Smart tax strategies for Australian investment property tax deduction

.

Investing in Australian real estate can bolster your financial portfolio through rental income and potential capital gains. As an investor, you can claim investment property expenses on your tax return, which could include council rates, body corporate fees, and interest on your investment loan, all of which are designed to decrease your taxable income and, consequently, your income tax.

However, it’s crucial to be aware that not all investment property expenses are tax-deductible. The Australian Taxation Office (ATO) delineates non-deductible expenses, and knowledge of these rules is essential for lawful tax deduction claims. Adhering to these guidelines ensures you’re legally maximising your property tax deductions, safeguarding your financial interests.

Immediate deductions for your investment property tax returns

When your rental expenses exceed the income—known as negative gearing—you can offset this loss against your other income, potentially reducing your overall taxable income. This strategy could enhance your tax benefits, especially if you’re paying capital gains tax on other investments. Always consult a registered tax agent to navigate the complexities of investment property tax deductions accurately.

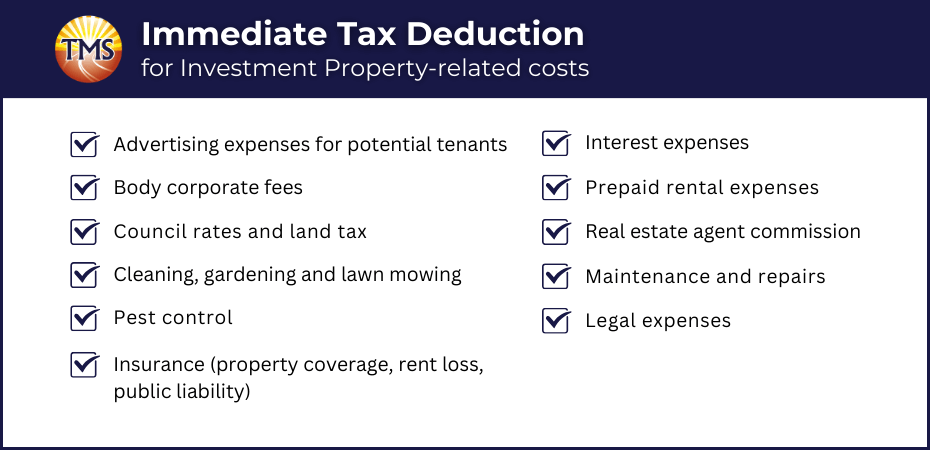

Here’s the list of the immediate tax deductions for investment property-related costs:

Navigating body corporate fees for tax deductions

Body corporate fees often include:

- Operational costs such as insurance and management fees

- Special levy funds set aside for particular projects, like building repairs

You can typically deduct regular contributions to body corporate funds, which go towards administration and maintenance, on your tax return. However, fees allocated for capital improvements are not immediately deductible but may qualify for a capital works deduction after the improvements are completed and if the expenses are drawn from specific funds

How interest deductions on investment loans works

It’s wise to seek advice from a registered tax agent or tax advisor to ensure you’re fully leveraging your tax benefits in compliance with the law. This is particularly important for complex matters like depreciating assets or the tax implications of certain deductions.

After-tax income contributions

- The purchase of an investment property

- Buying depreciating assets for the property, such as an air conditioning unit

- Repairs on the property, like roof damage repair

- Renovations or improvements on a property that is rented or intended to be rented, for instance, adding a deck

Prepaid interest expenses for up to 12 months or interest accrued during essential repairs that leave the property unrentable can also be claimed.

Example: Jamie and Alex’s interest deduction

Navigating non-deductible interest charges on investment loans

- If the property is used for personal use at any time.

- For the part of a loan that’s used for personal purposes, such as purchasing a family car.

- When the loan is for buying a new home that doesn’t generate rental income, even if your investment property is used as security for that loan.

- For any part of the loan that’s diverted for personal use, regardless of whether you’re ahead on your mortgage payments.

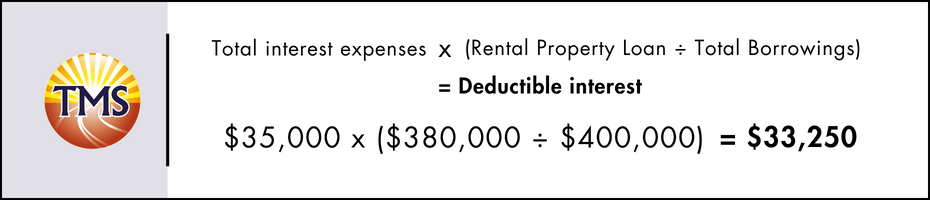

Example: Taylor’s deductible interest calculation

Taylor’s deductible interest is calculated based on the portion of the loan used for the investment property.

Grasping which interest expenses on rental properties are deductible and which are not is vital for maintaining compliance and securing the best possible tax advantages. It’s always recommended to consult with a tax professional to tailor this information to your specific situation.

Maximising deductions with pre-paid expenses

You’re generally eligible to claim an immediate deduction in the year you pay for these expenses if:

- The expense is less than $1,000.

- The expense is $1,000 or more, but the service period does not exceed 12 months, such as when you pay for an annual insurance premium midway through the financial year.

The service period refers to the time frame the service is contracted to be provided in exchange for the payment. This period starts on the later of two dates: when the service provision begins according to the agreement, or when you actually incur the expense.

Navigating maintenance and repair deductions

The costs for maintaining and repairing your property are deductible expenses. These are the costs you incur to keep your property in a condition suitable for rental and to fix any wear and tear or damages that occur from renting it out.

To qualify for these deductions, your property must be rented out or available for rent consistently. This applies even if the property is temporarily vacant, for example, due to unexpected weather leading to booking cancellations or despite efforts to find tenants.

Claiming immediate deductions for repairs and maintenance

For your rental property, immediate deductions can be claimed for repair and maintenance costs incurred within the income year.

Repairs should rectify damage or defects from normal wear and tear. Immediate deductions are not allowed for initial repairs—issues present at the time of property purchase.

Examples of deductible repairs include:

- Replacing broken windows

- Fixing storm-damaged gutters

- Repairing fences affected by tree damage

- Servicing electrical appliances

Maintenance tasks to prevent damage or maintain good condition, like painting walls or cleaning pools, are also deductible. Expenses must relate to the period the property was rented out to be eligible for deduction.

Deducting legal expenses for rental property

Legal expenses for your rental property can include costs for preparing, registering, and maintaining rental agreements. If these legal costs are directly linked to earning rental income, they’re typically deductible in the year you incur them.

Claimable and non-claimable legal expenses for rental property

Deductible legal expenses for rental properties include:

- Costs to evict a non-paying tenant

- Court action expenses for lost rental income

- Legal fees for defending against third-party injury claims on your property

These deductions can reduce your taxable income, aiding in the financial management of your rental property.

However, not all legal expenses are immediately deductible:

- Solicitor fees for property purchase

- Costs for preparing loan documents (though these may be deductible as borrowing expenses)

- Legal costs to oppose land resumption

- Fees for defending property title (like against actions by a mortgagee)

Such expenses are capital in nature, potentially impacting the Capital Gains Tax when you sell the property. Accurate categorisation is essential for tax compliance.

Spreading deductions over time for investment property costs

For certain expenses related to repair, maintenance, and improvements on your investment property, you won’t be able to claim immediate tax deductions. These costs must be claimed over several years. This includes the depreciation of capital works on the property, such as structural improvements or renovations, and borrowing expenses related to your investment loan.

For instance, if you make substantial improvements to your rental property, like adding a new room or renovating a kitchen, you cannot claim the entire expense in the year it occurs. Instead, these are considered capital works and the costs are deductible over a set period, offering a tax benefit each year that reflects the depreciation of the improvement.

Similarly, borrowing expenses—like loan establishment fees or lender’s mortgage insurance—aren’t immediately deductible. They are typically spread out over five years or the term of the loan, whichever is less.

Understanding these rules ensures you stay compliant while gradually reducing your taxable income through these investment property tax deductions. Always consult with a registered tax agent to navigate these complex deductions accurately on your tax returns.

Claimable borrowing expenses for your property

You can claim deductions for several borrowing expenses related to securing a property loan:

- Loan establishment fees

- Lender’s mortgage insurance (the insurance your lender takes out, charging you for it)

- Title search fees required by your lender

- Costs for preparing and filing mortgage documents, including solicitors’ fees

- Mortgage broker fees

- Property valuation fees required for loan approval

- Stamp duty charges on the mortgage

Claiming these expenses over the correct period can help reduce your taxable income.

Understanding capital expenditures on rental property investment

Deductions for capital expenditures, including capital works, improvements, and major renovations on rental properties, can’t be claimed immediately. However, you may be able to claim these expenses over several years. Expenses that are for generating rental income, like borrowing costs and legal fees, may not be deductible right away but can reduce your taxable income over time.

Maximise deductions with capital allowances

The capital allowance system lets you claim deductions for the depreciation of assets that help generate income. For example, the decrease in value of a dishwasher in a rental property can be deducted, provided the property is rented or genuinely available for rent. This method accounts for asset wear and tear in income-producing properties, helping to offset the costs of property management.

Navigating initial repair costs and asset replacement

Expenses incurred to fix defects or deterioration present at the time you purchase a property are capital expenses. These costs might be deductible over time as either capital works or capital allowances, depending on their nature. Initial repair costs for pre-existing issues are not immediately deductible but can be claimed as capital works deductions over several years.

Clarifying asset replacement deductions

For substantial asset replacements, like an entire fence or building structure, you can potentially claim the expense as a capital works deduction. For replacing depreciating assets such as appliances or carpets, you’re allowed to claim their decline in value, which helps in preserving the property’s value and functionality over time.

Understanding non-deductible property expenses

When investing in rental property, not all borrowing costs are tax-deductible. It’s important to distinguish between what you can and cannot claim to ensure accurate tax filings. Below are categories of expenses that typically do not qualify for tax deductions:

- Borrowing expenses that are non-claimable

- Second-hand depreciating assets that are not deductible

- Other non-deductible expenses

For a detailed breakdown of these non-claimable costs, you would need to refer to specific resources or guidelines provided by tax authorities.

Who are TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Understanding asset protection for your growing business

Asset protection for growing businesses and...

Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties

Taking Money Out of Your Private Company: How to...

Unlock the Benefits of a Bucket Company: Maximise Tax Savings and Protect Your Assets

Unlock the Benefits of a Bucket Company:...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.