Super Due Dates

.

As an employer, you have specific responsibilities to fulfill regarding superannuation contributions for eligible employees, who are essentially those classified as employees under superannuation regulations. One such responsibility is supplying your eligible staff with the standard superannuation choice form. This form instructs you on which complying super fund you are obligated to make super payments into. For an in-depth explanation of the superannuation standard choice form, please refer to our dedicated article here.

In Australia, employers have a legal mandate to remit the correct sum of super guarantee contributions. These payments must be made punctually, aligning with the Super Due Dates each quarter. Businesses typically coordinate these super payment due dates with their payroll, meaning employees receive both their salaries and super contributions simultaneously.

Calculations for super contribution payments are based on an employee’s ordinary time earnings, which is the remuneration received for regular work hours. Keep in mind that if the due date falls on a weekend or public holiday, the payment needs to be made by the next business day to meet the Australian Taxation Office guidelines.

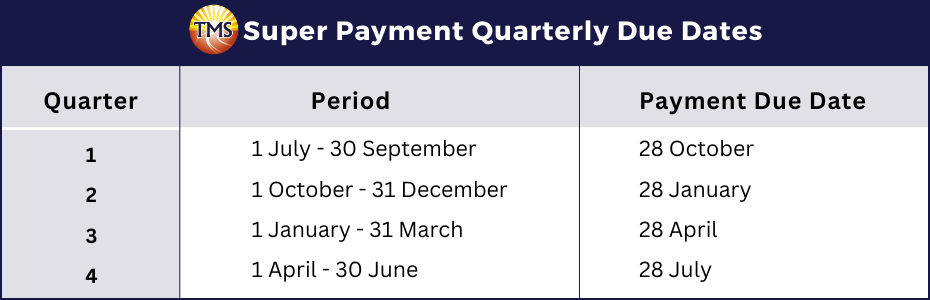

What are the Super payment quarterly due dates for this year?

The quarterly periods are always the same, and the payment deadline consistently falls on the 28th of the subsequent month.

Here’s the breakdown:

- Quarter 1: From 1 July to 30 September, with a super payment due date of 28 October.

- Quarter 2: Spanning from 1 October to 31 December, and the super payment is due by 28 January.

- Quarter 3: Covering 1 January to 31 March, with the super payment deadline set for 28 April.

- Quarter 4: Running from 1 April to 30 June, and the super payment must be made by 28 July.

What if the Deadline lands on a weekend or public holiday?

What are the consequences if I miss the super payment due dates?

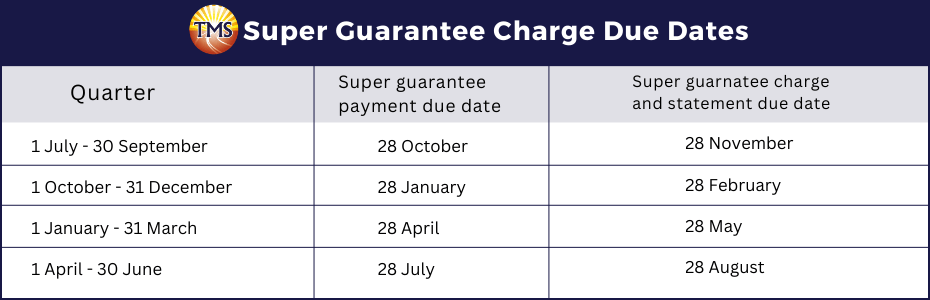

Failure to meet the super payment due dates can result in the imposition of the Superannuation Guarantee Charge (SGC), which includes government fees such as an administration fee and accrued interest. It is strongly recommended to ensure your super contributions are made promptly and in accordance with the established due dates to avoid incurring these additional costs.

Compliance with these due dates is crucial to fulfill your superannuation obligations and prevent any penalties associated with late payment.

Deadlines for settling the Super Guarantee Charge

Functions of a Clearing House

A clearing house serves as an intermediary responsible for distributing superannuation contributions to the respective funds of your eligible employees on your behalf.

It is important to emphasise that Super Guarantee Contributions (SGC) sent to a clearing house prior to the due date may not be credited to the employee’s super fund until after the due date. This distinction holds significance because the official ‘payment’ of the employee’s super contribution is determined by the date it’s received by the super fund, rather than the date when the employer submits the payment to the clearing house.

If you have concerns about potentially missing an SG due date or suspect that SG contributions you have transmitted may have encountered delays, it is advisable to verify the processing timeframe of your clearing house to ensure that payments are processed in advance of the payment due dates.

Factors to consider regarding due dates

It’s important to recognise that not all super funds mandate contributions to be made on a quarterly schedule; some may necessitate more frequent payments, such as monthly.

Meeting the Super Guarantee Contribution payment due dates, while crucial, doesn’t automatically guarantee compliance with the requirements of every super fund.

It’s advisable to review the contractual agreements you have in place with the super fund, awards, or contracts to confirm that super contributions are being remitted punctually as per the respective terms.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Ready to optimise your super payments and financials strategy?

Schedule a free consultation wit TMS Financials today.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.