

Receiving the Dividend

The Gross-Up Step

Taxation and Offsetting

This strategy not only assists in meeting your minimum loan repayment but also provides a tax-efficient way to manage your financial obligations while optimizing your overall tax position

To learn more about how to use Fully Franked Dividends to meet your minimum loan repayment, click here.

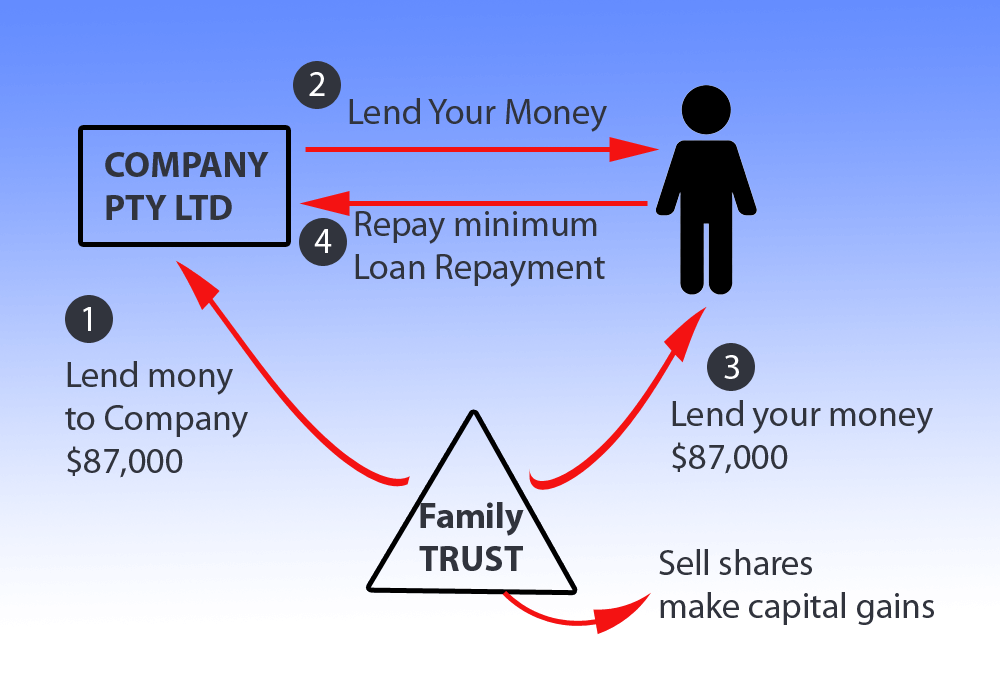

Offset against Credit Loans in a company

1. Check if the Company Borrowed from You

2. Scenario Example

3. Avoiding Division 7A Rules

4. Trust Lending Back

5. you take that $87000 and pay the company back

6. Important Checks

In simple terms, you can offset the loan your company owes to a trust by making a journal entry and proper documentation. This way, you avoid Division 7A rules. Just ensure the trust’s funds come from selling shares and not from another company.

The Role of a Proactive Accountant in Financial Strategies:

Some accountants just do the basics, but a great one goes the extra mile. When it comes to tricky stuff like offsetting credit loans without breaking the rules, you need to be super careful. If you mess up, you could end up with more money problems.

If you’ve never heard about certain money tricks before, it might be because your accountant isn’t thinking ahead. In the money world, seeing the big picture and finding opportunities is a big deal. A good accountant doesn’t just crunch numbers; they help you build a better financial future.

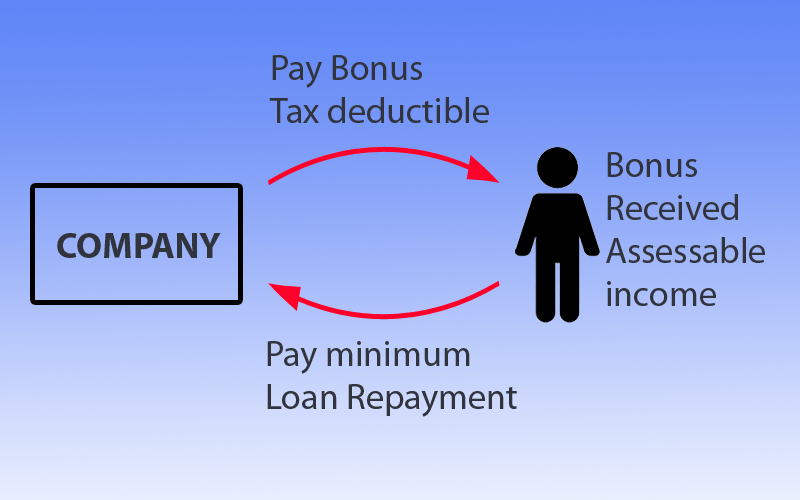

Paying Bonus to Fund Minimum Loan Repayments

Here’s how it works:

Getting a Bonus

Your Personal Tax

Better Than Unfranked Dividends

Market Value Matters

Watch for Excessive Payments

Other Costs

In simple terms, this strategy lets you use a director’s bonus to cover your minimumloan repayments. Just remember to keep things in line with market values, and be aware of any extra costs involved.

Paying a bonus seems like an easy way to implement, but you need to work out how much to pay the bonus so it’s not excessive. You can do this through careful calculations. For us, we use tax planning to assess different scenarios and determine the right amount for your company to pay you as a bonus, ensuring it’s not excessive. If you’re considering this strategy, reach out to us for assistance in finding the optimal bonus amount tailored to your specific situation,

Transferring an Asset

This method doesn’t involve actual cash exchange, but it’s crucial to maintain comprehensive documentation to prove the transaction’s occurrence. Make sure this process is completed by 30 June to stay compliant. You may need to create documents like a sale and purchase agreement or a deed of offset to ensure everything is properly recorded.

When selecting the assets to transfer, focus on those that are currently at a loss. The goal is to choose assets that won’t trigger capital gains tax when transferred. Keep in mind that companies don’t enjoy the 50% capital gains tax (CGT) discount that individuals might get. So, if your company eventually sells the transferred asset, it will be liable for tax on the full capital gain. This strategy is particularly useful for assets you believe won’t appreciate in value.

However, a word of caution regarding assets used for personal enjoyment, such as cars or boats. If you find yourself in a tight financial spot with insufficient assets or cash for repayments, transferring these personal use assets to the company can be an option. But here’s the catch: once the company becomes the owner of these assets, you’ll need to pay market rent to the company each time you use them. Failure to do so might lead to the unpaid rent being treated as a deemed dividend under Division 7A, a tax regulation. It’s essential to keep these personal use assets primarily for company events rather than personal leisure to make this strategy more tax-efficient.

Borrow from Bank

Getting a Bank Loan Another option is to get a separate loan from a bank to cover your repayment. These loans typically have higher interest rates than your regular home loan. It’s important to note that the interest on this bank loan won’t be tax deductible. This is because the purpose of this loan is to repay your Division 7A loan, which was originally taken for personal use, such as buying that boat. So, while it’s an option, it won’t provide any tax benefits.

Refinancing for Lower Minimum Loan Payments with a 25-Year Term

Here’s how it works:

Secured Loan

Extended Loan Term

Reduced Minimum Payments

When you stretch out your loan over 25 years, your minimum loan payments each year become significantly lower. For example, if you had to pay $85,691 annually, it could reduce to around $34,663. This makes your financial burden lighter and more manageable.

In summary, refinancing to a 25-year term essentially means securing your loan with assets and spreading out your repayments over a longer period. This can result in substantially lower minimum loan payments, making it a smart strategy to ease your financial obligations.

To implement this strategy, you’ll need legal assistance. If the assets you want to use as security, like your property, already have a mortgage with a bank, and the bank is the primary lender, you’ll need their consent to place a second mortgage on the property. If they agree, a lawyer will prepare the necessary loan agreement with security over the property, making the loan a secured one. The ATO allows a 25-year term for secured loans, which substantially reduces your minimum loan repayments. Funding this reduced amount should be more manageable for you.”

Ready to refinance your loan and reduce your payments?

Ready to Resolve Your Division 7A Loan Challenges? Let's Take Action!

Our team of DIV7A specialists is here to provide you with personalized solutions. Start by completing the Division 7A Loan Assessment Form, and we'll evaluate your situation promptly. Your financial success is our priority.

Start Tax Planning Now

Wondering how to withdraw money from your company while maximizing benefits and minimizing costs? It all starts with effective tax planning.

Book an Appointment

Ready for Personalized Solutions? Schedule Your Appointment!

Talk to a DIV7A Specialist

Still have questions or want to discuss your unique circumstances? Our DIV7A Loan specialists are here to help.