What is a Franked Dividend and How does it work?

.

Franked vs unfranked dividends — When the company issuing the dividend has paid tax, the investor who holds the shares will receive a franked dividend with a franking credit attached to it.

The franking credit is a kind of tax credit attached to dividends paid to shareholders that represents the amount of tax paid on profits generated in Australia by the company issuing the dividend.

An unfranked dividend is a dividend which has not had any tax paid on it, and as a result, income received from an unfranked dividend is taxed like any other kind of taxable income. Most dividends received from non-Australian companies will be unfranked dividends with no franking credits attached.

What’s the difference between a fully franked dividend and a partially franked dividend?

The difference between a fully franked dividend and a partly franked dividend comes down to the amount of tax paid by the company paying the dividend. A fully franked dividend is when a dividend carries a franking credit against the whole amount of the dividend. This occurs when a company has paid a dividend from fully taxed retained earnings.

The amount of taxes paid by the company is what determines whether a dividend is fully franked or partly franked. For example, if a company has only paid tax on 50% of the profit that is distributed as a dividend to shareholders, the dividends paid will be partially franked dividends. Companies aren’t required to pay tax on profit they distribute to shareholders.

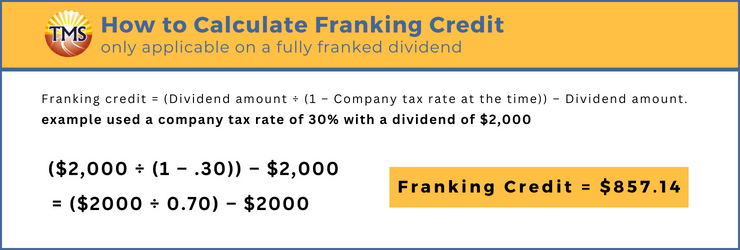

The formula used for calculating the franking credit applicable on a fully franked dividend is:

Franking credit = (Dividend amount ÷ (1 – Company tax rate at the time)) – Dividend amount.

For a company paying a dividend of $2,000 on a company tax rate of 30%:

Franking credit = ($2000 ÷ (1 – 0.30)) – $2000

= ($2000 ÷ 0.70) – $2000

= a franking credit of $857.14

As part of their dividend statement, the shareholder would receive a dividend of $2,000, which is fully franked, along with a franking credit of $857.14.

In the case of an unfranked dividend, the shareholder is liable for taxes on the complete amount of $2,857.14 ($2,000 + $857.14). However, when the dividend is fully franked and accompanied by a franking credit, the individual still reports $2,857.14 as taxable income.

Understanding Franking Credit

A franking credit, also recognised as an imputation credit, signifies the tax already settled by a business on its profits in Australia. Dividends are typically financed from profits, implying that the money distributed to investors has already undergone taxation.

Investors can receive franking credits in addition to the actual dividend amount paid by the company they have invested in. During tax time, investors include the tax credits and dividend payments on their individual tax returns to avoid double taxation of their income. This ensures fairness between dividends and other forms of investment income, such as interest earnings from term deposits, which are only taxed once.

Investors who opt for franked dividends can enjoy tax advantages through the provision of franking credits. On the other hand, investing in companies that offer unfranked dividends can add diversification to your portfolio and potentially enhance future returns.

Considering the advantages associated with both options, it is advisable to seek the assistance of a qualified financial advisor when making investment decisions. Taking into account your individual financial circumstances is crucial in determining the most suitable strategy for long-term investors.

What are the tax benefits of franking credits and franked dividends?

The tax benefits of a franking credit is that it allows the shareholder to receive a tax credit that reduces the tax payable on their dividend income. As such, some investors intentionally purchase shares that issue franked dividends as part of an investment strategy aimed at reducing tax payable. In such an investment strategy, unfranked dividends would be less desirable as they would not provide the same tax offset as fully franked dividends.

In some cases, excess franking credits may result in a refund where the investor’s marginal tax rate is below the 30% company tax rate.

Why franked dividends can be so valuable to retirees

Franked dividends can be valuable to retirees because retirees typically have a low level of income and a correspondingly low marginal tax rate as a result.

To illustrate, if a retiree has a level of income below $18,200, instead of reducing tax payable the excess franking credits are returned as a tax refund, because the marginal tax rate on income under $18,200 is 0%

How do you calculate a grossed-up fully-franked dividend yield?

To calculate a grossed-up fully-franked dividend you must divide the dividend yield by 70 and multiply by 100. For example, if a company declares a dividend of $100 fully fully franked, the grossed-up dividend is $142.85, including franking credits of $42.85.

What do investors look for in franking credits?

Franked distributions refer to distributions that have already been subjected to taxation. These distributions are accompanied by refundable franking credits, which help decrease the tax liability on investors’ net income. This approach is implemented in Australia to prevent shareholders from facing double taxation.

Investors find shares that offer franked income appealing due to the tax advantages associated with them. Since a considerable portion of the returns from share investments often come from dividends, it is essential to understand the tax implications of dividend income and the corresponding franking credits.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.

[wpforms id=”265615″ title=”false”]