What Are Loan Repayments to Shareholders?

Why Choose Loan Repayments?

Tax Efficiency

Division 7A Compliance

Cash Flow Management

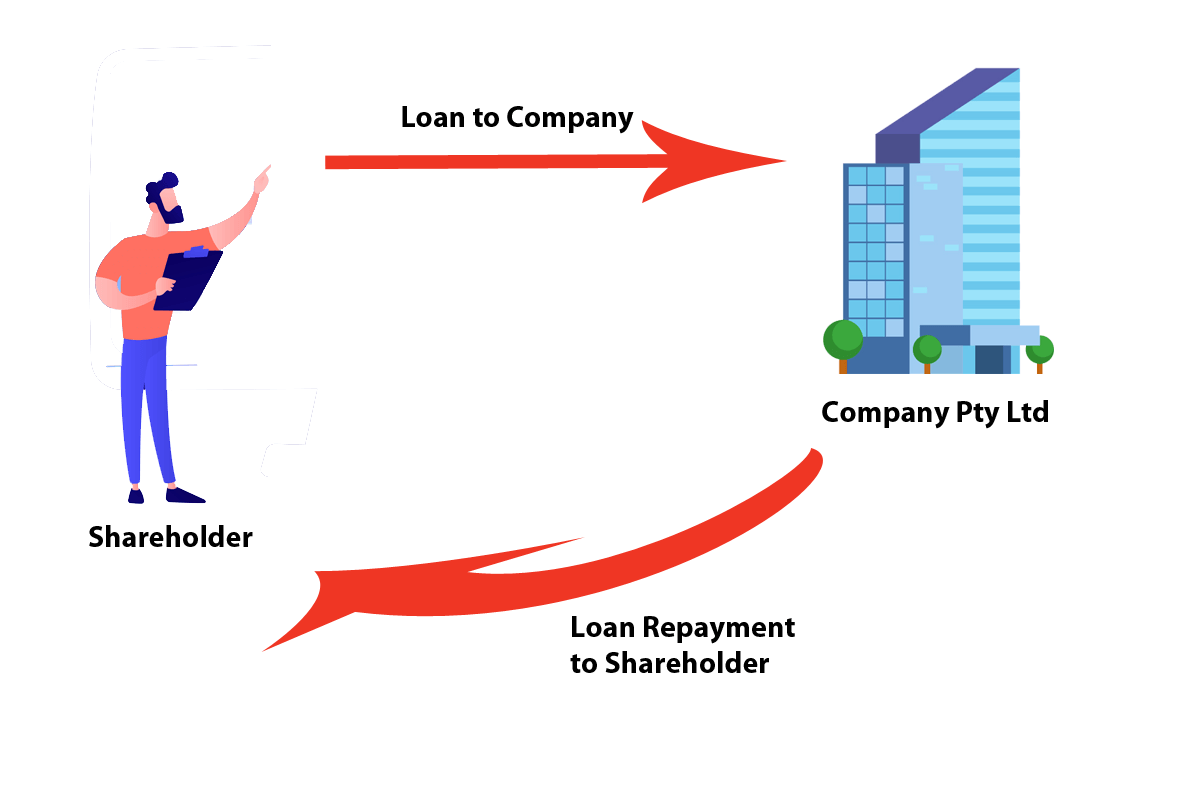

How It Works

Documentation of Loan

Loan Repayment Schedule

Avoiding Division 7A

Benefits

Tax-free

Cash flow management

No impact on profit distribution policies

Tax Implications

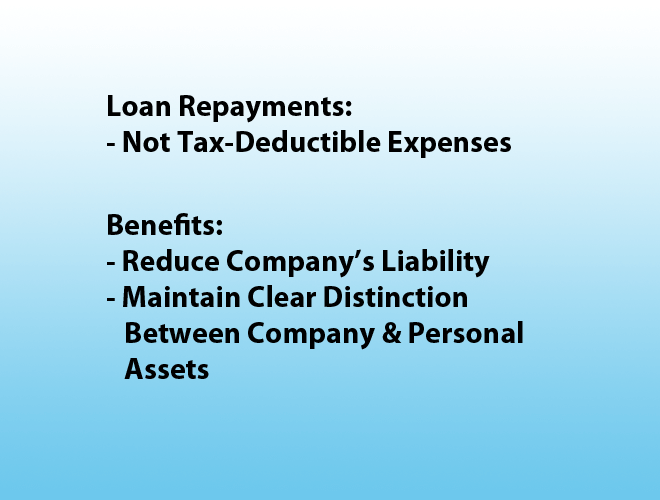

For the Company

Loan repayments made by the company are not tax-deductible expenses but do reduce the company’s liability and help in maintaining a clear distinction between company funds and personal assets.

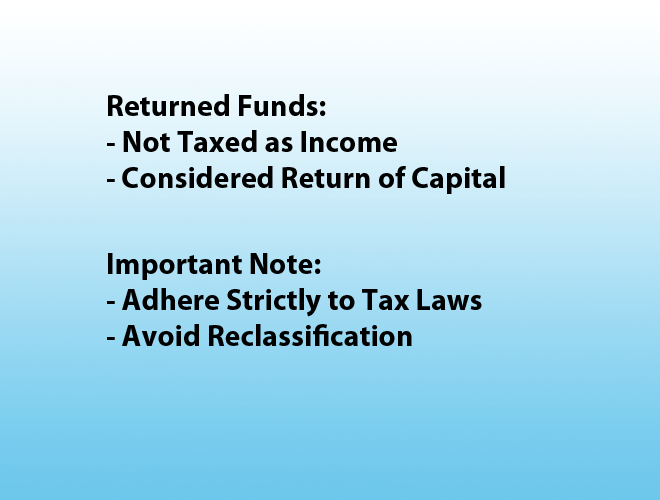

For the Shareholder

The returned funds are not taxed as income, as they are considered a return of capital. However, it’s essential that the loan and its repayment adhere strictly to tax laws to avoid reclassification.

Potential Challenges

Careful consideration is required to ensure compliance with Division 7A to prevent re-characterization as dividends.

Potential Risks and Considerations

Compliance Risks

Financial Planning

Our Services

Loan Repayment Planning

Documentation and Compliance

Financial Health Checks

How We Can Help

By setting up clear loan agreements with documented terms and conditions.

Advising on repayment schedules that suit the company’s financial situation.

Ensuring that loan repayments are made in a manner compliant with Division 7A and other relevant tax laws.

Case Study : John’s Bakery Pty Ltd – A Real-World Examples

- Background

- Objective

- Considerations

- Steps Taken

- Outcome

- Division 7A Clarification

- Expert Opinion

- Contact Us

Over time, the bakery has become profitable and accumulated a significant cash balance. John now wishes to withdraw $200,000 from the company. He plans to use this money to give to his son as a deposit for his first home.

Loan Repayment vs. Dividend: A repayment of the loan principal to John does not constitute a dividend and is not taxable as income to John.

Division 7A Compliance: Despite being a loan repayment, it is a common misconception that Division 7A does not apply. In fact, Division 7A may apply if the loan from the company to a shareholder does not meet certain criteria.

Adherence to Loan Terms: The company ensures that any repayments made to John are in accordance with the established loan agreement terms.

Documentation and Records: All transactions and repayments are thoroughly documented, and records are maintained to demonstrate compliance with the loan terms.

There is no personal income tax for John on the loan repayment because it is a return of capital.

The company maintains proper documentation to confirm that the transaction aligns with Division 7A requirements.

Ready to Resolve Your Division 7A Loan Challenges? Let's Take Action!

Our team of DIV7A specialists is here to provide you with personalized solutions. Start by completing the Division 7A Loan Assessment Form, and we'll evaluate your situation promptly. Your financial success is our priority.

Start Tax Planning Now

Wondering how to withdraw money from your company while maximizing benefits and minimizing costs? It all starts with effective tax planning.

Book an Appointment

Ready for Personalized Solutions? Schedule Your Appointment!

Talk to a DIV7A Specialist

For expert advice on optimizing your Director’s salary package, please use the form below to get in touch with us: