What car buyers and businesses need to know about Luxury Car Tax

.

For car buyers, business owners, or those buying imported luxury cars, understanding the Luxury Car Tax (LCT) is crucial. The tax applies to vehicles exceeding the luxury car tax threshold, impacting both luxury and some high-priced non-luxury vehicles. LCT also takes into account fuel efficiency, with fuel-efficient vehicles receiving a higher LCT threshold, meaning a lower LCT is applied.

The Luxury Car Tax is calculated on the GST-inclusive value of the car, including dealer delivery charges and accessories. Buyers should also consider any potential exemptions, such as for emergency vehicles or vehicles modified for disability access. Failing to meet LCT obligations can lead to penalties enforced by the Australian Tax Office (ATO), so it’s important to understand the correct format for calculating and paying LCT.

If you’re unsure about how LCT affects your vehicle purchase or business, whether for personal use or trading stock, book a consultation with TMS Financials today.

What is the purpose of the Luxury Car Tax?

The Luxury Car Tax (LCT) is a tax applied to vehicles that exceed a set price threshold in Australia. It was originally introduced to protect the local car manufacturing industry and curb the importation of high-end luxury vehicles. However, with the shift towards fuel-efficient cars and larger SUVs, along with the end of domestic car production, the relevance of LCT has come into question.

One criticism of the LCT is its broad application to vehicles not typically viewed as luxury cars. For example, fuel-efficient vehicles like the Toyota Landcruiser and Nissan Patrol often exceed the LCT threshold, making buyers pay additional taxes for vehicles commonly used for practical purposes, such as towing or transporting goods. At the same time, some luxury brands, like entry-level Mercedes-Benz or Audi models, may avoid the tax, despite being marketed as luxury cars. This inconsistency has raised concerns about the fairness and effectiveness of the LCT in its current form.

Why are non-luxury cars subject to Luxury Car Tax?

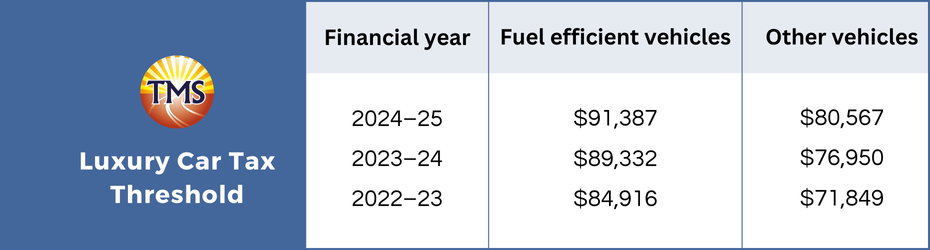

In Australia, the Luxury Car Tax (LCT) can apply to vehicles that are not traditionally seen as luxury simply because their prices exceed the LCT threshold. For the 2023-24 financial year, the threshold for non-fuel-efficient vehicles is set at $76,950. As a result, midsize SUVs or family sedans, which are practical and not necessarily considered luxury, can incur the tax if their price crosses this limit, leading to unexpected costs for buyers.

To promote eco-friendly choices, the LCT threshold for fuel-efficient vehicles is higher, at $89,332, for the same period. This allows fuel-efficient cars to avoid the tax more easily, aligning with the government’s goal of encouraging greener vehicle options. Meanwhile, standard vehicles that do not meet fuel efficiency standards face a lower threshold, making them more likely to be subject to LCT, reflecting the government’s broader environmental strategy.

Examples of non-luxury vehicles that attract Luxury Car Tax

Many popular vehicles, typically seen as family or practical options, are often subject to the Luxury Car Tax (LCT) despite not being regarded as luxury cars. For example, models like the Toyota RAV4, Ford Territory, and various Honda and Nissan vehicles can exceed the LCT threshold due to their pricing. Though these vehicles are designed for everyday use, their cost surpasses the LCT limit, resulting in unexpected taxes for buyers.

This highlights how the LCT can affect consumers who purchase vehicles primarily for practicality, such as for family use or commuting, yet still face additional costs due to the price exceeding the LCT threshold. These cases raise concerns about how the LCT applies to vehicles not traditionally associated with luxury.

How the Luxury Car Tax is calculated

The Luxury Car Tax (LCT) is calculated based on the value of a vehicle that exceeds the LCT threshold, excluding certain costs.

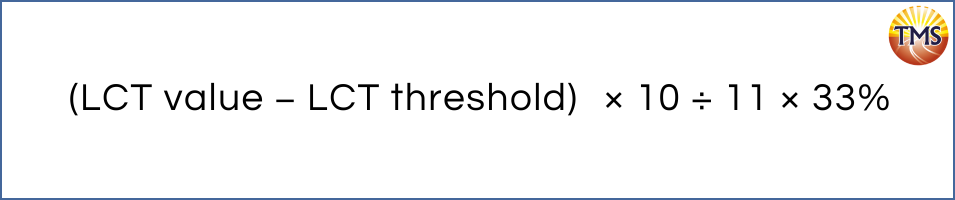

To determine the LCT owed, the following formula is used:

The LCT value includes the vehicle’s retail price along with the Goods and Services Tax (GST), customs duty, dealer delivery charges, warranties, and any accessories or modifications. These factors together make up the taxable value that is subject to the LCT.

Certain costs are not included in the LCT calculation. These include the LCT itself, stamp duty, transfer fees, registration, compulsory third-party insurance, extended warranties, financing fees, and service plans. These costs must be calculated separately when determining the total price of purchasing a luxury vehicle.

Which cars are subject to the Luxury Car Tax?

The Luxury Car Tax (LCT) applies to cars such as sedans, station wagons, four-wheel drives, and limousines that carry fewer than nine passengers and weigh under two tonnes. Vehicles that exceed a set value threshold are affected, but there are exceptions for motorcycles and commercial vehicles primarily used for carrying goods, which are not subject to LCT.

To promote fuel efficiency, the Australian Taxation Office (ATO) has set a higher LCT threshold for fuel-efficient vehicles. For the 2024-25 financial year, cars that consume 7 litres or less per 100 km have a threshold of $91,387, meaning only the value above this amount is taxed. This incentivises buyers to choose environmentally friendly options.

From 1 July 2025, stricter standards will apply for fuel-efficient vehicles. To qualify for the higher threshold, cars will need to have a combined fuel consumption of less than 3.5 litres per 100 km. This adjustment reflects Australia’s increasing focus on encouraging greener, more sustainable vehicles.

Luxury Car Tax thresholds and rates

The Luxury Car Tax (LCT) rate is fixed at 33% for vehicles with a value exceeding the LCT threshold. This rate applies to cars imported, acquired, or sold when their LCT value surpasses the set threshold for the financial year. The 33% rate has been in place since 3 October 2008, following amendments to the original LCT legislation outlined in the A New Tax System Luxury Car Tax Imposition – General Act 1999.

The LCT threshold is adjusted annually, and if the GST-inclusive value of the car exceeds this limit, LCT must be paid unless specific exemptions apply. The LCT value includes not only the vehicle’s base price it also includes the cost of any parts, accessories, or attachments supplied or imported along with the car, further contributing to its taxable value for that financial year.

How to stay compliant and avoid penalties with the Luxury Car Tax

Failing to pay the required Luxury Car Tax (LCT) can lead to significant penalties, including fines and interest charges on the unpaid amount. These costs can accumulate over time, making it even more expensive for car buyers and businesses. The Australian Taxation Office (ATO) enforces strict guidelines to ensure compliance with the LCT on vehicles that exceed the threshold.

To avoid penalties, it’s crucial to meet all LCT obligations promptly. This includes accurately calculating the LCT owed based on the vehicle’s value and ensuring payment is made within the required timeframe.

Exemptions for disability-modified vehicles under the Luxury Car Tax

The Australian Taxation Office (ATO) provides exemptions from Luxury Car Tax (LCT) for vehicles modified to accommodate people with disabilities. Car manufacturers or dealerships that offer these modifications can help customers avoid LCT on the cost of specific adaptations, such as wheelchair access or hand controls. While LCT applies if the vehicle’s value exceeds the threshold, the tax does not extend to the cost of these disability-related modifications, allowing for more accessible transportation options.

It’s important to note this exemption only applies to the cost of the modifications themselves. For instance, if a luxury vehicle’s base price, such as a model from a high-end car manufacturer, exceeds the LCT threshold, the tax will still be owed on the vehicle’s original price. The exemption will only reduce the taxable value by the cost of the modifications, not eliminate the entire LCT amount.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

How high-income earners can boost their super through salary sacrifice

How high-income earners can boost their super...

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

How high-income earners can benefit from voluntary super contributions

How high-income earners can benefit from...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.