Guide to understanding the Maximum Super Contribution Base (MSCB) and how to manage your superannuation contributions

.

As part of an employee’s remuneration package, employers are obligated to make regular Super Guarantee (SG) contributions to their employees’ super fund in accordance with the superannuation rules. However, it’s crucial for high-income earners to be mindful of the government’s quarterly cap on an employee’s earnings base for which employers must make these contributions.

This cap is referred to as the Maximum Superannuation Contribution Base (MSCB) and is linked to the Average Weekly Ordinary Time Earnings (AWOTE), leading to adjustments every financial year. The MSCB sets the maximum limit on the amount of an individual employee’s earnings base for SG contributions by the employer, ensuring that contributions do not exceed this threshold. This cap helps in managing concessional and non-concessional contributions within the contribution caps set by the government.

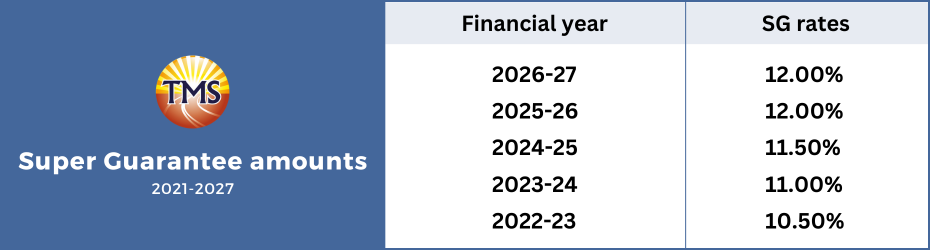

Superannuation Guarantee (SG)

The Superannuation Guarantee (SG) contribution rate represents a specific portion of your income that the government requires. Your employer is obligated to contribute this amount to your superannuation fund. For the financial year 2023-24, this rate is set at 11% of your ordinary time earnings, which pertains to the income you earn during your standard working hours. If employers fail to make the necessary contributions on behalf of their employees, they may be subject to the “super guarantee charge” imposed by the government. It’s essential to highlight that the SG rate is on track to incrementally increase to 12% by 1 July 2025, in line with government-mandated adjustments to bolster retirement savings.

If you want to know more about Super guarantee charges, use the link here.

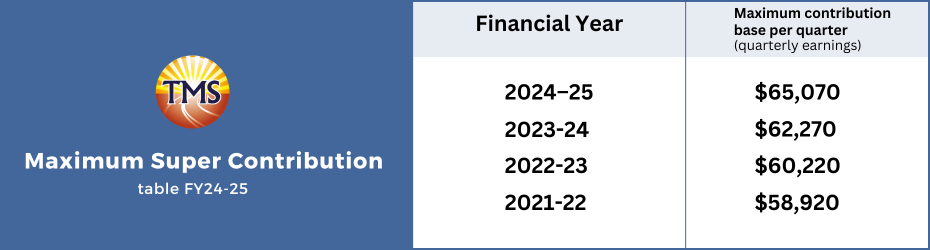

Maximum Super Contributions Base (MSCB) for the 2023-2024

For the 2023-24 financial year, the Maximum Super Contribution Base (MSCB) is set at $62,270 per quarter, which accumulates to an annual limit of $249,080 ($62,270 x 4 quarters). Consequently, the maximum SG contribution that an employer is required to make per quarter is $6,849.70 ($62,270 x 11%). It’s worth noting that the MSCB solely applies to SG contributions and does not govern other mandatory contributions, such as those mandated by industrial awards or enterprise agreements.

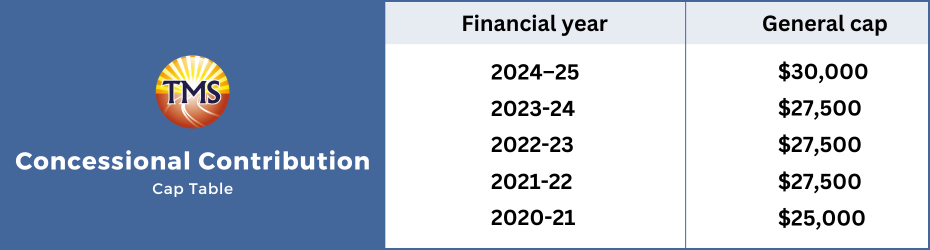

What is concessional contributions?

Generally, if an individual’s annual income combined with their before-tax super contributions amounts to less than $250,000, they will be subject to a 15% tax rate on their concessional contributions. However, if their income, in addition to their concessional (before-tax) super contributions, exceeds $250,000 within a given financial year, they will incur an additional 15% tax on the portion of their concessional contributions that surpasses this threshold.

Concessional contributions cap

For the 2023-24 tax year, the Concessional Contributions Cap is established at $27,500 annually. This cap serves as the boundary for the total before-tax contributions an individual can make to their superannuation fund while enjoying the concessional tax rate, ensuring compliance with taxation regulations.

Carry-forward concessional contributions

Moreover, you have the ability to harness up to four years of contributions that remained untapped for the 2022-23 financial year and capitalise on the entirety of five years’ worth for the 2023-24 financial year. This empowers individuals with super balances below $500,000 to embark on catch-up contributions, capitalising on their previously unused contribution limits.

In essence, this provision grants individuals the latitude to carry forward their dormant concessional contributions for a duration of up to five years, affording them the flexibility to make more substantial contributions to their superannuation fund in the future.

Excess concessional contributions

What are non-concessional contributions?

It’s important to note that non-concessional contributions exclude any contributions made by an employer on the individual’s behalf, such as salary sacrifice contributions. The term specifically applies to personal contributions initiated by the individual using their after-tax income, and these contributions are not eligible for a tax deduction.

Non-concessional contributions caps

There are restrictions on the maximum sum of after-tax contributions that can be directed to a superannuation fund, even though these contributions have already been subjected to the individual’s standard income tax rate. As of the 2023-24 tax year, the cap for after-tax contributions is established at $110,000 annually.

It’s crucial to note the following:

- If an individual’s superannuation balance reaches or exceeds $1.9 million by the conclusion of the prior financial year, their non-concessional contribution cap for the current financial year will be reduced to zero.

- Once an individual reaches the age of 75, they have a 28-day window after the end of that month to make non-concessional personal contributions to their super fund.

- For individuals under 75 years old (formerly under 67 years before 2022-23, and under 65 years for the 2020-21 financial year and earlier), with a super balance less than $1.68 million on 1 July 2023, they may have the option to bring forward the contributions for the next two years, allowing a lump sum contribution of $330,000 in the present financial year. For example, if an individual makes a $330,000 contribution during the 2022-23 financial year, they won’t be eligible for further after-tax contributions until the 2025-26 financial year.

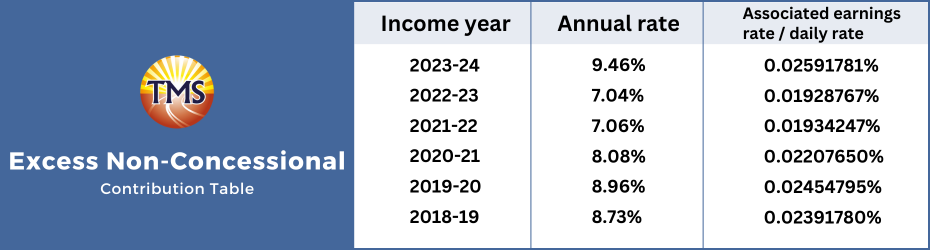

Excess non-concessional contribution

If you exceed the set limit for non-concessional contributions, you’re presented with a couple of alternatives:

- First option is to withdraw the additional non-concessional contributions alongside 85% of the relevant earnings. Should you opt for this, the entirety of the earnings will be subject to your prevailing tax bracket, inclusive of the Medicare levy. You’ll also be eligible for a 15% tax credit to offset the taxes already paid on those gains while they were part of your super fund.

- If you decide not to withdraw and instead want to be assessed for added non-concessional contributions tax, it’s essential to notify the ATO and specify the particular superannuation account you intend to use to address the tax due.

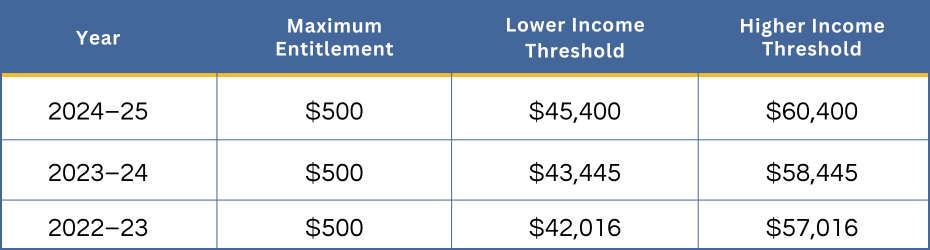

Government co-contribution program and eligibility criteria

Additionally, at least 10% of your total income must come from eligible employment-related activities or running a business. You should also be under 71 years old at the end of the financial year, not hold an eligible temporary resident visa during the financial year (unless you are a New Zealand citizen or hold a prescribed visa), and file an income tax return for the relevant financial year.

Furthermore, your total superannuation balance, encompassing super and pension interests, must not exceed $1.9 million at the conclusion of the prior financial year. To be eligible, you also need to ensure that you have not exceeded your non-concessional contributions cap for the applicable financial year.

The specific amount of the co-contribution varies based on your income and the quantity of non-concessional contributions you make. It’s important to note the co-contribution is not disbursed if your income reaches or surpasses the higher income threshold. Additionally, there is a minimum payment of $20, and payments are rounded to the nearest five-cent increment.

What is the Low Income Superannuation Tax Offset (LISTO)?

If your annual income is $37,000 or less, you may qualify for a LISTO contribution to your superannuation account. This contribution amounts to 15% of the total concessional (before-tax) super contributions made either by you or your employer, with a maximum limit of $500 per income year.

Spouse Contributions

As the contributor, you may be eligible for a tax rebate of up to $540 per financial year for making spouse contributions. The full rebate is accessible if the following conditions are met:

- You contribute a minimum of $3,000 to your spouse’s super account.

- Your spouse’s total assessable income, including reportable fringe benefits and reportable employer super contributions, is below $37,000 for the year.

Downsizer Super Contributions for 55+ Individuals

Transfer Balance Cap

Impact on Age Pension

One-Time Opportunity

Managing the excess contributions of an employer

However, if the contributions made by the employer result in the employee exceeding the concessional contribution cap, the Australian Taxation Office (ATO) will issue a notification to the employee, indicating that their cap has been surpassed. In such a scenario, the excess amount will be subject to taxation at the individual’s marginal tax rate, with a 15% tax offset being applied to account for the contributions tax already remitted by the super fund.

To assist in managing the payment of excess concessional contributions, you have the option to withdraw 85% of the surplus amount, which is calculated as the excess contributions minus the 15% contributions tax.

Super transfer balance cap: managing your retirement savings

It’s important to note that the cap applies to all of an individual’s retirement accounts. For individuals who initiated their retirement income stream on or after 1 July 2021, the transfer balance cap was elevated to $1.9 million, with potential variations ranging from $1.6 million to $1.9 million per person. Should an individual exceed the transfer balance cap while still actively employed, they may become ineligible for specific benefits, including the government co-contribution, tax offsets for spouse contributions, as well as the after-tax contributions cap and bring-forward period.

Re-contributing COVID Early Release Super: Rebuilding Your Superannuation

These re-contributions can be executed during the period spanning from 1 July 2021 to 30 June 2030. However, it is important to emphasise that the total re-contribution must not exceed the sum accessed through the COVID-19 early release program, and it cannot be claimed as a personal superannuation deduction.

To facilitate these re-contributions, individuals are required to notify their fund by submitting an approved form either before or at the time of making the contribution.

Could a bonus or overtime pay effect my MSCB?

In cases where an employee’s earnings surpass the MSCB for a specific quarter due to factors like overtime or a bonus, the employer’s obligatory SG contribution is limited. Consequently, the employee does not receive an SG contribution based on their entire income for that quarter.

For instance, if an employee earns $75,000 in one quarter and $69,000 in another during the current financial year (2023-24), the maximum SG payable by the employer into their super account for both quarters is capped at $6,849 per quarter ($62,270 * 11%), despite the varying income levels earned in each quarter.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Ready to optimise your super payments and financial strategy?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.