Understanding Unit Trusts: benefits, drawbacks, and operational insights

.

A unit trust is a unique arrangement where trust assets are divided into units, and these units are owned by unit holders. The unit trust deed is an essential document that outlines the rules and rights governing these trust assets and the structure they belong to. Every unit holder, based on the units they possess, receives a portion of the trust’s income and capital.

The unit trust may have different classes of units, much like a company can have varying classes of shares. For land tax purposes, and especially under the NSW land tax purposes and the land tax management act, unit trusts and their units are treated distinctly. While unit holders may hold a legal or equitable interest in the trust assets, for tax considerations, it’s the units that are regarded as the assets rather than any underlying property or other asset of the trust.

There are several potential benefits to a unit trust. It offers income tax advantages due to its capability to distribute net income from its trust assets. Moreover, it presents asset protection advantages and potential capital gains benefits. There are fixed unit trusts and non-fixed trusts, each with its own unique features. For instance, in a fixed unit trust, unit holders have a defined interest in the income and capital of the trust assets, based on their units held. This stands in contrast to discretionary trusts, where distributions can vary based on the trustee’s discretion.

How does a unit trust function?

Various entities such as individuals, businesses, pension funds, and other trusts can hold units in a unit trust. Often, these units are owned through pension funds or family discretionary trusts.

However, it’s less typical for an individual to directly hold units, as these units might be seen as assets vulnerable to claims by creditors in case of legal disputes against the individual.

Similarly, it’s uncommon for companies to own units in a unit trust. This is because companies aren’t eligible for the potential 50% discount on capital gains tax that an individual unit holder might receive when selling their units or when the unit trust distributes capital gains.

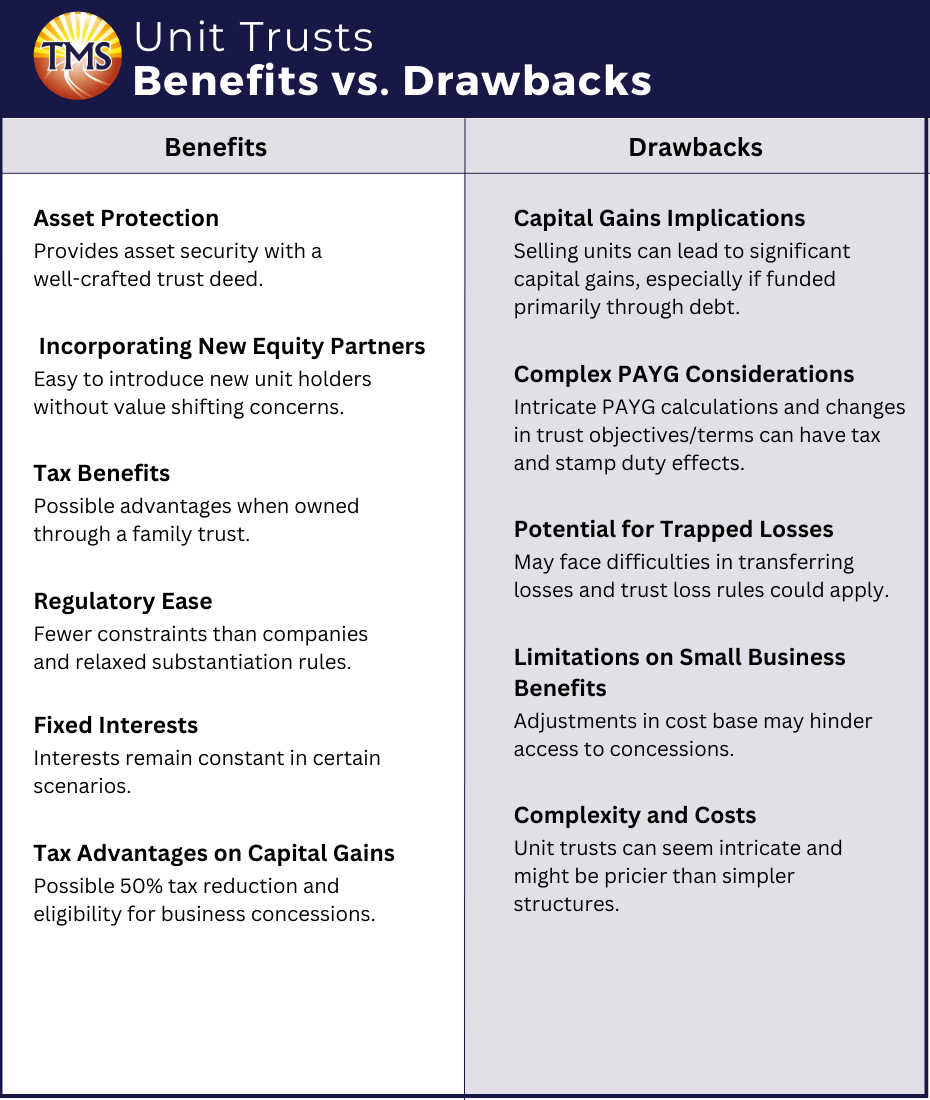

Benefits of a unit trust

There are multiple advantages to choosing a unit trust structure:

- Asset protection: a unit trust can provide asset security when accompanied by a well-crafted trust deed.

- Incorporating new equity partners: introducing new unit holders is simple, as there are no concerns with value-shifting regulations.

- Tax benefits: if a unit trust is owned through a family trust, unit holders might benefit from several tax advantages associated with family trusts.

- Regulatory Ease: compared to companies, unit trusts face fewer regulatory constraints. They operate without a designated regulatory body and are subject to more relaxed substantiation rules than individuals.

- Fixed interests: in a scenario where a unit trust comprises unrelated parties, their respective interests remain constant.

- Tax advantages on capital gains: a unit trust could qualify for a 50% capital gains tax reduction and might also be eligible for small business concessions.

Drawbacks of a unit trust

While unit trusts offer many advantages, there are also notable downsides.

- Capital Gains implications: when a trust is primarily funded through debt instead of equity, selling units might lead to significant capital gains. Alterations in unit holdings might also expose pre-capital gains tax assets to capital gains tax.

- Complex PAYG considerations: unit holders could face intricate PAYG (Pay As You Go) calculations. Moreover, making changes to the trust’s objectives or terms can have repercussions for both capital gains tax and stamp duty.

- Potential for trapped losses: choosing to treat the unit trust as a family trust might not always be possible. Losses can get confined within the unit trust structure. Additionally, the intricate trust loss rules might come into play, hindering the transfer of losses to other managed entities, such as companies.

- Limitations on small business benefits: the accessibility of small business concessions could be hindered due to adjustments in the cost base.

- Complexity and costs: clients might struggle to grasp the nuances of the trust deed, making unit trusts seem intricate. Furthermore, establishing and managing a unit trust can be pricier compared to simpler structures like sole traders or companies.

How to establish a unit trust?

Setting up a unit trust can be achieved in two primary ways:

- A Settlor provides a starting amount, termed the Settled Sum, to the Trustee. This sum is managed based on the stipulations of the unit trust deed. Once the trust is in place, additional individuals have the option to purchase units within the trust.

- The alternative approach involves initial unit holders purchasing starting units in the trust. They do this by transferring the required amount to the Trustee.

It’s worth noting that by choosing the second approach, where initial unit holders directly buy their initial units, the need for a separate Settlor (who isn’t a unit holder) is eliminated.

Appointing a trustee

The Trustee can either be an individual or a corporation. However, it’s advisable to designate a company as the Trustee. This ensures enhanced governance and eliminates the challenges of monitoring the entry and exit of individual Trustees. Furthermore, the unit trust deed should allow unit holders to own shares in the trustee company, mirroring the proportion of their units in the trust.

Appointing a unit holder

Various entities can become unit holders in a unit trust. This includes individuals, companies, pension funds, and different types of trusts. The prevalent practice is for units to be owned through a pension fund or a family discretionary trust.

Individuals directly holding units is not the norm. The reason being, if the individual faces legal action, these units, classified as “assets”, could be targeted by creditors. Similarly, it’s rarer for a company to be a unit holder. This is primarily because companies aren’t eligible for the standard 50% capital gains tax reduction, either when selling the units or when capital gains are passed to the unit holders from the unit trust.

‘Fixed’ vs. ‘Non-fixed’ unit trusts

Unit trusts can be categorised as either fixed or non-fixed for tax considerations.

A fixed unit trust is defined by the absolute interests in both the trust’s income and capital that are definitively held by the unit holders. On the other hand, any trust not fitting this criterion is termed a non-fixed trust. This is sometimes referred to as a hybrid trust, given its blend of both fixed and non-fixed interests.

There are various reasons why a trust might be deemed non-fixed. For instance, the Trustee might possess the authority to distribute specific income or capital selectively among unit holders. Alternatively, the Trustee could have the capability to issue or buy back units at prices diverging from the market value, leading to a shift in value between unit holders.

It’s worth noting that non-fixed trusts can encounter challenges like not being able to roll over losses, distributing taxed dividends from their stock investments, and being ineligible for some capital gains tax benefits.

Fixed unit trusts

Even if unit holders feel they possess a steadfast interest in a unit trust’s income and capital, the trust will only be recognised as a “fixed trust” under the trust loss provisions of the Income Tax Assessment Act 1936 when:

- Entities, like individuals, companies, or other trusts, maintain unwavering entitlements to the entire income and capital of the trust, and

- The trust deed incorporates a provision specifying that units can only be redeemed or issued at a rate consistent with the unit trust’s net asset value, as outlined by Australian accounting standards during the time of redemption or issuance.

If the trust deed permits alternative valuation methods for new units or for unit redemptions, then, even without any discretionary components, such a trust will be labeled a “non-fixed trust” concerning the trust loss regulations. These types of trusts must pass extra criteria to roll over their losses.

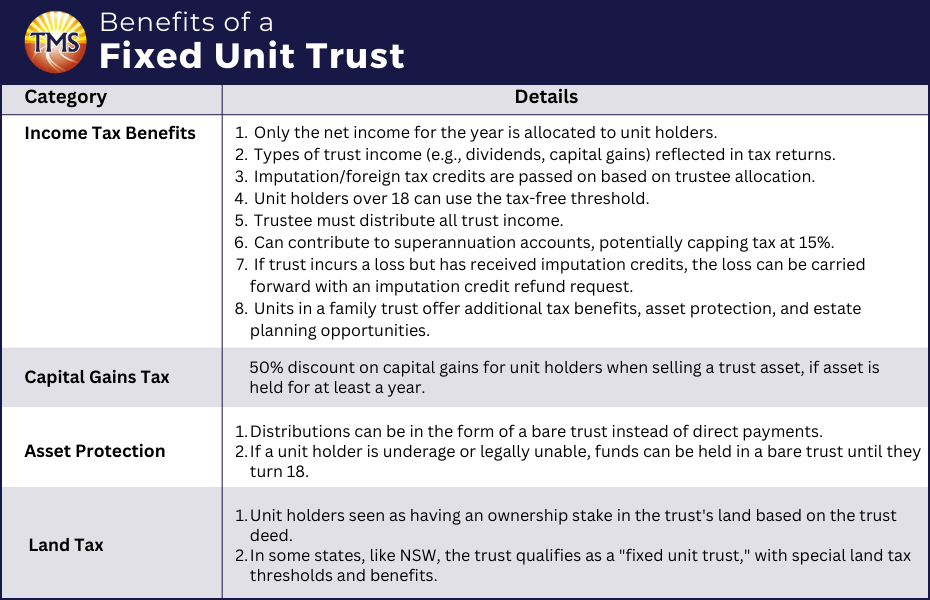

Benefits of a fixed unit trust

A fixed unit trust offers several benefits to its unit holders. It provides a clear structure for managing assets and distributing income. From tax savings to asset protection and straightforward land tax rules, a fixed unit trust simplifies financial processes and can provide added security for your investments.

Income tax benefits

- Within a unit trust, only the net income generated in a financial year needs to be allocated to unit holders. They must report this distribution as income for the same year the trust earned it, not the distribution year.

- Types of trust income, such as those from dividends or capital gains, are noted in unit holders’ tax returns. Moreover, any imputation or foreign tax credits are passed on to unit holders based on the trustee’s allocation.

- For unit holders above 18, the tax-free threshold can be availed when receiving income distributions.

- A fixed unit trust’s trustee must disperse all the trust’s income, with no option to accumulate it within the trust.

- The trust can contribute to unit holders’ superannuation accounts relative to their unit shares, potentially capping the tax on trust income to the superannuation’s 15% rate.

- If the trust incurs a loss but has received imputation credits within the same year, the trustee can lodge a tax return, carry the loss forward, and request an imputation credit refund.

- Units within a family trust grant unit holders access to several tax benefits, asset protection, and estate planning opportunities tied to family trusts.

Capital Gains Tax benefits

On selling a trust asset, unit holders can avail a 50% discount on capital gains. If the asset has been under trust ownership for a minimum of one year prior to sale, this discount is implemented when capital income is shared with unit holders.

Asset security benefits

Instead of direct payments, unit holders can choose distributions in the form of a bare trust. Consequently, within the fixed unit trust, the trustee will form a bare trust for that unit holder, holding onto the designated funds.

If a unit holder is underage or legally unable, the designated funds can be held in a bare trust by the trustee until they turn 18.

Land tax advantages

Under the trust deed, unit holders are perceived as having an ownership stake in the trust’s land. This ownership is grounded in the trust deed, which emphasises unit holders’ rights to the trust’s income, capital, and the option to request the trust’s dissolution and asset distribution.

In certain states’ Land Tax laws, such a unit trust qualifies as a “fixed unit trust,” enjoying the same threshold as land-owning trustees under this structure. Specifically in New South Wales, the Land Tax Management Act 1956 designates a “fixed trust” as one where the trust’s land is equitably owned by those considered land owners for tax purposes. Here, the trustee’s interest is overlooked.

These trust’s unit holders are seen as having an equitable stake in the trust’s land. The trust deed for this fixed unit trust allows these unit holders both current entitlement to the trust’s income and capital and the choice to request the trust’s termination and asset distribution to them.

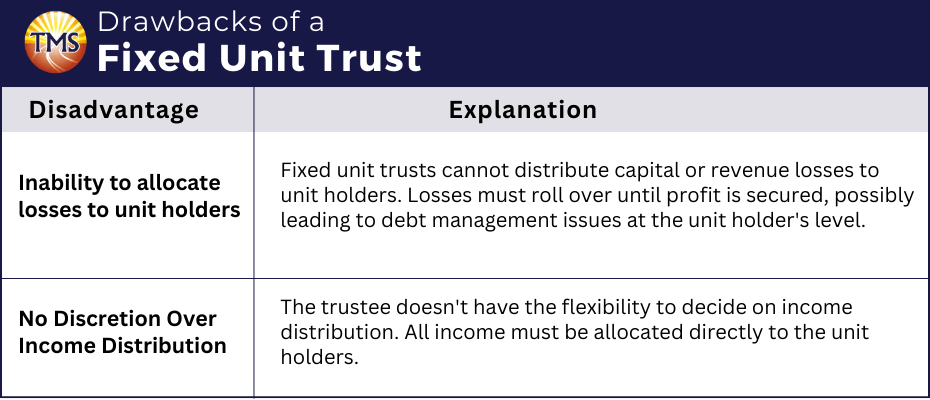

Drawbacks of a fixed unit trust

While fixed unit trusts offer many benefits, they come with certain limitations. From the inability to distribute losses to unit holders to a lack of flexibility in income distribution, it’s essential to understand these drawbacks when considering this type of investment structure. Let’s delve into the specific challenges of a fixed unit trust.

Inability to allocate losses to unit holders

One limitation of a unit trust is its inability to distribute either capital or revenue losses to its unit holders. This mandates that any losses be rolled over until the trust secures a profit. If a trust experiences a net loss, unit holders might contemplate managing debt at their level instead of within the trust to prevent the containment of negative gearing-type losses within the trust.

Lack of flexibility in income distribution

In a fixed unit trust setup, the trustee doesn’t possess the liberty to decide how income is distributed. All the income generated must be unequivocally allocated to the unit holders.

Lifespan of a unit trust

The lifespan of a unit trust is influenced by its establishment location as well as the location of the property it holds. For example, a unit trust formed in South Australia could potentially continue indefinitely. In contrast, trusts in other states usually have an 80-year maximum duration.

Terminating a unit trust

The procedure for ending a unit trust is detailed in its foundational document, the unit trust deed. Generally, the trust’s conclusion is initiated when the trustee, either independently or under the guidance of the unit holders, issues a written declaration that the trust will “vest,” meaning its assets will be allocated, at a specified time.

Following this, the trustee is obligated to gather all the trust’s assets, liquidate them into cash if needed, and settle any outstanding liabilities, which includes taxes. Once these obligations are met, the remaining assets or cash are distributed to the unit holders based on their respective shares.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Confused how unit trusts can benefit you?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.