Understanding the Family Tax Benefit (FTB): Eligibility, amounts, and supplemental support

.

The Family Tax Benefit is a two-part government payment that assists families with the costs associated with raising children. The first tax benefit, Part A, is per eligible child you care for, the second, Part B, is paid out per family for single-parent families, non-parental carers, and for some families that only have the one main source of income.

In addition to the Family Tax Benefit, you may also be eligible for child support payments if you are a parent or carer separated from the other parent. Your children will have to meet immunisation requirements and may also need to have a health check before they start school. Further eligibility requirements for both the Family Tax Benefit and child support payments are outlined below.

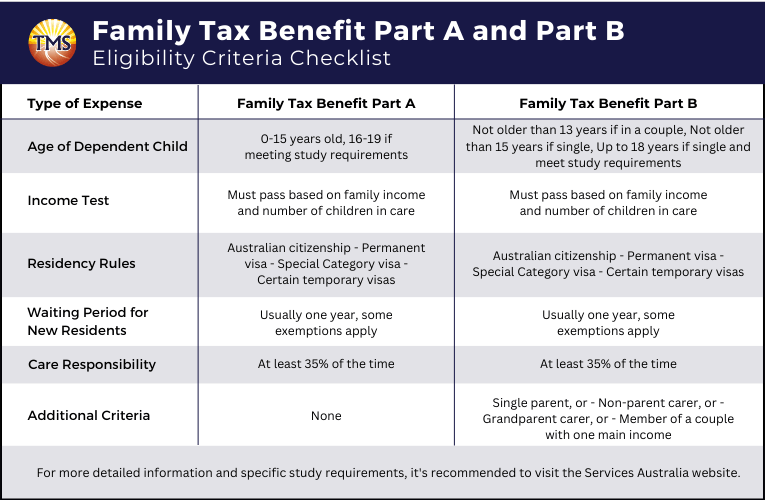

Eligibility criteria for Family Tax Benefit Part A and B

To qualify for Family Tax Benefit Parts A and B, the following criteria must be met:

- Dependent child aged 0-15 or 16-19 must meet study criteria. Details can be found on the Services Australia website.

- Must meet set family income criteria.

- Residency in Australia with statuses like:

- Australian citisenship

- Permanent residency

- Special Category visa

- Some temporary visas

- New residents usually wait a year for FTB. Exceptions can be found on the Services Australia website.

- The child’s care must be at least 35% your responsibility.

- Either a single parent, grandparent caretaker, non-parent caretaker, or single-income couple.

- Age limit for child: 13 for couples, 15 for singles, and 18 for singles if child meets study criteria.

Understanding Family Tax Benefits

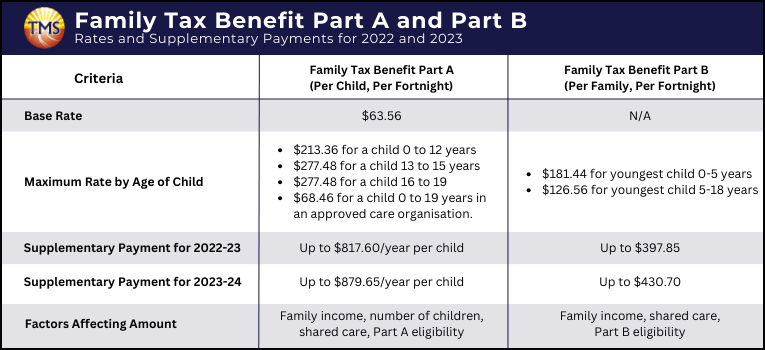

Amounts for Family Tax Benefit Part A

- $213.36 for a child 0 to 12 years

- $277.48 for a child 13 to 15 years

- $277.48 for a child 16 to 19 years who meets the study requirements

- $68.46 for a child 0 to 19 years in an approved care organisation.

If you receive Family Tax Benefit Part A as a lump sum, both the Newborn Upfront Payment and the Newborn Supplement will be included in that lump sum. If you receive Family Tax Benefit Part A fortnightly, you will receive the Newborn Upfront Payment as a lump sum and the Newborn Supplement in your regular Family Tax Benefit Part A.

Amounts for Family Tax Benefit Part B

- $181.44 if your youngest child is between 0 and 5 years old

- $126.56 if your youngest child is between 5 and 18 years old

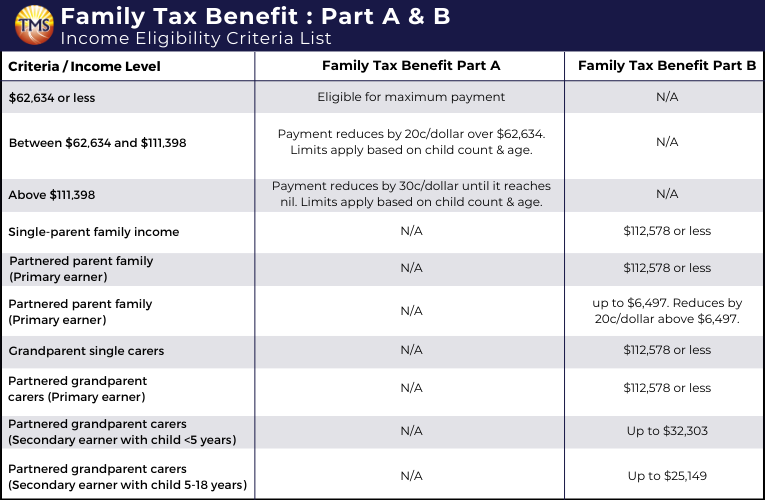

Understanding income limits for Family Tax Benefit Part A and B

Understanding the financial assistance available for raising children in Australia is crucial. Administered by Services Australia, the Family Tax Benefit program is a cornerstone of government support, aiding eligible families with dependent children. This program offers two types of family assistance payments: Family Tax Benefit Part A and Part B. The amount you may be eligible to receive depends on several factors, including your family’s circumstances and income. Here, we delve into the income test guidelines for each part, and how you can claim these benefits through your Centrelink online account linked to your myGov account.

Income thresholds for Family Tax Benefit Part A

- Up to $58,108: you may qualify for the maximum Part A payment.

- $62,634 – $111,398: your Part A payments decrease by 20 cents for each dollar over $62,634. Annual income limits may apply.

- Over $111,398: Payments decrease by 30 cents for each dollar over this threshold, potentially reaching zero. Yearly income restrictions may disqualify you based on the number and ages of your children.

Income thresholds for Family Tax Benefit Part B

- Single-Parent or Single Grandparent: maximum income of $112,578.

- Partnered Parents or Grandparents: primary earner’s income capped at $112,578. Secondary earner up to $6,497, then reduces by 20 cents/dollar above $6,497.

- Partnered Grandparent specifics: secondary income cap is $32,303 for youngest child under 5, and $25,149 if 5-18.

How to apply for the Family Tax Benefit

Once your myGov account is linked with Centrelink, you can initiate your claim process by responding to the required questions available on the Services Australia website. After completing the questions, you’ll come to a section where you can formally submit your claim.

Importance of accurate family income estimates

If your family’s circumstances change, such as income or the number of dependent children, notify Centrelink promptly. Doing so is essential for the financial year-end reconciliation through Services Australia.

Overestimating income may lead to an additional lump sum payment, while underestimating could require you to pay back excess amounts. Keep your estimates current to ensure you receive the correct Family Tax Benefit you’re eligible for.

Claim online

No myGov account?

If you don’t have a myGov account, you can easily create one and then link it to Centrelink. Follow the steps outlined on the Services Australia website to do so.

Alternative claim methods

- For fortnightly payments, print and complete the “Claim for Paid Parental Leave and Family Assistance” form.

- For a lump sum payment for a past financial year, use the “Claim for an annual lump sum payment of FTB for the 2020–2021 financial year” form.

- Alternatively, you can visit a service centre to submit your claim.

Managing your options and obligations for Family Tax Benefit

Changes can include:

- Your name or address

- Rent payments

- Your income or your partner’s income

- Your child commencing or ceasing full-time secondary study from age 16

- You or your child leaving the country, either temporarily or permanently

- Non-requirement to lodge a tax return for you or your partner

By responsibly managing these obligations, you help ensure that the Family Tax Benefit you receive matches your eligibility and current circumstances.

Newborn supplement and upfront payment

Multiple birth allowance

By exploring these additional options and meeting their respective eligibility criteria, families can better navigate the costs and responsibilities of raising children. Remember to consult Services Australia via your myGov account linked to Centrelink for more details on how these supplements could benefit your family.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Need personalised guidance on the Family Tax Benefit?

Schedule a FREE consultation with TMS Financials today.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.