Guide to Claiming Fuel Tax Credit for Your Business

.

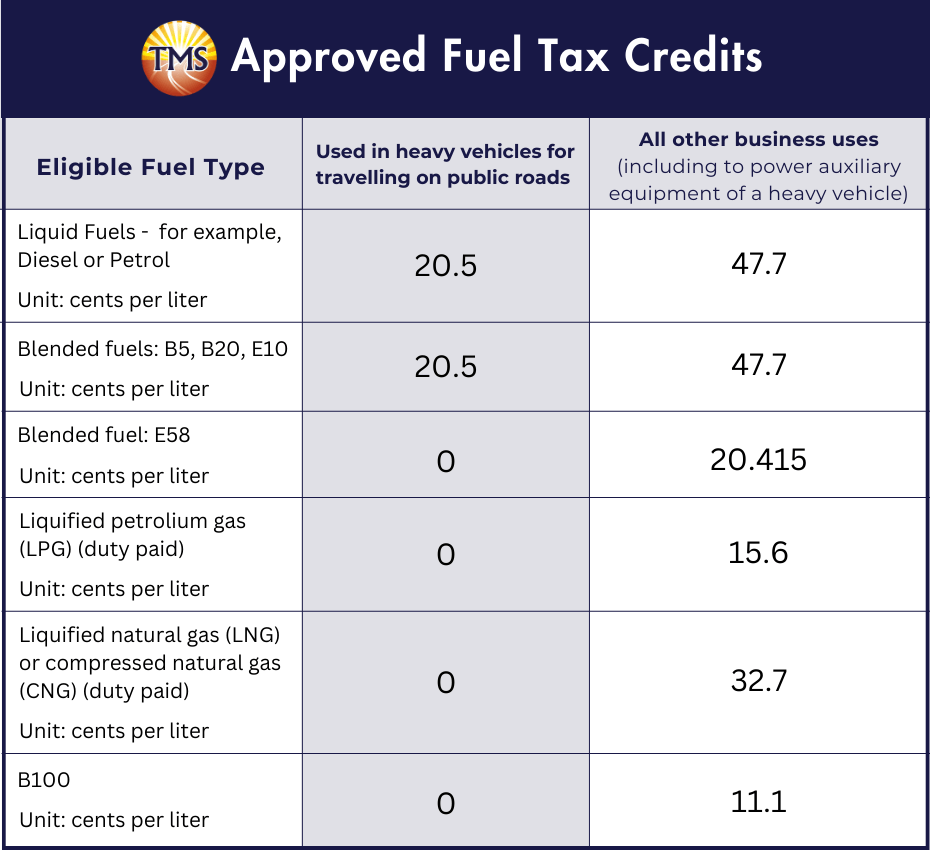

Claiming Fuel Tax Credits is an opportunity for businesses who have bought fuel, such as petrol, diesel, or other eligible fuels, for business activities. The tax credit, determined in cents per litre, can be claimed when submitting the Business Activity Statement (BAS) for the current financial year, or up to four years from the purchase of the fuel.

The Fuel Tax Credit rates are updated twice a year, in February and August, and are influenced by changes in the Consumer Price Index (CPI) and the price of fuel. These changes take into account factors like excise or customs duty, ensuring businesses get the most accurate rate for their claims.

Different types of vehicles and uses of the fuel can influence the credits you can claim. For example, heavy vehicles such as diesel trucks might have different Fuel Tax Credit rates compared to light vehicles. Furthermore, the fuel consumed on public roads attracts a road user charge, while fuel used on private roads may have a unique rate.

Recent changes to Fuel Tax Credits

In July 2024, the rates for biodiesel (B100) were adjusted as part of the regular updates to excise tax rates. Fuel tax credit rates are now indexed twice a year, in February and August, to reflect changes in the consumer price index (CPI). The most recent adjustment occurred on 5 August 2024.

It’s important to note that the fuel tax credit rates can vary based on the type of fuel and its use. For instance, rates may differ for fuel used in heavy vehicles traveling on public roads due to changes in the road user charge. For current and past fuel tax credit rates, use the fuel tax credit calculator to determine the correct amounts for your Business Activity Statement (BAS). Remember to claim your credits within four years of the earliest BAS due date to remain eligible.

Understanding Eligible Vehicles and Fuels for Claiming Fuel Tax Credits

Eligible Vehicles for Fuel Tax Credits

On-Road Vehicles

- Waste collection vehicles

- Concrete transport vehicles

- Refrigerated vehicles

- Vehicles equipped with sleeper cabins for long-haul travel

- Heavy vehicles with specialised auxiliary power equipment, such as trucks used for loading/unloading, elevated work platforms, truck-mounted cranes, drilling and pumping equipment, and blowers for dry products.

Off-Road Vehicles

- Graders

- Backhoe Loaders

- Front-end Loaders

- Wheeled Excavators

- Forklifts

- Wheeled Bulldozers

- Fertilizer Spreaders

- Combine Harvesters

- Tractors

Approved Fuels for Fuel Tax Credits

- Liquid fuels: like petrol and diesel

- Blended fuels: such as B5, B20, E10

- Liquefied Petroleum Gas (LPG) [duty-paid]

- Liquefied Natural Gas (LNG) or Compressed Natural Gas (CNG) [duty-paid]

- Other blended fuels: E85 or B100

So, if you’re in a business that uses these types of vehicles and fuels for your business activities, make sure to check the current Fuel Tax Credit rates to maximize your claim.

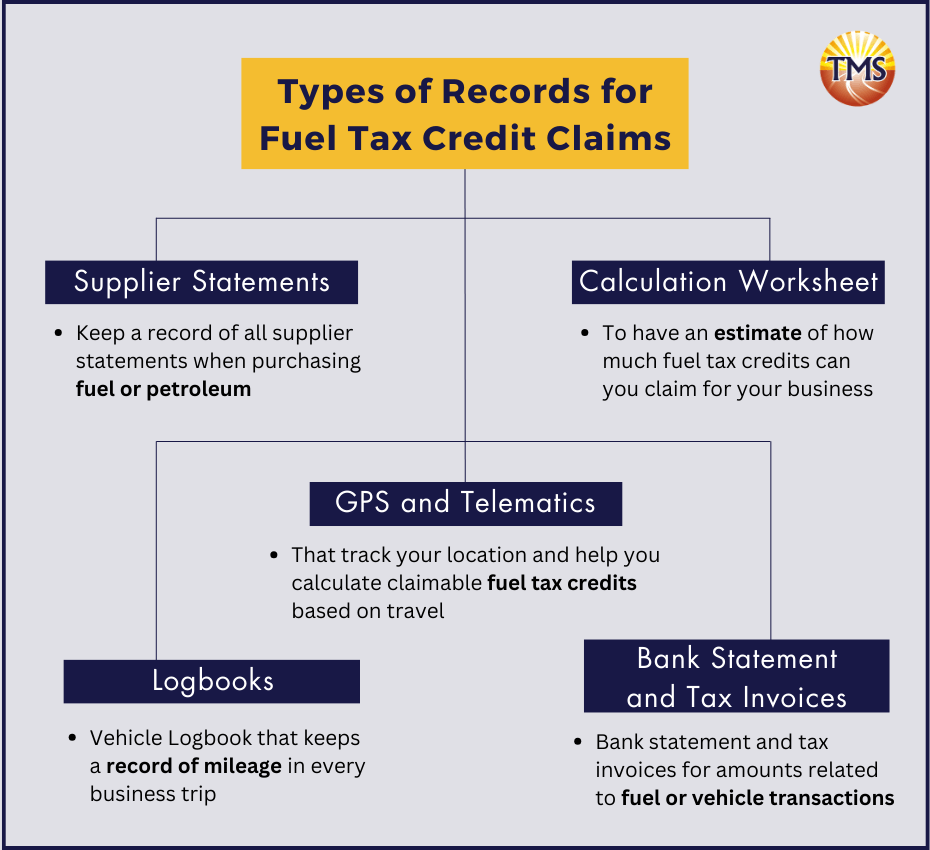

How to Accurately Report Fuel Tax Credit Rates

Always verify the type of eligible fuel used in your vehicle. Moreover, it’s crucial to accurately compute and report the excise tax or excise duty paid on the fuel within your BAS. This ensures you’re claiming the correct amount for Fuel Tax Credits related to your business activities.

Guidelines for Claiming Fuel Tax Credits

- A logbook detailing the start and end dates for the specific period you’re claiming for.

- Dates for each journey you’ve logged.

- Odometer readings taken before and after each trip.

- An account of the purpose for each trip and the number of kilometres traveled.

- The percentage of overall business use as recorded in the logbook.

- Odometer readings at both the beginning and end of each income tax year, as documented in the logbook.

Heavy vehicle operators may claim additional tax credits for fuel consumed by auxiliary equipment, provided the vehicle’s gross mass exceeds 4.5 tonnes. Various fuel types and storage methods are subject to specific conditions.

For non-heavy vehicles used on both public and private roads, you’ll need to calculate the proportion of off-road use to claim accordingly. This remains true even if public roads are used to connect private properties.

Guide to Calculating Fuel Tax Credits: On-Public vs Off-Public Road Use

Step 1: Calculate Diesel Consumption on Public Roads

Diesel consumption rate x kilometres traveled on public roads.

There are two methodologies to figure out the kilometres you’ve travelled on a public road:

- Actual Kilometres Traveled: For this, you must possess records proving the distance you covered. This typically means maintaining logs or records, which can be critical when you’re filing your Business Activity Statement (BAS) to ensure you claim the right amount.

- Derived Kilometres Traveled: With this approach, you determine the kilometres by multiplying your total travel distance by 98.4%. It’s a standard estimation but, even if you choose this method, it’s beneficial and recommended to retain accurate records reflecting your complete distance traveled.

Step 2: Calculating Diesel Consumption Off Public Roads

Total litres of eligible diesel – Litres of diesel used on public roads.

This calculation helps you isolate the diesel consumption specific to off-public road usage, making it easier to report in your Business Activity Statement (BAS). Accurate calculations are vital for claiming the appropriate Fuel Tax Credit rates, which are expressed in cents per litre.

Step 3: Determining Your Fuel Tax Credits for the Reporting Period

(Diesel litres consumed on public roads x Public road rate) + (Diesel litres used off public roads x All other business uses rate).

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Maximise your Fuel Tax Credits Today!

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.