How to Use The Instant Asset Write-Off for Small Business Owners

.

The Instant Asset Write-Off incentive is one of the best tax-saving opportunities available to Australian businesses. With the 30 June, 2025 deadline approaching, now is the time to understand how this program can benefit your business.

Read our article to learn the details of the Instant Asset Write-Off and make informed decisions for your business.

What is the Instant Asset Write-Off Incentive?

The instant asset write-off is a valuable tax-saving measure introduced by the Australian government, allowing eligible businesses to claim an immediate deduction for the business portion of the cost of an asset in the year it is first used or installed ready for use. This incentive is available to businesses with an aggregated annual turnover of less than $10 million and applies to assets purchased and installed by 30 June 2025. Eligible assets include both new and second-hand assets, such as office equipment, vehicles, and other business necessities.

For assets costing less than $20,000, small businesses can write off the entire cost in the year the asset is used or installed, rather than depreciating it over time. This immediate deduction provides significant cash flow benefits, allowing businesses to reinvest sooner. The incentive also applies to multiple assets, provided each asset’s cost is under the relevant threshold. It’s important to note that businesses must apply the simplified depreciation rules to qualify, and some exclusions, such as the car limit, may apply.

The eligibility criteria and thresholds for the instant asset write-off have changed over time. Businesses need to ensure they meet the current requirements and apply the relevant thresholds based on when the asset was purchased, first used, or installed. If an asset’s cost exceeds the applicable threshold, the asset must be placed in the small business depreciation pool.

Who is Eligible for the Instant Asset Write-Off?

To be eligible for the program, your business needs to have an aggregated annual turnover of less than $50 million. This turnover threshold means that many Australian businesses are included in the scheme. Both new and eligible second-hand assets can be written off under the rules.

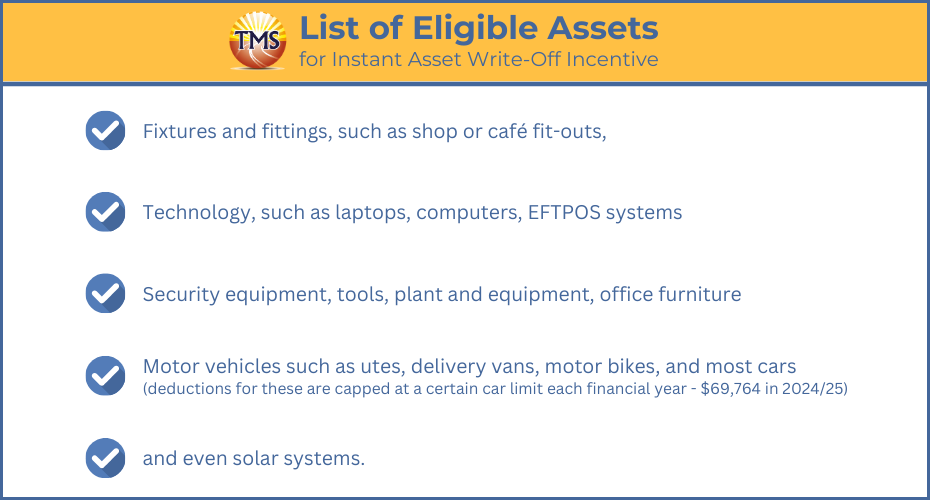

Here are the list of eligible assets for Instant Asset Write-Off Incentive:

Why is the Instant Asset Write-Off Important for Your Business?

How can you make the most of the instant asset write-off incentive before the deadline on 30 June 2025?

As a business owner, you might be wondering how to take full advantage of the instant asset write-off program before the current deadline on 30 June 2024. Here are some key points to help you maximise this opportunity and reduce your tax liability:

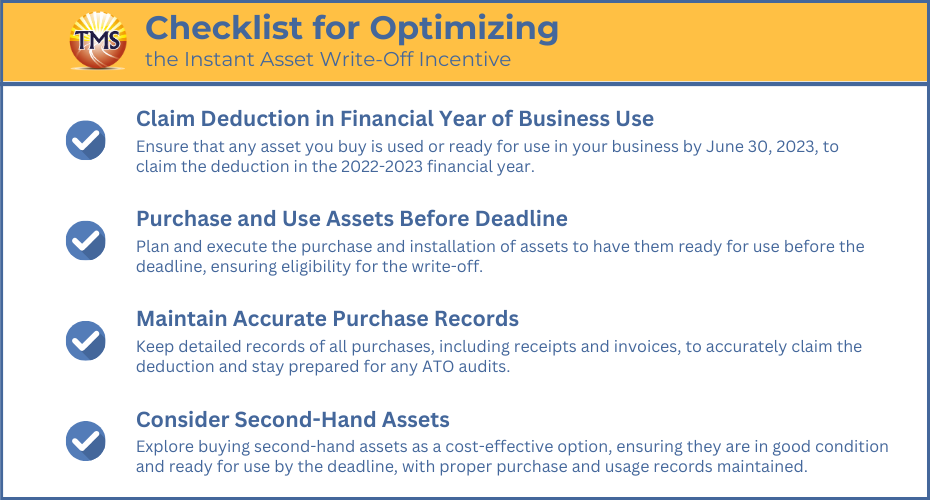

Claim the deduction in the financial year it was used for business purposes

Buy and use the assets before the deadline

Keep accurate records of your purchases

It’s crucial to keep proper records of all purchases made under the instant asset write-off scheme, including receipts, invoices, and any other relevant documentation. By keeping accurate records, you can ensure that you’re claiming the correct amount and avoid any issues with the Australian Taxation Office (ATO) if you’re audited.

Consider buying second-hand assets

If you’re looking for a cost-effective way to acquire assets for your business, you may consider buying eligible second-hand assets. You can claim the full cost of these assets in the same year you buy them, as long as they’re used or installed and ready for use before 30 June , 2025. However, it’s important to ensure that the assets are in good condition and fit for purpose, and that you keep proper records of the purchase and use.

By following these tips, you can make the most of the instant asset write-off program and maximise your tax savings before the deadline. Don’t miss out on this opportunity to grow your business and improve your cash flow. Contact TMS today to learn more about how we can help you take advantage of this program and other tax incentives available to your business.

Borrowing Money for Assets and Claiming Instant Asset Write-Off

Financing Options for Business Assets

Claiming the Instant Asset Write-Off for Financed Business Assets

You can claim the instant asset write-off for a financed business asset as long as your business meets the eligibility criteria. To be eligible, ensure your business has an aggregated annual turnover of less than $10 million. By utilising financing, you can immediately deduct the full business-related costs of capital items under the $20,000 threshold. Remember, it’s always best to consult with a professional to confirm your eligibility and understand the specific requirements for your business.

Claiming GST Input Tax Credit for Financed Business Assets

If your business is registered for GST and the assets are for business purposes, you can claim the input tax credit for the GST portion of the purchase price. Remember to report the GST amount on your business activity statement. As with the instant asset write-off, we recommend seeking professional advice to ensure your business is compliant with GST regulations and properly claiming the input tax credit.

Maximising the Benefits of Instant Asset Write-Off and GST Input Tax Credit

- Confirm your business’s eligibility based on the aggregated annual turnover.

- Ensure the assets are purchased for business use.

- Deduct the full business-related cost of capital items under the $20,000 threshold.

- Register your business for GST.

- Report the GST amount on your business activity statement.

Real-Life Examples of the Instant Asset Write-Off in Action

How Adam Expanded His Delivery Business and Lowered Tax Liability Using the Instant Asset Write-Off

Case 1: Adam’s Delivery Business Pty Ltd

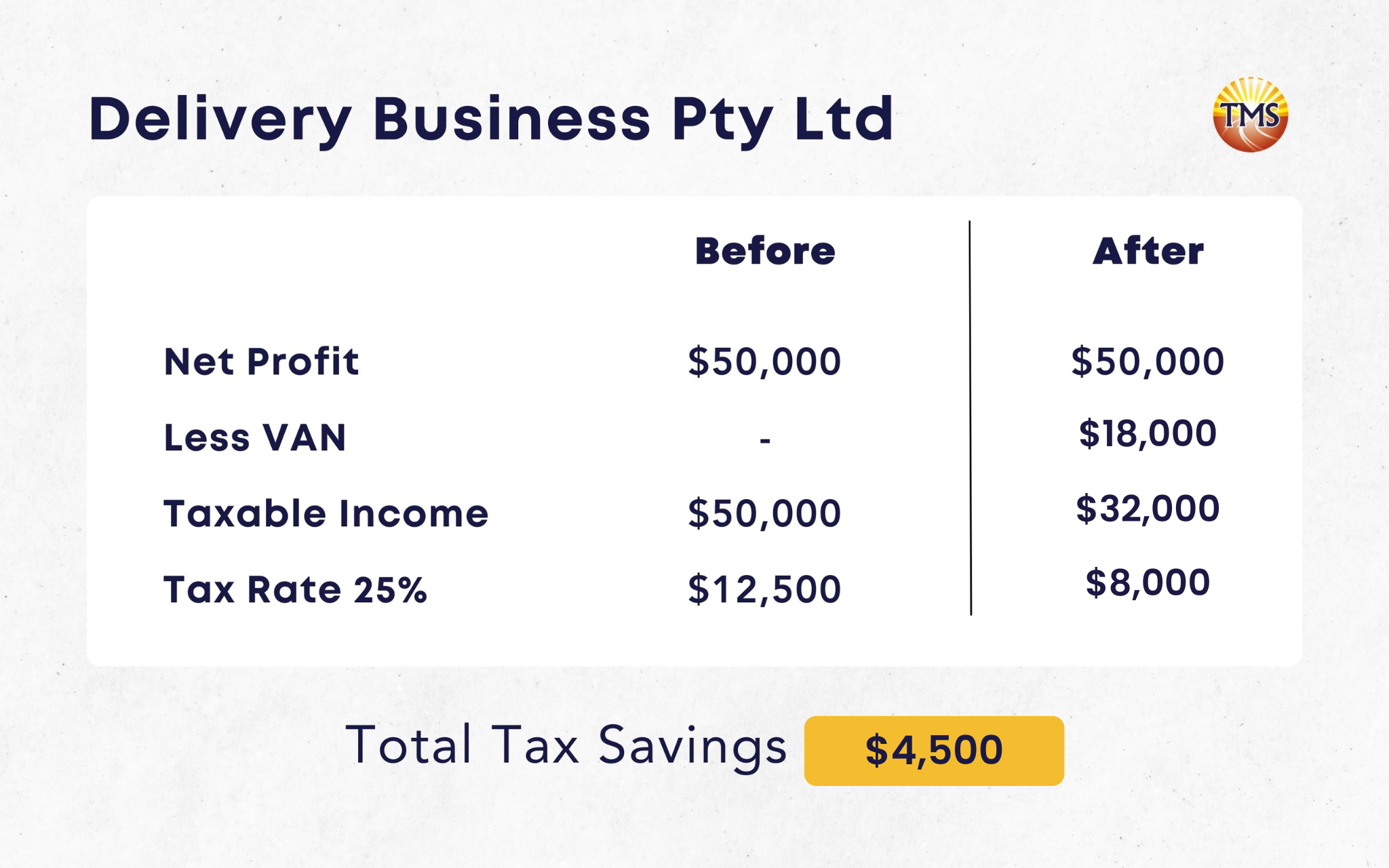

Adam is a hardworking entrepreneur who runs a small delivery business as the sole director of Delivery Business Pty Ltd. With an increasing demand for his services, Adam decides it’s time to expand his fleet by purchasing a new delivery van. He chooses a van that costs $19,800 (including GST) and plans to use it entirely for business purposes. Since his company’s aggregated turnover is less than $10 million annually, Adam’s business qualifies for the instant asset write-off.

Taking advantage of the instant asset write-off, Adam can claim an immediate tax deduction of $18,000 “(net of GST)” for the van in the financial year when the purchase is made, and the van is used or installed and ready for use. This deduction will reduce the company’s taxable income, lowering the amount of tax his business needs to pay for that financial year.

Operating as a company with a tax rate of 25%, the full deduction of $18,000 results in tax savings of $4,500. Let’s say Delivery Business Pty Ltd’s net profit is $50,000; with a tax rate of 25%, the tax liability would be $12,500.

By purchasing the van for $18,000 and claiming the instant asset write-off, Adam reduces the company’s taxable income to $32,000, and the tax payable becomes $8,000. Moreover, since Delivery Business Pty Ltd is registered for GST and the van is used solely for business purposes, Adam can also claim an input tax credit of $1,800 for the GST portion of the van’s purchase price. This credit would be reported on the business activity statement (BAS) and effectively reduces the amount of GST Adam’s business needs to pay.

In conclusion, by utilising the instant asset write-off and input tax credit, Adam’s Delivery Business Pty Ltd can experience significant cash flow benefits, allowing him to further invest and grow his business.

What’s the purchase threshold for the Instant Asset Write-Off?

Even if the combined asset costs of all the multiple assets you purchase exceed $150,000, you can still claim the instant asset write-off for each individual asset, as long as the cost of each asset is at or below the threshold.

Transforming Business Growth and Tax Savings: A Case Study of John and Jenny’s Restaurant Success with Proactive Tax Planning

John and Jenny own two restaurants under the JJ Family Trust, with John and Jenny being the only two beneficiaries in the trust. They are concerned about the significant profit they made this financial year, which is estimated to be around net profit $600,000. If they distribute the income 50/50, with taxable income of $300,000 each, the estimated tax payable would be $101,138 per person, the total tax payable $202,276.

They are looking for a way to reduce their tax liability while also investing in their business to make it more profitable. They work hard, seven days a week, but they still feel like they’re not getting ahead financially. They need to upgrade their kitchen equipment for both restaurants and are interested in finding a solution that benefits their business and helps save on taxes.

John and Jenny decide to purchase the following assets for their restaurants:

Commercial ovens costing $66,000 each (including GST) – one for each restaurant: $66,000 x 2 = $132,000

Industrial-grade dishwashers costing $16,500 each (including GST) – one for each restaurant: $16,500 x 2 = $33,000

Customised stainless steel benches and shelving costing $27,500 per restaurant (including GST): $27,500 x 2 = $55,000

High-end exhaust systems costing $44,000 per restaurant (including GST): $44,000 x 2 = $88,000

The total cost of all assets is $308,000 (including GST).

Claiming the Instant Asset Write-Off incentive:

Since each individual asset’s cost is below the $20,000 threshold, the business can claim an immediate deduction for the full cost of each asset (net of GST) under the instant asset write-off.

This means that in the financial year when the assets are first used or installed ready for use, the business can claim a total tax deduction of $136,000 (net of GST) for the asset purchases. The GST amount of $13,600 can be claimed as an input tax credit if the trust is registered for GST.

By utilising the Instant Asset Write-Off incentive, John and Jenny can significantly reduce their tax liability while investing in the growth of their business. This allows them to upgrade their kitchen equipment, improve efficiency and profitability, and ultimately achieve their financial goals.

We did the tax planning calculation, after we put in $136,000 as a tax deduction in our tax plan calculation, the estimated income for the trust net profit is $464,000. If we distribute $232,000 each to them, then tax payable is $70,538 each, total tax payable is $141,076.

The total tax savings of $61,200 is a substantial amount, and we also advised John and Jenny about additional strategies that could further reduce their tax liability. For instance, we suggested setting up a corporate beneficiary to cap their tax rate at 30% and making the maximum superannuation contribution of $27,500 each.

They decided to contribute the maximum amount to their super funds to enhance their retirement savings, ultimately enabling a comfortable retirement. After implementing these strategies, their individual tax payable was reduced, bringing additional tax savings.

In comparison to a scenario without tax planning, their total tax savings amounted to $149,850.

Get Professional Advice from TMS Financials

At TMS Financials, we can help you determine if the Instant Asset Write-Off is right for your business. We’ll work with you to assess your personal circumstances and advise you on the best course of action. Our team of experienced accountants can help you plan your cash flow, assess the rate of return on your investment, and ensure you meet all the eligibility criteria for the Instant asset write-off incentive.

Don’t wait until it’s too late to take advantage of this valuable tax break free financial health review now.

Disclaimer

Take Action Now And

Take advantage of this

Valuable tax break

Schedule a one on one review with our Certified Tax Agent now!

Related Articles

Understanding asset protection for your growing business

Asset protection for growing businesses and...

Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties

Taking Money Out of Your Private Company: How to...

Unlock the Benefits of a Bucket Company: Maximise Tax Savings and Protect Your Assets

Unlock the Benefits of a Bucket Company:...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.